Compliant Electronic Billing for Workers’ Comp: The Basics

Since October 2012, California claims administrators are legally obligated to compliantly accept and process workers’ compensation electronic bills. In that time, electronic billing has consistently offered providers a much faster and more efficient avenue for processing their workers’ comp bills, and daisyBill has answered thousands of questions about electronic billing rules and compliance.

Emerging from millions of data points – we’ve successfully processed and tracked over 1.5 million electronic bills – is a rock-solid understanding of compliant electronic billing and its substantial differences from traditional paper billing. Can’t tell your 837s from your 275s? Not sure why your electronic bills are rejected? We compiled this primer to help you through the alphanumeric soup.

This guide draws upon two free resources from the California Division of Workers’ Compensation (DWC) that outline comprehensive electronic billing rules and responsibilities for providers and claims administrators:

- The Medical Billing and Payment Guide compares the rules for paper versus electronic medical treatment bills.

- The Electronic Medical Billing and Payment Companion Guide supplements and explains California’s electronic standards and requirements for all bill types in the workers’ compensation system.

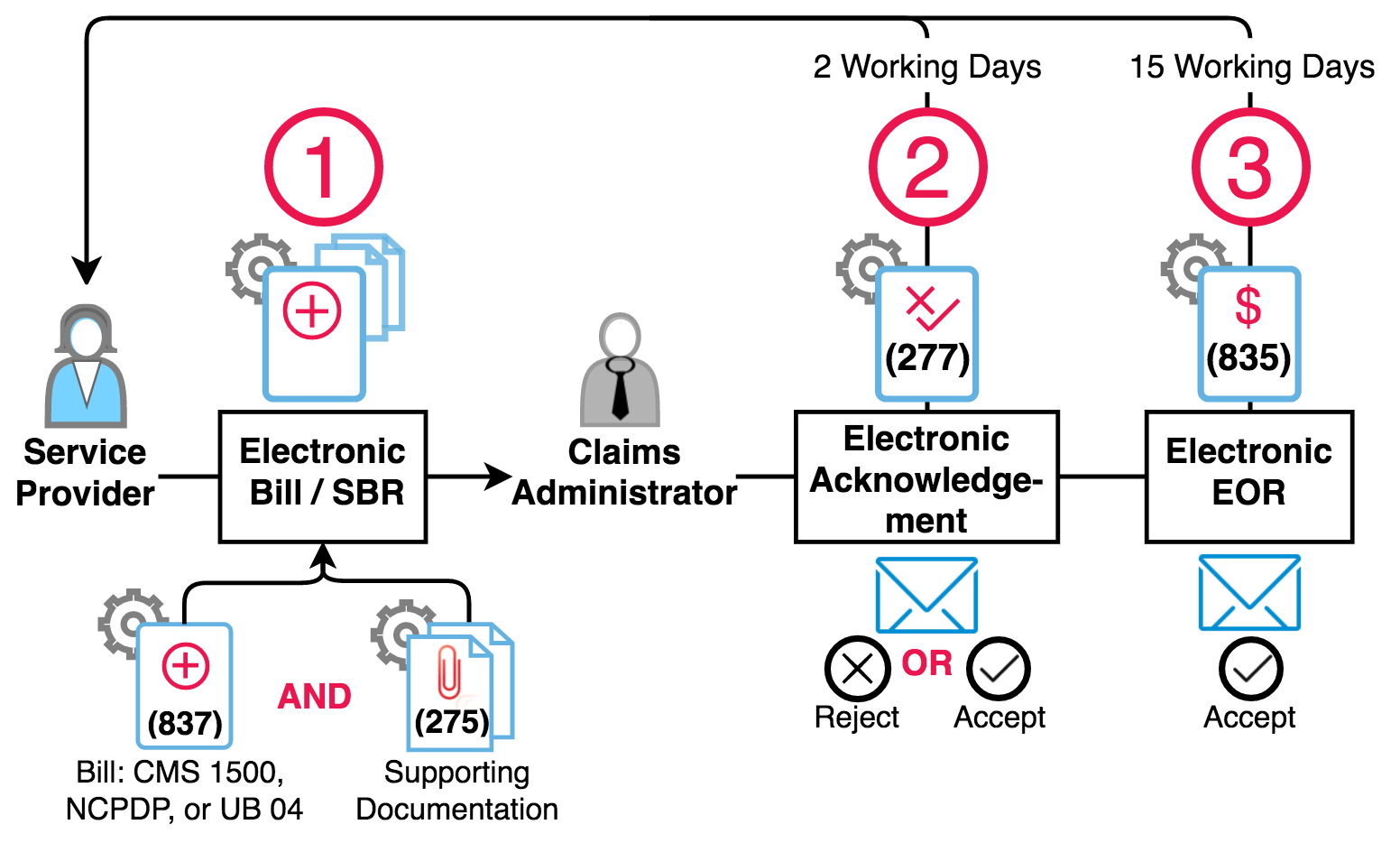

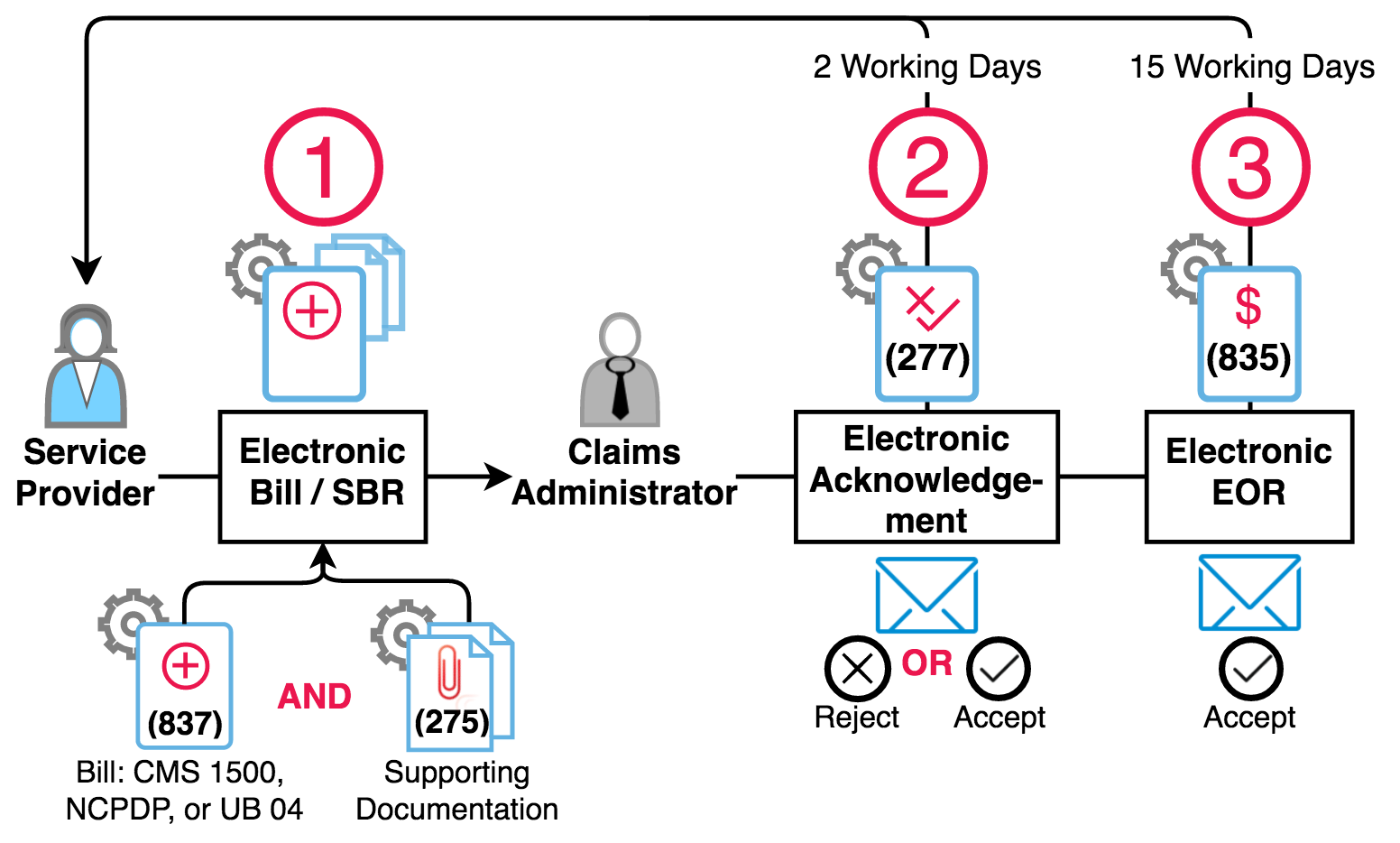

Per the DWC, there are three main steps required to compliantly submit and process electronic bills. Let’s take them one by one.

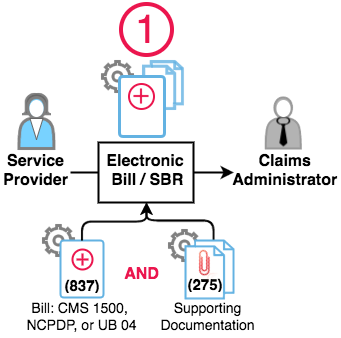

Step 1 - 837 Electronic Bill + 275 Supporting Documentation

A provider creates and electronically transmits a complete bill to the claims administrator.

A complete electronic bill is comprised of two parts:

- Treatment information. The data that normally populates a CMS 1500 or other paper billing form is converted into an electronic file known as an 837. Rather than being submitted on a paper form via the mail, the bill information is sent electronically to the claims administrator.

- Supporting documentation. The required workers’ compensation-specific supporting documentation, such as the PR-2 or DLSR, is sent to the claims administrator in PDF format in a separate file known as a 275 file.

Step 2 - 277 Acknowledgment

Within two working days of receipt of a complete electronic bill from a provider, the claims administrator must review the electronic bill and return an acknowledgement to the provider. This mandatory acknowledgement is known as a 277.

The 277 acknowledgement alerts the provider of two possible outcomes:

- The bill is accepted for adjudication or processing.

- The bill is rejected and will not be adjudicated or processed.

An accepted 277 acknowledgement documents that the claims administrator received the bill and that the bill will be processed – this is like receiving a certified return receipt in the mail.

A rejected 277 acknowledgement means the claims administrator will not process the bill. Per the DWC regulations, there are seven reasons why a claims administrator may return a rejection acknowledgement:

- Invalid form or format

- Missing information

- Invalid data

- Missing attachments

- Missing required documents

- Injured workers’ claim of injury is denied

- There is no coverage by the claims administrator

The claims administrator must send the provider a specific rejection acknowledgment explaining the reason for the rejection so the provider can correct the error and re-submit the bill.

Step 3 - 835 Electronic Explanation of Review

Within 15 working days from receipt of an accepted electronic bill, the claims administrator must send the provider an electronic EOR. The electronic EOR is known as an 835 file. (By way of contrast, claims administrators are allowed a whopping 30 calendar days to remit a paper EOR after receipt of a paper bill).

This EOR timeline only applies to bills that were accepted by the claims administrator in Step 2.

Put it all together, and the steps look like this:

Behind the Scenes

Generally speaking, providers and claims administrators cannot transmit or receive the various required electronic files – the 837, 275, 277, and 835 – that underpin electronic billing, so each hires a third party to manage electronic billing on their behalf. That’s where we come in. daisyBill is an EDI agent, or electronic billing expert, that helps providers compliantly submit and process electronic bills according to the above outlined three steps.

As the EDI agent hired by a provider, daisyBill submits compliant electronic bills (837s) with supporting documents (275s) to the EDI agent hired by a claims administrator. The claims administrator EDI agent, in turn, sends daisyBill either the accepted and rejected acknowledgements (277s) and sends daisyBill the electronic EORs (835s).

Ultimately, providers and claims administrators are responsible for the compliance of the EDI agents they hire. Stay tuned – we’ll examine the relationships among EDI agents, providers, and claims administrators in greater detail in the coming weeks.

Thousands of workers’ comp professionals across the state use daisyBill to compliantly process electronic bills. To learn more, schedule a no-pressure demo with one of our billing experts.

Request Demo

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.