Four Year Flubs: Some Claims Administrators Still Reject Electronic Billing

Let’s start with some old news: Since October 2012, California claims administrators must accept electronic billing for workers’ compensation bills. Fast-forward four years, and most claims administrators complied. Some even thrived. Others, however, still struggle with habitual non-compliance.

daisyBill anticipates submitting over 1,000,000 electronic bills in 2016 alone. Inevitably, a few of those bills don’t find their way to the claims administrator on the other side of the electronic data interchange (EDI) wire. Whenever this happens, we collect relevant data points, but we don’t stop there – we fax, email, or even print and mail paper bills to guarantee our clients the claims administrator receives their bills.

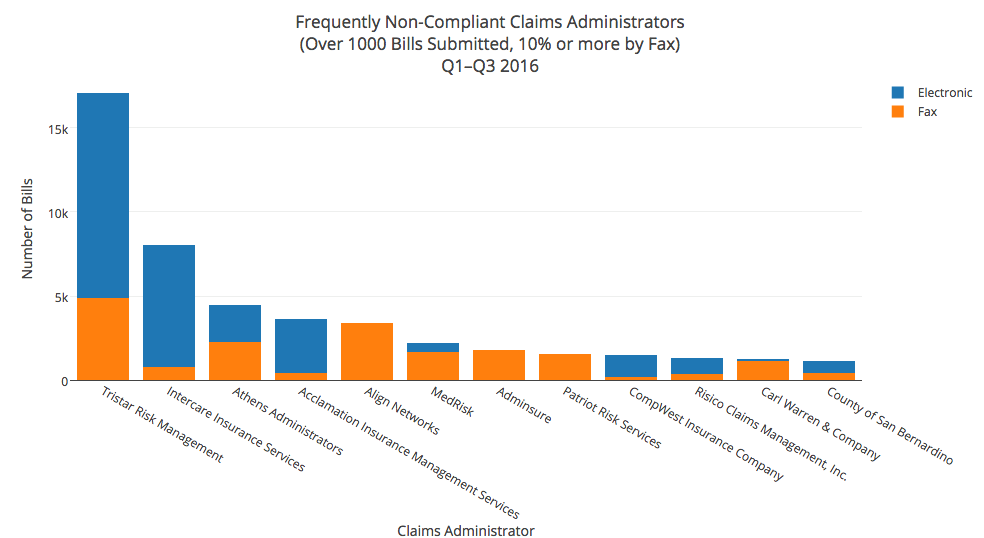

Comparing the number of successful electronically submitted bills to the number of bills we submitted by fax provides a clear picture of the claims administrators that are routinely non-compliant. To eliminate noise from the data, we filtered out all claims administrators with fewer than 995 total bill submissions, as well as those who successfully accepted electronic bills over 90% of the time.

The resulting list of eight claims administrators serves as something of an electronic billing hall of shame. First, we’ll analyze these offending claims administrators by volume of bills submitted.

The more orange you see, the more bills we faxed. It’s disturbing to see relatively large claims administrators like Tristar and Athens Administrators on this electronic hall of shame list. Those two respectively ranked eighth and twentieth on our list of the top 20 claims administrators by volume of bills processed. (They were also two of the slowest to remit payment.) Chalk it up as another reminder that quantity is no guarantee of quality.

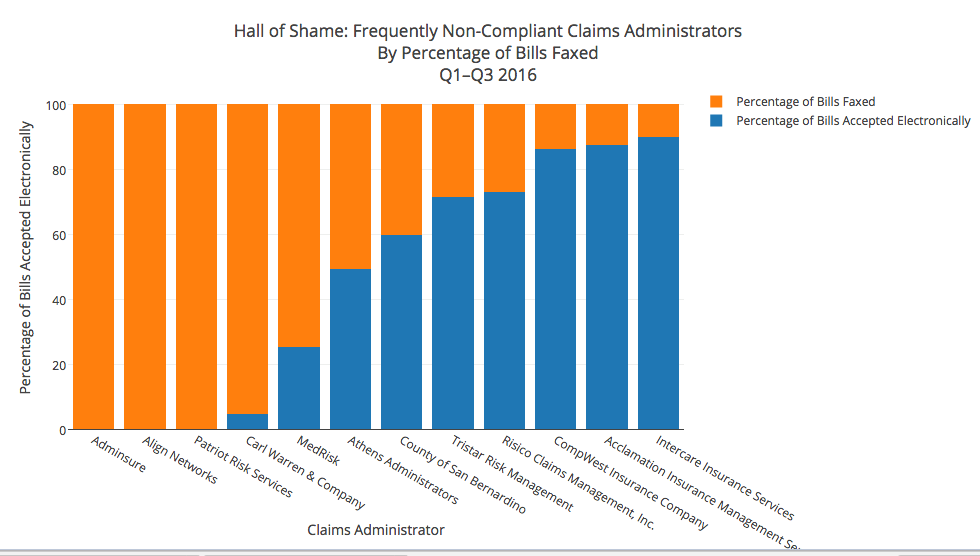

Next, let’s use those same eight claims administrators to look at the percentage of bills submitted electronically and by fax.

Adminsure and Patriot Risk Services each failed to accept a single electronic workers’ compensation bill through the first three quarters of 2016. Athens Administrators only managed to accept electronic bills half of the time.

In an interesting twist, the County of San Bernardino accepts electronic bills at only a 60% clip. So not only is the county denying treatment to some of the victims of the 2015 terrorist attack – they’re struggling with non-compliance around electronic billing, too.

What’s a provider to do when faced with this kind of behavior? We recommend filing an audit complaint*. It’s the single most effective way to notify the DWC of non-compliance – they may even intervene on your behalf.

If you use daisyBill, we’ll make sure that your bill reaches the claims administrator. Please file Audit Complaints nonetheless. daisyBillers can use the Bill History to keep tabs on bills submitted electronically and submitted by fax. From the same Bill History, you can quickly and easily create an Audit Complaint.

We encourage non-daisyBillers to use the forms on the DWC Audit Unit Website to file an Audit Complaint. To make things easier, we provide an online library of suggested Audit Complaint language. A few minutes spent alerting the DWC to non-compliant behavior helps make the system better for all of us.

NOTE: The Audit Complaint form was updated in 2019. Access the updated form here: https://www.dir.ca.gov/dwc/Auditref.pdf

To learn more, head to our resource library and watch our webinar on Audit Complaints.

For information about how daisyBill’s Revenue Cycle Management software increases revenue and efficiency for workers’ comp billing, schedule a live demo with one of our billing experts.

Request Demo

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.png)