Reports: The Metrics that Matter for Work Comp Providers

At daisyBill, we recognize that providers are running a business.

For injured workers to get the care to which they’re entitled by California law, provider offices count on correct, timely payment. To that end, we track important metrics that shed light on what’s working — and what’s not — for our providers’ bottom lines. With so much data, and so many complex rules and regulations for billing and payment, deciding which analytics to focus on can be a challenge. Below are metrics that should matter to your office.

Workers’ comp billing and payment differ drastically from that of group health or Medicare. Providers should review the analytics that have the greatest impact on their practice; it’s crucial to focus on the right numbers.

Our Billing Software clients can access a wealth of data using our Reports feature. For our Managed Accounts clients, we furnish four monthly reports that highlight the most critical metrics for each practice. No matter the provider, we believe these four data sets are the most crucial in determining how to reduce friction and boost revenue.

Today, we take a look at the first two of those four. We believe that every work comp provider, regardless of their billing system, should request regular reports on these metrics from their billing professionals to ensure the best payment outcomes.

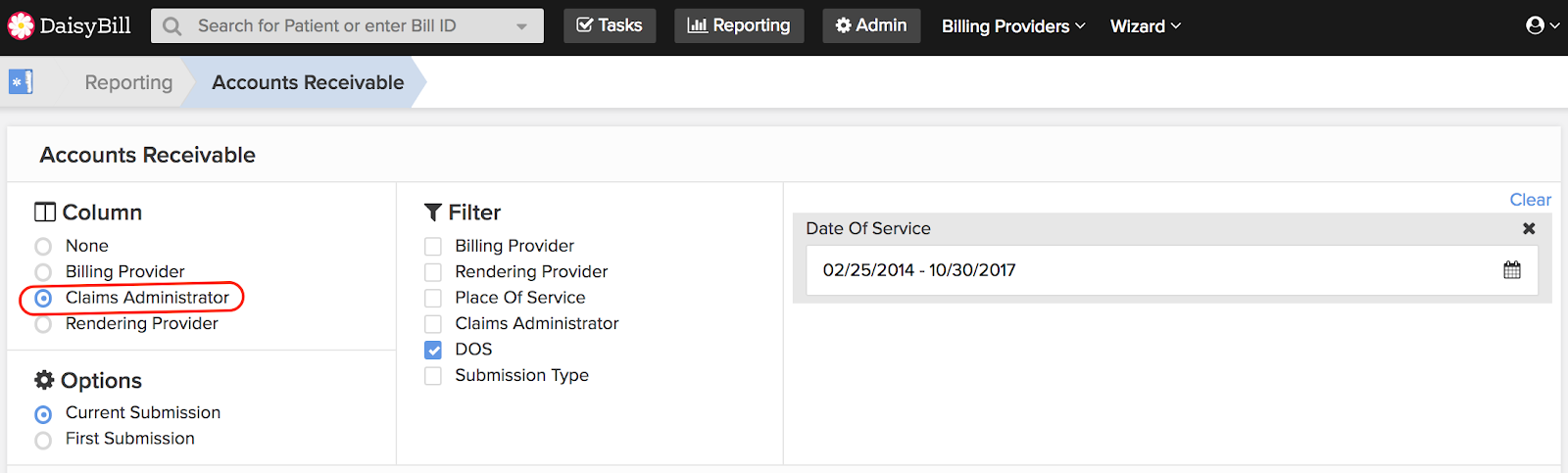

1. Accounts Receivables by Claims Administrator

One thing work comp providers should insist on is timely payment. Knowing which insurers, self-insured employers, and third-party administrators (TPA’s) pay on time (and which don’t) are critical to decisions about treating injured workers. If a given claims administrator consistently drags their heels on remitting payment, it’s time to reconsider whether or not to continue seeing the workers that administrator refers.

For an example of what essential pattern this report reveals, look at the screenshot below. This provider is paid on time, except for 11 bills that went unpaid for over 60 days. As it turns out, 10 of those bills went to the TPA Athens Administrators. For whatever reason, Athens does not consider timely paying this provider a priority.

Payment for electronic medical treatment bills is due within 15 working days of receipt. By law, claims administrators must pay penalties and interest payments after 45 days for non-government employers.

We strongly recommend analyzing the payment times for all original bills. Providers should insist on timely payment from those claims administrators that don’t measure up.

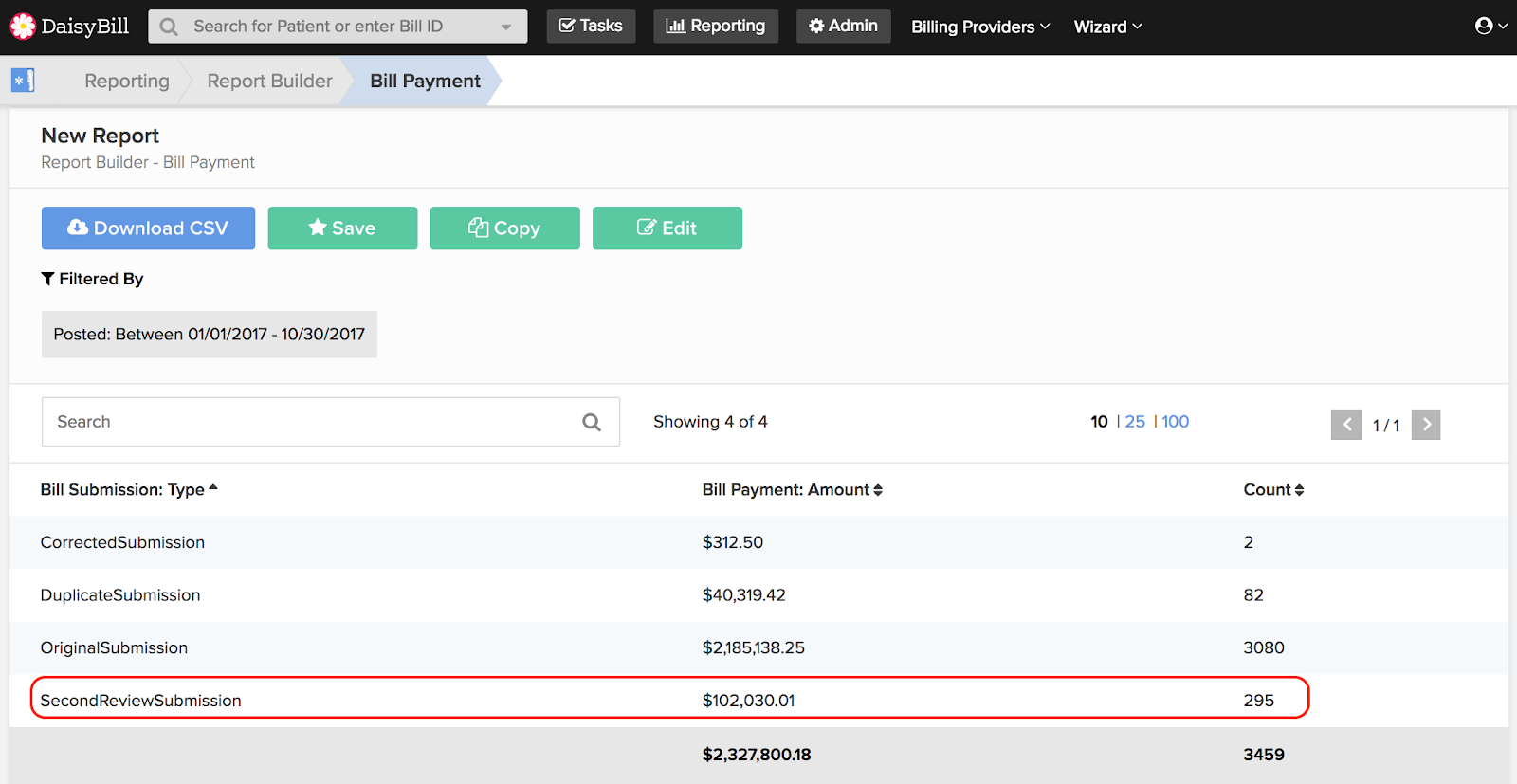

2. Payments By Submission Type

Payment of original bills is not the only metric that matters, however. As we’ve discussed before, providers must turn to Second Review appeals when claims administrators pay incorrectly. There’s no way around this: in California worker’s comp, Second Reviews are a NECESSITY for all providers. Our metrics show that between 7-10% of all bills require a Second Review appeal to obtain correct payment. .

Every provider should take a look at how much they collect by submission type. As the numbers in the screenshot below demonstrate, appealing incorrect reimbursement is a fight worth having:

The provider, in this case, submitted 295 Second Review appeals for the year to date, collecting $102,030 as a result. Approximately 8.5% of the provider's submissions are Second Review appeals, with an average collection per appeal of $346. This provider's significant collections from Second Review appeals should demonstrate why this monthly metric is so critical.

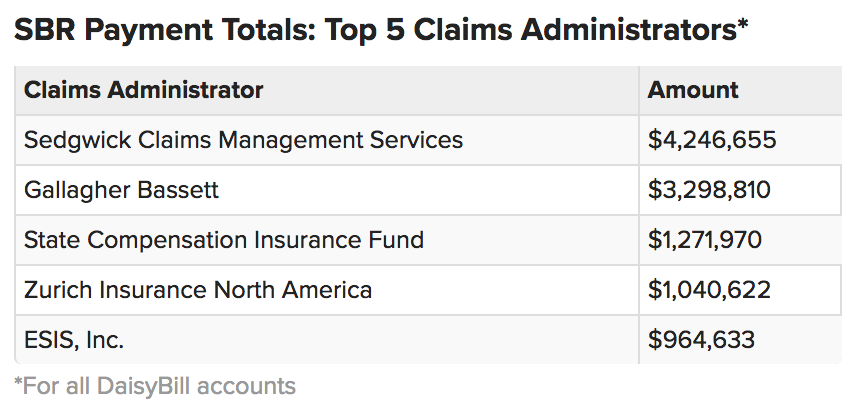

Naturally, it’s vital to know which claims administrators cause the most friction by remitting incorrect payments in the first place. daisyBill tracks that information for each client, so providers know from whom they can expect improper reimbursements. The table below shows our worst offenders for all our clients’ accounts collectively:

In the fight for timely, proper reimbursement, knowledge is key. Providers must seek the knowledge they need to hold payors accountable and leverage their administrative resources to the greatest possible effect. That effort starts with good analytics. Arm yourself with the correct metrics to know where your money goes, where it comes from, and where it gets stalled. Your business just might depend on it.

daisyBill offers everything providers need to streamline workers’ comp billing and payment, including detailed analytics. Our Reports feature allows providers to crunch the numbers that matter most, while our Managed Account services tailor billing to each provider’s specific needs. Schedule a free demonstration today, and see what daisyBill can do for your office.

REQUEST DEMO

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.