AmTrust Addresses Electronic EOR Issue

Insurer AmTrust North America provided an excellent example of how claims administrators, working in good faith with providers, can resolve Electronic Data Interchange (EDI) issues and come into compliance with California law.

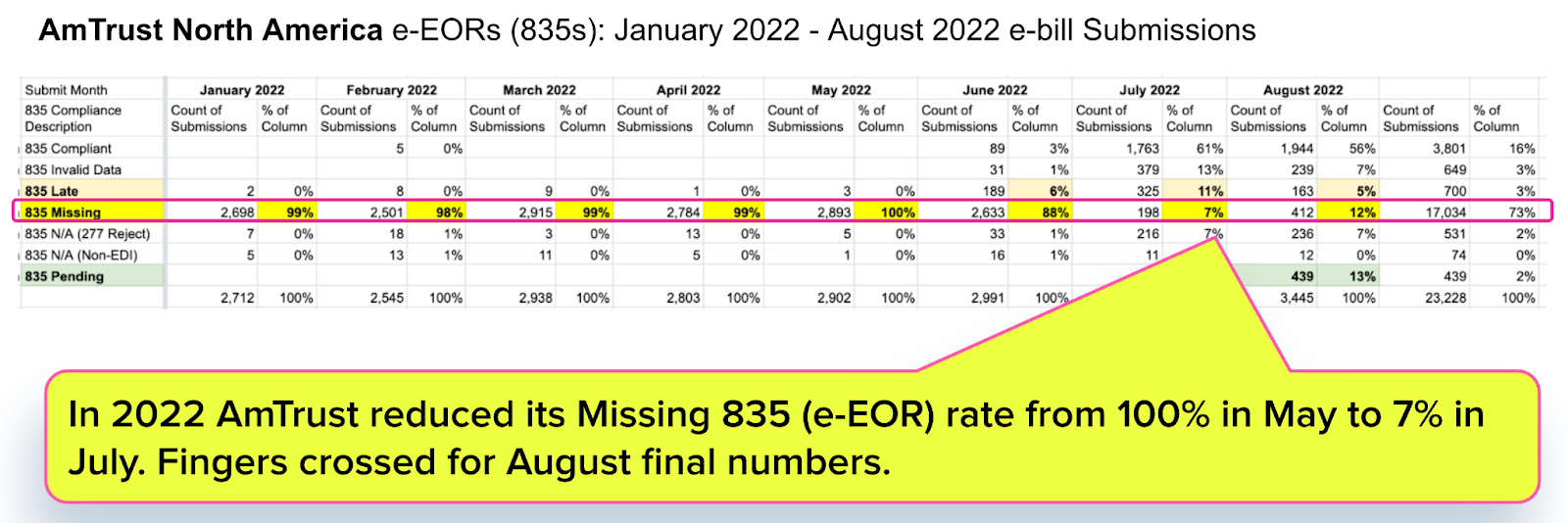

For the first six months of 2022, AmTrust consistently failed to send electronic Explanations of Review (e-EORs) to providers in response to electronic bills, as California mandates. As we’ve explained often in this space, e-EORs are the critical final part of an e-billing transaction.

Now, we are happy to report that AmTrust has improved by leaps and bounds. However, the insurer still has some work to do in order to reach full compliance.

AmTrust: (Almost) Completely Failing to Return e-EORs

In April, daisyBill first reported that AmTrust’s compliance rate in sending e-EORs (in the mandatory X12 835 file format) was an astounding 0-1%. At the same time, we filed thousands of formal Audit Complaints with the Division of Workers’ Compensation (DWC) — only to file thousands more the following month, when AmTrust failed to change its ways.

Finally, in July, AmTrust started returning e-EORs following a change of clearinghouse (clearinghouses accept and respond to e-bills on behalf of claims administrators, which generally lack the technology to do so).

While we cannot comment with any certainty regarding whether or not the clearinghouse switch fixed the issue, the result was a leap forward for AmTrust in the direction of compliance. According to our data, AmTrust went from 100% non-compliance in May with the e-EOR mandate, to just 7% non-compliance in July.

AmTrust: (Almost) Completely Resolving e-EOR Issue

AmTrust’s improvement has been both drastic and extremely welcome news, but the job isn’t quite done yet. As of August 31, 2022, AmTrust’s e-EOR non-compliance rate was 12%, an increase from the previous month’s 7%. AmTrust’s compliance rate may (or may not) improve as data from the rest of August rolls in.

That said, responding electronically to electronic bills is a legal requirement, not a request or best practice.

There is no acceptable rate of non-compliance with e-billing requirements, any more than there is an “acceptable” number of times to shoplift or cheat on your taxes. AmTrust’s 12% rate of e-EOR non-compliance so far for August represents 412 e-bills from providers who were either not paid, or forced to waste practice time and resources manually posting information from a paper EOR.

We hope AmTrust continues on its current path, and that we can report a 100% compliance rate in the very near future.

Protect your practice revenue. Harness the power of daisyBill software, data, and expertise for faster, better workers’ comp billing.

GET IN TOUCH

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.