AmTrust Pays Physician FAR Less Than Interpreter

.gif)

Why do California doctors refuse to treat injured workers? Today’s story offers a giant, unmistakable clue.

For the same encounter with an injured worker, AmTrust North America paid an interpreter a far higher reimbursement for their services than it paid the physician for the treatment provided. The reason? Steep reimbursement reductions allowed by California’s PPO “pay-to-play” system.

AmTrust used an Anthem Blue Cross contract to reduce this physician’s reimbursement to less than half the rate the Third-Party Administrator (TPA) paid for the interpreter services.

While interpreter services are invaluable to workers’ comp, every California physician should be outraged by the story below, which demonstrates that after a dozen years of schooling (with accompanying student debt), an M.D. who evaluated an injured worker was paid only 44% of the amount paid to the interpreter who facilitated the evaluation.

CA Workers’ Comp: Undervaluing Physicians

In August 2023, a physician evaluated an injured worker with the (essential) assistance of a language interpreter. Following the visit, the physician sent AmTrust a 20-page report detailing the injured worker’s condition, including a Request for Authorization (RFA) for additional treatment.

For this single encounter, AmTrust paid the following amounts:

- $96.16 to the physician for Evaluation and Management (E/M) CPT code 99214

- $220.00 to the interpreter for interpreting during the E/M visit

The $96.16 reimbursement AmTrust paid the physician for the E/M visit was:

- 51% below the Official Medical Fee Schedule (OMFS) reimbursement rate of $196.29

- 32% below the Medicare rate of $140.90 for the same E/M service

California workers’ comp physicians should be incensed by the following reimbursement facts:

- The Interpreter Fee Schedule reimburses interpreters $220 compared to the Physician Fee Schedule, which reimburses physicians $196.29 for a common E/M service.

- California allows Medical Provider Networks (MPNs), in conjunction with PPOs, to reduce physician reimbursements to unsustainable rates substantially below the amounts allowed by the OMFS or Medicare.

The arithmetic above demonstrates that California workers’ comp values interpreter services more than physician services — and that’s before PPOs take the often substantial contractual cuts that doctors agree to under threat of exclusion from MPNs.

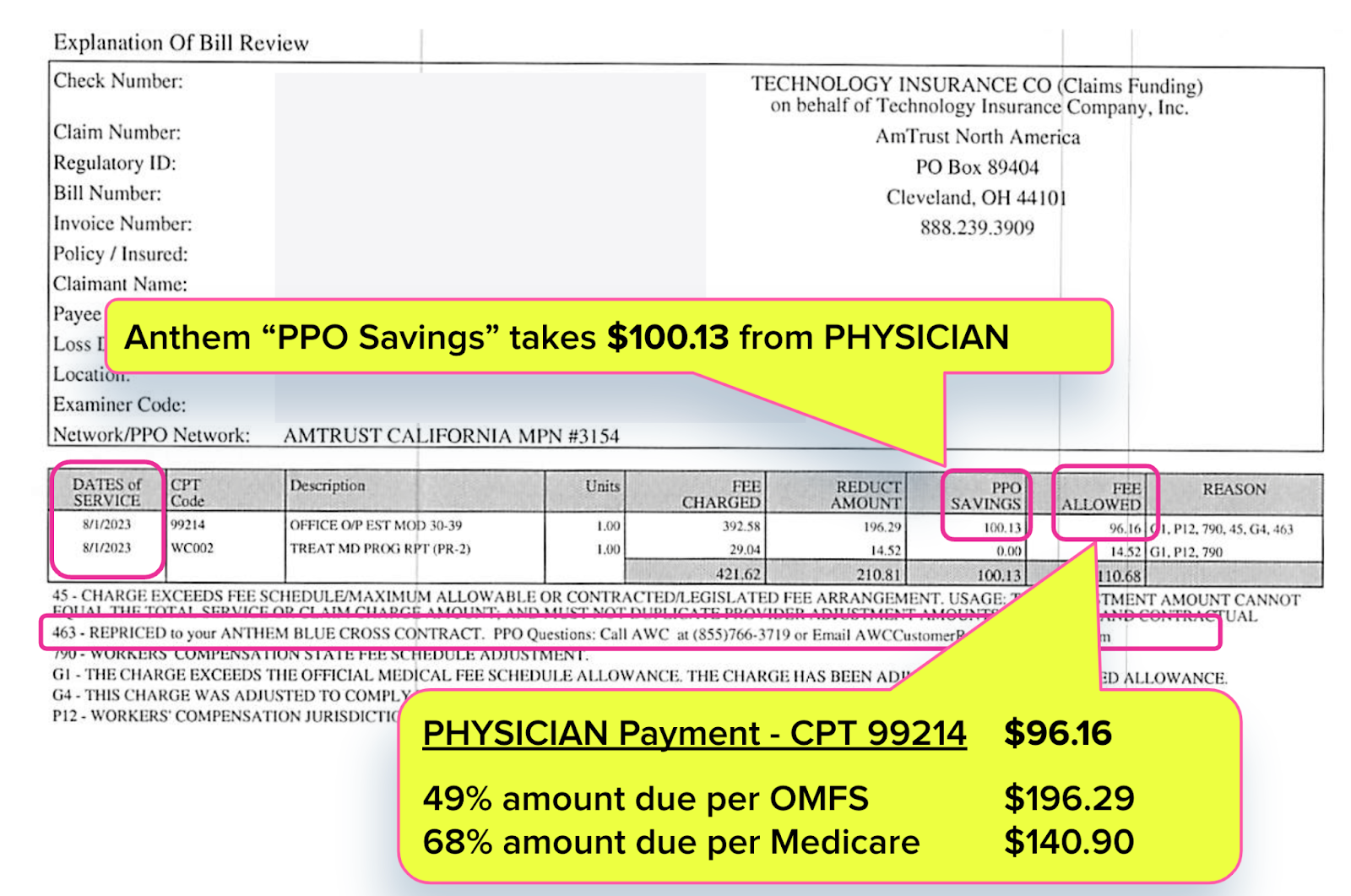

Anthem Reduces Physician Payment to 49% of OMFS

This physician conducted a moderate-complexity evaluation (CPT 99214) and prepared a detailed, 20-page Primary Treating Physician’s Progress Report (PR-2) that included an RFA (shown below, blurred for privacy).

It takes a substantial amount of time, effort, and administrative resources for a physician to conduct an evaluation and produce a report and RFA like the one above. As we often remind readers, the Physician Fee Schedule is supposed to pay 40% more than Medicare rates because treating injured workers is expensive for physicians.

But, of course, the Physician Fee Schedule is meaningless when PPOs reduce reimbursements to sub-Medicare levels.

For example, the Explanation of Review (EOR) below shows that AmTrust paid this physician $96.16 for E/M services, rather than the $196.29 owed per the OMFS.

AmTrust listed an Anthem Blue Cross PPO Contract to justify the $100.13 physician reimbursement reduction. This EOR shows AmTrust paid the physician less than the amount cut by Anthem Blue Cross.

To our knowledge, Anthem furnished zero services to the injured worker, yet this PPO took over 50% of the physician’s reimbursement.

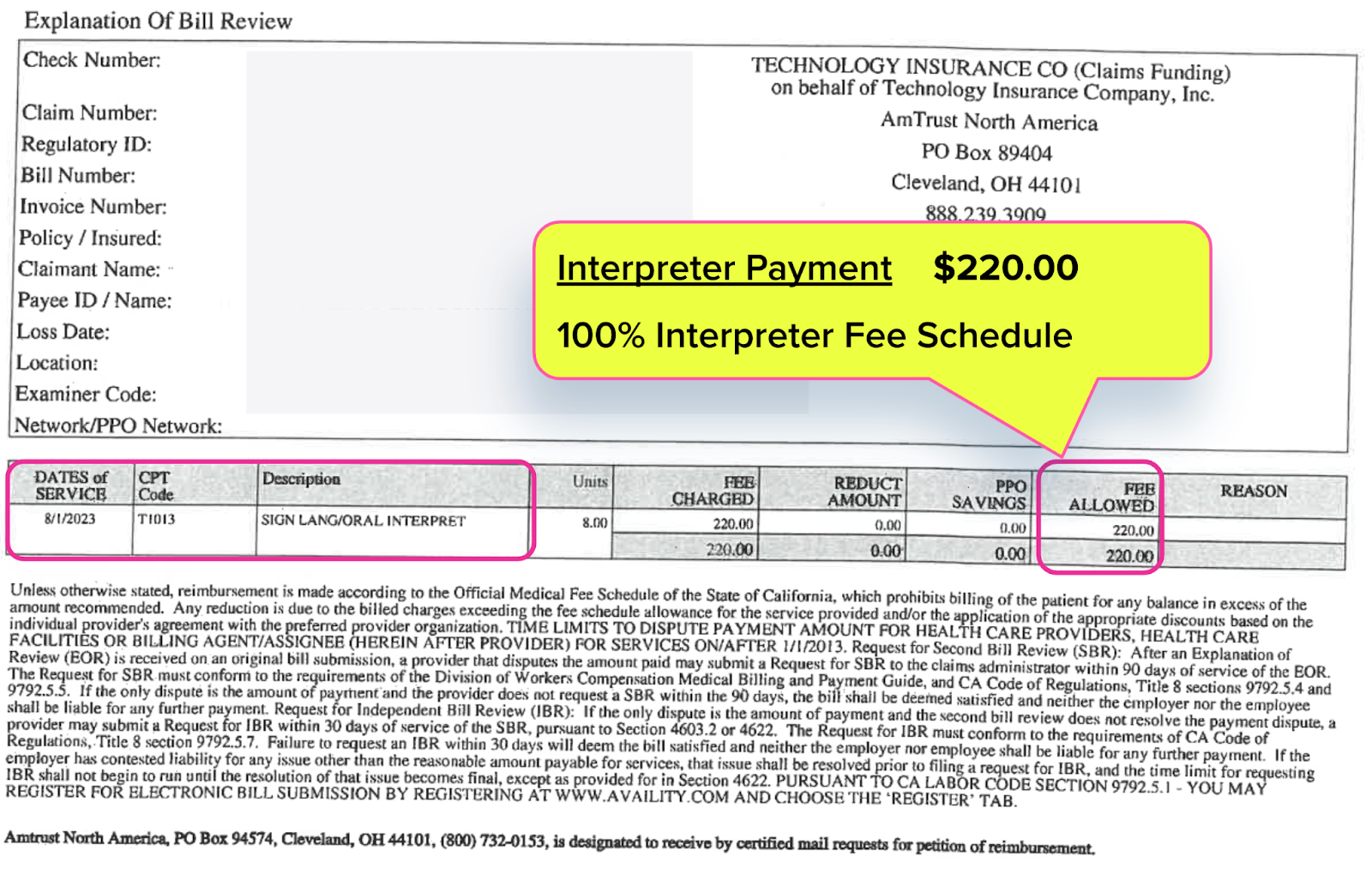

Interpreter Paid 100% Fee Schedule (As They Should Be)

The interpreter separately billed AmTrust for facilitating the evaluation of the injured worker, whose primary language was not English. Below is the EOR AmTrust sent to the interpreter, along with payment. The EOR shows AmTrust paid the interpreter $220.00.

The interpreter fee schedule found in California Code of Regulations Section 9795.3 requires claims administrators to pay either a minimum of $90 or “the market rate” for each encounter. This EOR reflects that AmTrust paid the interpreter the market rate as required.

No PPO nonsense here, just fee schedule rates commensurate with the indispensable services that interpreters provide to injured workers in a multilingual economy.

Why should it be any different for physicians, whose services are undoubtedly as critical to an injured worker’s treatment?

Physician “Value” Revealed

Altogether, for the E/M service, AmTrust paid the physician only 44% of the amount paid to the interpreter for facilitating that evaluation. To decry this is not to undervalue interpreters, but to acknowledge the massive investment of time, effort, and money required to become a licensed physician.

This tale demonstrates that California significantly undervalues the physicians that treat injured workers.

We have written extensively about how claims administrators, MPNs, PPOs, and other entities contort workers’ compensation into a financial chokehold that strangles physicians with contractual discounts, dubious down coding, surprise removal from networks, and endless, costly bureaucratic struggles to obtain authorization and correct reimbursement.

California allows MPNs and PPOs to use workers’ comp physicians as profit centers — while offering arguably nothing of value to injured workers.

Neither California legislators nor its regulators seem willing to halt this reimbursement carnage. Until physicians have finally had enough of the MPN/PPO pay-to-play system and cancel their discount reimbursement contracts, many physicians will receive reimbursements that are substantially less than the reimbursement paid to interpreters.

Remember: MPNs need doctors. Doctors do not need MPNs.

daisyBill makes workers’ comp billing easier, faster, and less costly. Request a free demonstration below.

REQUEST DEMO

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.gif)

agreed , but what are physicians doing about this fruad?? Why is the not on CNN and local news?? we need media and social media attention to this immediately ,and we need to stratagically come up with a solution to this issue.