Sedgwick Pays WRONG Fee Schedule Amount (Again, per Annual Tradition)

Another fee schedule update, another Sedgwick screw-up.

Like clockwork, Sedgwick Claims Management Services, Inc. ignores California's fee schedule updates, shortchanging providers and pocketing the difference. It’s workers’ comp Groundhog Day—but with real financial pain for doctors treating injured workers.

Once again, Sedgwick did not update its payment systems to reflect increases to the Official Medical Fee Schedule (OMFS) that became effective February 1, 2025. Despite the California Division of Workers' Compensation (CA DWC) (and daisyNews) publicizing the update, Sedgwick reimburses providers at the previous lower (wrong) rates.

This isn’t just about incompetence—it’s about profits. Sedgwick’s private equity owners presumably make bank from Sedgwick's shortchanging California providers year after year.

Each instance where a provider does not have the administrative resources to dispute Sedgwick’s wrong (lower) reimbursement, it’s money in the bank for Sedgwick and its private equity owners.

Below are just a few examples of the administrative work Sedgwick's annual tradition inflicts on California workers’ comp providers. This is not how workers’ compensation should work.

And the CA DWC? Year after year, they watch this happen and do nothing. Their silence speaks volumes—allowing Sedgwick’s annual payment “errors” to continue unchecked.

Sedgwick Forces Mountains of Appeals

Effective for dates of service starting February 1, the CA DWC raised the OMFS Physician and Non-Physician Practitioner reimbursement Conversion Factor from $48.51 to $48.79, representing a (paltry) 0.58% increase in physician fees in 2025. As a result, reimbursements for these services now reflect 150.84% of the corresponding Medicare rates.

Yet, when a provider sends Sedgwick a bill for the higher reimbursement owed, Sedgwick cuts checks as though the reimbursement increase never happened.

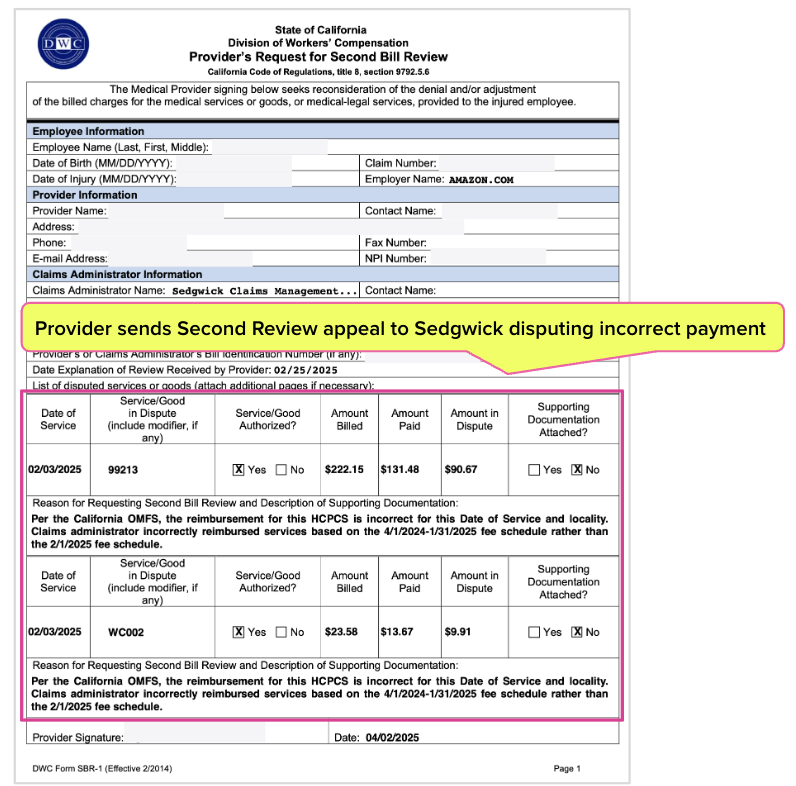

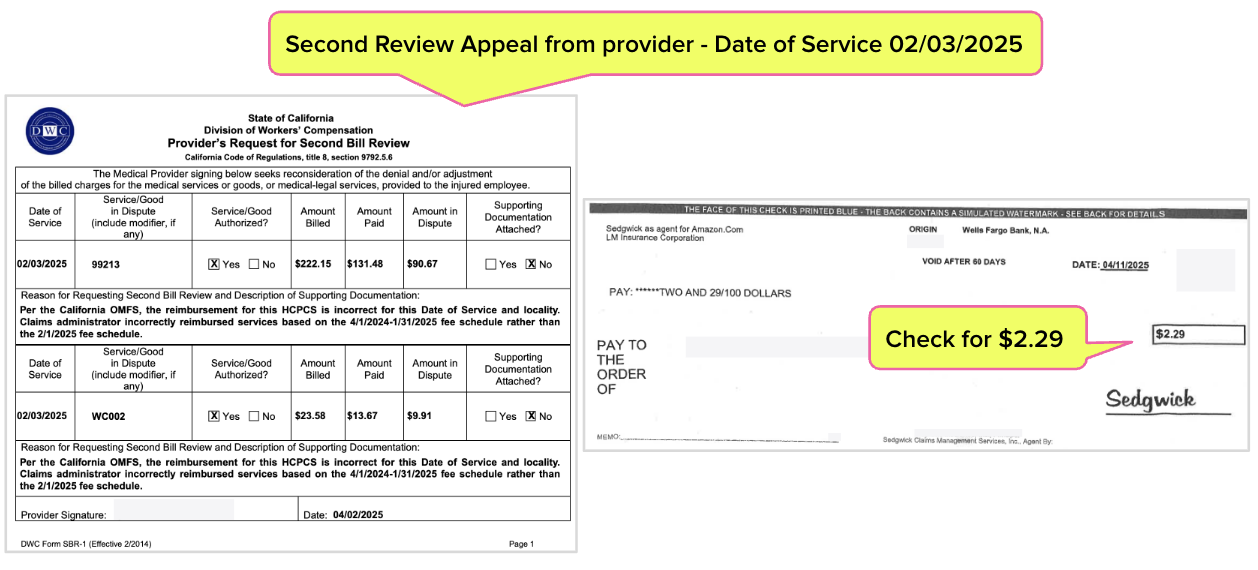

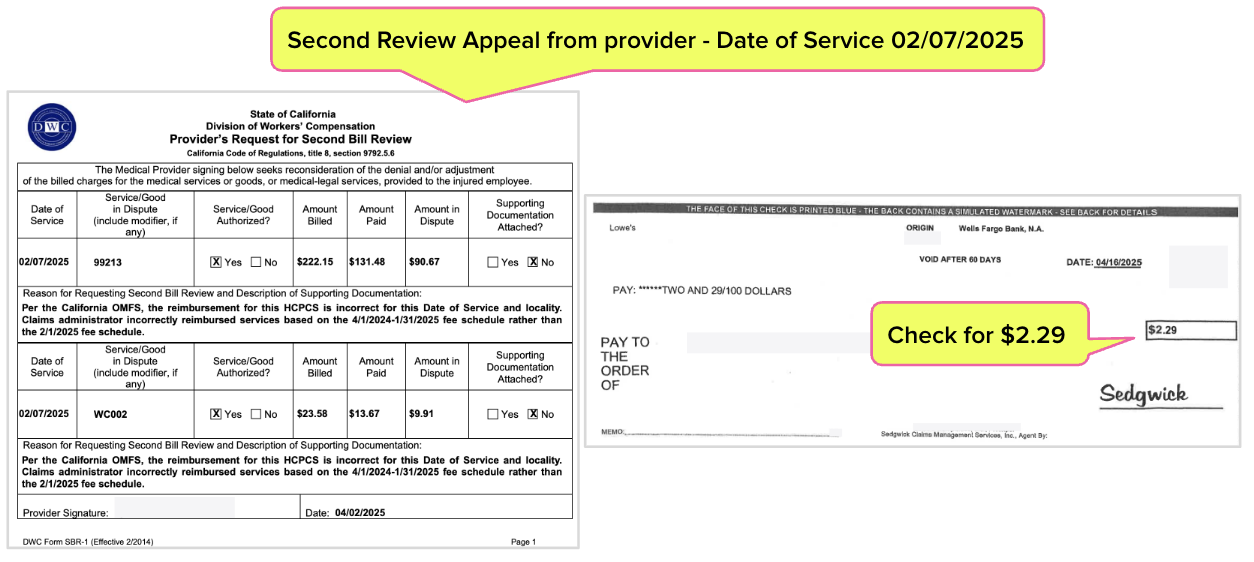

Providers must complete and submit a Second Review appeal like the one below to dispute each 0.58% underpayment to obtain the reimbursement increase. If a provider fails to undertake this administrative burden, the provider sacrifices the reimbursement rightfully owed.

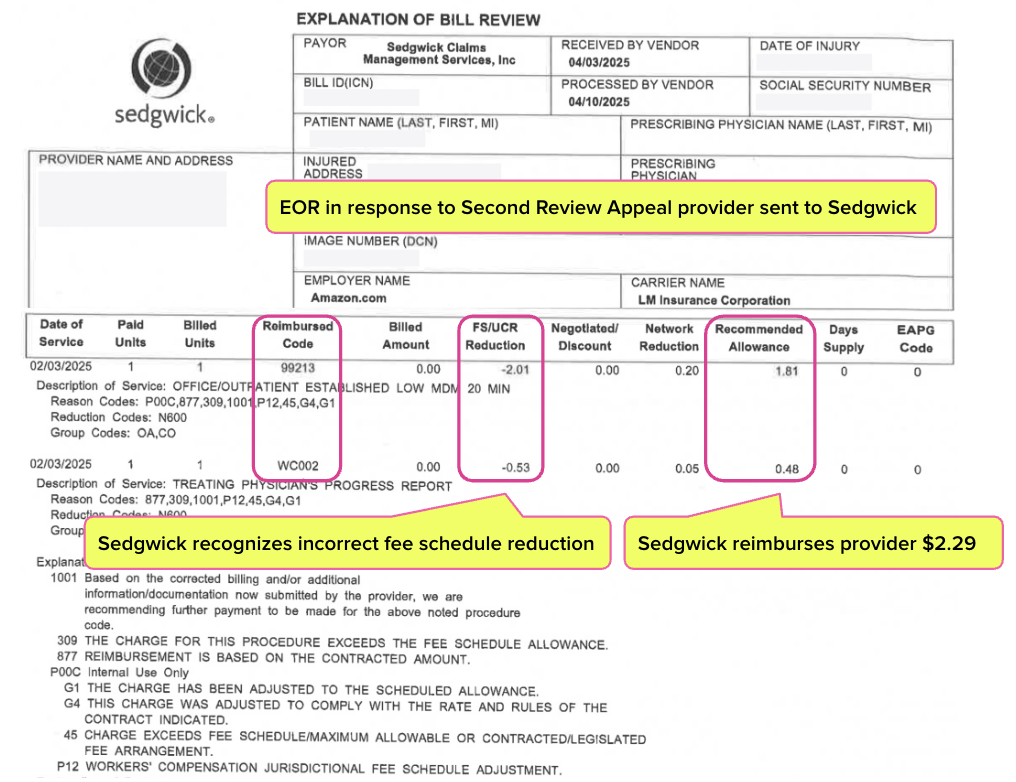

Sedgwick sent the provider the Explanation of Review (EOR) below in response to the Second Review appeal above. This EOR acknowledges Sedgwick owed an additional $2.29.

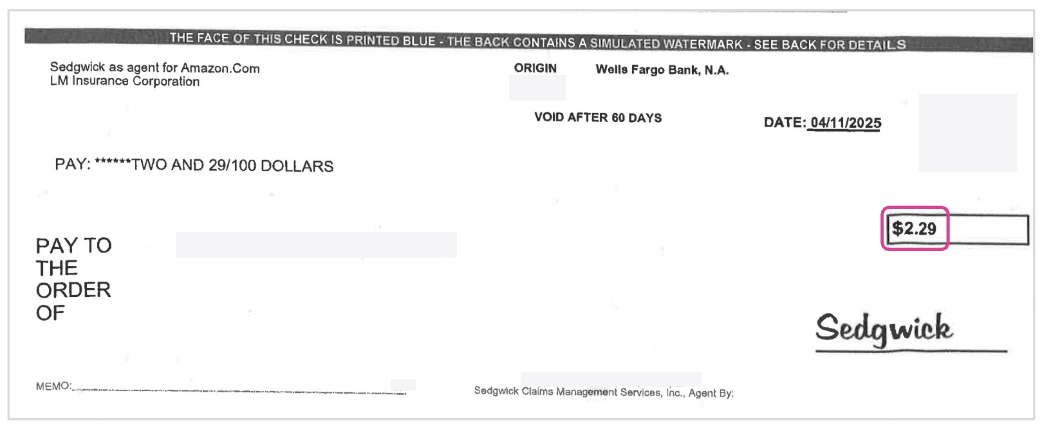

The provider must undertake this appeals process for every bill for which Sedgwick makes this payment “mistake”—which is unbelievably often. And, each time, Sedgwick has to remit a check like the one below for the difference between the current rates and the previous rates.

For just $2.29 per bill, Sedgwick forces providers into a bureaucratic nightmare of appeals. It’s death by a thousand cuts—but for Sedgwick, it’s likely millions in the bank.

Sedgwick Underpays Single Practice 220 Times in < 3 Months

Multiply the example above by 220—because that's how many times Sedgwick has paid a single practice at the wrong reimbursement rate since the OMFS increase took effect.

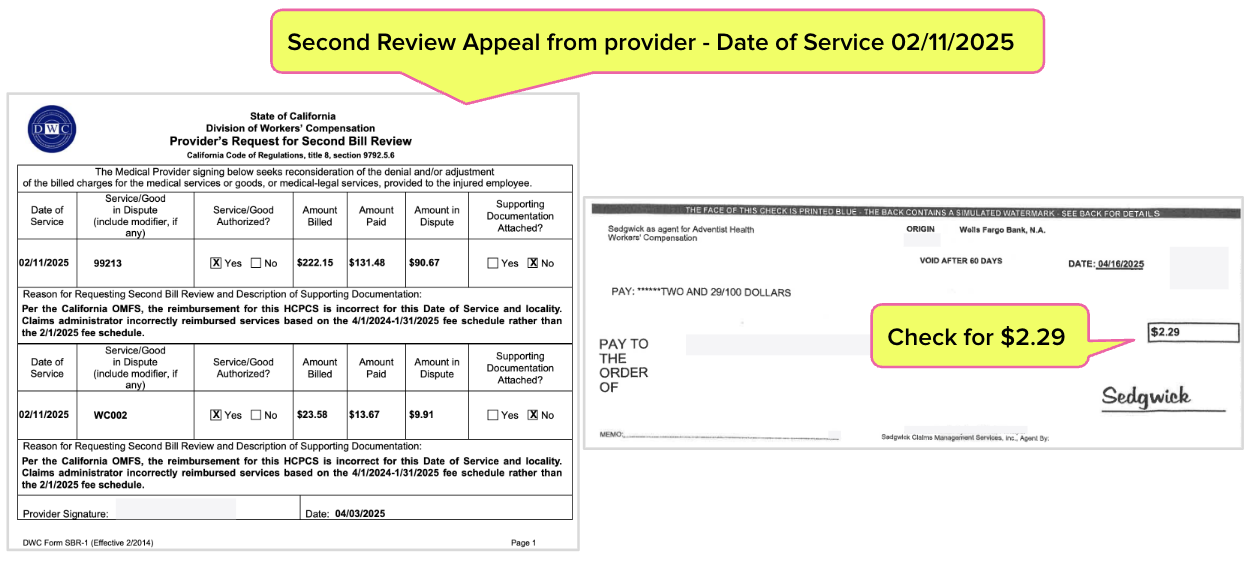

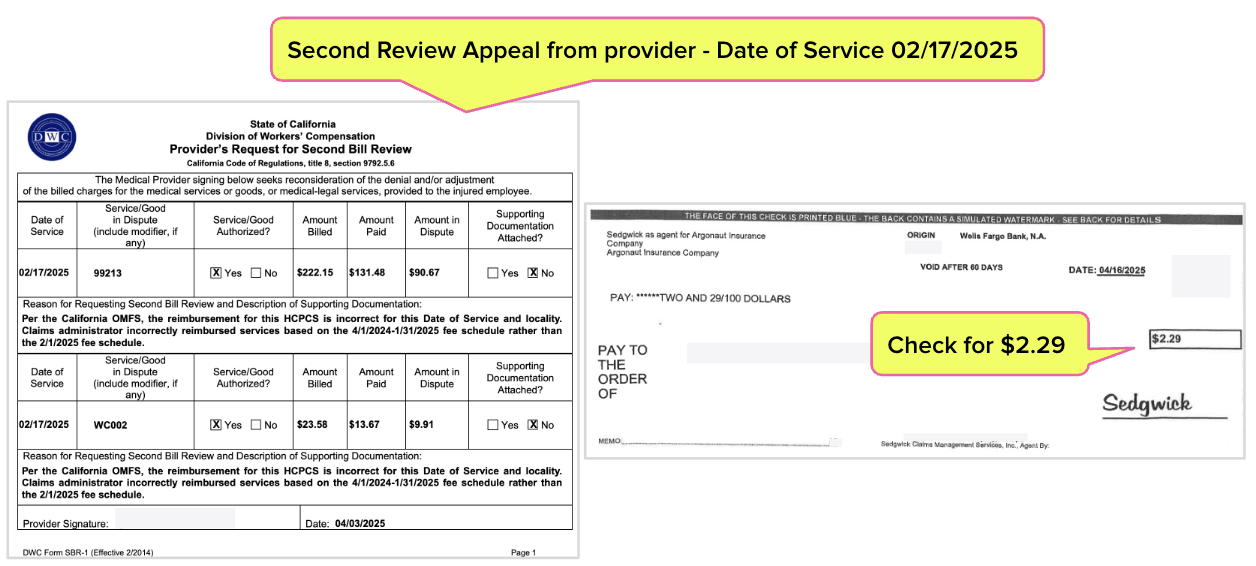

Below are five more examples, each requiring the provider to submit a separate Second Review appeal and collect a separate $2.29 payment from Sedgwick.

Annual “Glitch” Creates Profit at Scale

Worse, because this is Sedgwick, practice staff likely had to post payments manually—thanks to Sedgwick’s blatant disregard for California regulations requiring electronic Explanations of Review (e-EORs).

And Sedgwick doesn’t stop there. This claims administrator routinely denies legitimate Second Review appeals, labeling them as “duplicate bills”—a demonstrably untrue claim that blocks providers from recovering what they’re rightfully owed.

If you can stomach it, try this thought experiment:

- Multiply Sedgwick’s fee schedule violations across thousands of providers statewide.

- Factor in Sedgwick’s denials of appeals that providers are forced to submit just to get paid correctly.

- Add Sedgwick’s refusal to send EORs electronically, creating even more administrative chaos for providers.

- Now, tally the hours lost, delayed payments, and forfeited reimbursements.

The result? Millions of dollars siphoned from California providers’ pockets into Sedgwick’s bottom line—money Sedgwick “earned” not by providing medical care, but through administrative warfare against providers.

Let us keep track of fee schedule rates—and who isn’t paying correctly. Click below to see how daisyBill makes it easy.

BILL EASIER

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

"OMFS Groundhog Day" LOL!