Late Bill Payment? Collect Penalty and Interest.

The passage of Senate Bill 1175 last autumn placed a lot of emphasis on the timely filing of California workers’ comp bills. But what about timely payment? Claims administrators must also meet billing deadlines. And if they miss those deadlines, they owe providers self-executing penalty and interest.[1] Claims administrators often ignore this requirement altogether, but providers do have a recourse.

Penalty and interest rules and deadlines vary for different bill types.

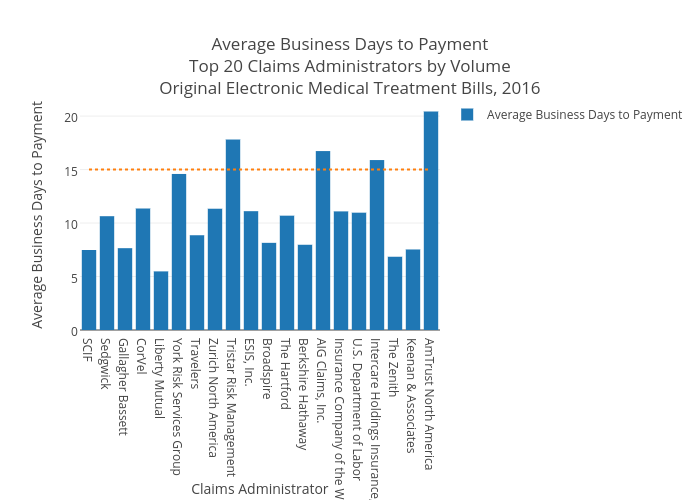

Medical Treatment Bills

A claims administrator incurs 15% penalty and 10% accrued interest per annum if payment is remitted untimely for medical treatment bills and services. For nongovernment employers, payment is untimely if a provider receives payment after 45 days from the claims administrator receipt of the the bill. For government employers, payment is untimely if a provider receives payment after 60 from the claims administrator receipt of the bill.[2]

According to the California Division of Workers’ Compensation Medical Billing and Payment Guide, the penalty and interest are to be self-executing. This means the claims administrator should automatically include the penalty and interest when sending a late payment. The provider should not have to ask for this payment.

We also recommend filing an Audit Complaint. They’re a simple way to hold claims administrators accountable, and you can file anonymously, so reporting improper behavior poses no risk to your relationship with the claims administrator in question.

Medical-Legal Bills

Claims administrators incur a 10% penalty and 7% accrued interest per annum[3] if they remit untimely payment for medical-legal bills. Payment is untimely if it is received more than 60 days after the claims administrator received the original med-legal bill. No distinction is made between government and nongovernment employers.

Per the California Code of Regulations § 10451.1, med-legal providers who are owed penalty and interest for an untimely bill payment should file a Petition for Determination with the Workers’ Compensation Appeal Board (WCAB), citing that the claims administrator in question breached a duty as defined by Labor Code § 4622(a).

Once again, we also recommend filing an Audit Complaint. We provide a free online library of suggested Audit Complaint language. A few minutes of copying and pasting could lead to the DWC intervening and correcting a claims administrator’s non-compliance. Each time you file, you improve California workers’ comp billing for the entire community.

Takeaway

If a claims administrator fails to remit timely payment, providers are entitled to penalty and interest payments. Though claims administrators are supposed to self-regulate and pay penalty and interest automatically, it’s important to keep track of any untimely payments and hold the claims administrator accountable by filing a lien or petition for determination, as well as an audit complaint. daisyBill Billing Software clients can track accrued penalty and interest payments using the Bill History page.

Thousands of workers’ comp professionals across the state use daisyBill to compliantly process electronic bills. To learn more, schedule a no-pressure demo with one of our e-billing experts.

REQUEST DEMO

[1] This is set forth in Section 7.2 of the California Division of Workers’ Compensation Medical Billing and Payment Guide.

[2] Full rules and regulations for medical treatment bills are available in the Medical Billing and Payment Guide and California Labor Code § 4603.2.

[3] Full rules and regulations for med-legal bills are available in California Labor Code § 4622.

NOTE: The Audit Complaint form was updated in 2019. Access the updated form here: https://www.dir.ca.gov/dwc/Auditref.pdf

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.