CA Physical Therapist Pushes Back: Providers Not the “Bad Guys”

Recently, daisyNews pushed back against Managed Care Matters’ (absurd) accusation that providers will respond to Republican healthcare cuts by “jacking up” the prices of injured workers’ treatment.

One reader strongly agrees with us—and cites an iPTCA lawsuit against MedRisk (a client of Managed Care Matters’ Joe Paduda) and offers essential context about how MedRisk uses aggressive, potentially illegal contracting schemes to slash workers’ comp providers’ reimbursements while pocketing the difference.

According to the iPTCA lawsuit,

- MedRisk contracts with workers’ comp payers (insurers and Third-Party Administrators) to schedule injured workers with MedRisk-contracted providers.

- MedRisk preferentially refers injured workers to those providers willing to accept the deepest reimbursement discounts.

- MedRisk keeps the difference—pocketing profits by shortchanging frontline providers who (actually) care for injured workers.

A California physical therapist (PT) described the MedRisk game bluntly (emphases ours):

“MedRisk has been contracting for providers well below the OMFS [Official Medical Fee Schedule] without being licensed as a 'contracting agency.'... They refer patients to the cheapest providers to keep most of the $$$ paid for rehab services. Some call it fee-splitting. Others call it kickbacks. Attorneys call it illegal.”

According to this reader’s comment, iPTCA has so far prevailed in every motion. The implications? California’s workers’ comp system is being rigged—not by providers but by MedRisk (one of many vertically integrated, private equity-backed workers’ comp administrative entities) exploiting regulatory loopholes to extract profits.

Below, see the details of the allegations against MedRisk—and ask yourself who’s really manipulating reimbursement rates to the detriment of employers and the workers’ comp system.

iPTCA: MedRisk Illegally Reduces Reimbursement Rates

According to the iPTCA lawsuit, MedRisk profits by (emphasis ours):

“…by referring injured workers to those of its contracted health care professionals who acquiesce to the deepest discounts.”

The complaint alleges that MedRisk pressures PTs to accept discounts under the threat of fewer referrals. Further, when a PT furnishes services to an injured worker, MedRisk:

- Collects reimbursement from the payer

- Subsequently pays the provider less than what MedRisk collected

The complaint continues (emphases ours):

“...MedRisk solicits (or extorts) deep discounts of a specified amount from its contracted health care professionals as an inducement for it to send them more referrals…

…Further, MedRisk’s payor clients do not directly pay health care professionals’ claims. Rather, MedRisk pays these claims and pockets whatever difference there is between what MedRisk is paid by payors and what MedRisk pays these professionals…”

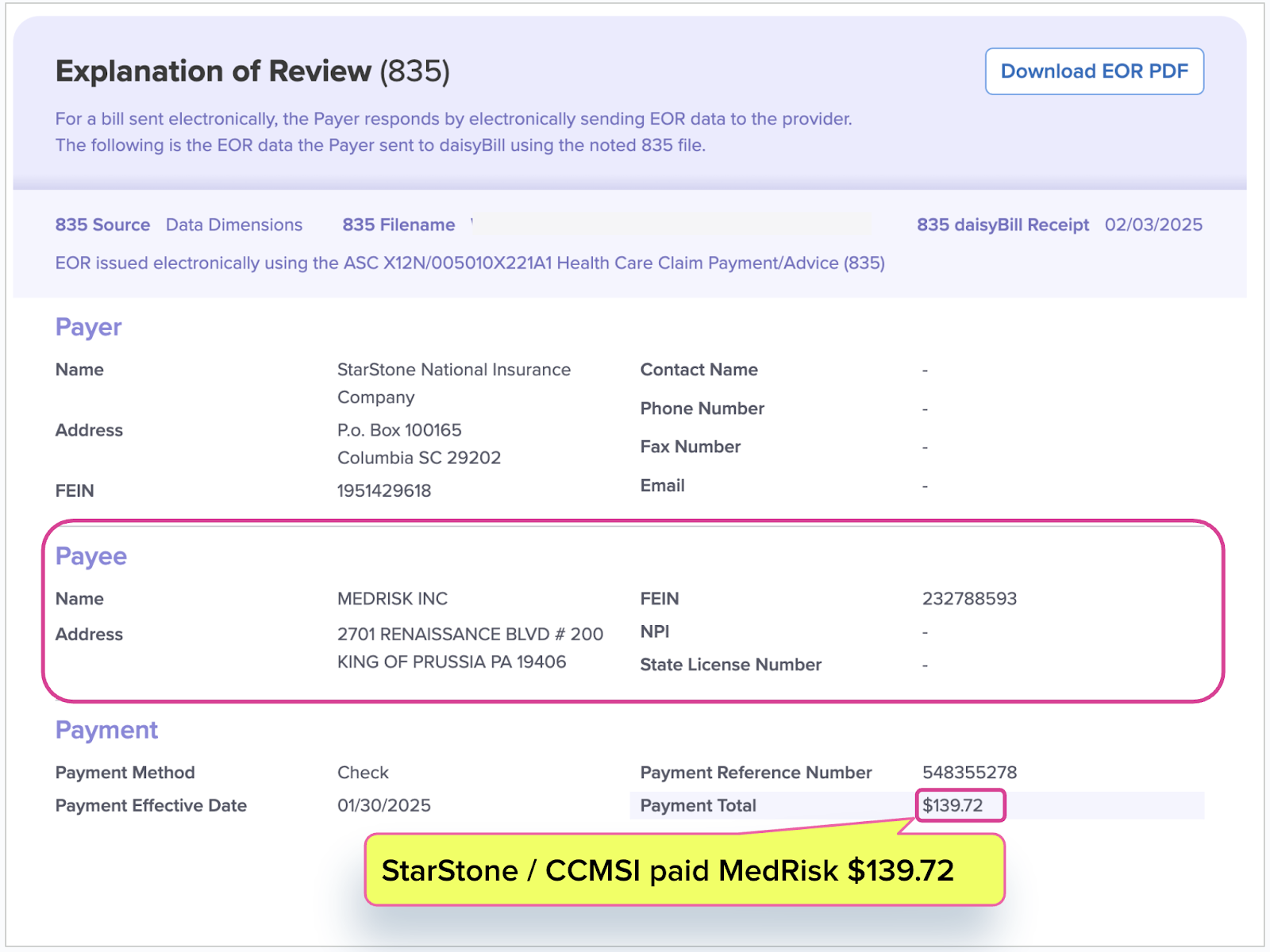

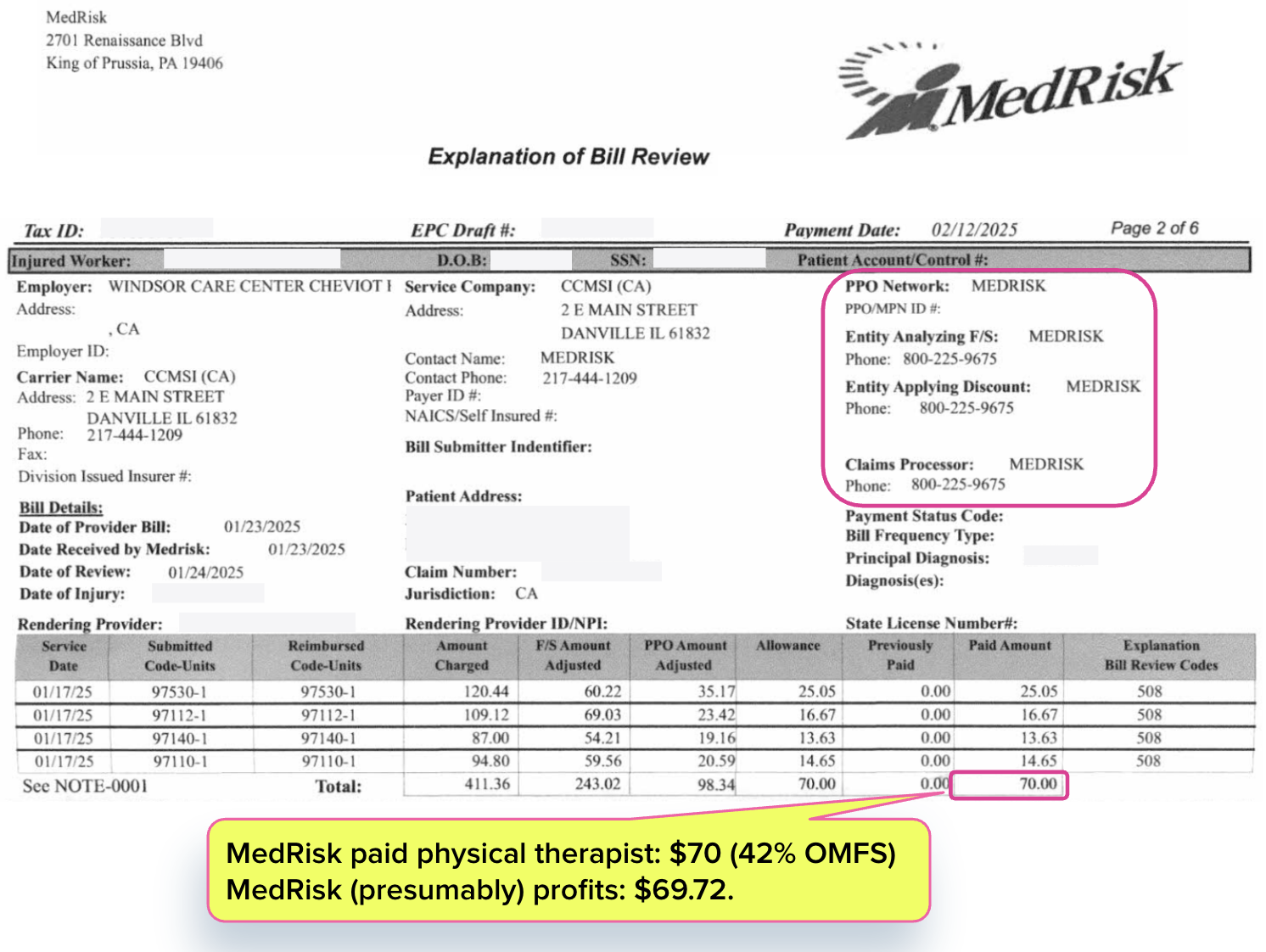

daisyNews has many examples of this dynamic. One electronic Explanation of Review (e-EOR) we received shows that StarStone/ CCMSI paid MedRisk $139.72 for physical therapy services. Subsequently, MedRisk paid the physical therapist $70, which represents only 42% of the amount owed per the OMFS.

MedRisk provided zero treatment to the injured worker and pocketed $69.72. That’s not just unfair. It’s financial sabotage.

This isn't an isolated case. It’s standard operating procedure in a system where entities owned by deep-pocketed private equity firms manipulate reimbursement flows to enrich themselves—forcing providers out of the workers’ comp system altogether.

The reality of workers’ comp is that providers must wage a daily battle against administrative entities, like MedRisk, that have extensive resources and powerful backers—simply to obtain reimbursement at sustainable rates.

And too often, providers lose these battles.

When a private equity-aligned pundit speculates about providers plotting to “jack up” reimbursements, we have to counter that this ignores a real, more immediate problem that verifiable reimbursement data reveal: private equity and the vendors they control are pushing reimbursements down—and pushing providers out of the system.

daisyBill empowers providers to treat injured workers with minimal hassle for appropriate reimbursements. Schedule a brief call with our team to learn how we can help your practice.

SCHEDULE CALL

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

This article is 100% true and accurate. I experience this extorsion everyday and also have been threatened that if I request a high rate of payment, my referrals would be reduced. Med Risk and others like One Call have a tiered provider referral system whereby the referrals a distributed to the providers who accept the lowest payment. It is truly unbelievable what these companies have been allowed to get away with. DaisyNews and iPTCA should be commended for exposing this illegal practice that penalizes hard working physical therapists who are dedicated to helping injured works return to their jobs.

This is extremely frustrating as a private practice owner who is contracted with these big Networks. We struggle to provide quality care to our patients for the low rates that we are given. With the cost of everything going up in California, we really need this money to continue to provide quality care. I honestly don't believe that these Networks provide much value and in some cases cause more problems. They loose authorizations, cause extended time lapse between auths, cut the number of visits approved by the insurance adjustors, and half the time can't provide answers to questions when called on by providers. Most insurance adjustors I speak with are annoyed with the way these Networks manage their patient's visits. It's too bad we can't just directly contract with the insurance companies more often and cut out the middle man.

I came to this article as an innocent patient trying to understand why it was so hard to get ahold of OneCall and MedRisk. Now I thoroughly understand why they are so ponderously unhelpful.