Payor Rankings: The Slowest-Paying Work Comp Claims Administrators

We believe that accountability is an important aspect of the fight for proper reimbursement. To that end, we track the time claims administrators take to pay our work comp providers.

Because electronic billing and payment is so much easier and more efficient than the paper variety, California Labor Code holds higher standards for timely payment of e-bills. Most insurers meet those standards, but sadly enough, some do not. We feel duty-bound to call out those insurers who consistently take their sweet time remitting payment.

Our providers, and the injured workers they treat, deserve better.

Absent a separate reimbursement contract, all payors (insurance companies, self-insured employers, and third-party claims administrators) have 15 working days to pay electronic bills, according to California Labor Code § 4603.4. Sadly, providers are essentially responsible for enforcing this rule, which results in inconsistent compliance by payors.

To shed light on payor behavior, we created our Insights Tool and its Average Days to Payment tracker.

This tool compiles data for physician, medical-legal, interpreter, copy services, and pharmacy bills. For all these services, we track payment for Original Bills, Second Review, and Independent Bill Review (IBR). We also rank insurers by the sheer volume of bills they process, tracking their respective percentages of the total number of bills submitted.

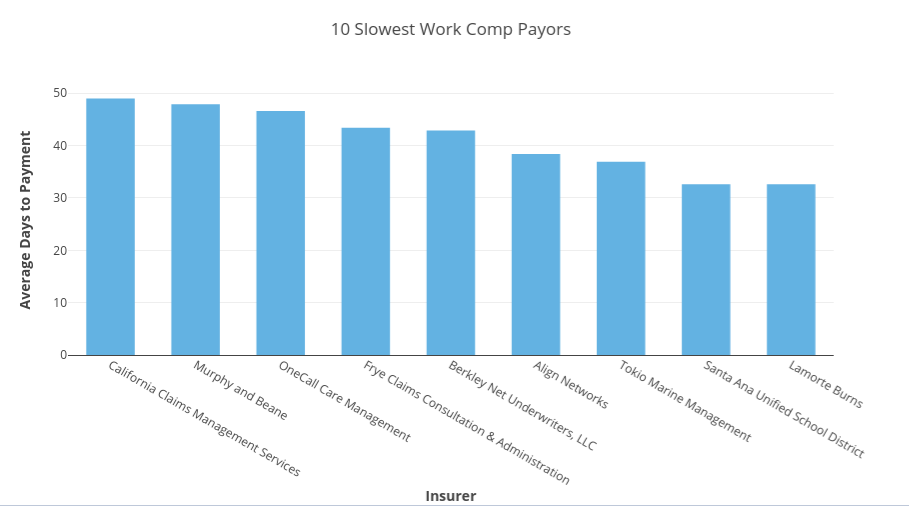

The Slowest Work Comp Payors

For original medical bills submitted between July 1, 2016, and June 30, 2017, 71 of our 289 payors had an average days to payment exceeding 15 days. In some cases, the late payments are nothing short of blatant noncompliance. In others, the insurer secured separate reimbursement contracts which freed them from the 15-day mandate — giving themselves legal cover for wildly excessive payment times.

The 10 slowest payors all exceeded the 15-day benchmark by at least 17 days, taking more than double (and in some cases triple) the time California law considers reasonable for paying electronic bills. All 10 were smaller claims administrators, processing less than 1% of all bills submitted, leaving no room for excuses about volume.

The dubious distinction of Slowest Payor went to a third-party administrator, California Claims Management Services. With a whopping 49 average days to payment, CCMS took the most scenic possible route to reimbursement. On average, payments reached their destination over a month later than the 15-day standard.

On behalf of our providers, we can only offer this payor a sincere “Seriously?”

Also breaking the 40-day mark were Murphy & Beane, OneCall Care Management, Frye Claims Consultation and Management, and Berkley Net Underwriters, LLC. Align Networks, Tokio Marine Management, Santa Ana Unified School District, and Lamorte Burns rounded out the Bottom 10 with average days to payment in excess of 30.

Be Careful When Signing Reimbursement Contracts

Again, some of these payors (like OneCall and Align) are specialty networks, or other entities that secured separate reimbursement contracts with providers. While under no legal obligation to remit payment within 15 days, payors like these nonetheless stand as a stark warning to providers about the dangers of reimbursement contracts. Providers, read the fine print! Know what you’re getting into when signing a reimbursement contract.

We recommend providers amend their proposed contracts and accept nothing slower than a 20-day deadline for payment of bills. Even in cases where a network acts as a friction-producing middleperson, payment should never take longer than that.

Demand Timely Payment

Absent a separate contract, we strongly encourage providers to take action when payments are late. For medical services, Labor Code 4603.2 requires non-government employers to pay penalty and interest if a bill is not paid within 45 days of receipt. Government employers must pay penalty and interest if a bill is not paid within 60 days of receipt (Despite the 15-day limit for e-bills, penalty and interest only apply after the respective 45 or 60 days).

Unfortunately, penalties and interest are “self-executing,” which means that insurers are trusted to penalize themselves by voluntarily remitting the appropriate fees. Unsurprisingly, this “Honors System” is rarely honored. For a complete guide to calculating and obtaining penalties and interest for late payments, see our FAQ.

By standing firm and demanding correct, timely payment for the authorized treatment of injured workers, work comp providers can protect their bottom lines. In a system that often seems designed to make obtaining payment as tough as possible, providers should use every tool at their disposal — starting with reliable electronic billing.

Need e-billing? We’ve got e-billing. California workers’ comp billing and payment is complicated enough. Save time, decrease administrative costs, and get your office paid quickly and correctly. Schedule a free demonstration of daisyBill for your office today.

REQUEST DEMO

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.