PPO Data Update: The Toll on CA Doctors Who Treat Injured Workers

DaisyBill’s California OMFS Reimbursement Reduction page tracks in minute detail the data around Preferred Provider Organization (PPO) and other discount contracts. Now, we’ve added a crucial update to the data set, providing a fuller picture of the toll discount contracting entities take on providers in the state.

This data can be examined from many angles. But no matter how you look at it, one thing is apparent: the unchecked spread of PPO and other network discounts is hurting the financial sustainability of restoring California injured workers to health.

As of today, we added new data, encompassing an additional 35,000 bills.

New (Bigger) Data Set on Reimbursement Reductions

Previously, our data set included only bills where the claims administrator paid less than 100% of the rates established by the California Official Medical Fee Schedule (OMFS).

In other words, before today, the data focused exclusively on payments that claims administrators discounted to rates below the OMFS. By request of some of our readers and other interested parties, we expanded that data set to be more comprehensive.

As of today, our reimbursement data page includes all payments for which a valid electronic EOR was returned to DaisyBill providers since January 1, 2021. In other words, the data now includes all bills where the claims administrator reimbursed the provider at 100% of the OMFS rates.

This means that, except in cases where the claims administrator denied payment or failed to compliantly return a valid electronic EOR, the page now displays data for all California bills for all of the following medical services:

- Physician & Non-Physician Practitioner Medical Services

- ASC Services

- Durable Medical Equipment, Prosthetics, Orthotics, and Supplies (DMEPOS)

- Pharmacy Services

- Pathology Services

By way of comparison, see the screenshots of our previous overview of the data compared to the new and expanded data as of today, 9/30/2021.

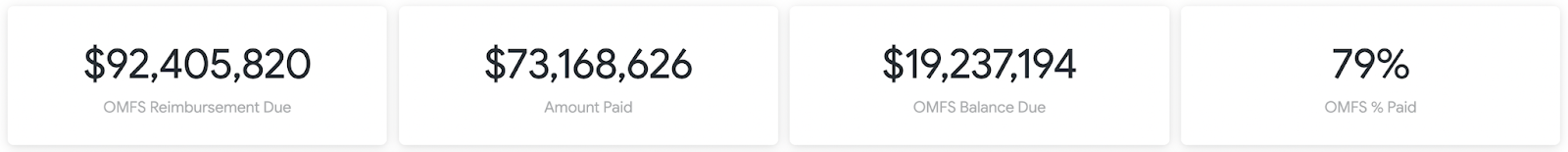

(Previous) 09/29/2021 Reimbursement Data - 378,000 Original bills

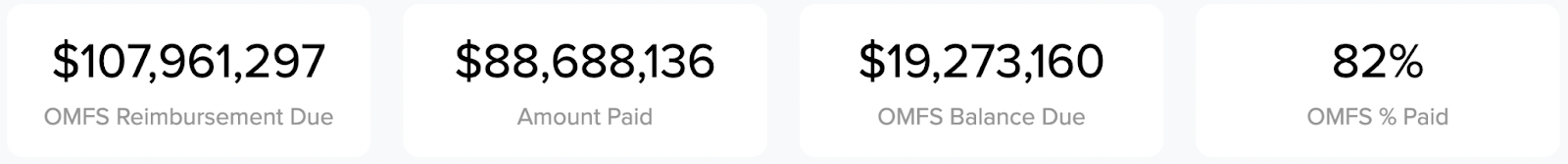

(Current) 09/30/2021 Reimbursement Data - 413,000 Original bills

This more complete picture includes nearly $108 million in due reimbursement, per the OMFS — and the staggering collective loss of over $19 million unreimbursed to providers in 2021.

Since the newly added data is exclusively for bills paid at 100% OMFS, the overall percentage of OMFS paid rises slightly, from 79% to 82%.

These numbers are updated daily, but we expect the basic takeaway to remain the same: roughly 20% of the compensation California deemed reasonable for treating injured workers was not paid to providers.

The enormity of this data shows that the California OMFS is nothing more than a fantasy, since PPOs and other discount contracting entities take money meant to compensate doctors for treating injured workers. It is truly shameful that the state allows employers’ workers’ comp premiums to enrich these organizations, rather than paying to restore injured workers to health.

DaisyBill makes authorization, payment, and appeals faster, easier, better. Contact us to learn how DaisyBill can save your practice thousands in revenue for workers’ comp services.

GET PAID ON TIME

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.