CorVel Disguises PPO Discounts

We’ve raised the alarm about Preferred Provider Organization (PPO) and Network discount contracts before. Supposedly, in exchange for more patients, these PPO and Network contracts reduce reimbursements to below the amounts established by the state’s workers’ comp fee schedule.

CorVel is actively obscuring the amount of money providers forfeit by entering into these one-sided contracts.

Self-insured employers and other payers concerned about the lack of providers willing to treat injured employees should be alarmed by this abuse of providers. Most importantly, who, exactly, is pocketing the reimbursements that would otherwise go to providers but are diverted by these PPO and Network discounts?

As illustrated below, CorVel’s Explanations of Review (EORs) combine two different reductions into one lump sum, collapsing together the Bill Review reduction amount and the PPO Network reduction amount. This tactic camouflages how much of the reduction is attributable to each reason — making it impossible for providers to determine whether the provider was properly reimbursed.

Industry-Standard EORs

Various reductions can trim dollars and cents from the charge for a given workers’ comp service. Crucially, for transparency’s sake, it is standard in the industry for EORs to detail exactly what reductions were applied to a reimbursement.

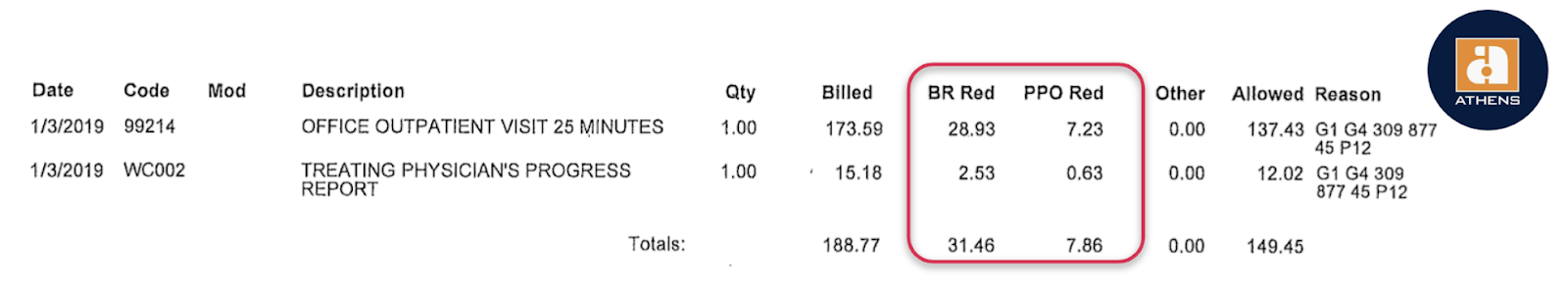

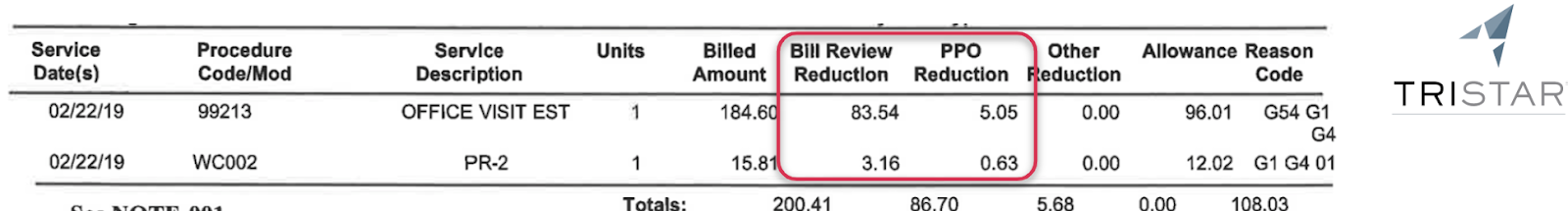

Below are two industry-standard EOR examples that distinguish between the two types of reductions:

- Bill Review (BR) Reduction: the amount the Provider charge was reduced to equal the reimbursement allowed by the state fee schedule. This calculation allows the provider to confirm the accuracy of the fee schedule reimbursement.

- PPO Reduction: The amount hijacked from the provider due to a PPO contract. Isolating this amount allows the provider and the employer to see the amount the provider sacrificed for the sake of PPO/Network participation.

CorVel Payment Obfuscation

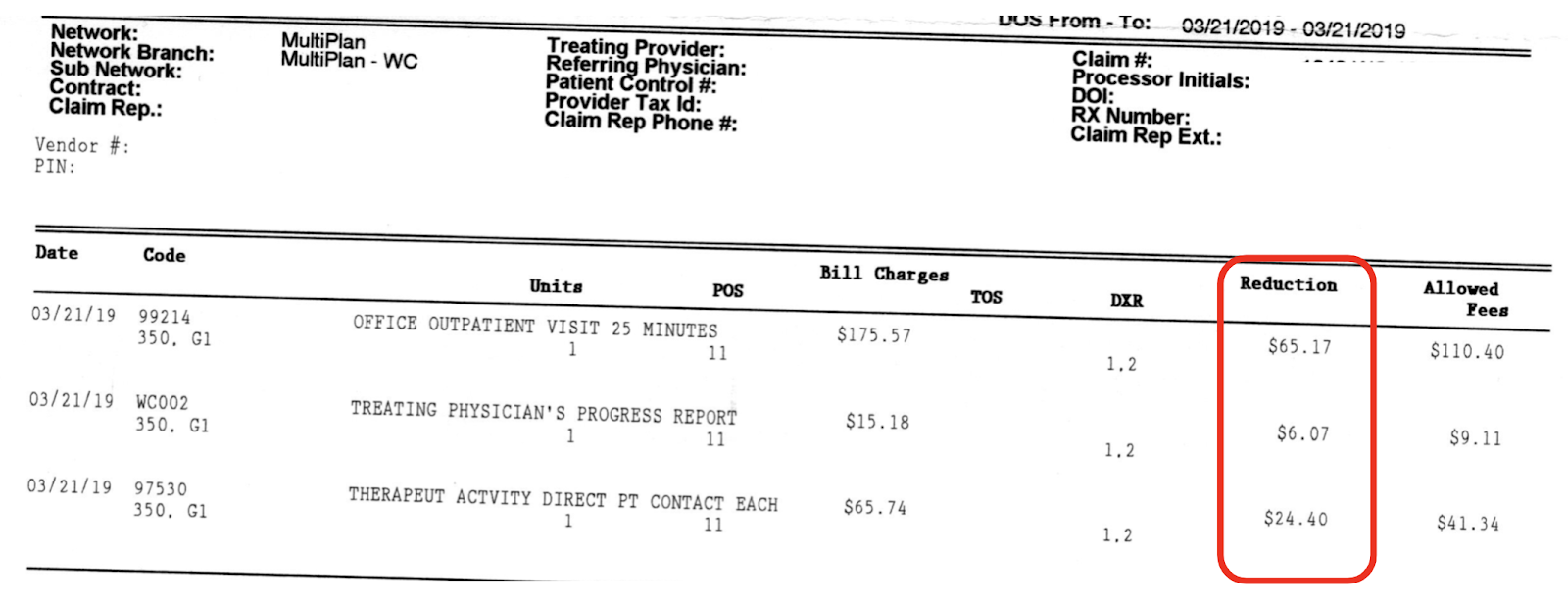

In the EOR example below, CorVel applied both a bill review reduction and a MultiPlan Network (PPO) reduction to the bill. But CorVel doesn’t list these reductions separately; the EOR simply has a single “Reduction” column in which CorVel combines all reductions to the reimbursement.

From the EOR, there’s no way to know how much the provider forfeited specifically due to the MultiPlan Network discount and how much was due to bringing the charge in line with California’s Official Medical Fee Schedule (OMFS).

Convenient, isn’t it?

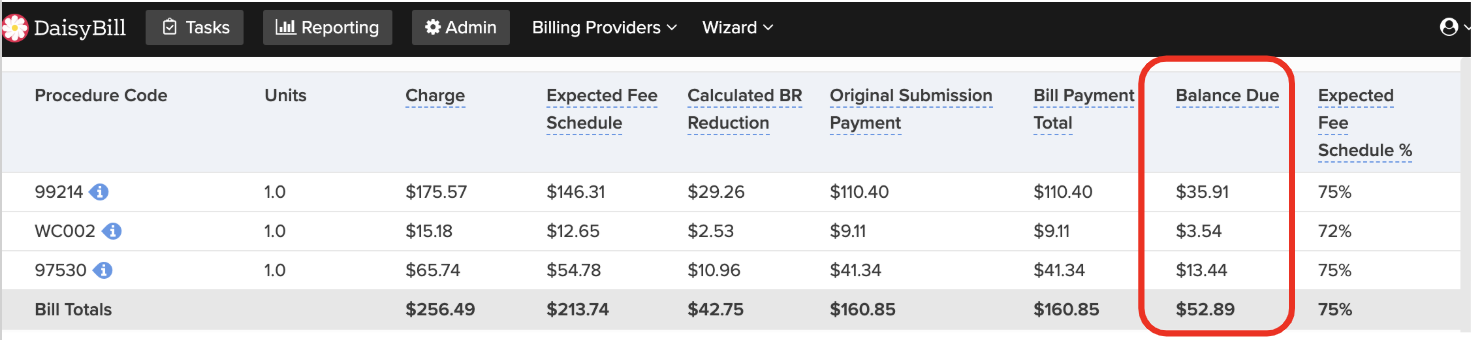

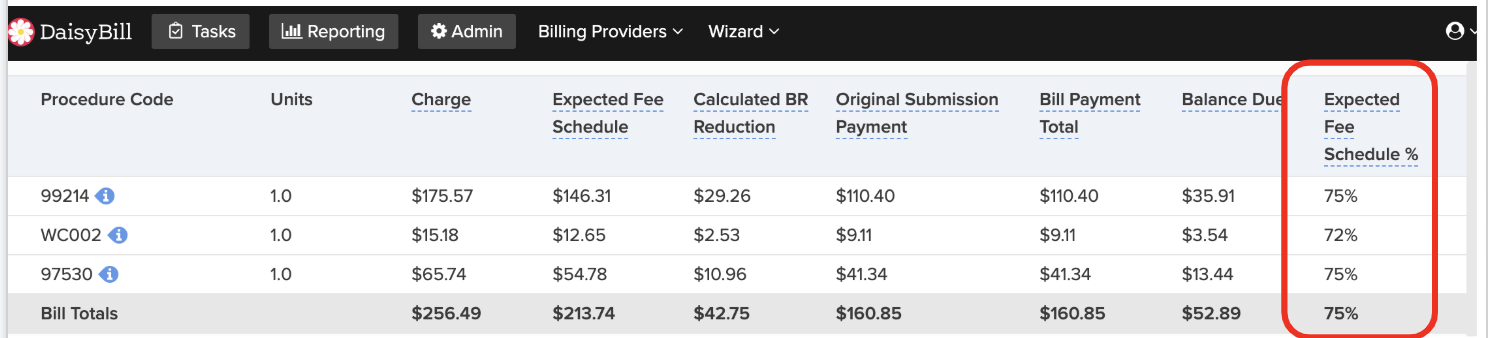

However, DaisyBill’s software shows the provider that CorVel paid $52.89 below the reimbursement allowed by California’s OMFS.

We can only assume this amount represents the amount taken by the MultiPlan Network. We ask again: Who, exactly, is pocketing the reimbursements that would otherwise go to providers but are diverted by these PPO and Network discounts?

Reduced Reimbursement Inconsistencies

Using DaisyBill, the provider knows that CorVel/MultiPlan reimbursed the services only 75% of the amount allowed by the OMFS for two of the codes. Whereas for the California-specific code WC002, CorVel/MultiPlan reimbursed the provider only 72% of the amount allowed by the OMFS.

Because the Corvel EOR does not separately display the Bill Review reduction and the PPO Reduction, the provider cannot possibly discern the reason for the 75% versus the 72% discrepancy in the reduction reimbursement.

In other Corvel EORs, the reimbursement is as low as 70% of OMFS rates — hidden in the murk of the single “Reduction” column that CorVel uses to obscure the math.

Provider Payment Abuse Hurts Injured Workers

PPO and other discount contracts are a plague on workers’ comp providers. We ask again: who, exactly, is pocketing the reimbursements that would otherwise go to providers but are diverted by these PPO and Network discounts?

CorVel is hiding the damage behind the smoke and mirrors of an opaque EOR. Further, employers should also be alarmed by this accounting obfuscation. It’s time to demand transparency, by regulation if necessary.

DaisyBill’s Billing Software doesn’t just make billing easier — it empowers providers to know exactly what’s in the EOR, and to take action when necessary to protect your office’s revenue. Sign up for a free demonstration, and see what DaisyBill can do for your office.

SCHEDULE DEMO

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.