PPO: Why Your Practice Should Renegotiate (or Cancel) Discount Contracts

Preferred Provider Organizations (PPOs) are choking the financial life out of providers who treat injured workers. This problem is being reported by doctors throughout the United States.

However, with the right support and information, practices can push back against PPO discounts.

Below, see how PPO contract renegotiations impacted two practices’ revenue. Many providers have no idea how much revenue they’re sacrificing for PPOs each year. The result: doctors who treat injured workers become the profit centers for PPOs — entities that offer arguably nothing of value to injured workers.

It’s time to stop the financial bleeding.

Providers can use analytics to get a handle on revenue management, and demand claims administrators pay financially sustainable reimbursements. The practices below are proof.

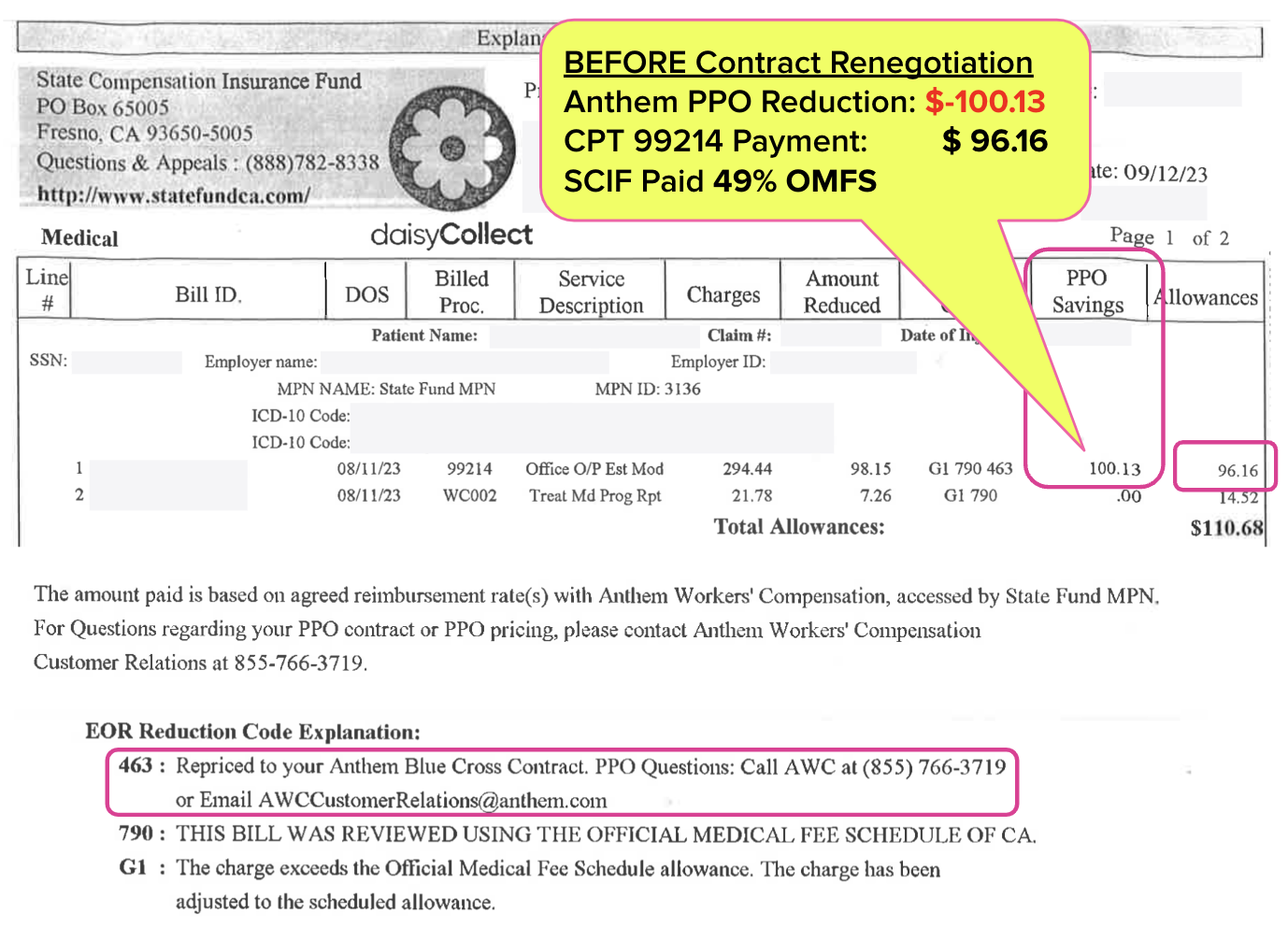

Practice #1: E/M Reimbursements Increase Substantially

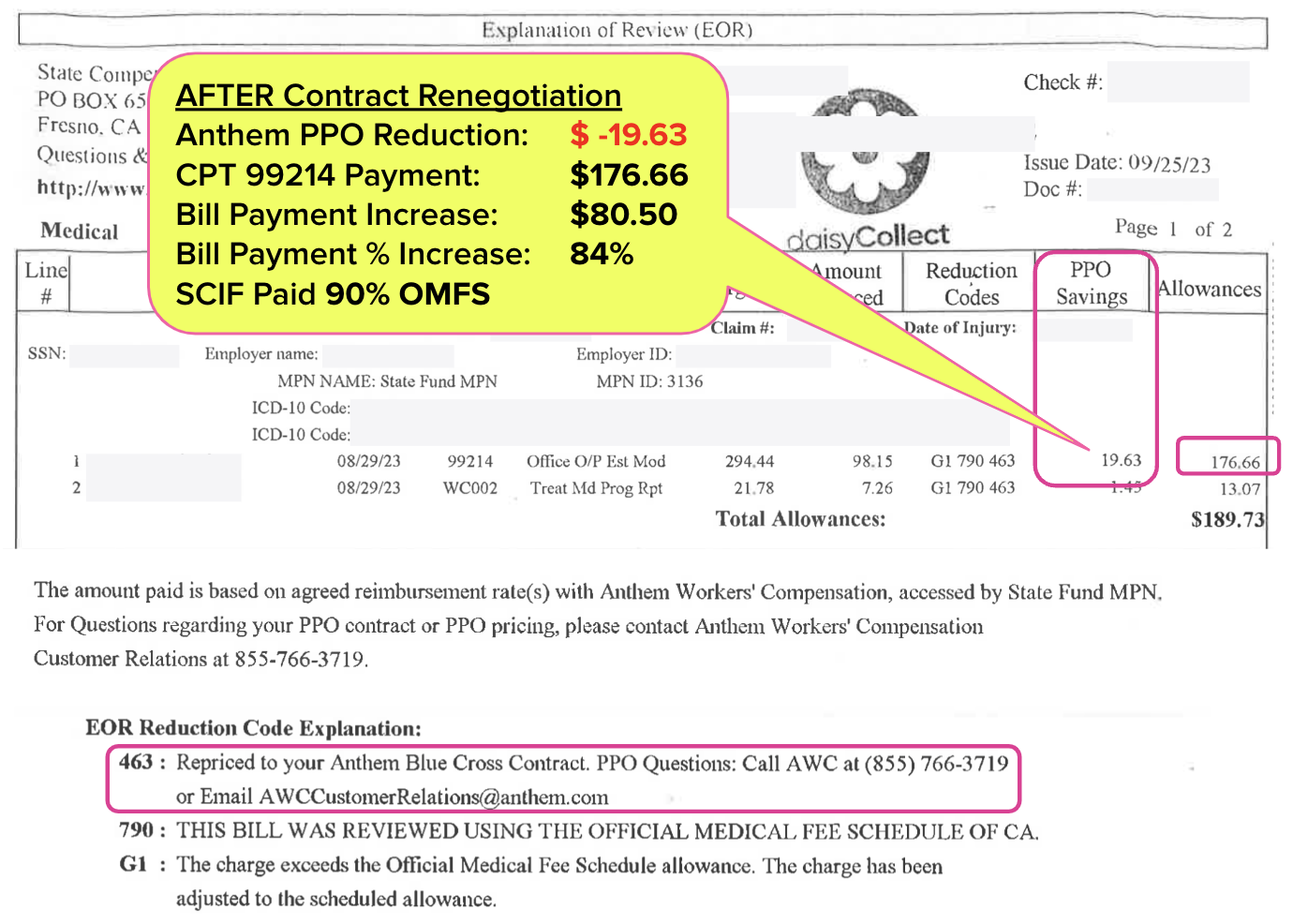

The Explanations of Review (EORs) below show how a California practice renegotiated the terms of their contract with PPO Anthem to increase the reimbursement rate for common Evaluation and Management (E/M) code CPT 99214 by 84% (no, that is not an error).

In the first EOR, State Compensation Insurance Fund (SCIF) reduced the reimbursement to $100 below the fee schedule rate and paid the provider just $96.16, equivalent to only 49% of the OMFS rate.

The second EOR is for the same CPT 99214 — but this time SCIF reduced the reimbursement to only $19.63 below fee schedule and paid the provider $176.66, or 90% of the OMFS rate.

By renegotiating their Anthem Workers’ Compensation contract, the practice increased its payment for CPT 99214 by over $80.

The negotiation tactics were simple: the practice refused to treat injured workers unless Anthem agreed to a higher percentage of fee schedule rates. This was not an idle threat, as the practice realized it was actually losing money by treating injured workers in exchange for reimbursements below Medicare rates.

Practice #2: Bill Payment Averages Increase Substantially

Remember: the above is just one example of one procedure code according to one discount contract agreement.

Providers need powerful analytics to extrapolate the results of PPO renegotiation and get a snapshot of the overall practice impact. That’s where daisyBill’s Bill Payment Averages report can be instructive.

The practice in the video below canceled and renegotiated several major discount contracts in 2021 (with some assistance from daisyCollect). The original discount contracts, including an Anthem contract, reimbursed the provider at rates well below fee schedule.

Watch the video to see how drastically reimbursements improved. Spoiler Alert: The average worker’s comp payment per bill for this practice increased from $209 in 2021 to $279 in 2023.

Injured workers nationwide deserve the care they need. Providers deserve to be reimbursed appropriately for rendering that care.

All we need is a clear view of the problem by the numbers, and the will to take action. daisyBill is here to help.

daisyBill makes workers’ comp billing easier, faster, and less costly. Request a free demonstration below.

REQUEST DEMO

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.gif)

.gif)

Renegotiating or even cancelling is easy. The hard part is getting the PPO networks to pass along the info so the old rates don't continue to be applied.