"Not on File": How to Get e-Billing Right

How workers’ comp e-billing should work: you submit bills (and medical documents) with a few clicks. Payments arrive quickly, and your e-billing software automatically posts payments to your account.

Hours of work are spared. Life is good.

But e-billing doesn’t always work that way for workers’ comp. We often hear from (non-client) providers whose workers’ comp e-bills go weeks without payment — or never get paid.

When they call the payer, these providers are told the e-bills are “not on file.” Managing revenue becomes a nightmare as the practice struggles to track hundreds (or more) of bills. Questions we commonly get from these providers include:

- Why are our e-bills not on file?

- How do we get these ‘lost’ e-bills paid?

- Do we send a duplicate e-bill or mail a paper bill?

So why are the providers’ e-bills getting lost?

The problem: These providers use the same e-billing software for workers’ comp bills as they use for their private insurance or Medicare patients. And workers’ comp e-billing is very, very different from private insurance or Medicare e-billing. Often, their “e-bills” are simply dropped to paper and snail-mailed.

The solution: End-to-end e-billing software designed specifically for workers’ comp.

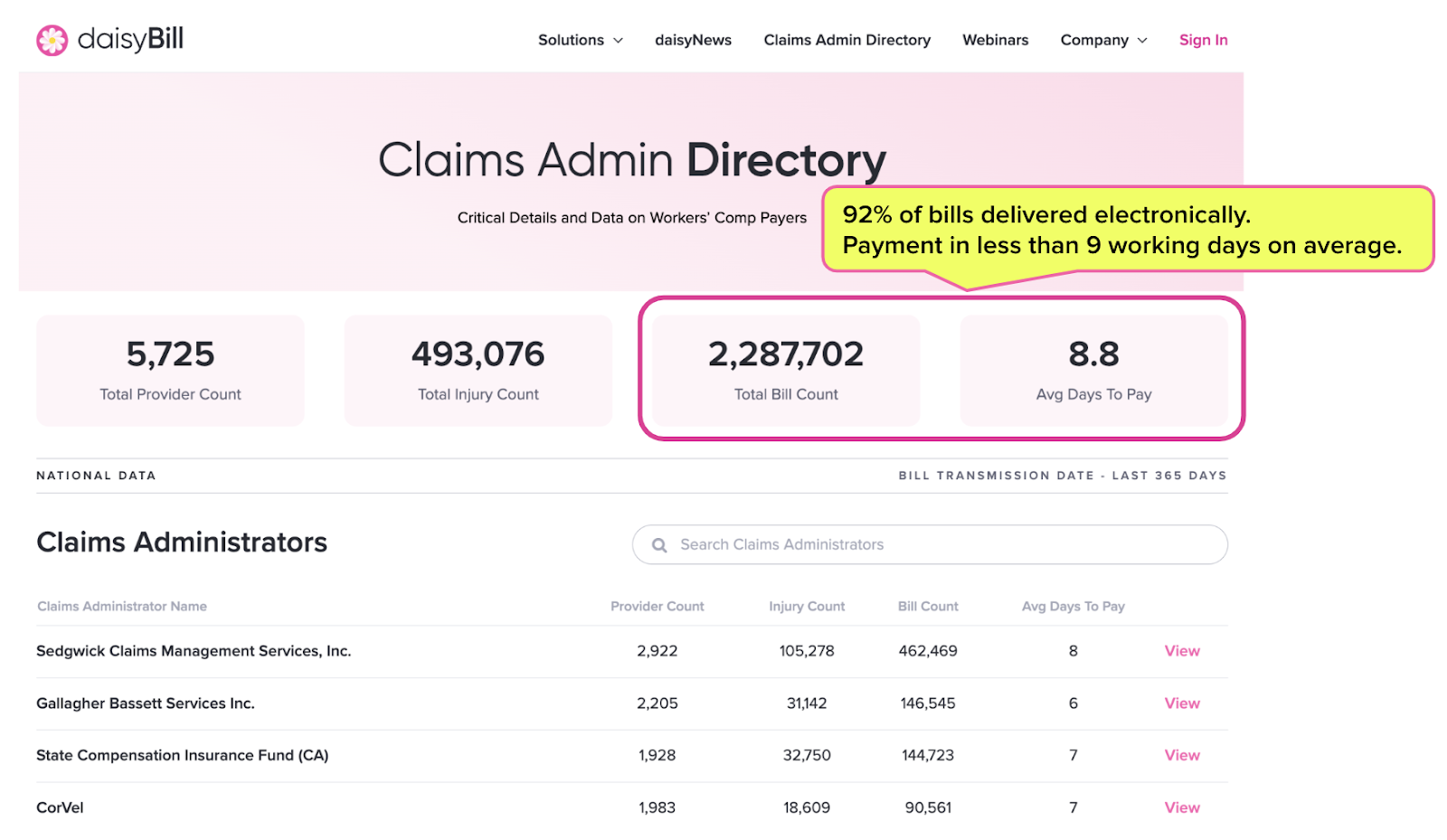

The right technology for workers’ comp e-billing exists. And it works really, really well. In fact, of the millions of e-bills sent through daisyBill annually:

- 92% make it to the payer successfully as e-bills

- Only 7% are emailed or faxed

- Less than half of 1% of bills are mailed

As a result, our e-bills don’t get “lost” — and payment to daisyBill providers arrives in 8.8 days on average.

e-Billing for Workers’ Comp (That Works)

The good news: you can get reimbursed quickly and correctly for treating injured workers, and never wonder where an e-bill or supporting documents “ended up” ever again.

The technical details of pulling off such staggeringly quick payments are complex and tedious. But it’s what we do. We deliver.

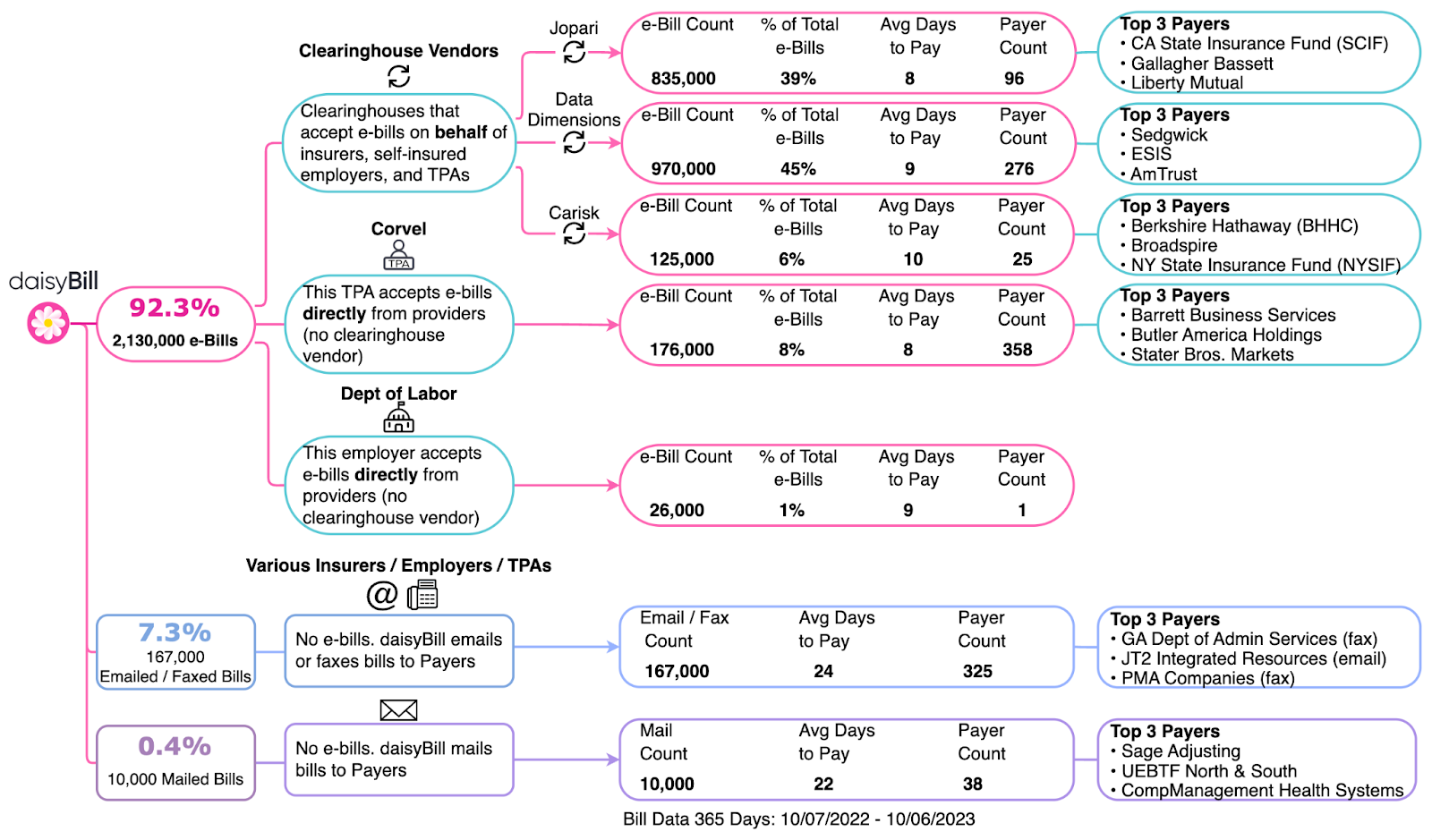

The table below demonstrates the technical workflow of how we deliver millions of workers’ comp bills to hundreds of workers’ comp payers:

- daisyBill maintains direct electronic connections to each clearinghouse (more on that later in this article) used by insurers, employers, and TPAs – in total, daisyBill sends over 1.9 million bills to these three clearinghouses.

- For the payers that do not use a clearinghouse (CorVel and the US Department of Labor), we deliver e-bills directly to these entities.

- Since not all states require e-billing for workers’ comp bills, daisyBill has established direct email and fax bill routes with payers where e-billing is not required.

This sophisticated bill routing technology means that just 0.4% of bills are mailed from daisyBill.

Your (So-Called) e-Bills Are Snail-Mailed

Imagine if people weren’t getting your emails.

You investigate and find out that when you send an email, someone at Gmail or Outlook prints it out, puts it in an envelope, and snail-mails it to the recipient.

It would be a scandal (besides ruining the entire premise of You’ve Got Mail).

But that’s what happens when you try to send workers’ comp e-bills using standard e-billing software for group health. Far too often, your workers’ comp e-bills are ‘dropped’ to paper and mailed to the payer’s bill review.

And all too often, your practice isn’t paid on time or at all.

Why “e-Bills” Are Mailed

With standard group health e-billing software, your workers’ comp e-bill might make it to the payer. But there’s a strong chance it won’t. This is because of the way payers accept e-bills through intermediaries called clearinghouses.

Different payers use different clearinghouses. If your e-billing software doesn’t have a direct electronic pathway to the correct clearinghouse, it’s like throwing a dart at the map; your e-bill could end up anywhere.

Group health e-billing software typically sends every e-bill to a single clearinghouse — and it’s often the wrong clearinghouse, depending on the payer. The “wrong” clearinghouse may attempt to forward bills to the correct clearinghouse, but not always successfully.

In the end (if you’re lucky), someone at a clearinghouse along the way will simply give up on trying to get the bill where it’s going electronically and stick it in the mailbox.

Which is to say…you may be paying for electronic billing software that often isn’t sending bills electronically.

The result is lost bills and supporting documents, and interminable waits for payment while your practice's Accounts Receivable backs up like rush hour traffic.

Reliable e-Billing Data

Bottom line: if you’re using group health software for workers’ comp, it's very likely your bills are being dropped to those old-fashioned slices of dead tree we call "paper.”

That’s the problem daisyBill solves. Our website is updated daily with the count of workers’ comp bills transmitted in the last 365 days and the average number of working days it took the providers to receive payment.

Because 92% of bills are transmitted successfully as e-bills, our providers are paid in less than 9 days.

Over 5,700 providers use to successfully submit millions of e-bills annually. If your practice treats injured workers, this is the best way to ensure correct, fast payment.

daisyBill makes workers’ comp billing easier, faster, and less costly. Request a free demonstration below.

REQUEST DEMO

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.