2016 Claims Administrator Days to Payment: Liberty Mutual to AmTrust

If you’re a regular visitor to our blog, you’ll recognize a common refrain: Electronic billing is fast, efficient, and easy. How fast, exactly? California Labor Code § 4603.4 makes it pretty clear: “Payment for medical treatment provided or prescribed by the treating physician… shall be made with an explanation of review by the employer within 15 working days after electronic receipt” of an electronic bill.[1]

Now that all of our data from 2016 is officially in the books, let’s take a closer look at which claims administrators beat this fifteen-day requirement for original medical treatment bills – and which ones left something to be desired.

Throughout the calendar year, DaisyBill received electronic explanations of review (EORs) for almost 350,000 original medical treatment bills alone. Of course, many more electronic bills for medical treatment were submitted – many never even received an EOR. But that’s a story for a different blog post.

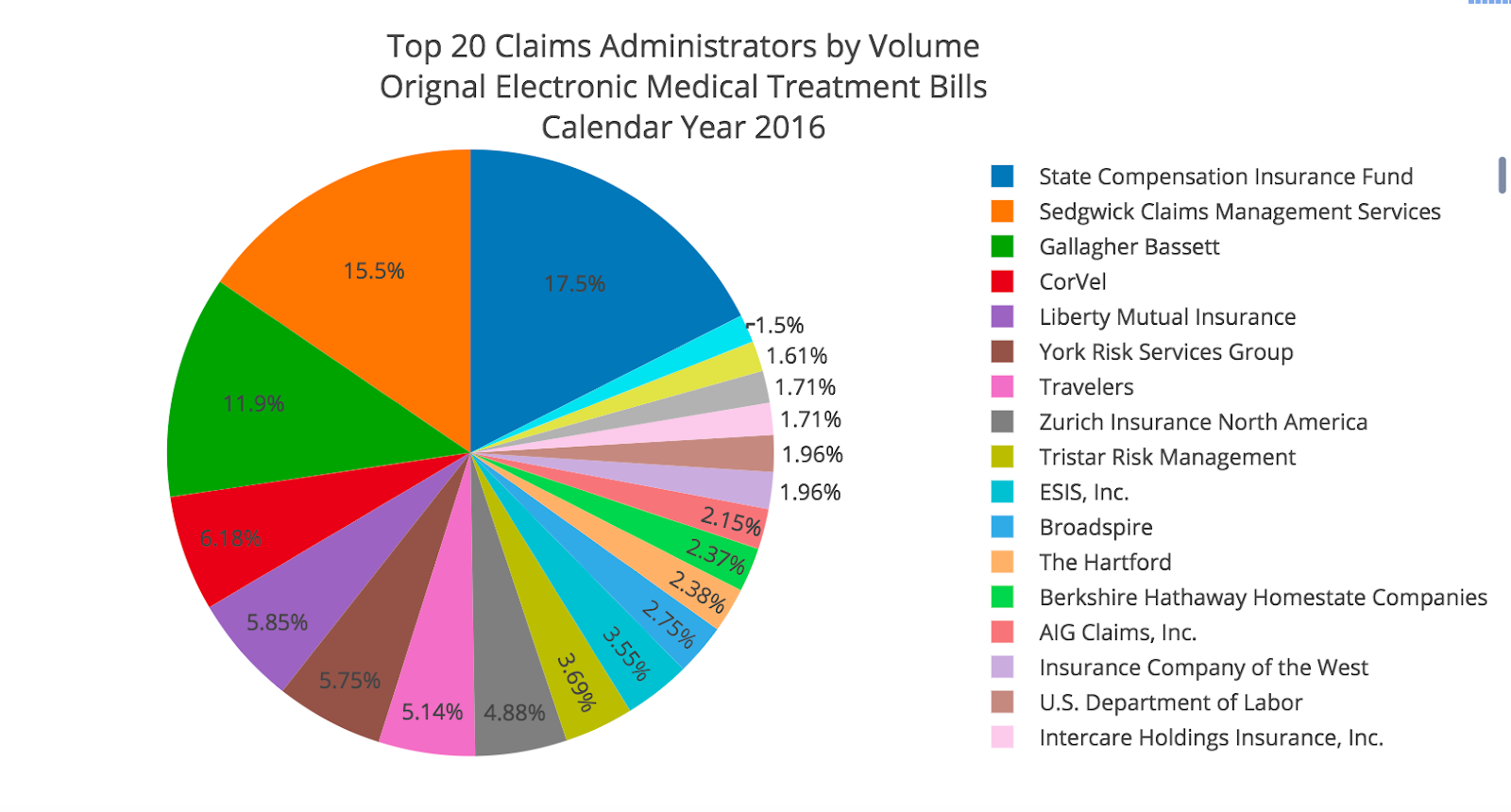

First, we isolated the top 20 claims administrators for the 350,000 bills that received EORs by volume.

Many of these names are probably familiar to you, with State Compensation Insurance Fund, Sedgwick, Gallagher Bassett, CorVel, and Liberty Mutual doing the heaviest lifting.

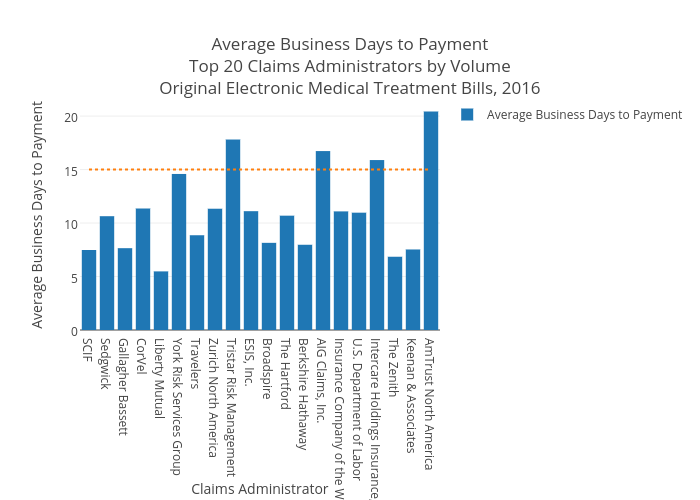

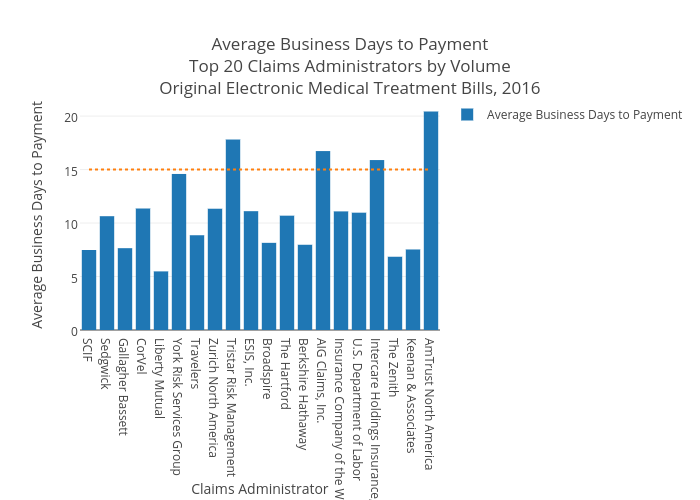

The real question, of course, is how these juggernauts perform against the requirement of Labor Code 4603.4. To visualize compliance with this regulation, we graphed our top twenty claims administrators by average business days to payment. Remember, fifteen is the magic number here, represented by the dotted line below.

Long-time readers won’t be surprised to see Liberty Mutual leading the way once again, with a blistering average of 7.72 business days to payment. Only one other claims administrator – The Zenith – delivered payment on original submissions of medical treatment bills in ten business days or fewer, with an average of 9.69. Gallagher Bassett, SCIF, and Keenan and Associates all fell between ten and eleven average days to payment.

Unfortunately, non-compliance was rampant among the top twenty claims administrators in 2016. Corvel, York Risk Services Group, Zurich Insurance North America, Tristar Risk Management, ESIS, AIG Claims, Insurance Company of the West, Intercare, and AmTrust North America all failed to consistently meet the fifteen-day deadline. That’s nine non-compliant claims administrators from the top twenty – a whopping 45%. AmTrust North America and Tristar Risk Management were particularly egregious, with average business days to payment of 28.62 and 24.92, respectively.

Meanwhile, the U.S. Department of Labor, which is not subject to California state regulations and is therefore exempt from the mandate in Labor Code 4603.4, nonetheless averaged exactly 15.00 days to payment.

We’ll be back in the coming weeks with an analysis of top-performing claims administrators, plus days to payment overviews for medical-legal bills, second reviews, and more. In the meantime, here’s to a compliant 2017.

Tired of submitting your work comp via mail and waiting weeks – if not months – for payment to come through? We can show you a better way. Click below to schedule a demo and experience the power of electronic billing.

REQUEST DEMO

[1] Full text of Labor Code 4603.4 here.

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.gif)

.png)