MedRisk’s 2025 Industry Trends Report: Every Accusation Is a Confession

In its 2025 Industry Trends Report, MedRisk assumes the role of an objective industry observer in the workers’ compensation sector—and blames providers for rising costs.

Behind this thin veil of objectivity lies a far more cynical reality: MedRisk is complicit in and profiting from the very cost drivers it claims to expose. Every accusation that MedRisk levels at providers is essentially a confession of its own practices.

MedRisk’s report claims that rising costs in workers’ comp are due to:

- Medical inflation

- Provider consolidation

- Providers "strategically" using the UB-04 billing format instead of the CMS-1500

Each of these points is presented without meaningful data or cited methodology and with a tone of alarmism that borders on propaganda.

Let’s be clear: state and federal fee schedules dictate reimbursement rates, and Utilization Review (UR) protocols determine which procedures providers may furnish. Providers can’t just conjure higher payments out of thin air—however, MedRisk can extract value from workers’ comp (while delivering none) by inserting itself into the reimbursement stream.

The Ironic Truth About Consolidation

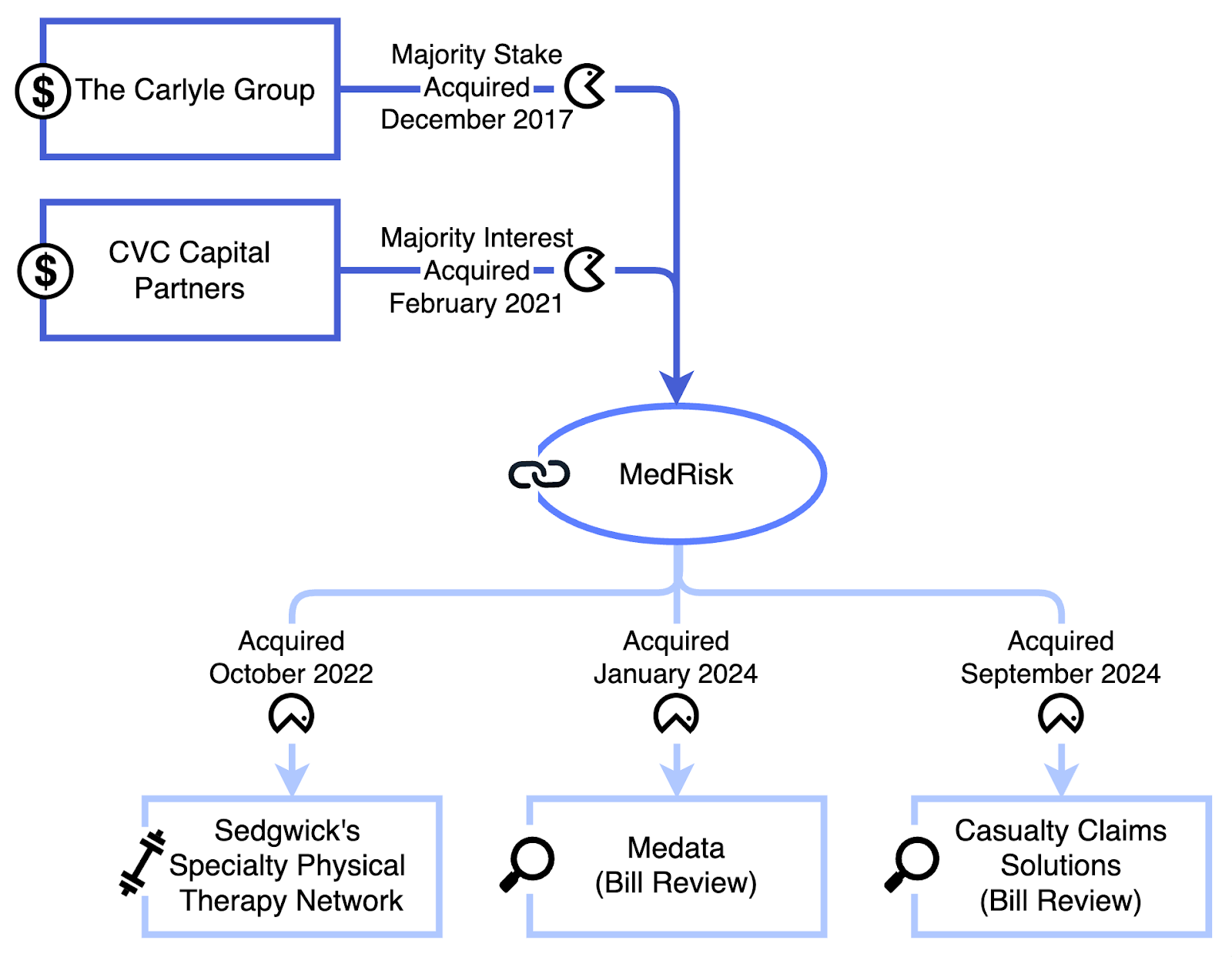

Perhaps the most outrageous claim in MedRisk’s report is that provider consolidation increases costs. Yet MedRisk itself is a monument to private equity consolidation.

Since 2022, MedRisk has:

- Acquired Sedgwick’s physical therapy network

- Bought Medata, a bill review company

- Purchased Conduent’s Casualty Claims Solutions business

This puts MedRisk at the center of vertically integrated, private equity-backed claims administration, bill review, and payment disbursement monolith—all while presenting itself as a helpful facilitator.

MedRisk’s owners?

CVC Capital Partners and The Carlyle Group. (Carlyle is also heavily invested in Sedgwick, the largest workers’ comp Third-Party Administrator in the nation).

In other words, MedRisk is the consolidation it claims to fear.

Who’s Really “Jack[ing] Up” Costs?

The irony is stark: MedRisk accuses providers of manipulating reimbursements. Its business model relies on siphoning reimbursements from claims administrators and underpaying providers — sometimes well below fee schedule rates — through discount networks and proprietary payment schemes.

As this exposé points out, MedRisk profits from friction: it delays, denies, and discounts claims in ways that serve private equity, not injured workers or medical professionals. Then, it publishes a glossy report pretending providers are the problem.

As one reader commented recently in response to our article about MedRisk:

“Most insurance adjustors I speak with are annoyed with the way these Networks manage their patient's visits. It's too bad we can't just directly contract with the insurance companies more often and cut out the middle man.”

The Fox Lectures the Henhouse

MedRisk’s report reads like a masterclass in projection: the very tactics it warns about are its bread and butter.

It’s hard to believe that MedRisk’s report is a dispassionate, good-faith analysis. Given MedRisk’s (and its private-equity owners’) role in the reimbursement discounting industry, we must question whether the report is a self-serving narrative designed to deflect attention from its business model.

The real inflation in the workers’ compensation system isn’t coming from providers — it’s coming from the ever-expanding administrative middle, where companies like MedRisk and its private equity overlords mine the system while pointing fingers at those who actually deliver care to injured workers.

Until MedRisk acknowledges its role in “jacking up” costs, no one should take its blame-shifting “research” seriously.

Protect your practice—with alerts for improper denials and reductions, your staff will know when to take action and secure correct reimbursement. Schedule a free demo today.

REQUEST DEMO

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.png)

Thank you for your dedication to educating the Workers’ Compensation industry and reminding us that at the heart of it all, what truly matters is timely, quality patient care — and showing respect for the providers who deliver it. Something that is way overdue.