Myth Debunked: Payer "Doesn't Accept" e-Bills

When non-client providers contact us about workers’ comp e-billing, they inevitably share frustrations based on certain e-billing myths. In this series, we address the most common misconceptions.

Workers’ Comp e-billing myth: Many workers’ comp claims administrators (aka payers or carriers) do not accept e-bills.

Providers report to daisyBill that they are often told that a claims administrator “doesn’t accept” e-bills. This is usually a pure, steaming pile of bunk, as evidenced by daisyBill’s 2023 e-billing data.

Fact #1: In 2023, daisyBill providers sent over 2.4 million bills to claims administrators. daisyBill sent 93% of these bills electronically to claims administrators as e-bills.

So why does the myth persist? One possible explanation is that these providers used a single clearinghouse to send all their e-bills, with (predictably) poor results.

Fact #2: Claims administrators (with two exceptions) do not maintain the necessary technology to accept e-bills from providers, so they hire a clearinghouse vendor to accept e-bills from providers.

It’s easy for a clearinghouse to deliver e-bills to its claims administrator clients, but not all claims administrators hire the same clearinghouse. When the e-bill belongs to a claims administrator that is not the clearinghouse’s client, delivering the e-bill through a competing clearinghouse is much trickier — so clearinghouses often simply mail bills to claims administrators that are not their own clients.

Below, we explain how daisyBill technology successfully delivers so many providers’ bills electronically as e-bills.

Solving the e-Billing Clearinghouse Problem

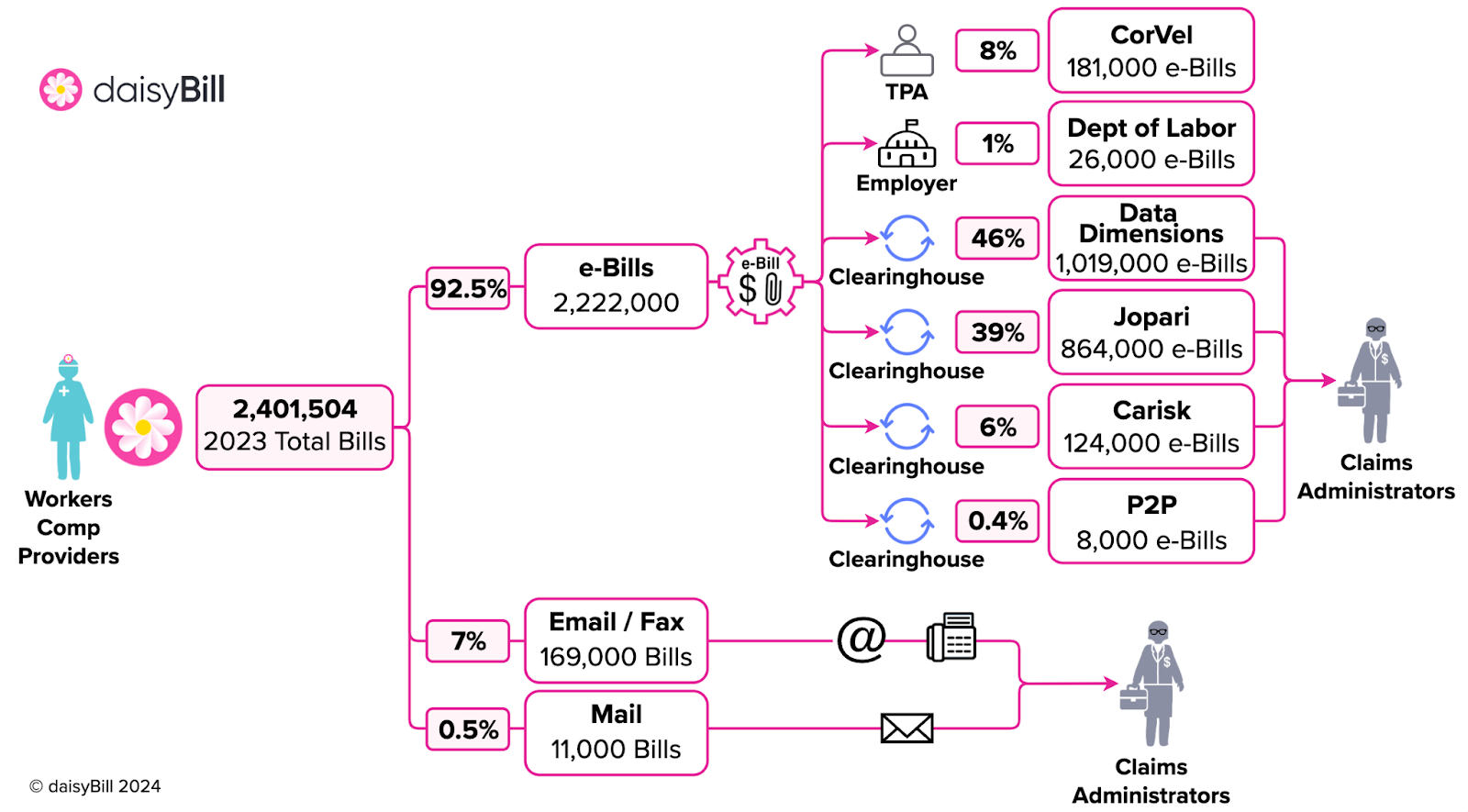

Using daisyBill, providers simply select the claims administrator and can trust the technology to send their bill to the right place for the fastest payment. Below is the data outlining how daisyBill sent all 2,401,504 bills in 2023:

- 92.5% of bills were sent as e-bills to one of the four clearinghouses, CorVel, or the DOL.

- 7% of bills were emailed or faxed to the claims administrator (the claims administrators who do not accept e-bills but agree to email and fax delivery).

- Less than a single percent of bills were mailed to the tiny minority of claims administrators who genuinely insist on mail delivery.

Workers’ comp claims administrators hire one of four clearinghouses to accept e-bills from providers: Jopari, Data Dimensions, Carisk, and P2P. Only Third-Party Administrator (TPA) CorVel and the US Department of Labor (DOL) maintain technology to accept e-bills directly from providers.

Delivering e-bills in the vast network of claims administrators using multiple clearinghouses (with thousands of unique Payer ID numbers) is complex.

Clearinghouse technology is ill-suited to deliver all your e-bills, for a simple reason: serving providers is not the clearinghouse’s primary function. Servicing providers is a clearinghouse’s side gig. When clearinghouse technology fails, the clearinghouse resorts to snail mail, creating the impression that e-billing isn’t viable.

Fact #3: daisyBill (and only daisyBill) maintains direct electronic delivery routes for e-bills with every clearinghouse (plus the DOL and CorVel), as shown above.

Clearinghouses are great tools for claims administrators who need them to accept e-bills from providers. But for providers, using a clearinghouse as a makeshift e-billing solution is like using a hammer to perform the function of a screwdriver — it can work in theory, but the results reveal the reality.

Get your e-bills delivered and paid in record time. Schedule a free demonstration of daisyBill below.

SCHEDULE DEMO

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.gif)