Essential Checklist for Work Comp Explanations of Review

EOR sent? Check. On time? Check. Complete information? Check.

If you can’t check off all those boxes for every bill, something is wrong. Explanations of Review (EORs) are mandatory, with mandatory deadlines and mandatory information that must be included.

Why do we keep repeating the word “mandatory”? Because many claims administrators treat the laws that govern EORs as if they’re optional.

The California Labor Code is not optional.

Furthermore, EORs are a critical element of communication between the claims administrator and the provider. The only way providers can understand why a claims administrator denies or disputes a bill is by reading the EOR.

If a provider doesn’t use EORs to understand and act on unpaid or underpaid bills, then that provider is losing money!

Labor Code §4603.3 states that “an employer shall provide an explanation of review…”

Let’s break down what that means. Use the handy checklists below to navigate through the Labor Code’s very specific requirements for both timeliness and completeness.

Checklist for EOR Timeliness

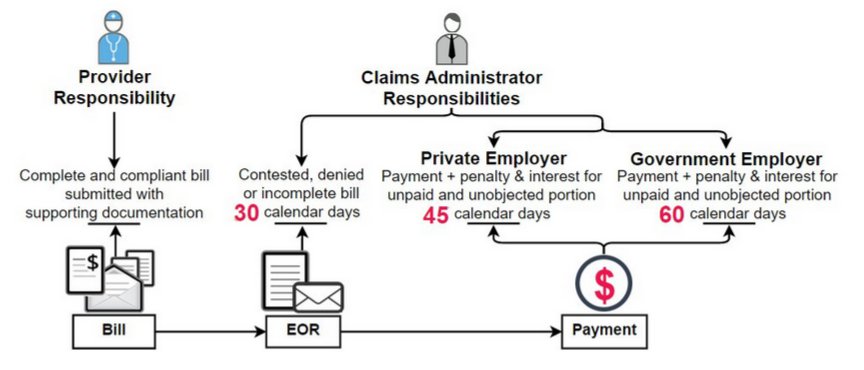

Non-electronic CONTESTED bills:

▢ EOR due within 30 days of receipt of the original bill

Non-electronic UNCONTESTED bills:

▢ EOR + Complete Payment due within :

- 45 calendar days, for non-government employers, of receipt of the original bill, or

- 60 calendar days, for government entities, of receipt of the original bill

Medical-legal bills:

▢ EOR due within 60 days of receipt of the Original bill

Electronic bills (contested or uncontested) submitted by Health Care Providers:

▢ Electronic EOR due within 15 working days of receipt of the original e-bill

Request for Second Review:

▢ Final EOR due within 14 days of receipt of the Second Review

Checklist for EOR Completeness

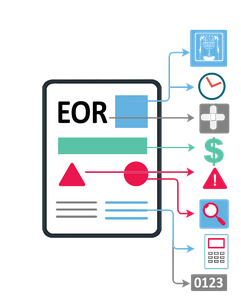

For medical and non-medical bills, the EOR must contain all of the information specified in Labor Code section 4603.3. There are six mandatory items:

▢ An itemized bill and the amount requested to be paid

▢ Amount the claims administrator actually paid

▢ The basis for any adjustment, change, or denial of the bill

▢ Any additional information related to this decision

▢ Reason for the denial

▢ The claim administrator’s contact information

In addition, for medical treatment bills, the DWC requires four additional items:

▢ The information in Table 3.0, Appendix B of the DWC’s Billing Payment Guide

▢ Notification of items being contested, denied, or considered incomplete, using the

DWC’s Bill Adjustment Reason Codes (BARCs)

▢ Any additional information required for payment

▢ The claims administrator’s contact information

If a claims administrator does not provide an EOR that is both timely and complete, then that EOR is noncompliant, and the provider should file an Audit Complaint.

With daisyBill’s technology, it’s easy to file an Audit Complaint in seconds. Even if you are not a daisyBiller, we can help you submit an Audit Complaint to report a misbehaving claims administrator. We believe that workers’ comp CAN work--but we need your help to make it so!

Don’t forget to watch daisyBill’s free EOR webinar on the Webinar Library. You’ll learn how to use EORs to understand the reasons claims administrators pay (or don’t pay) your bills.

VIDEO AND SLIDES

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.