EDI Agent Responsibilities in California Workers’ Comp

Over the past several weeks, we’ve taken a close look at various aspects of compliant e-billing for California workers’ compensation bills. Today, we turn our focus to the role of EDI agents such as DaisyBill. EDI agents are a crucial cog in workers’ comp billing – providers and claims administrators are not equipped to generate and receive the various electronic files that underpin the e-billing system. Choosing a good EDI agent – and knowing their responsibilities – is crucial to billing success.

Provider, EDI Agent, Clearinghouse and Claims Administrator Responsibilities

Per the California Division of Workers’ Compensation (DWC), providers and claims administrators are allowed to hire third-party e-billing specialists, known as EDI agents or clearinghouses, to help compliantly process the 3-step e-billing exchange.

Section 7.6 of the DWC’s Electronic Medical Billing and Payment Companion Guide clearly defines the relationship among providers, EDI agents, and claims administrators. The DWC states that “health care providers, health care facilities and billing agents/assignees choosing to submit their bills electronically must enter into a Trading Partner Agreement either directly with the claims administrator or with the clearinghouse that will handle the claims administrator’s electronic transactions.”

To compliantly submit workers’ comp electronic bills, a provider or provider’s EDI agent must:

- Individually contact each claims administrator to determine the electronic address to route electronic bills (837 files) directly to that claims administrator. Failure to abide by this direct connection requirement is the number one reason some provider EDI agents fail at workers’ comp e-billing.

- Establish protocol with the claims administrator or its designated clearinghouse for submitting the required workers’ comp supporting documentation (275 files) that must accompany every electronic bill.

- Electronically submit appropriately designated Second Reviews for provider-disputed payments. Second Review regulations require electronic transmission of the Second Review when the Original bill was submitted electronically.

- Receive electronic Explanations of Review (835 files) from the claims administrator or the claims administrator’s clearinghouse.

For providers hiring an EDI agent to process electronic billing, it is critical to confirm that the EDI agent routes your electronic bills directly to that claims administrator.

In order for claims administrators to compliantly process workers’ comp electronic bills, they must inform providers of their direct electronic address, including the Payer ID and clearinghouse. The claims administrator’s clearinghouse also must uphold certain responsibilities to ensure compliant e-billing, including:

- Receiving and processing compliant electronic bills (837 files) and supporting documentation (275 files) sent by providers.

- Issuing providers timely rejection or acceptance acknowledgements (277 files).

- Transmitting electronic explanations of reviews (835 files) to providers.

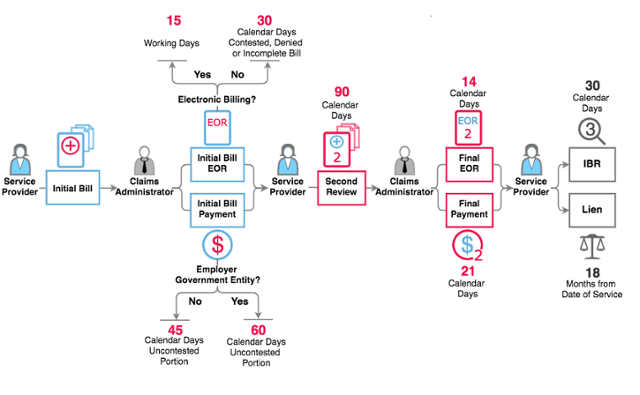

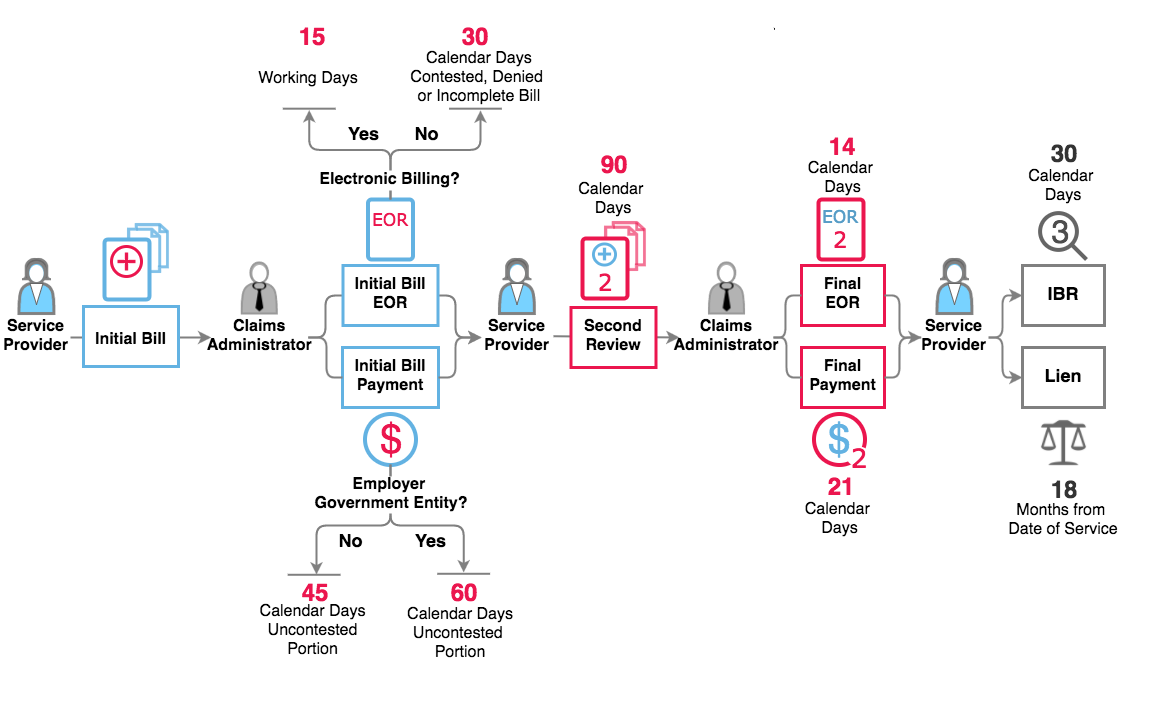

One look at the workflow of an electronic bill is sufficient proof that this complicated system demands compliance from all parties:

Ultimately, providers and claims administrators are responsible for the compliance of the EDI agents and clearinghouses hired process for the 3-step e-billing exchange. For providers especially, choosing a compliant EDI agent can be the difference between receiving payment and getting your revenue stuck in electronic purgatory.

Want to learn more about e-billing for California workers’ comp? We hosted a webinar in May devoted to e-Billing, and we shared eye-popping data on compliance, time to payment, and more.

E-BILLING FOR EVERYONE

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.