Discount Dangers, Part I: The Silent PPO

Discount Dangers is a DaisyBill series on the various ways discount contracts cheat workers’ comp providers out of reimbursement. With this series, we shine a light on the worst discount practices, and help providers fight back.

There’s a danger lurking in Preferred Provider Organization (PPO) discount contracts: the “silent” PPO.

For group health, when providers agree to a proprietary discount for the members of a PPO, the doctors are incentivized to accept the discounted reimbursement based on a promised stream of patient referrals. For example, a doctor may accept a discounted reimbursement schedule from Blue Cross, and in exchange, Blue Cross includes the doctor’s name as a preferred provider, steering more Blue Cross members to that provider’s office.

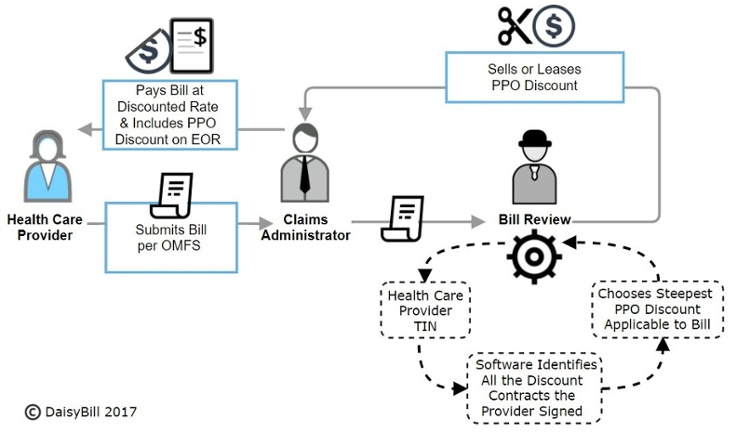

A silent PPO is when a workers’ comp insurer or self-insured employer’s TPA leases or purchases a PPO discounted fee schedule and applies the reduced PPO reimbursements to bills received from the workers’ comp provider. To be clear, the doctor did not sign a contract with the workers’ comp insurers and self-insured employers.

While group health PPO discounts may make financial sense for a doctor, extending these discounts to workers’ comp payers does not. These silent PPO discounts always reduce reimbursement to below the amount allowed by California’s Official Medical Fee Schedule (OMFS). For a provider, there is no return on investment, because unlike the standard PPO arrangement, no one steers patients to the provider in a silent PPO.

How do these discounts happen? Upon receipt of a workers’ comp bill from a provider, bill review uses a computer program that identifies all the discount contracts signed by that provider. The reviewer then chooses the steepest PPO discount to apply to the bill, and reduces the reimbursement due to the provider.

Without any discernable benefits, the provider is unfairly reimbursed and forced to accept up to a 30% reduction below the reimbursement as allowed by the Official Medical Fee Schedule (OMFS). Bill review and/or the TPA and the PPO all benefit by taking a percentage of the “savings,” with the employer receiving only a small percentage thereof.

Fortunately, the California legislature recognized the predatory nature of silent PPOs and enacted legislation to protect providers and the workers’ comp system. California Labor Code 4609 mandates that whenever a provider signs a discount contract, the PPO must inform the provider in writing if the PPO discount is transferred to another entity. More importantly, this Labor Code also specifies that employers who bind providers to PPO discounts must actively encourage workers to visit those providers. Patient “steering’ is an actual legal requirement.

In 2007, a Workers’ Compensation Appeals Board (WCAB) judge ruled in favor of a provider because the California State Compensation Insurance Fund (SCIF) failed to meet the requirements of Labor Code 4609. In Woodruff v. Greenfield (2007) BAK0141023, Good Samaritan Hospital in Los Angeles treated an injured trucker and billed SCIF over $69k. SCIF then sent a reduced payment of less than $10k, citing a Blue Cross PPO discount.

In the legal battle that ensued, the WCAB judge found that SCIF was out of compliance with LC 4609, because SCIF had not directly entered into a compliant discount agreement with Good Samaritan Hospital, and SCIF had not compliantly steered any patients to Good Samaritan.

SCIF’s decision not to appeal the WCAB ruling was a “silent victory” for providers against silent PPOs, of which most providers remain unaware. Despite this ruling, bill review for workers’ comp insurers and self-insured employers continue to skirt the requirements of Labor Code 4609, because providers have neither the time nor the resources to fight back.

Unfortunately, bill review companies, TPAs, and PPOs continue to profit by using computer algorithms to cheat providers out of reimbursements guaranteed by the OMFS. Like a tree canker that weakens the main plant, these complex Silent PPO algorithms only benefit claims administrators and bill review, at the expense of workers’ comp as a whole.

Injured workers, employers, and providers all suffer when Silent PPOs take hold. These Silent PPOs hurt workers’ comp by making treatment of injured workers an even worse financial proposition for providers. Employers and injured workers are left with fewer and fewer providers willing to deal with the endless onslaught of Silent PPO discounts and reduced reimbursements.

In the coming weeks, DaisyBill will offer providers guidance to end, or at the very least, manage these Silent PPO discount contracts.

DaisyBill offers a full range of tools to keep providers from being taken advantage of, including our Work Comp Wizard's OMFS calculator. This calculator quickly determines exactly how much providers are owed based on the latest updates to all 7 workers’ compensation fee schedules. Try it today!

TRY THE WORK COMP WIZARD

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.