FL: Urgent Care e-Billing Success

Treating injured workers can be financially sustainable and beneficial for practices—but only if workers’ comp bills and reimbursements are tracked and managed effectively.

The best way to accomplish this is to send workers’ comp bills electronically (e-billing).

The same technology used to submit e-bills and post reimbursements automatically can also provide essential payment analytics, empowering practices to better understand whether treating injured workers is financially viable.

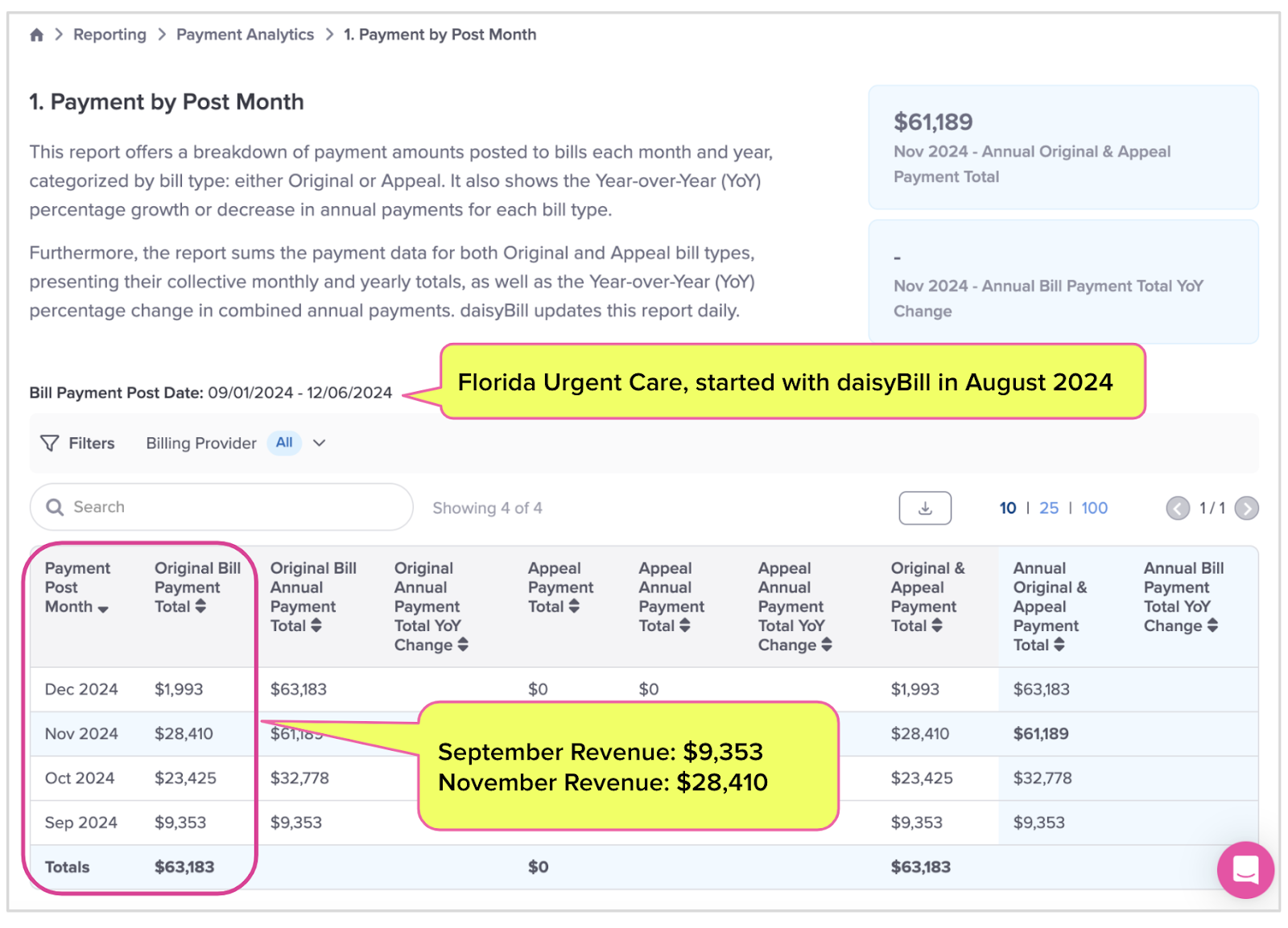

For example, see the reimbursement data from a Florida Urgent Care practice that began using daisyBill’s workers’ comp-specific e-billing technology earlier this year.

Because daisyBill automates so much of the administrative work necessary to receive payment for treating injured workers, this practice’s billing became 10x easier and revenue began to flow quickly and consistently.

See the details below!

Florida Practice Sees Revenue Roll In

Billing for workers’ comp is a massive administrative undertaking. Without the right technology, it’s also incredibly sluggish, with unseen revenue piling up in Accounts Receivable for months.

Moreover, the sad fact is that improper payment denials, discounting, downcoding, and payer non-compliance are like financial piranhas stripping practices of revenue—one small bite at a time.

The only financially viable way to treat injured workers is to automate revenue management with technology that can:

- Bill accurately with minimal staff time

- Ensure near-instant bill delivery

- Automatically post electronic payments (typically received in days)

- Send alerts for late and incorrect payments prompting staff to follow up with appropriate actions

- Provide reliable analytics and track progress toward financial benchmarks

The results can be dramatic when a practice adopts technology designed for workers’ comp.

For example, the Florida practice below began using daisyBill in August 2024. As the screenshot from the practice's Payment by Post Month analytics shows, the first full month for which data was available was September 2024, during which the practice brought in $9,353.

But the financial dam broke as the practice ramped up its (easy, quick) electronic bill submission.

With daisyBill, the practice quickly submits bills and gets paid at a drastically increased clip. In November, the practice brought in $28,410 (it’s early December as of this writing, hence the lower amount for December revenue).

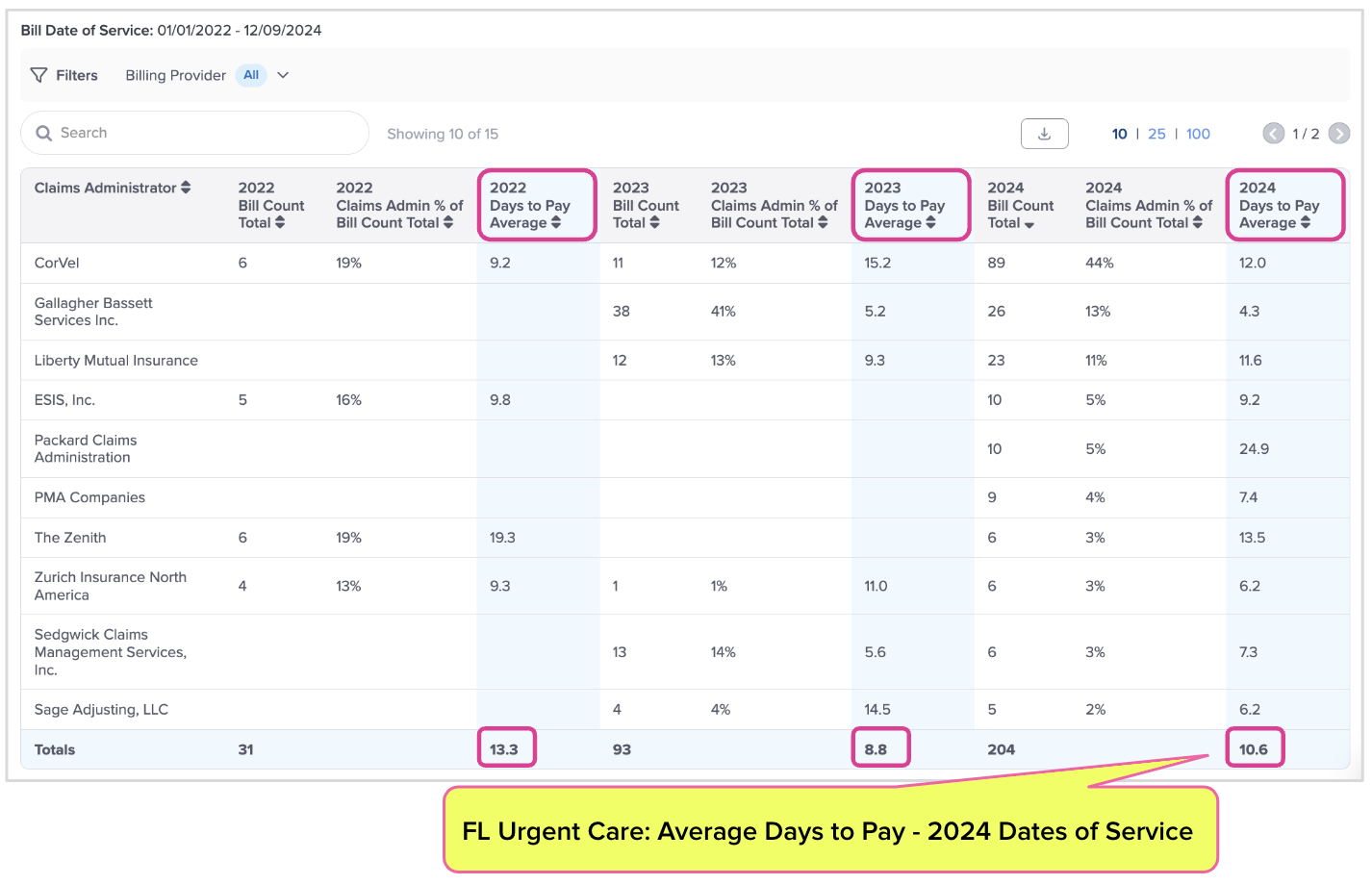

daisyBill payment analytics also track how quickly payers reimburse our clients.

As the analytics below show, for bills with Dates of Service in 2024, the Florida practice was paid in 10.6 days on average.

Note that despite starting with daisyBill in 2024, the practice had outstanding bills for 2022 and 2023 dates of service. These bills were either not sent, lost in the mail, or simply ignored by the claims administrator. Once the practice started e-billing all bills, including those for old dates of services, they were processed rapidly.

Advanced e-billing tech cannot solve all the problems of workers’ comp. However, automation, efficient workflows, and powerful analytics can accomplish one critical objective: making it financially sustainable to treat injured workers.

Nationwide, daisyBill increases revenue and decreases hassle for providers who treat injured workers. Get a free demonstration below.

SCHEDULE DEMO

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.gif)

.gif)