CA: Substantial Telehealth Reimbursement Increase for Workers' Comp - Part 2

This is the second of our series on retroactive telehealth rule changes announced by the California Department of Workers’ Compensation (DWC) on 5/12/2020. Today we focus on the substantial reimbursement increase for the telephone-only CPT codes 99441, 99442, and 99443. These reimbursement changes impact all dates of service on or after 3/1/2020.

This is a three-part series of posts explaining the recent changes to allowed telehealth services and the reimbursement consequence for these telehealth services.

This series will cover the three major changes announced by the DWC:

- Yesterday’s post addressed the retroactive update to the Place of Service Code that is reported on the CMS 1500 when a provider furnishes telehealth services.

- Today’s post analyzes the increased reimbursement for telephone CPT codes 99441 – 99443.

- Watch for a post next week on the adoption of the CMS updated Covered Telehealth Services, including newly added audio telehealth services.

Retroactive Reimbursement Increases - CPT codes 99441, -42, -43

On April 30, 2020, to adequately reimburse providers for the audio-only services, the Centers for Medicare & Medicaid Services (aka “CMS” or “Medicare”) increased payments for telephone evaluation and management visits to crosswalk to payments for similar office and outpatient visits. Specifically, CMS retroactively increased the Relative Value Units (RVUs) assigned to these codes retroactive for all dates of service on or after March 1, 2020. With the adoption of higher RVUs, CMS is closely crosswalking the reimbursement of CPT codes 99212, 99213, and 99214 to 99441, 99442, and 99443 respectively.

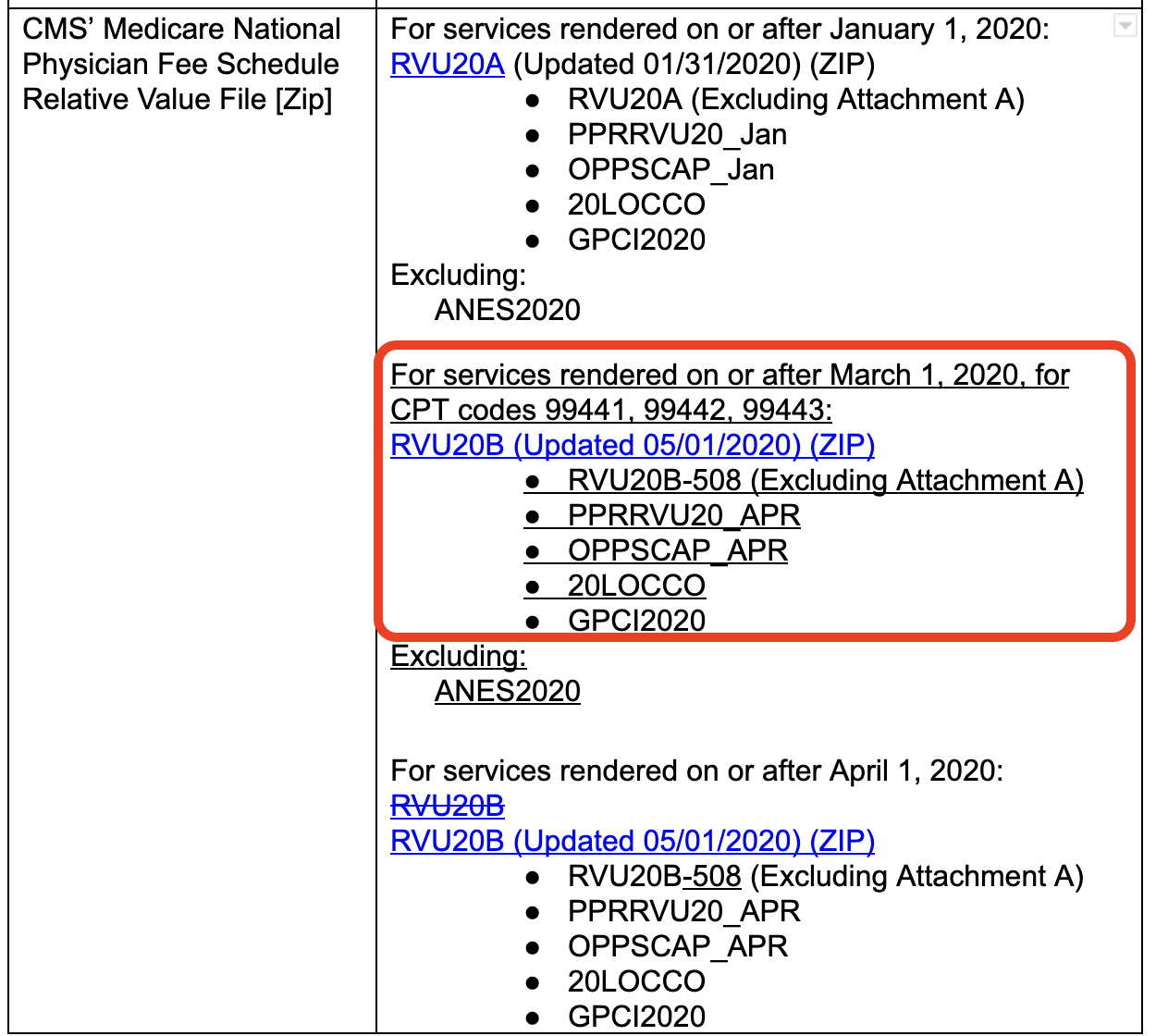

For California workers’ comp telehealth services, the 5/7/2020 Administrative Director Order adopted increased reimbursements for CPT codes 99441 through 99443, effective retroactively for all dates of service on or after 3/1/2020. In § 9789.19, the Physician and Non-Physician Practitioner Fee Schedule adopts the increased Relative Value Files used by CMS for these CPT codes.

This retroactive order adoption means that many providers are now entitled to substantially increased amounts of reimbursement for previous and future telephone evaluation services. For each CPT code, the table below shows the previous reimbursement, the current reimbursement, and the difference between the reimbursements.

Procedure Code |

99441 |

99441 |

Increase |

99442 |

99442 |

Increase |

99443 |

99443 |

Increase |

DOS 2020 |

1/1 |

3/1 |

1/1 |

3/1 |

1/1 |

3/1 |

|||

Alameda And Contra Costa - 7 |

$21.07 |

$71.76 |

$50.69 |

$40.48 |

$116.29 |

$75.81 |

$59.48 |

$167.81 |

$108.33 |

Butte - 55 |

$19.02 |

$61.90 |

$42.88 |

$36.82 |

$101.71 |

$64.89 |

$54.08 |

$147.44 |

$93.36 |

Fresno - 56 |

$19.02 |

$61.90 |

$42.88 |

$36.82 |

$101.71 |

$64.89 |

$54.08 |

$147.44 |

$93.36 |

Imperial - 71 |

$19.05 |

$61.96 |

$42.91 |

$36.88 |

$101.81 |

$64.93 |

$54.15 |

$147.58 |

$93.43 |

Kern - 54 |

$19.21 |

$62.31 |

$43.10 |

$37.24 |

$102.44 |

$65.20 |

$54.63 |

$148.51 |

$93.88 |

Kings - 57 |

$19.02 |

$61.90 |

$42.88 |

$36.82 |

$101.71 |

$64.89 |

$54.08 |

$147.44 |

$93.36 |

Los Angeles - 18 |

$20.07 |

$66.47 |

$46.40 |

$38.84 |

$108.55 |

$69.71 |

$56.93 |

$157.00 |

$100.07 |

Madera - 58 |

$19.02 |

$61.90 |

$42.88 |

$36.82 |

$101.71 |

$64.89 |

$54.08 |

$147.44 |

$93.36 |

Marin - 52 |

$20.84 |

$70.69 |

$49.85 |

$40.09 |

$114.70 |

$74.61 |

$58.88 |

$165.56 |

$106.68 |

Merced - 59 |

$19.02 |

$61.90 |

$42.88 |

$36.82 |

$101.71 |

$64.89 |

$54.08 |

$147.44 |

$93.36 |

Monterey - 64 |

$19.60 |

$63.98 |

$44.38 |

$37.91 |

$105.02 |

$67.11 |

$55.68 |

$152.19 |

$96.51 |

Napa - 51 |

$20.26 |

$68.16 |

$47.90 |

$39.02 |

$110.86 |

$71.84 |

$57.32 |

$160.16 |

$102.84 |

Orange - 26 |

$20.07 |

$66.47 |

$46.40 |

$38.84 |

$108.55 |

$69.71 |

$56.93 |

$157.00 |

$100.07 |

Sacramento, Placer, Yolo, El Dorado - 63 |

$19.18 |

$62.38 |

$43.20 |

$37.12 |

$102.52 |

$65.40 |

$54.52 |

$148.62 |

$94.10 |

San Benito - 65 |

$20.86 |

$70.31 |

$49.45 |

$40.20 |

$114.26 |

$74.06 |

$58.99 |

$164.99 |

$106.00 |

San Bernardino, Riverside - 62 |

$19.26 |

$62.48 |

$43.22 |

$37.41 |

$102.65 |

$65.24 |

$54.78 |

$148.73 |

$93.95 |

San Diego - 72 |

$19.51 |

$64.25 |

$44.74 |

$37.72 |

$105.15 |

$67.43 |

$55.36 |

$152.22 |

$96.86 |

San Francisco - 5 |

$21.07 |

$71.76 |

$50.69 |

$40.48 |

$116.29 |

$75.81 |

$59.48 |

$167.81 |

$108.33 |

San Joaquin - 68 |

$19.02 |

$61.90 |

$42.88 |

$36.82 |

$101.71 |

$64.89 |

$54.08 |

$147.44 |

$93.36 |

San Luis Obispo - 73 |

$19.10 |

$62.36 |

$43.26 |

$36.96 |

$102.36 |

$65.40 |

$54.28 |

$148.33 |

$94.05 |

San Mateo - 6 |

$21.07 |

$71.76 |

$50.69 |

$40.48 |

$116.29 |

$75.81 |

$59.48 |

$167.81 |

$108.33 |

Santa Barbara - 74 |

$19.58 |

$64.60 |

$45.02 |

$37.83 |

$105.68 |

$67.85 |

$55.55 |

$152.97 |

$97.42 |

Santa Clara - 9 |

$21.44 |

$73.43 |

$51.99 |

$41.14 |

$118.82 |

$77.68 |

$60.47 |

$171.37 |

$110.90 |

Santa Cruz - 66 |

$19.74 |

$65.37 |

$45.63 |

$38.12 |

$106.81 |

$68.69 |

$55.96 |

$154.53 |

$98.57 |

Shasta - 61 |

$19.02 |

$61.90 |

$42.88 |

$36.82 |

$101.71 |

$64.89 |

$54.08 |

$147.44 |

$93.36 |

Solano - 53 |

$20.26 |

$68.16 |

$47.90 |

$39.02 |

$110.86 |

$71.84 |

$57.32 |

$160.16 |

$102.84 |

Sonoma - 67 |

$19.63 |

$64.74 |

$45.11 |

$37.93 |

$105.92 |

$67.99 |

$55.68 |

$153.31 |

$97.63 |

Stanislaus - 60 |

$19.02 |

$61.90 |

$42.88 |

$36.82 |

$101.71 |

$64.89 |

$54.08 |

$147.44 |

$93.36 |

Sutter, Yuba - 70 |

$19.02 |

$61.90 |

$42.88 |

$36.82 |

$101.71 |

$64.89 |

$54.08 |

$147.44 |

$93.36 |

Tulare - 69 |

$19.02 |

$61.90 |

$42.88 |

$36.82 |

$101.71 |

$64.89 |

$54.08 |

$147.44 |

$93.36 |

Ventura - 17 |

$19.82 |

$66.01 |

$46.19 |

$38.31 |

$107.61 |

$69.30 |

$56.15 |

$155.53 |

$99.38 |

All Other Counties - 75 |

$19.02 |

$61.90 |

$42.88 |

$36.82 |

$101.71 |

$64.89 |

$54.08 |

$147.44 |

$93.36 |

Appeal Incorrect Reimbursements

In those instances where the provider received the incorrect, lower reimbursements for telephone evaluation services, this retroactive reimbursement increase means that providers will need to appeal for the higher reimbursement. The amount of additional revenue due to the provider for these services warrants the submission of an appeal for all bills reimbursed at the lower, and now incorrect, rates.

For all bills that received an incorrect lower reimbursement for telehealth services, providers need to immediately submit a Second Review appeal with the following Reason for Requesting Second Bill Review:

The reimbursement for this telehealth service was calculated using RVUs which were subsequently increased for all dates of service on or after 3/1/2020. Per the Order of the Administrative Director of the California Division of Workers’ Comp dated May 7th, 2020, the reimbursement for this telehealth service should be calculated using the higher RVUs found in CMS’ Medicare National Physician Fee Schedule Relative Value File RVU20B (Updated 05/01/2020)

For a closer look at all the changes announced earlier this week, watch our free workers’ comp webinar. We covered changes to Place of Service, audio-only codes, and CMS’ updated Covered Telehealth Services. In addition, we’ve spelled out exactly how to effectively appeal bills that are underpaid due to the confusion caused by these retroactive changes.

WATCH THE WEBINAR

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.gif)