e-Billing: Unstoppable Delivery of Workers' Comp Bills

.gif)

The days of hoping a workers’ comp e-bill will make it to the payer are over.

Too often, providers receive notification that their e-bills were rejected by the payer or its clearinghouse rather than processed for payment. Typically, the rejected e-bill is dropped to paper form and mailed — resulting in long waits for payment (or the bill getting lost entirely).

Data from 2023 show that daisyBill has solved this rejection problem.

Payers and their clearinghouses accepted 95% of the over 1.6 million California medical, pharmacy, and facility e-bills daisyBill providers submitted in 2023. Even better, daisyBill handled the remaining 5% using an almost entirely automated process for resolving e-bill rejections — with little to no intervention by the provider.

This automation means providers saved time and administrative resources. See the stats below as well as real-world examples of successfully, automatically managed e-bill rejections.

Data: e-Bill Acceptance by Clearinghouse

Almost all claims administrators hire clearinghouses to accept workers’ comp e-bills, with the exceptions of the federal Department of Labor (DOL) and CorVel (both of which possess the technology to accept providers’ e-bills).

The table below lists the three major clearinghouses (Data Dimensions, Jopari, Carisk), plus CorVel, the DOL, and P2P (a small workers’ comp clearinghouse to which daisyBill providers sent less than 1% of e-bills). In descending order of bill volume, the table shows how many e-bills each accepted from January 1 to December 31, 2023.

The headline: 95% of daisyBill California providers’ e-bills (1,544,505 e-bills) were accepted for processing.

Table: CA Medical, Pharmacy, Facility e-Bills Submitted 1/1/2023 - 12/31/2023

Clearinghouse |

Total e-Bills Submitted |

% of Total e-Bills Submitted |

e-Bills Accepted |

% of e-Bills Accepted |

Data Dimensions |

764,824 |

47% |

724,523 |

95% |

Jopari |

585,032 |

36% |

560,676 |

96% |

CorVel |

144,352 |

9% |

141,438 |

98% |

Carisk |

100,932 |

6% |

94,113 |

93% |

Department of Labor |

19,946 |

1% |

19,151 |

96% |

P2P |

5,653 |

0% |

4,604 |

81% |

Totals |

1,620,739 |

100% |

1,544,505 |

95% |

These statistics are more than just a marketing-friendly number; it’s proof that concerns about the efficacy of workers’ comp e-billing (based chiefly on bad experiences with the wrong kinds of software) are unfounded.

(Special shout-out to CorVel. The Third-Party Administrator accepted 98% of daisyBill e-bills in 2023, more than any clearinghouse or the DOL.)

Moreover, providers needn’t worry about the remaining 5% of e-bills that were not accepted. Below, see two examples from 2023 of how improperly rejected e-bills were handled by daisyBill’s automated solutions.

Improper e-Bill Rejections: Automatically Identified & Resubmitted

Clearinghouses reject e-bills by sending the provider a ‘277 Acknowledgement’ (277 ACK) indicating a problem with the e-bill. When a daisyBill e-bill is rejected, our software undertakes an automatic review:

- If prior bills with the same injury information were paid, daisyBill automatically resubmits the bill via facsimile, bypassing the clearinghouse that made the error.

- If no prior bills with the same injury information were paid, daisyBill generates a ‘Rejected Bill Task’ for the provider’s staff to correct any erroneous billing information entered by staff.

- If necessary, the software automatically alerts daisyBill staff to investigate and resolve erroneous e-bill rejections for which no explanation has been identified.

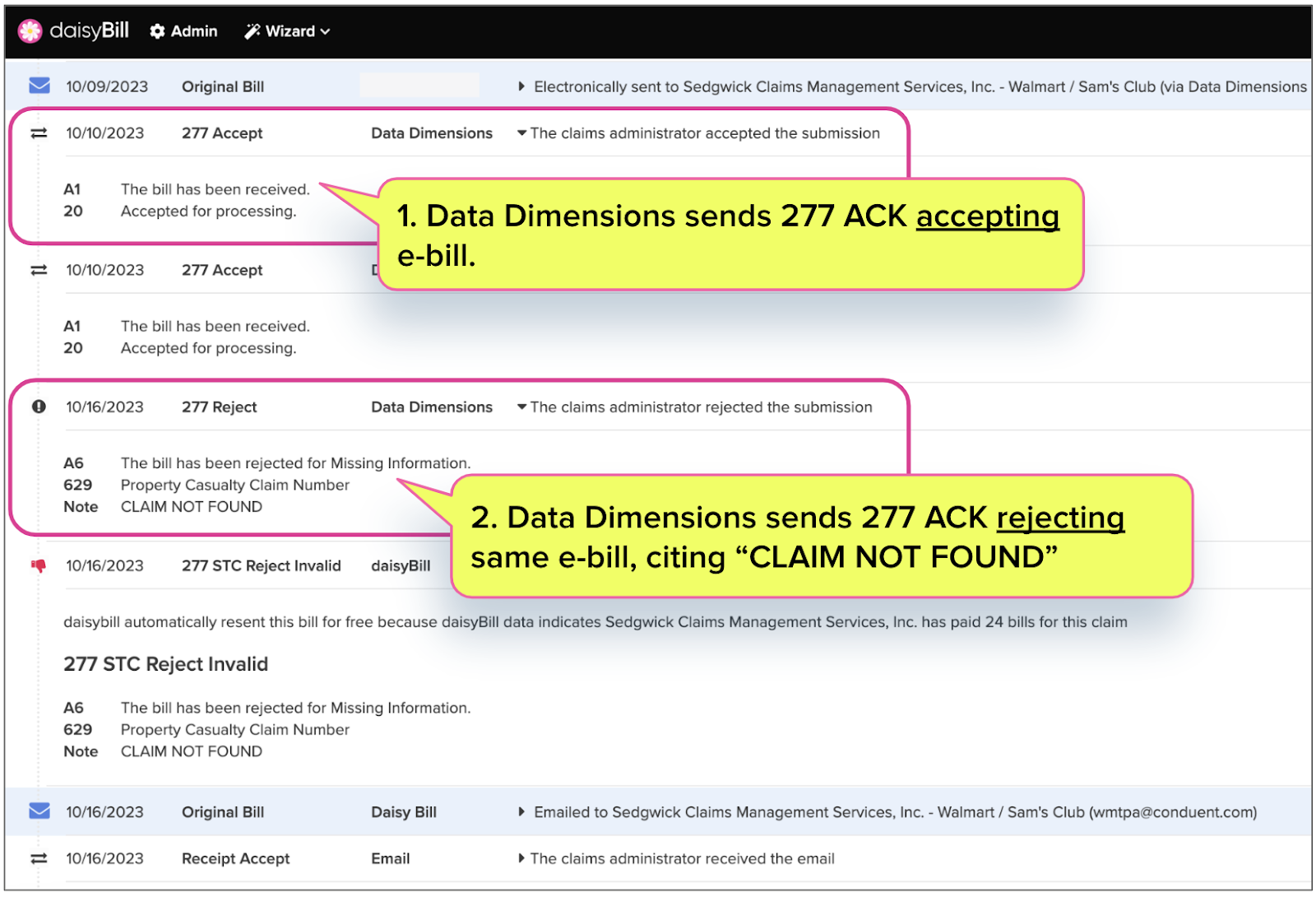

Example: Invalid “Claim Not Found”

For example, Data Dimensions improperly rejected a bill for Third-Party Administrator Sedgwick Claims Management Services, Inc. The fact that the e-bill was initially accepted is a red flag, indicating problems on the clearinghouse end.

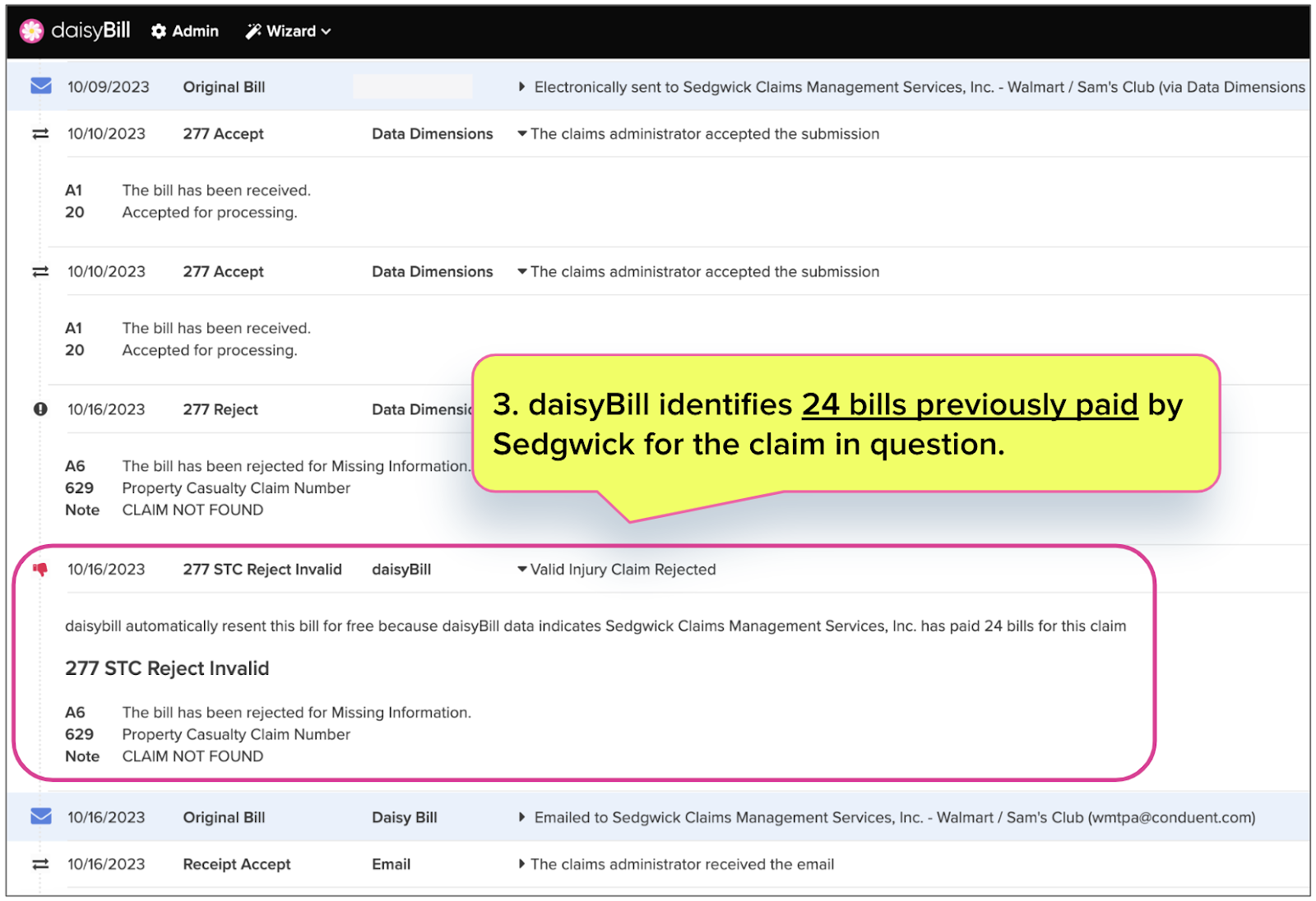

This is where daisyBill software stepped in, automatically searching to see if Sedgwick had paid any other bills for the same claim number and date of injury.

As it turns out, Sedgwick had paid 24 bills on this claim — the claim supposedly “not found.”

daisyBill then automatically resubmitted the bill via email, as the clearinghouse was incorrect.

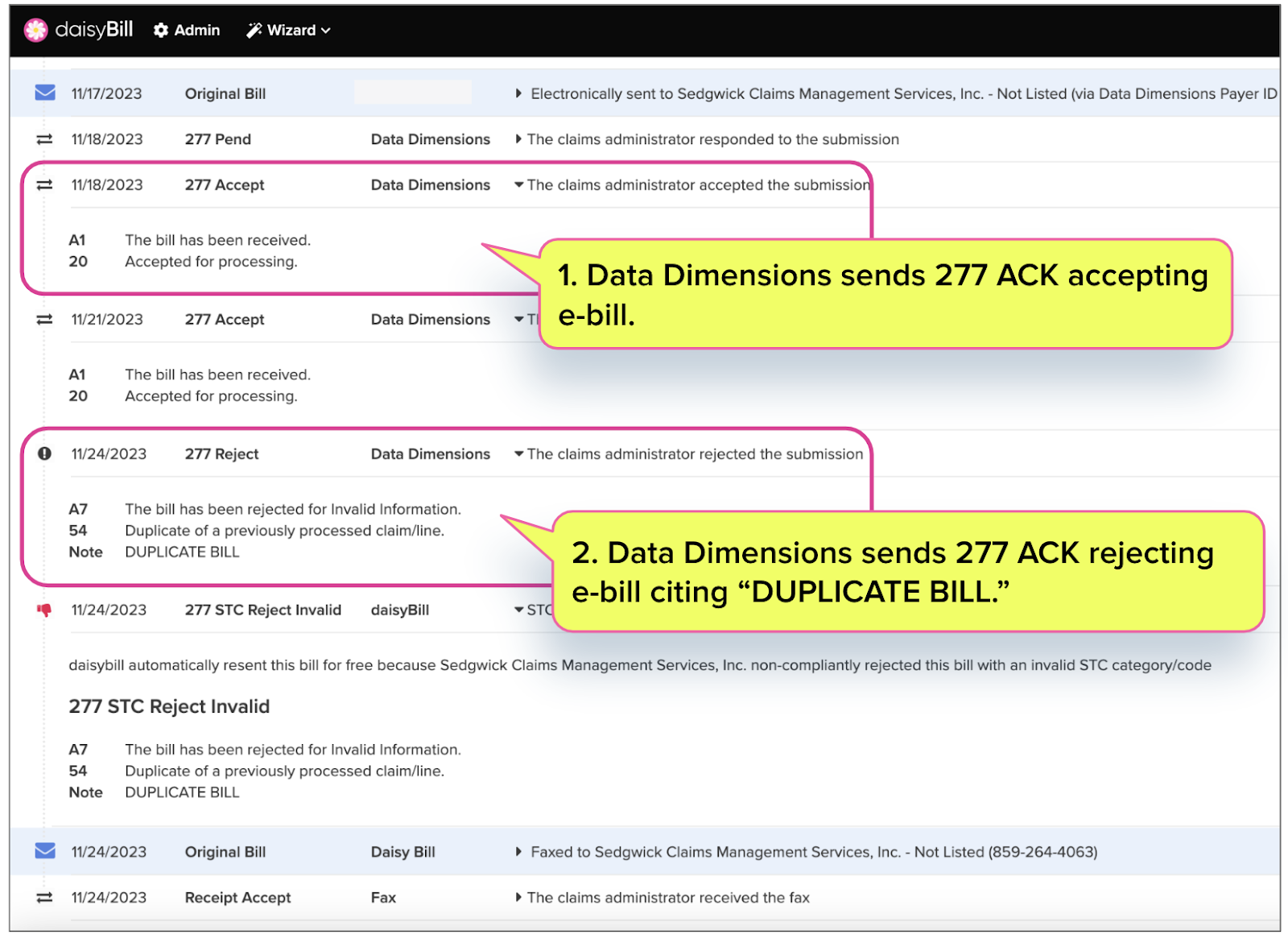

Example: Using 277 as EOR

Clearinghouses may only reject e-bills for one of seven specific reasons listed in the Division of Workers’ Compensation (DWC) Medical Billing and Payment Guide.

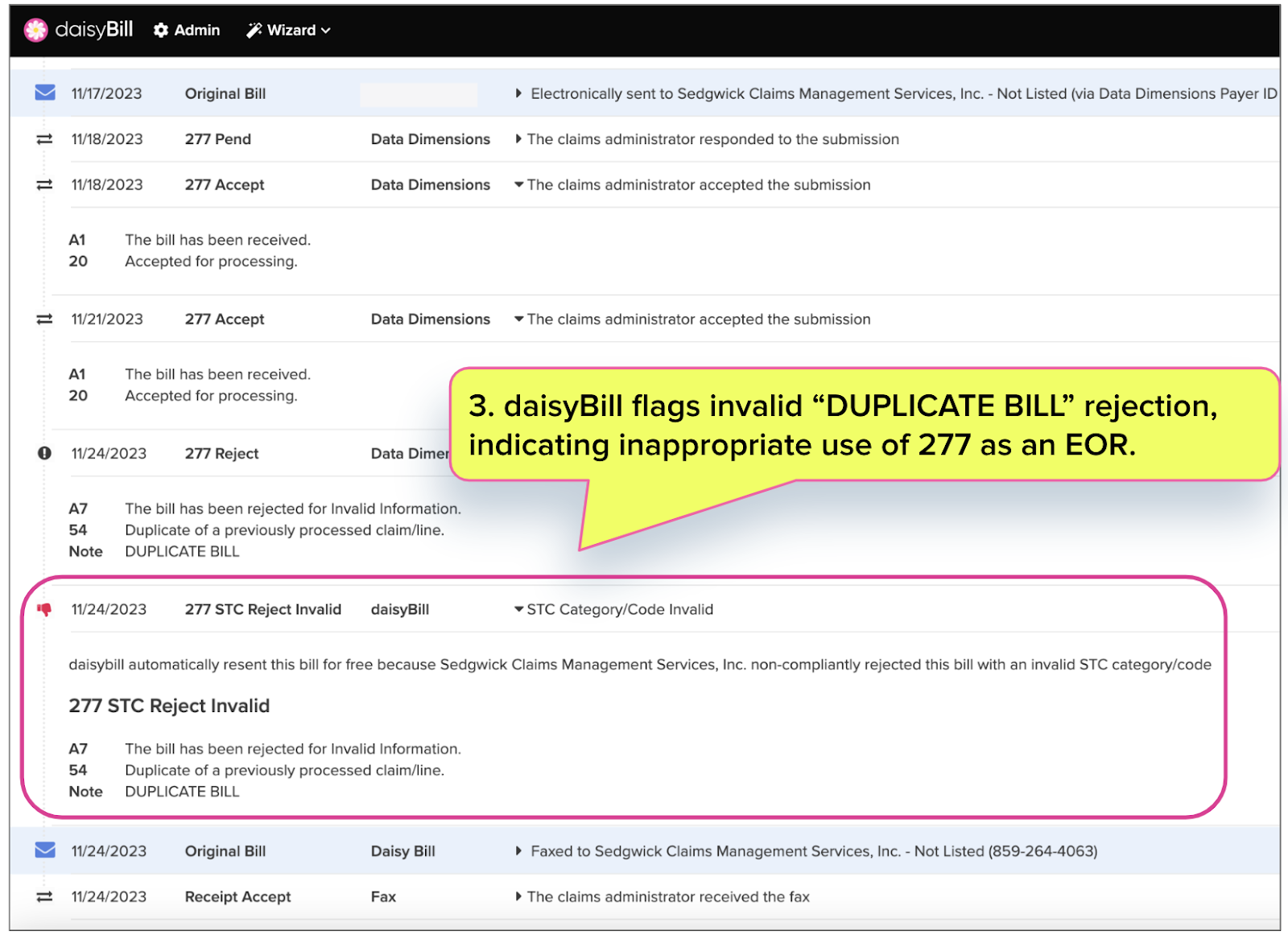

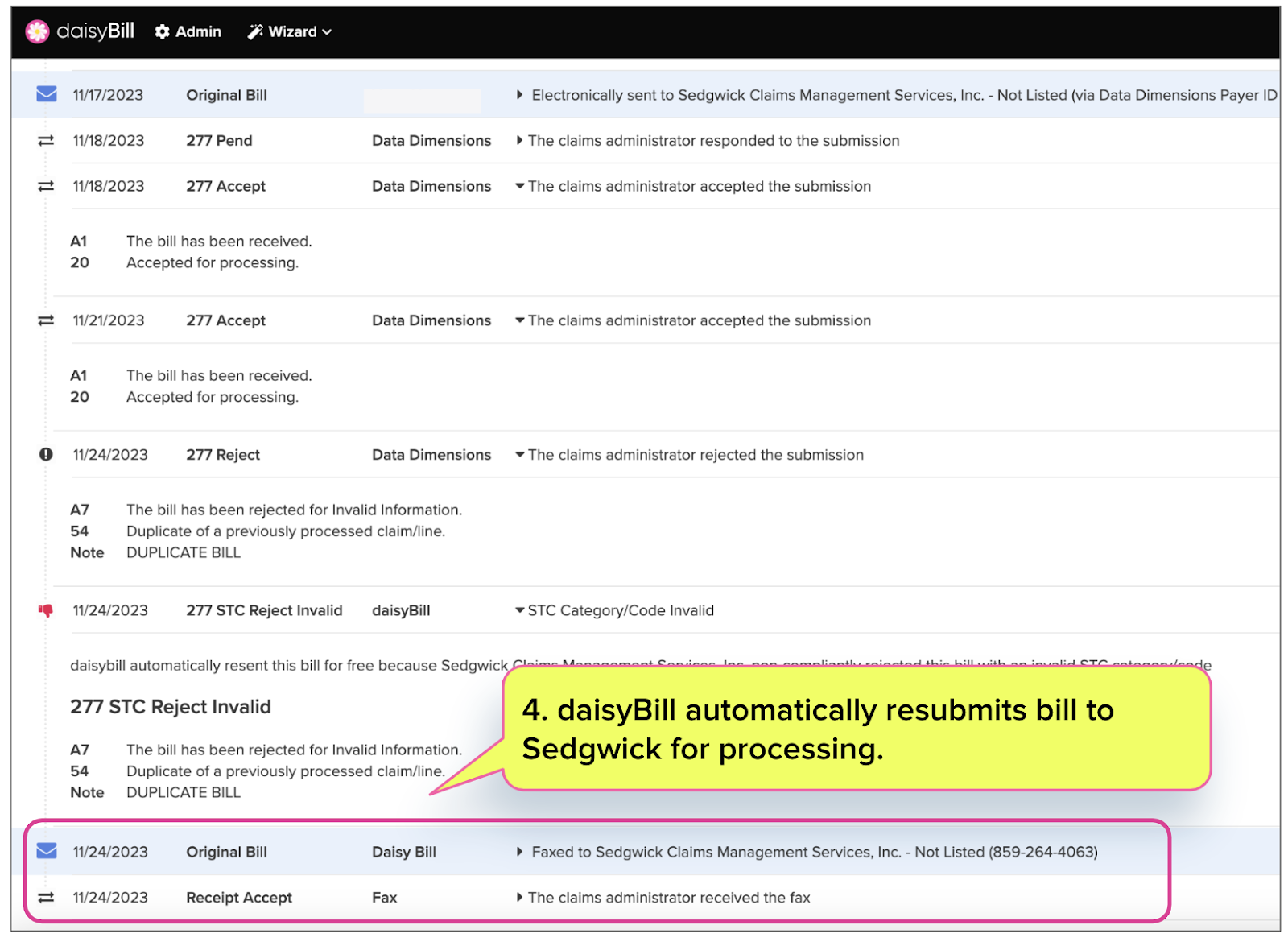

But sometimes, a clearinghouse will reject an e-bill for other reasons outside its purview. For example, Data Dimensions rejected the e-bill below on behalf of Sedgwick, citing “DUPLICATE BILL.”

If the bill was a duplicate, it is the role of Sedgwick’s bill review to make that determination and deny payment, citing “duplicate bill” on the Explanation of Review (EOR) — it is not the role of Data Dimensions to reject the e-bill at the clearinghouse stage.

Once again, alarms were raised when Data Dimensions first accepted, then rejected, the e-bill.

daisyBill automatically flagged the invalid rejection reason. Again, while Sedgwick may deny payment on the EOR for a duplicate bill, clearinghouses have no business adjudicating such an issue and essentially using the 277 ACK as an EOR.

Finally, daisyBill resubmitted the bill directly to Sedgwick.

That’s the power of workers’ comp-specific e-billing technology. e-Bills get where they’re going, along with their attendant medical documents, and payment arrives in less than 9 days on average*. And when hiccups occur, daisyBill makes it as easy as possible for the provider to get paid.

*Through daisyBill-verified submission routes, based on the previous 365 days of available data as of this writing.”

daisyBill makes treating injured workers easier, faster, and less costly. Request a free demonstration below.

REQUEST DEMO

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.