Sedgwick Stiffs CA Practice for Over $300,000

In California, claims administrators can siphon staggering amounts of revenue from practices using invalid Preferred Provider Organization (PPO) discounts—and doctors have no recourse.

As is so often the case, Third-Party Administrator (TPA) Sedgwick Claims Management Services offers the most egregious example.

California providers are pressured to pay PPOs a percentage of the reimbursements due for treating injured workers—an unfortunate state-endorsed arrangement we call “pay-to-treat.” Refusing to capitulate to the PPOs' demands can result in exclusion from Medical Provider Networks (MPNs) and loss of eligibility to treat workers covered by those MPNs.

Proponents of PPOs defend the pilfering by pointing out that technically, PPO pay-to-treat arrangements are not mandatory. If a provider doesn’t want to pay PPOs for the privilege of treating injured workers, the provider can simply choose not to treat injured workers—capitalism at work.

But of course, the “choice” to sacrifice revenue to PPOs is made under threat of exclusion from MPNs.

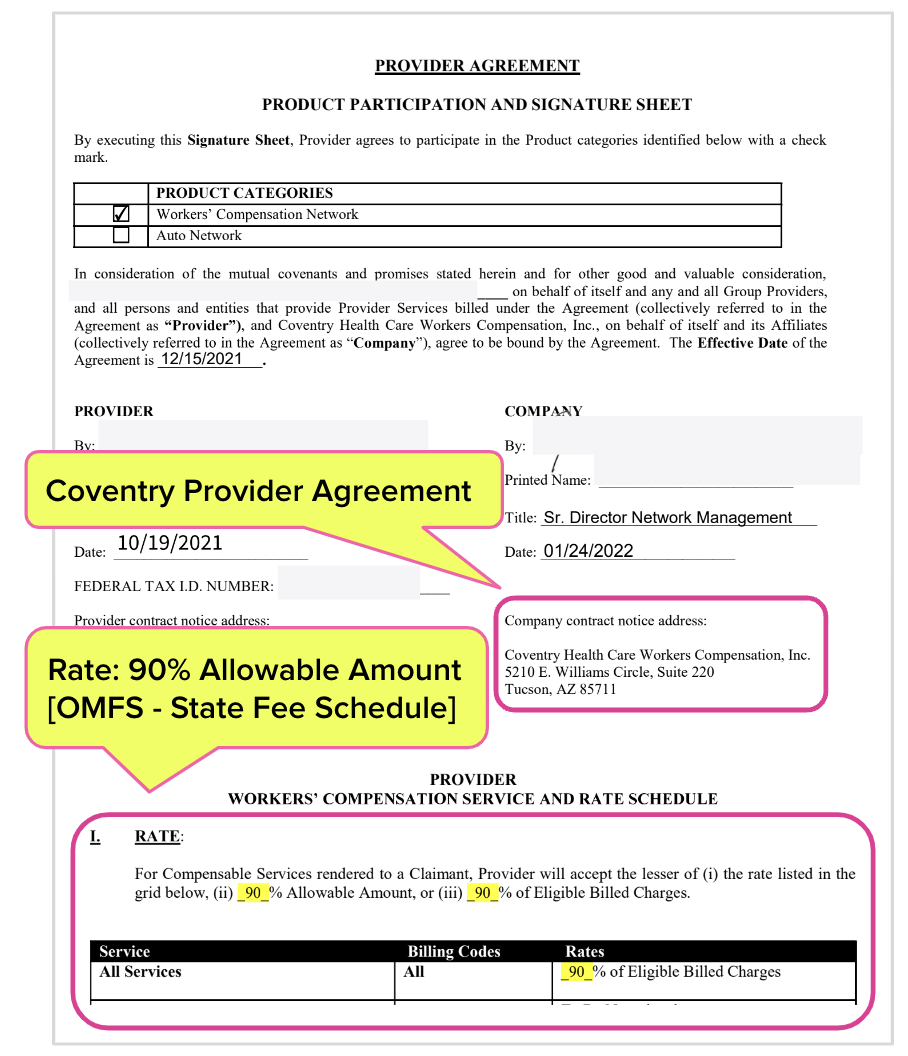

Below, we show how a California orthopedic practice agreed to accept only 90% of the Official Medical Fee Schedule (OMFS) rates for treating injured workers in exchange for membership in a Coventry PPO. These orthopedists thought they were mitigating the damage by limiting the revenue sacrificed to 10% of the amounts due under the OMFS.

However, Sedgwick had other ideas.

Over several months, Sedgwick repeatedly and consistently took far more than the contractually agreed-upon 10% discount. Citing the Coventry PPO contract, Sedgwick reduced the doctors' reimbursements to as low as 52% of the amount owed per the fee schedule.

Below are the painful details, including the signed Coventry contract demonstrating the 90% OMFS agreement. This payment abuse is not rare. It is representative of the payment torture inflicted on doctors throughout California who choose to treat injured workers.

As of today, Sedgwick owes this practice over $300,000 in revenue that was taken irrefutably in violation of the contract signed by the orthopedic practice. This is not capitalism; it is an unacceptable, unabated violation of the terms of a signed contract, enabled by the complete lack of consequences for payer misbehavior in California.

If it’s this easy to strip practices of this much payment with this much impunity, why would any rational provider choose to treat injured workers? California providers have every reason to flee this corrupted system.

Coventry PPO Contract Explained

The practice entered into the contract with Coventry in December 2021, agreeing to sacrifice 10% of the OMFS reimbursement amounts due.

Note that while the practice agreed to sacrifice revenue, the Coventry contract does not entitle the providers to be included in any MPN owned or controlled by Coventry. The contract states (emphasis ours):

“I understand that this form does not entitle me to participation in any Coventry Network, owned and operated by Coventry Health Care and/or its subsidiaries (collectively “Coventry”) and that I must meet certain criteria prior to my status as a participating provider.”

Sedgwick Pays Practice 52% OMFS, Citing Coventry PPO Contract

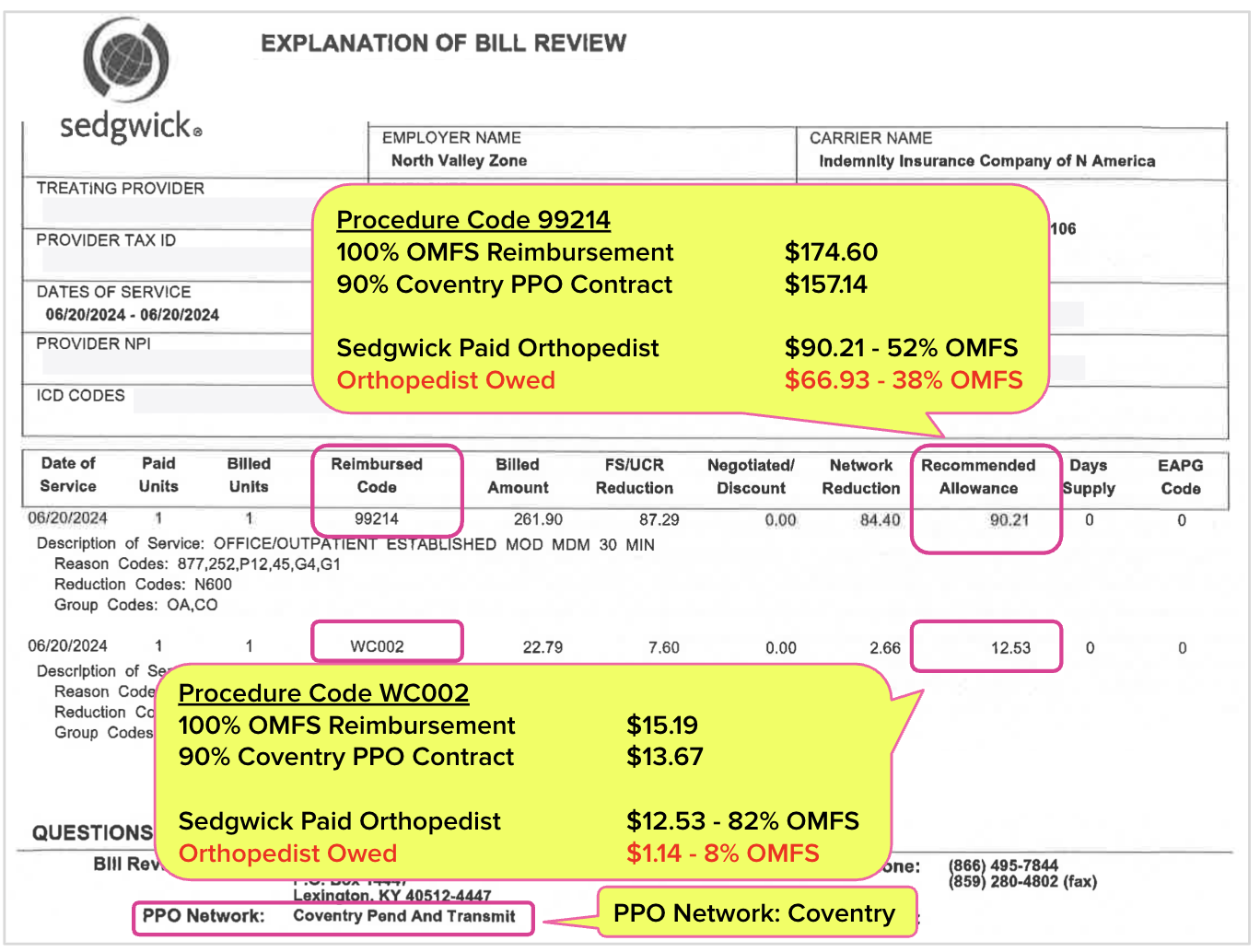

Sedgwick repeatedly referenced the Coventry PPO contract when reducing the practice’s reimbursements. However, rather than paying 90% OMFS rates as indicated in the contract, Sedgwick reduced payment rates to as low as 52% OMFS (equal to 76% of the amount allowed by Medicare).

In the example below, Sedgwick cited a Coventry PPO to justify “Network Reductions” well over the 10% reduction Sedgwick was contractually entitled to:

- Procedure Code 99214 (Evaluation and Management (E/M)): Sedgwick paid orthopedist 52% of the OMFS rate

- California Specific Code WC002 (Treating Physician's Progress Report): Sedgwick paid practice 82% of the OMFS rate

For bills with dates of service between 5/2/2023 and 9/13/2024, Sedgwick cited the Coventry PPO contract to reduce reimbursements for 6,962 procedure codes to rates well below 90% OMFS, in clear violation of the contract.

For those 6,962 procedure codes, Sedgwick owes this practice $317,007 in additional reimbursement.

This amount does not include the 15% penalties or 10% interest payments Sedgwick also owes for the improper withholding of correct reimbursements.

|

Procedure Count

|

OMFS Reimbursement Rate Due |

Reimbursement Due per 90% OMFS Coventry Contract |

Sedgwick Payment Total |

Sedgwick Payment as % of OMFS Rate |

Additional Payment Sedgwick Owes per 90% Contract |

6,962 |

$830,350 |

$747,315 |

$430,308 |

52% |

$317,007 |

This level of sustained abuse raises one obvious question: how is this allowed?

We will explore the answer in an upcoming article detailing daisyBill’s failed efforts to get Sedgwick to end its abhorrent reimbursement antics and pay the practice what is owed.

Those efforts included calling on the state’s Division of Workers’ Compensation (DWC), which once again demonstrated that claims administrators like Segwick have free rein to ignore contracts and violate California payment regulations.

This payment nightmare shows how easily California providers can fall victim to Sedgwick’s money grabs. If this abuse continues, the ongoing exodus of providers from this corrupt system may be the most logical example of capitalism at work.

daisyBill tracks responses to your bills, appeals, and RFAs — so your practice knows when payers break the rules. Click below to learn more or request a demonstration.

LEARN MORE

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.gif)

.png)

This is insane! Thank you so much for sharing this clear example. I am looking forward to your follow up article, and would love to assist in any way I can to help end this corruption.