Electronic EORs for Workers’ Comp: Timing and Compliance

This month, we’ve placed an emphasis on analyzing and explaining the vagaries of electronic billing for California workers’ compensation medical bills. The state’s Division of Workers’ Compensation (DWC) requires that providers who choose to submit electronic bills and all claims administrators follow the electronic billing rules set out in its 65-page Electronic Billing and Payment Companion Guide. To be clear, these rules are not optional. Yet some claims administrators demonstrate habitual non-compliance. Today, we zero in on the failure to return an electronic Explanation of Review (EOR).

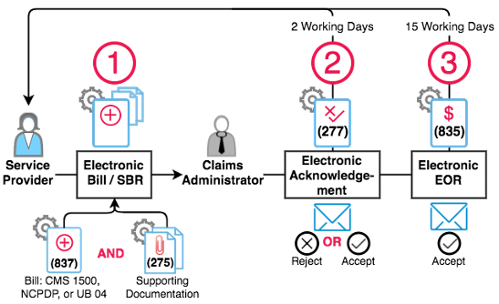

To recap, compliant electronic workers’ comp billing consists of three basic steps:

- Providers: Compliantly submit an electronic bill (837) and supporting documents (275) directly to the claims administrator or the claims administrator’s designated clearinghouse.

- Claims Administrators: Within two days, return an acknowledgment (277) to the provider accepting or rejecting the electronic bill.

- Claims Administrators: WIthin fifteen working days return an electronic explanation of review (EOR) (835) for accepted bills to the provider.

For bills submitted electronically, returning compliant electronic EORs is a requirement of the workers’ comp e-billing system. Failure to return an electronic EOR leads to all sorts of complications:

- Increased billing expenses. Electronic EORs save providers the significant processing costs associated with manually posting paper EORs.

- Transparency. Electronic EORs make it possible for providers, claims administrators, and regulators to easily track exactly if and when bills are paid, as well as payment amounts.

- DWC rules are not optional for claims administrators. Claims administrators need to follow the rules (including EOR compliance) in order for the workers’ comp system to truly benefit from electronic billing.

Even so, our analysis of the top 20 claims administrators by volume of bills submitted in 2016 shows flagrant non-compliance almost across the board.

Claims Administrator |

Electronic EOR |

EOR Outstanding |

Manual EOR |

Grand Total |

Electronic EOR Percent |

Sedgwick Claims Management Services |

28953 |

27935 |

28412 |

85300 |

34% |

State Compensation Insurance Fund |

53432 |

13530 |

7886 |

74848 |

71% |

Gallagher Bassett |

47692 |

5114 |

5105 |

57911 |

82% |

CorVel |

12839 |

16276 |

8578 |

37693 |

34% |

York Risk Services Group |

4658 |

15630 |

14322 |

34610 |

13% |

Liberty Mutual Insurance |

17802 |

3789 |

1400 |

22991 |

77% |

Travelers |

10844 |

3791 |

7485 |

22120 |

49% |

Zurich Insurance North America |

13284 |

6460 |

1759 |

21503 |

62% |

AIG Claims, Inc. |

0 |

10374 |

7423 |

17797 |

0% |

Employers Compensation Insurance Company |

0 |

7796 |

3618 |

11414 |

0% |

ICW - Insurance Company of the West |

4357 |

3569 |

1958 |

9884 |

44% |

Intercare Insurance Services |

3948 |

4034 |

1377 |

9359 |

42% |

Berkshire Hathaway Homestate Companies |

6774 |

1181 |

409 |

8364 |

81% |

California Insurance Guarantee Association |

3451 |

3734 |

7185 |

0% |

|

Keenan & Associates |

5338 |

440 |

303 |

6081 |

88% |

Acclamation Insurance Management Services |

41 |

1859 |

2672 |

4572 |

1% |

Cannon Cochran Management Services Inc. |

0 |

3323 |

1058 |

4381 |

0% |

Athens Administrators |

239 |

1127 |

1802 |

3168 |

8% |

Sea Bright Insurance |

1729 |

154 |

278 |

2161 |

80% |

Fireman's Fund Insurance Company |

1417 |

211 |

342 |

1970 |

72% |

AIG, Employers Compensation Insurance Company, California Insurance Guarantee Association, and Cannon Cochran Management Services each failed to remit a single electronic EOR throughout the calendar year. Acclamation Insurance Management Services escaped this ignominious distinction by remitting 41 electronic EORs out of 4572, for an underwhelming 1%.

On the other end of the spectrum, Gallagher Bassett, Liberty Mutual, Berkshire Hathaway, Keenan & Associates, and Sea Bright all returned electronic EORs more than 75% of the time, with Keenan & Associates leading the way at 88%. We don’t expect perfection, but even this figure leaves something to be desired.

For providers, electronic bill submissions means faster payments, and for claims administrators, reduced processing costs associated with traditional paper bills. In other words, compliant electronic billing is in everyone’s best interest.

We’re always happy to share our data and knowledge of electronic billing. If you represent a claims administrator that struggles with electronic EOR compliance, please don’t hesitate to reach out.

If you’re a provider and you aren’t regularly receiving electronic EORs, we strongly encourage you to file an audit complaint* to alert the DWC of non-compliance. At best, it could lead to DWC intervention. At worst, it gives the DWC valuable data and serves as a quick, simple way to affect change.

NOTE: The Audit Complaint form was updated in 2019. Access the updated form here: https://www.dir.ca.gov/dwc/Auditref.pdf

To learn more about e-Billing for California workers’ compensation, sign up for our webinar below. We’ll analyze all aspects of compliant e-billing, including the responsibilities of providers and claims administrators.

2017 WORK COMP OMFS CHANGES

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.gif)