New: NY Injured Worker Intake Form 2025

.gif)

New York providers: If your practice treats injured workers (or is considering doing so), optimize your intake process to avoid some of the pitfalls.

New York workers’ comp is undergoing significant changes to make it easier for physicians to treat injured workers:

- The CMS-1500 has replaced previous billing forms for workers’ comp.

- Starting August 1, all providers must bill for injured worker treatment electronically (e-billing), which includes submitting data to the Workers’ Compensation Board (WCB) in addition to the payer.

- All licensed New York medical providers may soon have the option of treating injured workers without going through the extensive WCB authorization process.

With so much in motion, gathering the right details at intake can help make the whole process smoother for your practice. That’s why we created a New York-specific workers’ comp intake form with all the required details.

Download the (free) fillable form below and get the essential billing information from every injured worker who visits your practice.

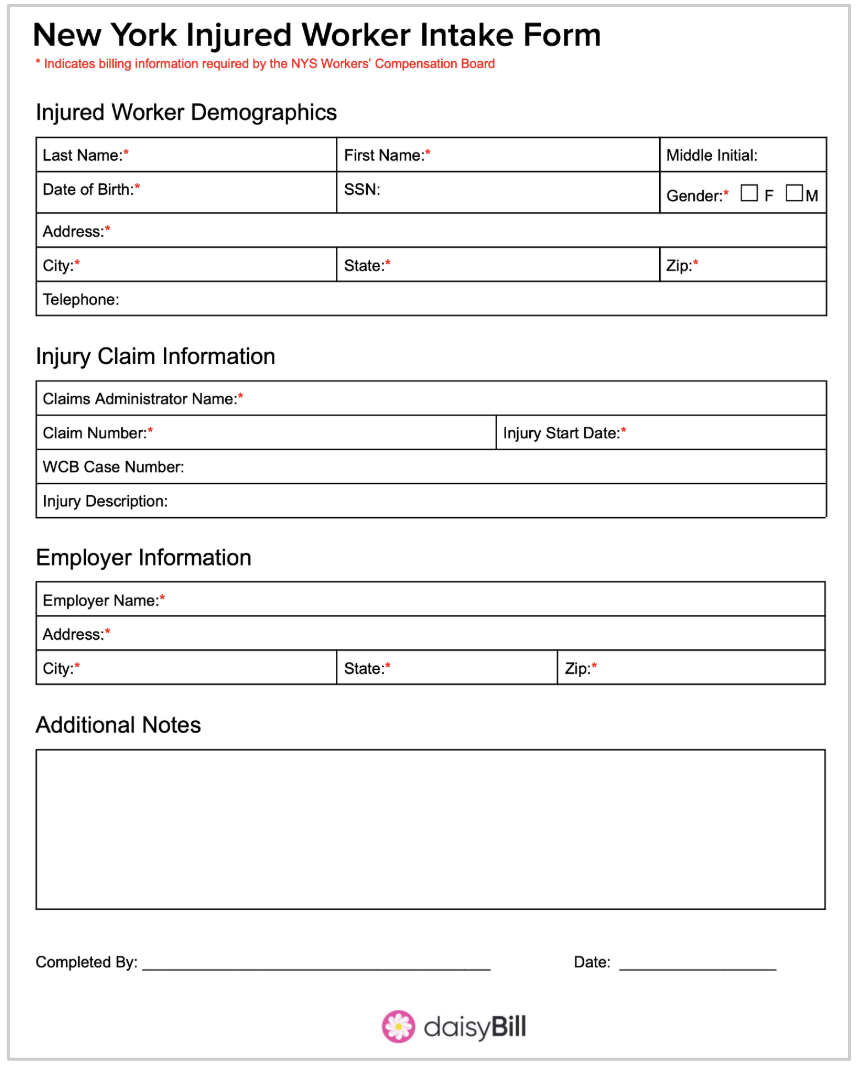

New York Injured Worker Intake Form 2025

For providers, proper and quick reimbursement means getting the necessary billing data. To that end, use a comprehensive injured worker intake form like the one below, which you can download here.

We aligned the fields in this form with the latest WCB billing requirements.

For the WCB Case Number under ‘Injury Claim Information,’ the provider may not always know the Case Number; however, if the provider knows the Case Number, the WCB requires (and urges) the provider to include it on the CMS-1500—so it’s best to record the Case Number at intake if possible. However, the Case Number is not mandatory.

NY Workers’ Comp e-Billing: Mandatory in 2025

Currently, New York workers’ comp medical providers have the option of e-billing. But starting August 1, 2025, all providers must send their workers’ comp bills electronically as the WCB will no longer enforce the payment of paper bills.

That means payers can ignore any paper bills that providers submit. If your practice hasn’t already, it’s time to start the transition to e-billing for workers’ comp (begin by choosing a WCB-approved XML Submission Partner).

In workers’ comp billing, any missing or incorrect information can give the payer a reason to deny payment. We designed the form above to help New York providers generate compliant original bills the first time, avoiding snags down the road.

If you have questions about e-billing for New York workers’ comp, contact our experts using the pink chat icon at the bottom right of this page or email us at info@daisybill.com.

Yep, we’re WCB-approved as an e-billing partner for NY doctors. See how easy we can make workers’ comp for your practice.

START BILLING BETTER

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.