DWC Proposes Even More Onerous RFA Requirements for Providers

More work for less money, that’s the continuing story of workers’ comp treatment

Recently David DePaolo wrote an article describing the DWC’s proposed MTUS guidelines requiring additional documentation as a “bad idea, plain and simple.”

Here at DaisyBill we agree with his opinion 100%. As suggested by David DePaolo, we recommend that physicians immediately submit an opposition comment to the DWC and we’ve posted the appropriate addresses at the bottom.

The proposed MTUS guidelines would require that when a doctor requests treatment that deviates from the MTUS standard recommendations, he or she must also provide additional supporting documentation for the deviation with a Request for Authorization (RFA). The additional substantiating documentation would consist of “‘a copy of the entire study or the relevant sections of the guideline’ containing the recommendation he or she believes guides the reasonableness and necessity of the requested treatment that is applicable to the injured worker’s medical condition or injury.”

Already the lengthy Request for Authorization (RFA) form, mandatory for every single treatment or service provided to an injured worker, requires treating physicians to cite the relevant MTUS guidelines supporting their recommended treatment. In addition to completing the RFA form with the required MTUS references, the treating physician must also generate and attach a required report, either the PR-2 or the doctor’s first report. Finally, the physician has to call the adjuster to determine where to fax the RFA (many claims administrators do not maintain a central RFA fax number) and wait patiently for a response. That’s a lot of steps before even getting to the point of being able to treat an injured worker -- and place these preliminary hurdles in the context of the mountain of paperwork and non-treatment-related steps that it requires to get the injured worker well enough to return to work.

Now here is the important part. As David DePaolo points out, “Physicians aren't paid to support their treatment requests under the present fee schedule.”

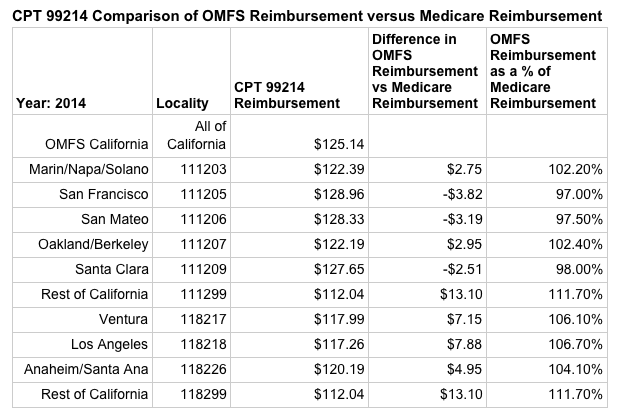

But just how little are physicians reimbursed for treating injured workers compared, for instance, for treating Medicare patients? Let’s start off with what the current OMFS fee schedule allows for an established evaluation and management visit (E/M code of 99214) as compared to what Medicare paid for the same code in 2014. (Unfortunately, due to the DWC’s delay in releasing an updated OMFS, we cannot provide 2015 comparisons).

The table below shows that physicians located in San Francisco, San Mateo and Santa Clara actually receive less for treating an injured worker than for treating a Medicare patient. (As a little background, the CMS allows for different reimbursement depending on where the services were rendered whereas the OMFS has a single reimbursement for the entire state of California).

Keep in mind that when a physician treats a Medicare patient there are no reporting requirements, no lengthy RFA forms, no complicated fee schedules, and no unreturned calls to a string of adjusters to determine if payment will be issued for the visit. And unlike workers’ comp, the CMS pays its bills quickly, electronically and correctly the first time without rampant downcoding.

Finally, while it may appear that some fortunate physicians are receiving a few dollars more to treat the injured workers of the state of California, these additional dollars are actually illusory.

DaisyBill has payment data for over 100,000 bills that clearly shows that unrestrained downcoding and network discounts reduce work comp reimbursements to meager fractions of Medicare reimbursements. In the next weeks, I’ll start posting DaisyBill’s aggregated data, based on processing over 1000,000 bills, that shows the impact of profligate downcoding and crippling network discounts.

CPT 99214 Comparison of OMFS Reimbursement versus Medicare Reimbursement

Year: 2014 |

Locality |

CPT 99214 Reimbursement |

Difference in OMFS Reimbursement vs Medicare Reimbursement |

OMFS Reimbursement as a % of Medicare Reimbursement |

OMFS California |

All of California |

$125.14 |

||

Marin/Napa/Solano |

111203 |

$122.39 |

$2.75 |

102.20% |

San Francisco |

111205 |

$128.96 |

-$3.82 |

97.00% |

San Mateo |

111206 |

$128.33 |

-$3.19 |

97.50% |

Oakland/Berkeley |

111207 |

$122.19 |

$2.95 |

102.40% |

Santa Clara |

111209 |

$127.65 |

-$2.51 |

98.00% |

Rest of California |

111299 |

$112.04 |

$13.10 |

111.70% |

Ventura |

118217 |

$117.99 |

$7.15 |

106.10% |

Los Angeles |

118218 |

$117.26 |

$7.88 |

106.70% |

Anaheim/Santa Ana |

118226 |

$120.19 |

$4.95 |

104.10% |

Rest of California |

118299 |

$112.04 |

$13.10 |

111.70% |

We are asking providers to write the DWC to protest the proposed additional MTUS document requirements. The DWC will accept written comments until 5pm, January 13, 2015.

By email:

By mail:

Maureen Gray

Regulations Coordinator

Department of Industrial Relations

P.O. Box 420603

San Francisco, CA 94612

By fax:

(510) 286-0687

Addressed to:

Maureen Gray

Regulations Coordinator

Department of Industrial Relations

Read More About RFAs:

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.