Intact Insurance Plays (Double) IBR Chicken

Welcome to another round of IBR Chicken!

The rules are simple. To avoid reimbursing a doctor for authorized workers’ comp services, a California claims administrator must simply:

- Authorize the treatment or service.

- When the bill arrives, shamelessly deny liability, compensability, or authorization (yes, you read that correctly).

- If the doctor submits a Second Review appeal, deny payment again on the same grounds (or falsely claim the appeal is a duplicate bill).

- If the doctor pays $180 to request Independent Bill Review (IBR), contest the dispute’s eligibility for IBR.

- Wait for the DWC to flip its coin regarding IBR eligibility.

As in any good game of Chicken, the claims administrator’s opponent (the doctor who treated the worker) may blink first. Filing the Second Review appeal, remitting $180 to initiate IBR, and indexing and submitting the IBR is a tremendous hassle that can deter even the most committed provider.

But worry not, payers.

If the doctor persists, there’s at least a 50/50 chance that California’s Division of Workers’ Compensation (DWC) will deem the authorized treatment ineligible for IBR, as the state agency’s wildly inconsistent decisions re: IBR eligibility demonstrate.

The latest player to enter the IBR Chicken arena: Intact Insurance Specialty Solutions, which recently denied payment for two Medical-Legal evaluations — both of which came at the request of Intact attorneys — on the grounds of contested liability.

Round One: Intact Insurance Loses IBR Chicken

There’s something extra special about playing IBR Chicken for a Medical-Legal dispute.

That’s because in order to play, the claims administrator must have the sheer audacity to claim lack of authorization or liability for a service they themselves requested.

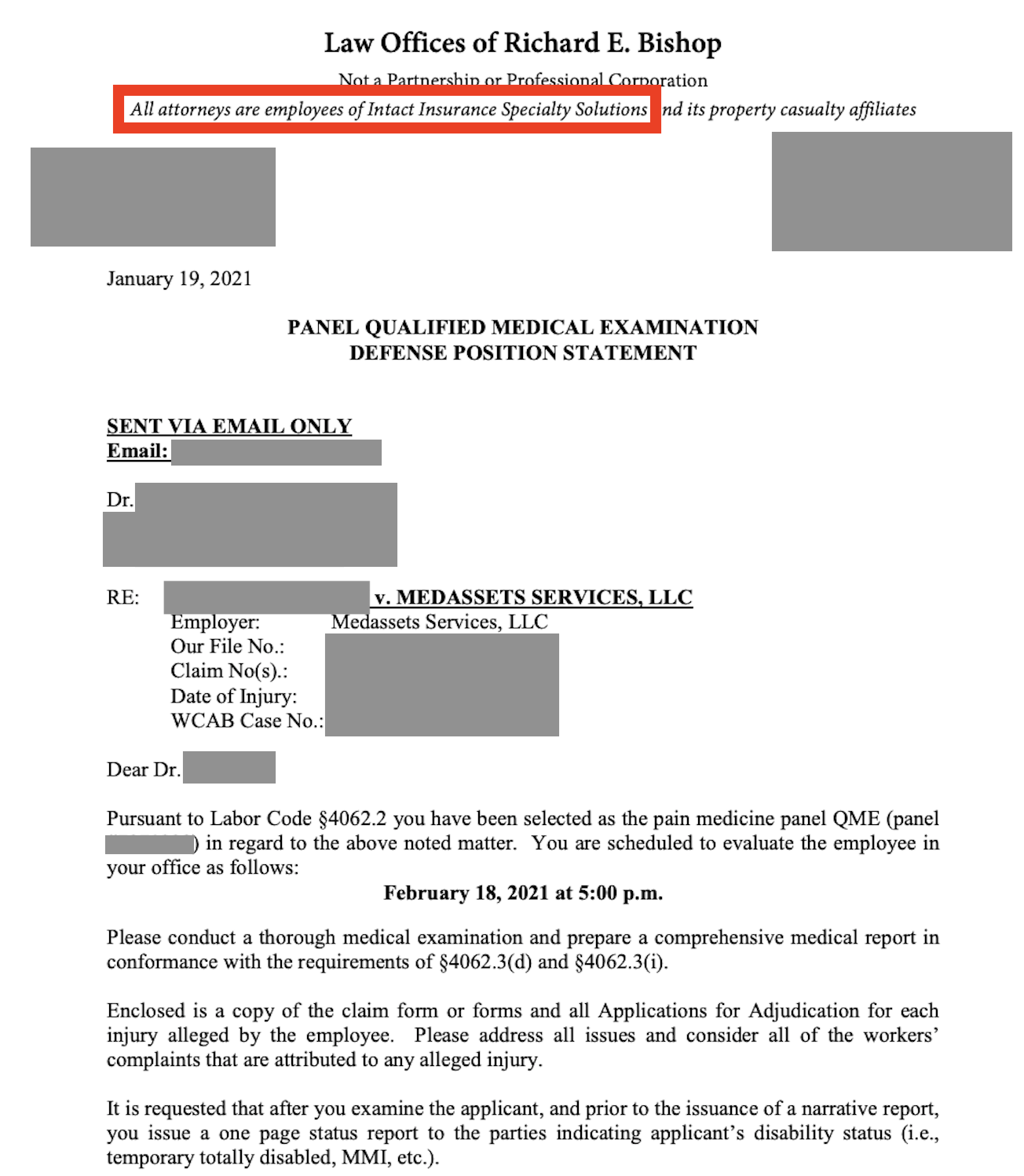

For example, when Intact needed a Medical-Legal evaluator to determine Intact’s liability for a workers’ injury, the Intact attorneys sent the QME the letter below, requesting the QME to address “all issues and consider all of the workers’ complaints that are attributed to any alleged injury.”

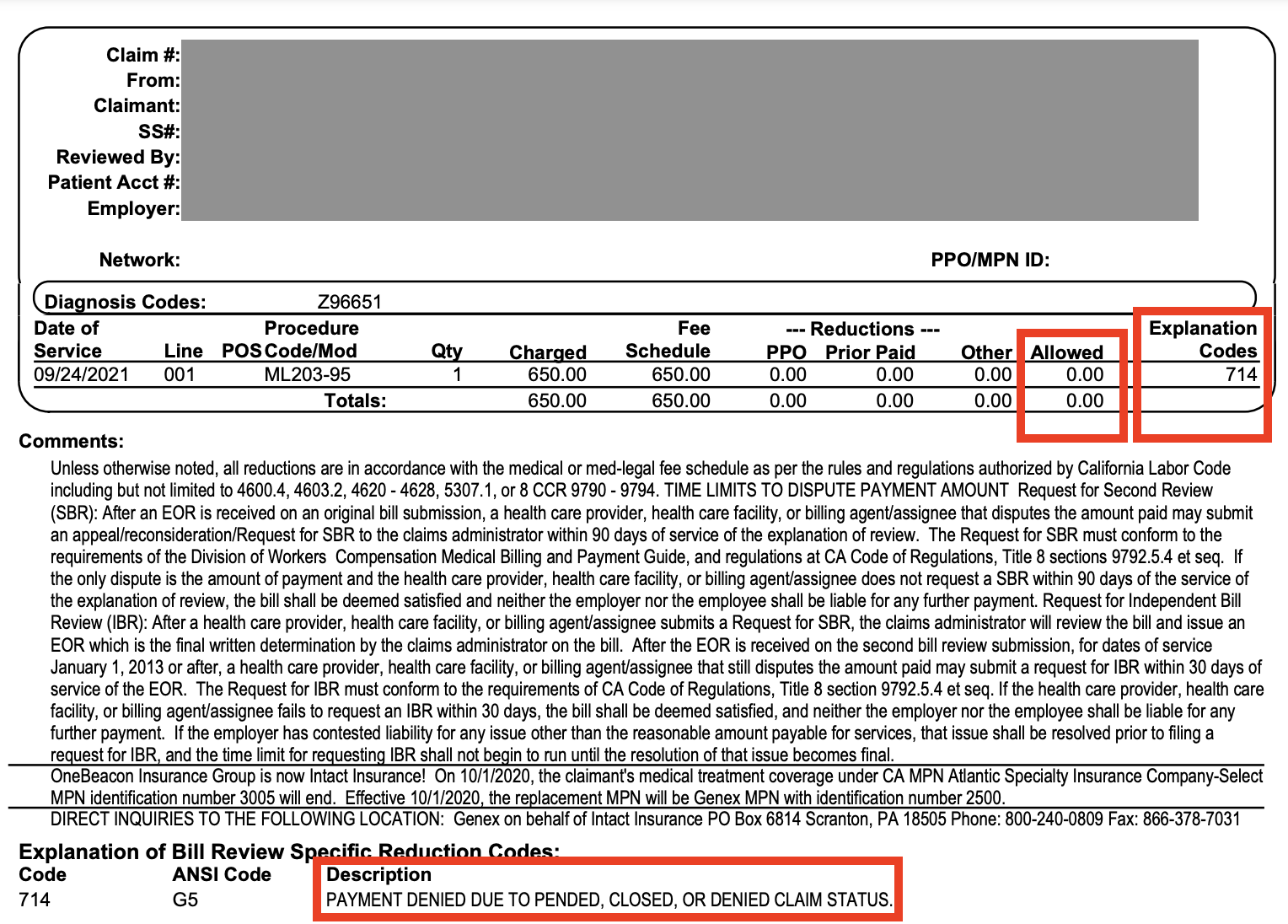

Yet when the bill for this medical-legal evaluation arrived, Intact denied payment due to “pended, closed, or denied claim status.”

Intact lost this first round of IBR Chicken; the QME appealed, and ultimately prevailed at IBR, with the DWC (and its IBR proxy, Maximus) overturning the absurd denial.

Maximus’ final decision is below.

Round Two: Intact Insurance Denies Payment for Supplemental Evaluation

Of course, Intact’s initial IBR loss was not the end of this game.

Intact subsequently requested a supplemental Medical-Legal evaluation from the same QME, for the same injury. And of course…

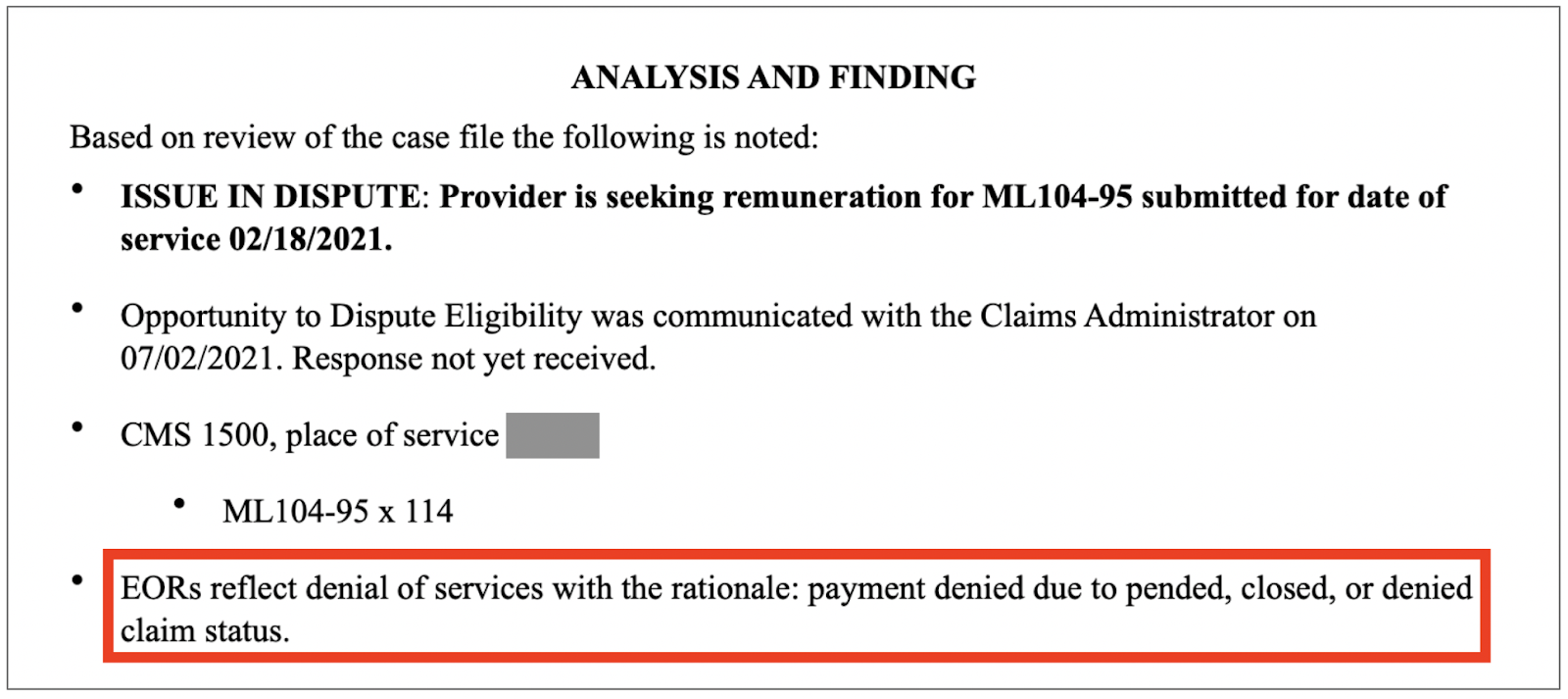

Intact denied payment for the supplemental evaluation too, based on — wait for it — “pended, closed, or denied claim status.”

Oh, where to begin?

As we’ve pointed out before (and as the most basic levels of human reasoning can attest) Medical-Legal evaluations are conducted precisely because the claim is disputed.

It seems that Intact believes denying liability also means denying payment to anyone who can help determine liability. By that logic, can we assume Intact isn’t paying its attorneys, who are also hired to help settle the liability issue?

Pushing Back: Second Review + Written Objection

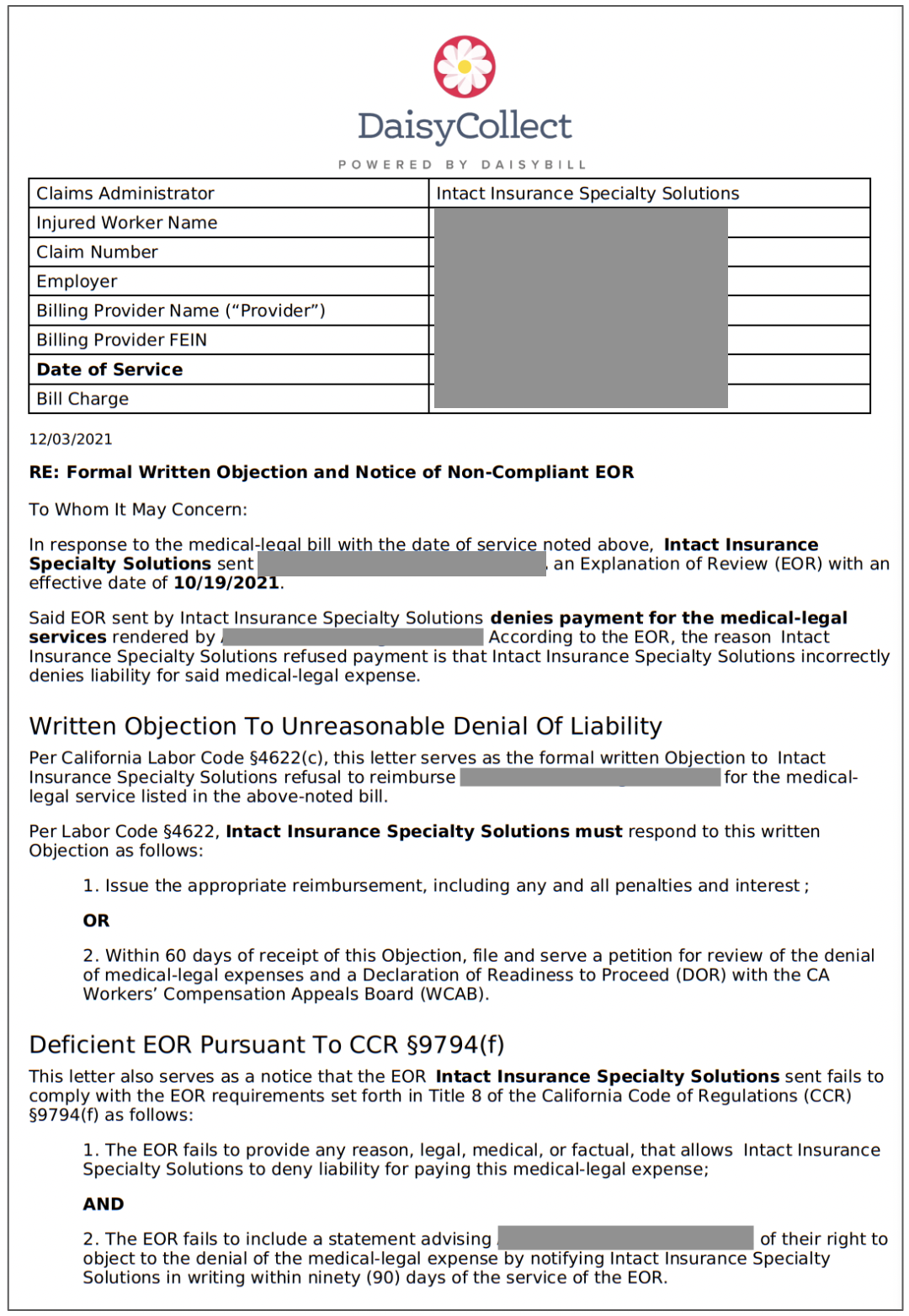

DaisyBill submitted another Second Review appeal on the provider’s behalf, to dispute the improper denial of payment for the supplemental evaluation.

In addition, we submitted a formal letter of objection to Intact’s denial per California Labor Code Section 4622(c). This formal letter of objection places the onus on Intact to either:

- Pay the disputed amount, plus penalties and interest, or

- File a petition with the Workers’ Compensation Appeals Board to review the dispute

Intact, clearly gunning for a spot on the California IBR Chicken Olympics team, denied payment again upon Second Review. As a result, DaisyBill requested IBR, a request that is pending as of this writing.

A Dangerously Mixed Message

Intact’s behavior has something to teach us, and something to teach the DWC. Intact improperly denied payment, on invalid grounds, for the same injury, four separate times, including twice after losing at IBR.

How could a seeming policy of “deny first, ask questions later,” possibly be viable?

Unfortunately, these are the corrupted payment rules that California providers are expected to navigate when treating injured workers.

Blatantly invalid denial reasoning that cites “threshold” issues like authorization, liability, and compensability are sometimes deemed eligible for IBR by the DWC and Maximus. But other times, these blatantly invalid denials reasons are deemed ineligible.

There’s no logic to it, only chance and the whims of the state. It’s a coin toss, one that often rewards claims administrators for playing IBR Chicken.

Until claims administrators are penalized for falsely raising “threshold” issues, there is no incentive for claims administrators to do anything other than deny payment based on issues like authorization, liability, and compensability — even when no such issues exist.

Payers like Intact Insurance will waste the time and resources of doctors again and again and again — often walking away with the doctor’s revenue in their pockets.

Make workers’ comp a better investment. From fee schedule calculators to billing software to complete managed billing, DaisyBill has your back. Contact us to learn more.

LET’S CHAT!

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.