Claim to Fame: 2016's Elite California Claims Administrators

Every quarter, we analyze and publish data on California claims administrators and time to payment for electronic workers’ comp bills. These reports provide a valuable snapshot of compliance – and non-compliance – throughout the industry. In recent days, we’ve examined time to payment for original electronic medical treatment and medical-legal bills. Today, we combine the two bill types to uncover the cream of the crop. Four claims administrators outshine all others in terms of speed.

Before crunching the numbers, let’s take a step back and consider electronic billing from a bird’s-eye view. Since October 2012, California claims administrators are legally obligated to compliantly accept and process workers’ compensation e-bills for medical treatment. No such requirement exists for medical-legal bills, but many environmentally conscientious claims administrators accept these bills in electronic format.

All told, DaisyBill has successfully processed and tracked almost 2 million electronic bills for workers’ compensation, encompassing medical treatment, medical-legal services, pharmacy services, copy services, and more. (Also worth mentioning: The millions upon millions of pieces of paper – and, by extension, thousands of trees – saved in that time.) This incredible profusion of data points provides us with a unique perspective when it comes to claims administrator analysis. Our sample size is so large that we can confidently point to certain claims administrators as demonstrating habitual compliance or non-compliance.

To determine the truly elite claims administrators of 2016, we settled on the following parameters:

- The claims administrator had to produce an average time to payment for original electronic medical treatment bills in 10 days or fewer, when California Labor Code 4603.4 mandates that payment for electronic bills is due within 15 days.[1]

- The claims administrator had to produce and average time to payment for original medical-legal bills of 20 days or fewer, when California Labor Code 4622 mandates that payment for paper medical-legal bills is due within 60 days.[2] (No such regulation exists for electronic med-legal bills.)

- The claims administrator had to process over 1,000 combined medical treatment and medical-legal electronic original bills over the calendar year.

The resulting party is vanishingly small – of the hundreds of claims administrators to which we routed electronic bills in 2016, only four meet our stringent requirements. Then again, they wouldn’t be elite if it wasn’t a small group.

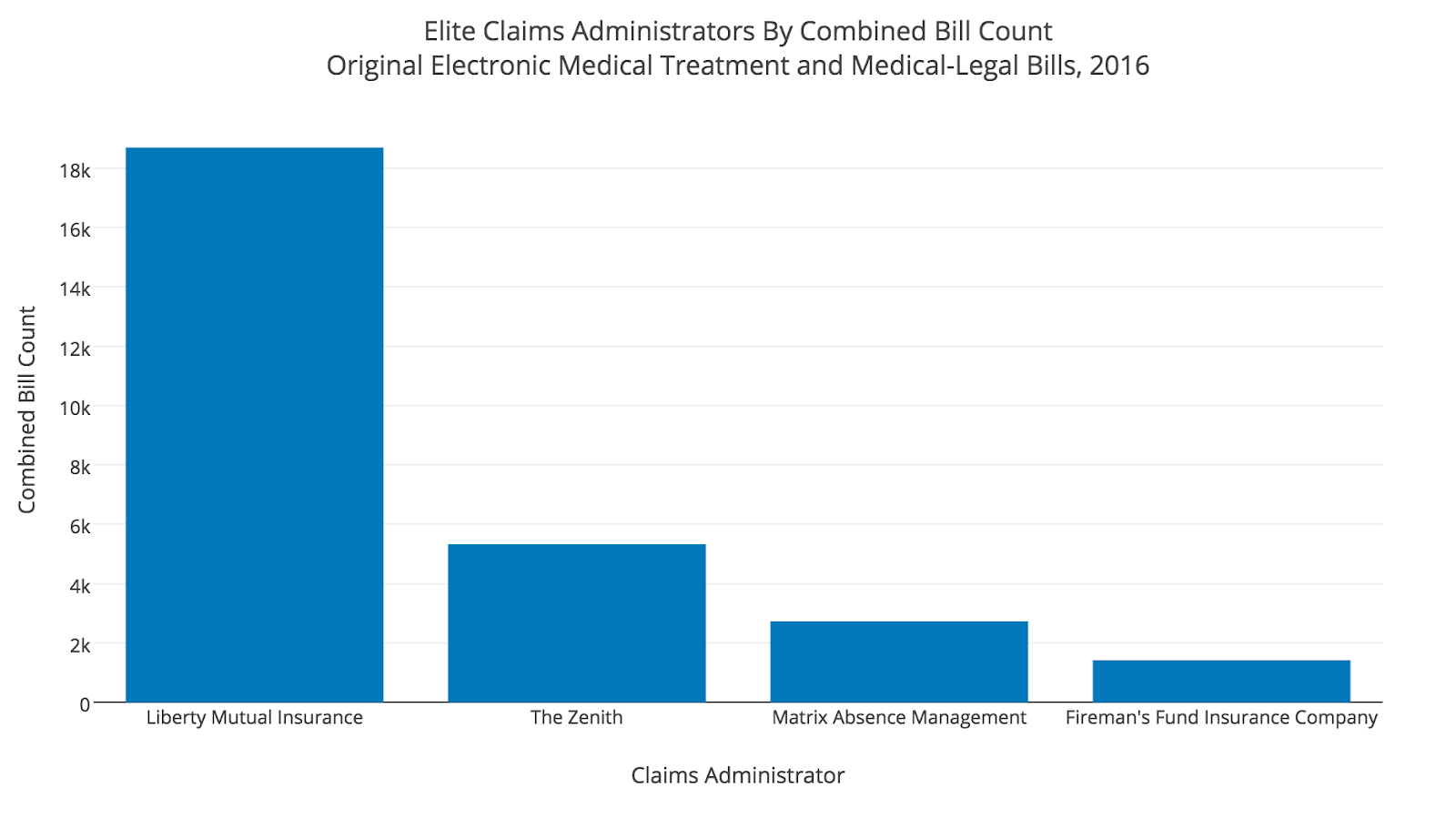

First, we’ll take a look at bill volume.

Bar Graph:

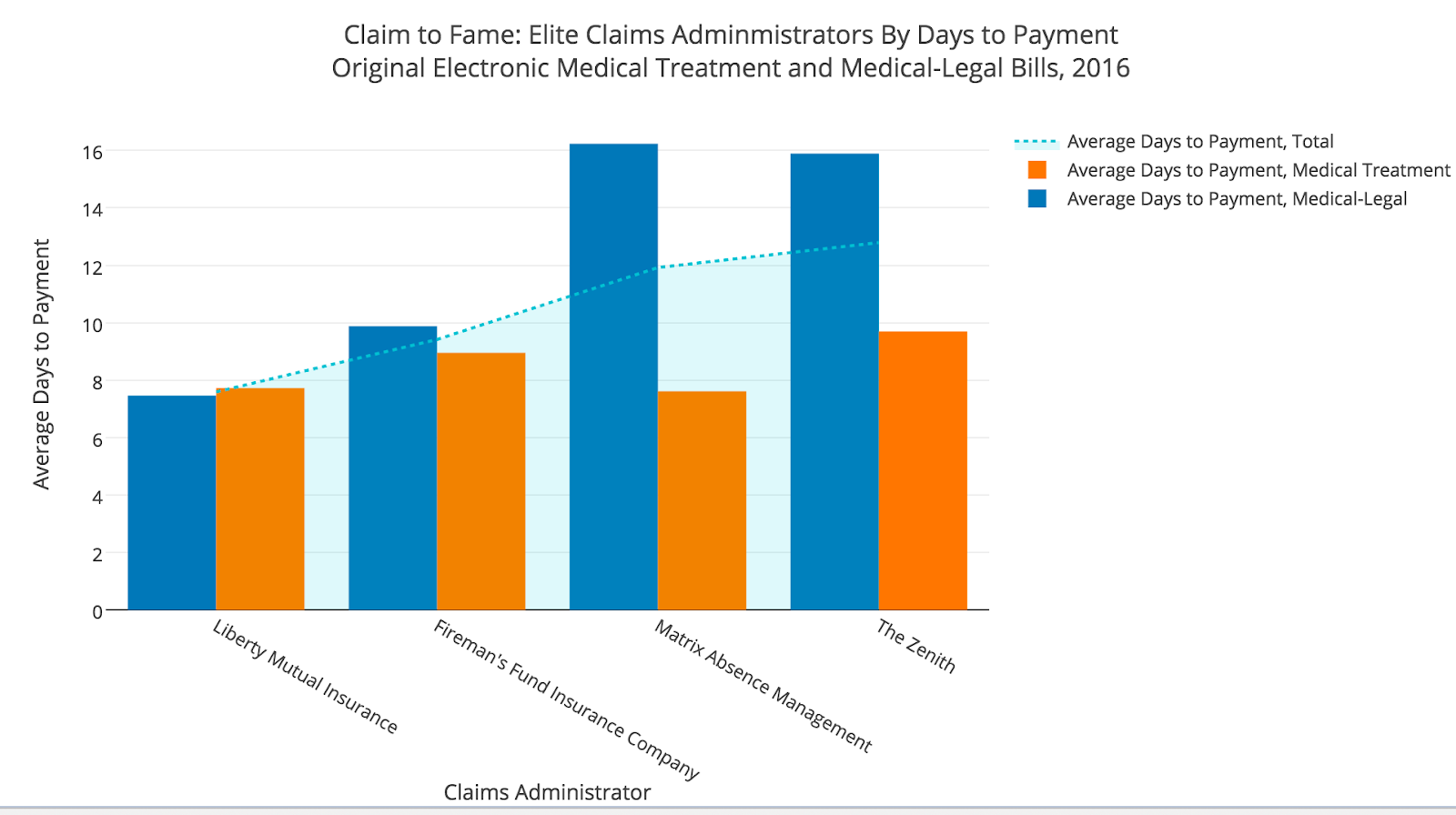

And here are those same four claims administrators by days to payment.

Bar Graph:

The clear standout, yet again, is Liberty Mutual. Not only did they process by far the most total bills, but they boast average days to payment of under eight days for each bill type. Liberty Mutual’s combined average is a scorching 7.59 days, spread over nearly 19,000 bills.

Eagle-eyed readers may remember The Zenith from our post on medical treatment bills – their 9.69 day average was praised then, and they pair it with a respectable 15.89 days for medical-legal bills for an overall average of 12.79 days.

Neither Fireman’s Fund nor Matrix Absence Management submit quite as many bills, but they both process them with astonishing speed. Fireman’s Fund checks in with a combined average of 9.42 days, while Matrix Absence Management weighs in with a score of 11.92 days. In fact, Matrix Absence Management remitted payment for their original medical treatment bills even faster than Liberty Mutual, with an average of 7.61 days to Liberty Mutual’s 7.72.

Any employer considering a workers' comp partner should closely examine these fantastic numbers. This group of claims administrators has obviously embraced the efficiencies of electronic billing, performing well beyond the requirements of California law. Unfortunately, many of their peers lag in current technology. Scores of California claims administrators grudgingly provide only the minimum level of effort and technology required for compliance. Many others ignore statewide regulations entirely and drag along in frustrating non-compliance. Providers must send a clear message: Embrace modern technology and regulations, or risk getting left behind.

We’ll be keeping an eye on claims administrators across the state this year in hopes of a positive trend emerging. Fingers crossed that a few more claims administrators rise up and join the elite quartet of Liberty Mutual, The Zenith, Fireman’s Fund, and Matrix in 2017.

Tired of submitting your work comp via mail and waiting weeks – if not months – for payment to come through? We can show you a better way. Sign up below to attend our e-billing webinar. We’ll cover the basics, and knock your socks off with blazing-fast average days to payment.

E-BILLING FOR EVERYONE

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.