AmTrust: Audit Complaint Filed With DWC

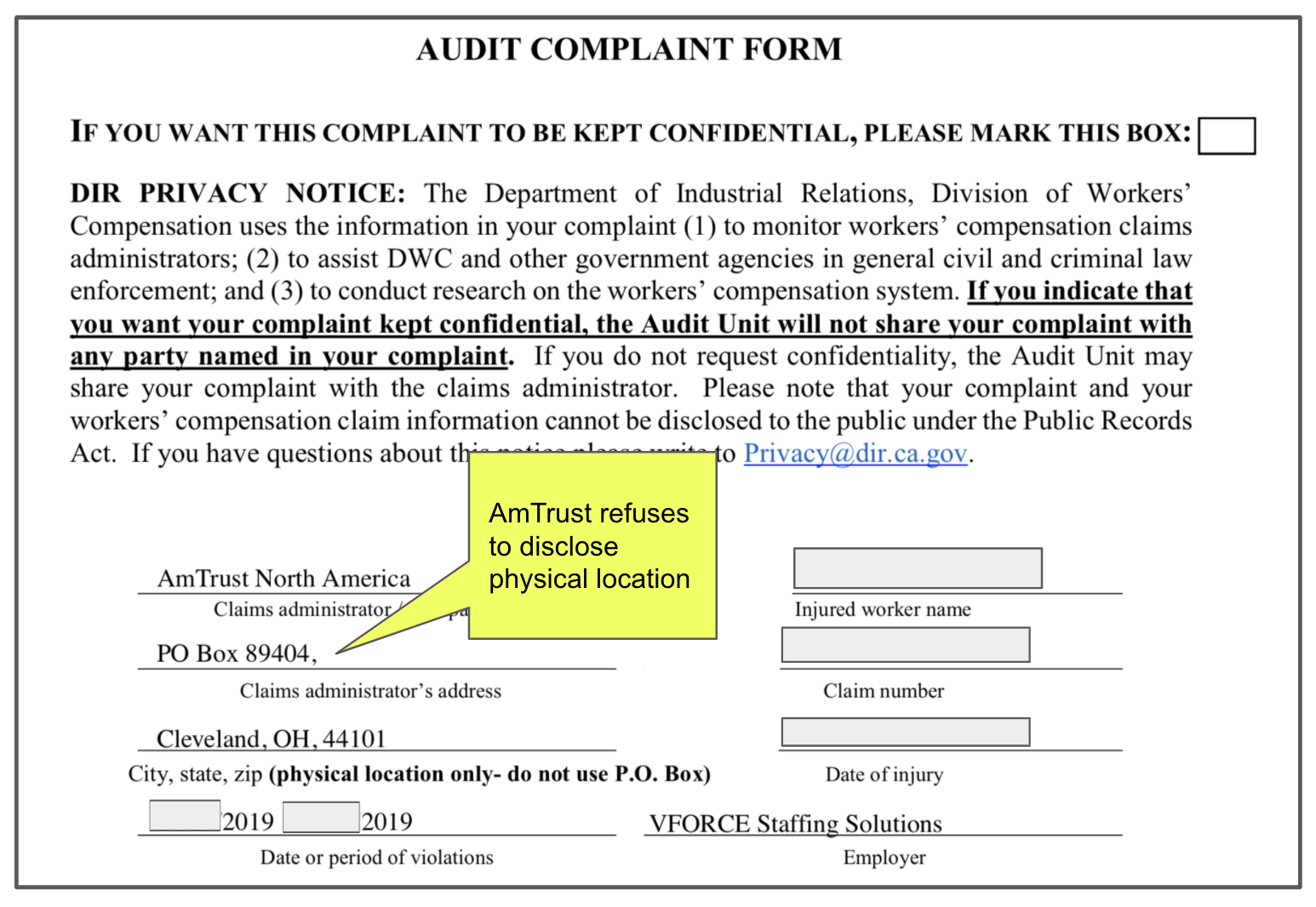

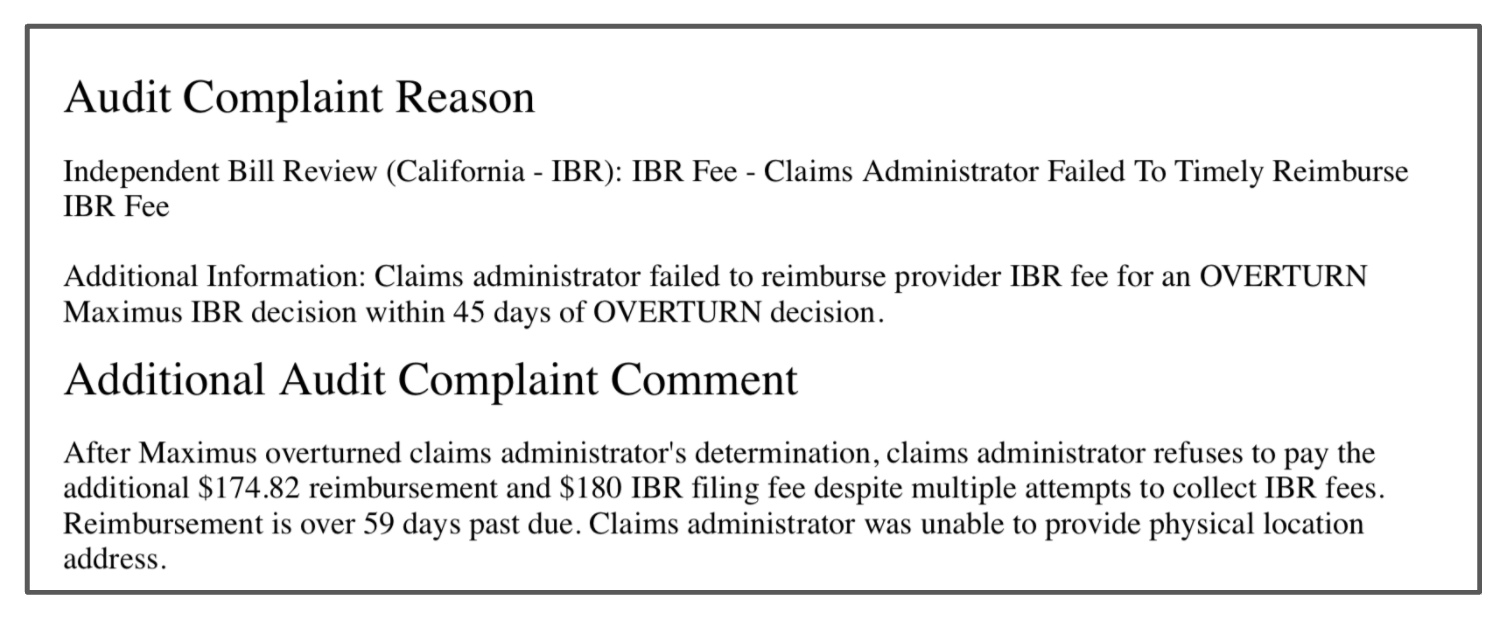

In a recent article, AmTrust - IBR Hall of Shame, we described how AmTrust refuses to properly reimburse a provider, despite a Maximus Independent Bill Review (IBR) decision that overturned AmTrust’s original and improper reimbursement. Below we show the audit complaint* that was filed with California’s Division of Workers’ Compensation (DWC) which explains the failure of AmTrust to compliantly adhere to California laws, regulations, and rules. Of course, the Audit Complaint makes no mention of common decency, which increasingly seems to have no place in AmDISTRUST workers’ compensation reimbursement.

An Audit Complaint is the single, free option available to providers to document and report the systemic inequity of California workers’ comp. With this post, we start publishing some of the many, many audit complaints filed against claims administrators by our users, redacted for privacy and anonymity of course.

Our hope is that employers who read these Audit Complaints will choose to avoid the insurers and third-party administrators that fail to adhere to California laws. If these insurers and third-party administrators cannot follow even the most basic rules of the system, how can they be trusted to care for injured employees?

Audit Complaint Filed With DWC

Below is the Audit Complaint filed by the provider to document AmTrust noncompliance.

AmTrust = AmDISTRUST

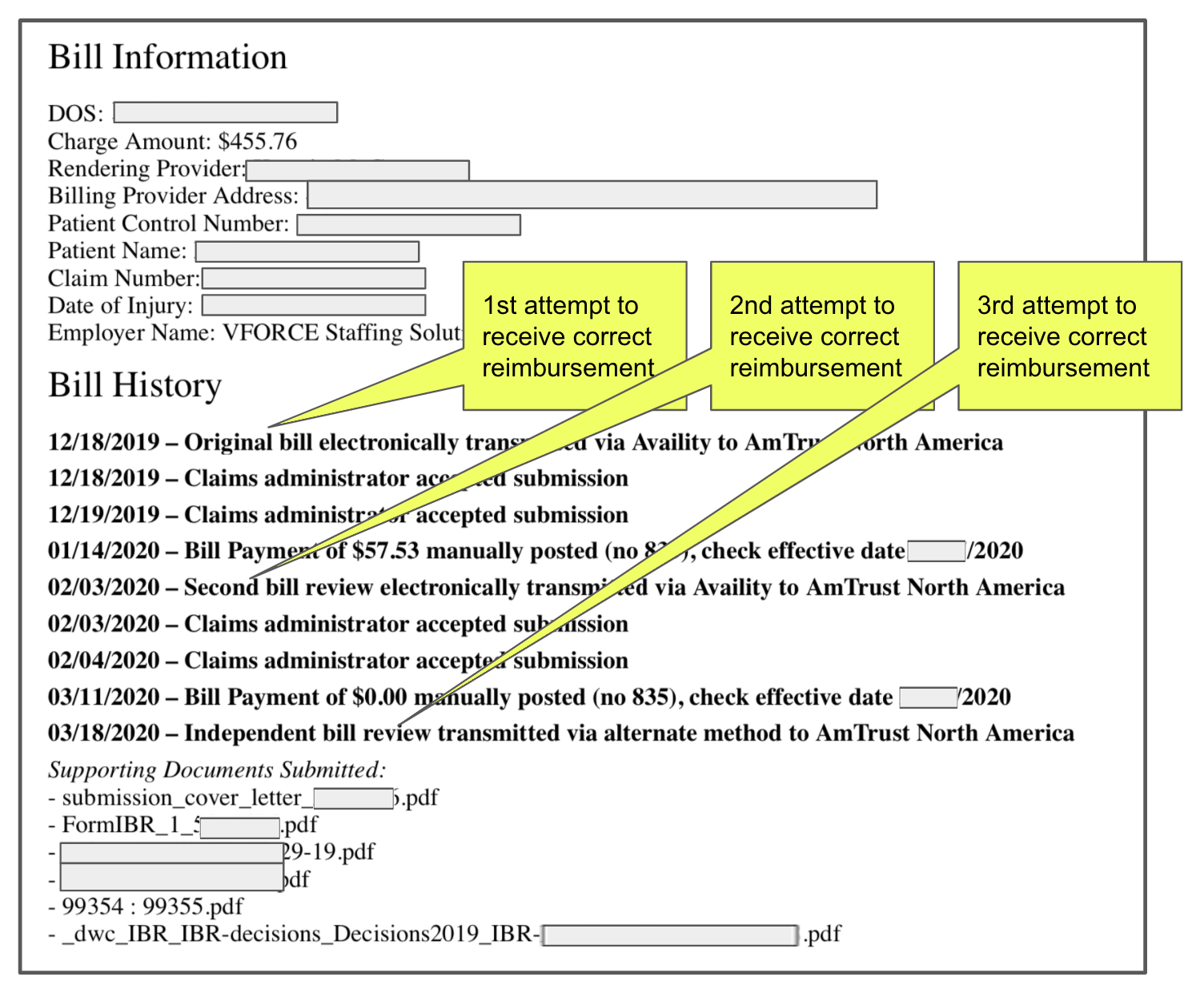

As a reminder, AmTrust has elected to implement its own version of California workers’ comp laws, rules and regulations. In this instance, the provider had requested and received authorization for the services that AmTrust subsequently denied. Per LAB §4603.2(e)(1) and 8 CCR §9792.5.5, the provider disputed the payment denial by timely filing a mandated Second Review appeal. In this appeal, the provider took pains to explain that the services were authorized and that therefore the correct reimbursement was owed.

In response to the Second review appeal, AmTrust seemed to have simply clicked the same “Deny” keyboard button, without addressing the provider’s reason for appeal, and once again turned down the provider’s request for correct reimbursement.

By denying the Second Review appeal, AmTrust forced the provider to expend even more resources to receive correct reimbursement. As mandated by California law, the provider’s next and only step was to file a 52-page IBR and pay $180 for Maximus to review the reimbursement dispute.

In its decision, Maximus agreed with the provider and ordered AmTrust to pay the correct reimbursement for the authorized treatment.

Despite the IBR decision, AmTrust continues to refuse to pay the provider. As documented previously, the provider’s representative sent fruitless emails and made multiple phone calls, pleading with AmTrust to pay the reimbursement as awarded by Maximus. AmTrust representative stated that California laws do not apply to AmTrust:

Spoke with adjuster RXXXX and they explained that they do not think the provider is on their MPN. According to the adjuster, AmTrust denies provider’s services and the IBR does not apply.

Now, to receive the amount awarded by Maximus, the provider must expend even more resources to hire legal representation to demand that AmTrust properly reimburse the provider for authorized treatment. Let’s quickly restate the steps taken by the provider so far:

- Request authorization, which is received

- Submit Original Bill with extensive supporting documentation, which is underpaid

- File Second Review appeal, which is denied

- File IBR, which is awarded to provider

- Plead for payment after “winning”

- Hire legal counsel to collect awarded payment + fees

Rather than paying the provider as ordered per LAB 4603.6, AmTrust continues to manipulate the systemically inequitable workers’ comp system. AmTrust simply refuses to comply with California law which means the provider must continue to shoulder the entire financial burden of enforcing California law. Without more expenditures by the provider, AmDISTRUST is allowed to enforce its preferred version of California workers’ comp laws.

*NOTE: The Audit Complaint form was updated in 2019. Access the updated form here: https://www.dir.ca.gov/dwc/Auditref.pdf

Filing an Audit Complaint is the one free way that providers can fight back. For DaisyBillers, it’s super easy to file through DaisyBill; for non-DaisyBillers, watch this short webinar that explains the audit process -- but remember to use the Audit Complaint form that was updated in 2019.

READ MORE ON AUDIT COMPLAINTS

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.gif)