TX DWC Identifies "Poor" Work Comp Carriers

The Texas Division of Workers’ Compensation (TX DWC) has released its official 2024 rankings of workers’ compensation insurance carriers—and the results are bad news for a handful of insurers.

Texas Labor Code requires the TX DWC to conduct assessments on insurance carriers and health care providers every two years to identify those that “adversely impact the workers’ compensation system” and may need extra oversight.

This information is worth having for Texas providers treating injured workers. Part of the state’s assessment criteria involves the timely processing of providers’ bills and appeals of improper payment denials and reductions.

Below, see the carriers that—this year—have a less-than-stellar reputation for compliance.

TX DWC: Performance-Based Oversight

Texas Labor Code Section 402.075(c) mandates that selected providers and carriers are regularly assessed for compliance with the most critical billing and payment requirements. These assessments have potential consequences; as § 402.075(c) states (emphases ours):

“The division shall examine overall compliance records and dispute resolution and complaint resolution practices to identify insurance carriers and health care providers who adversely impact the workers' compensation system and who may require enhanced regulatory oversight.”

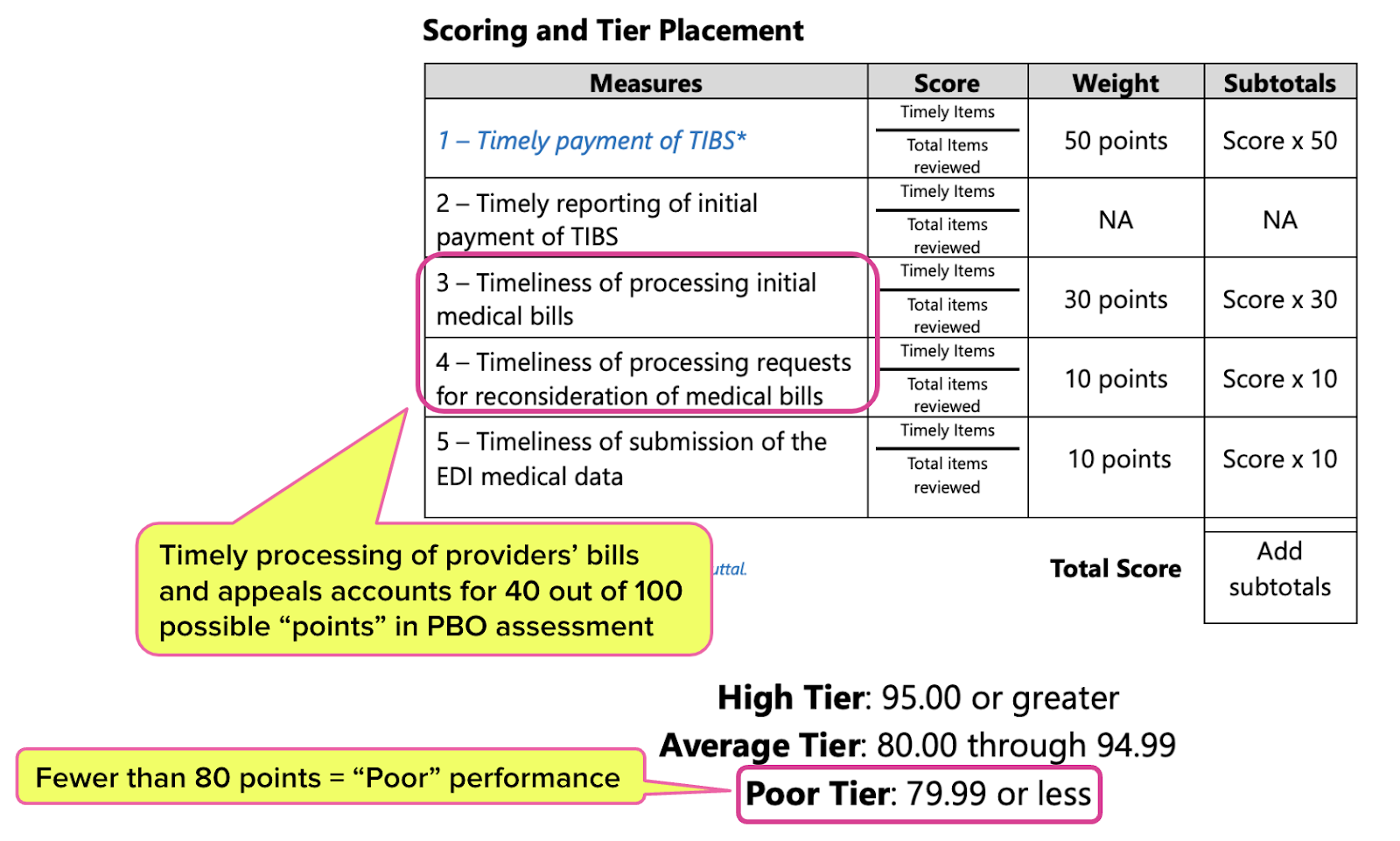

The TX DWC’s Performance-Based Oversight (PBO) assesses insurance carriers performance in five specific areas, three of which are of particular concern to providers, listed in bold below, who treat Texas injured workers:

- Timely payment of Temporary Income Benefits (TIBs)

- Timely reporting of initial payment of TIBs to the TX DWC (not factored into ranking)

- Timeliness of processing initial medical bills

- Timeliness of processing requests for reconsideration of medical bills

- Timeliness of submission of the EDI medical data to the TX DWC

Carriers self-report data to the TX DWC to assess these five areas. For the 2024 rankings, the TX DWC looked at data carriers submitted from January 1, 2024, to June 30, 2024.

The Texas PBO rating system assigns up to 30 out of 100 "points" to the timely processing of providers’ initial medical bills, and up to 10 points to the timely processing of requests to reconsider improper adjustments or denials.

In other words, timely bill and appeal processing is a significant factor in a carrier’s ranking—as it should be.

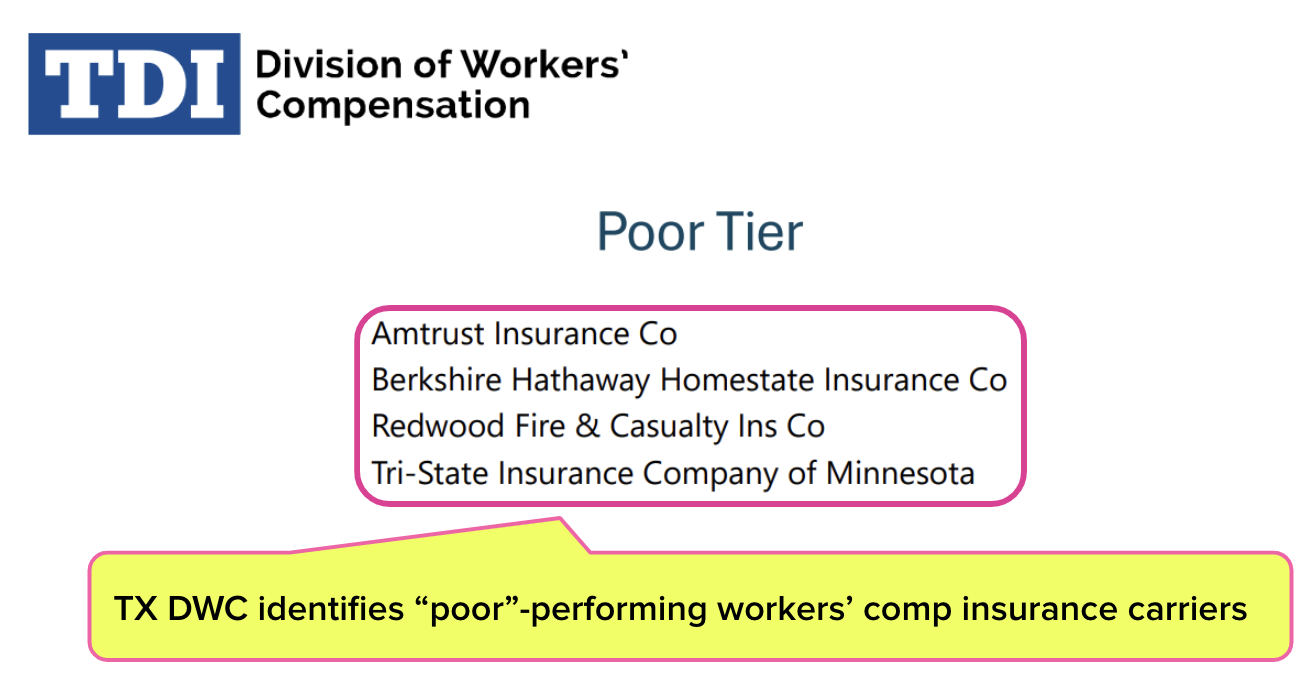

Based on those assessments, the TX DWC places insurance carriers into “High,” “Average,” or “Poor” performance categories. Any carrier that fails to score at least 80 points is considered a “poor” performer.

TX 2024 Poor Performers

The complete list of all three tiers is available here. Providers should consider these rankings when deciding whether to treat injured workers covered by a carrier.

Only four carriers, all insurance companies, were rated “Poor” for 2024, as shown below:

- AmTrust

- Berkshire Hathaway

- Redwood Fire & Casualty

- Tri-State Insurance Company of Minnesota

That AmTrust and Berkshire Hathaway would rank “Poor” doesn’t exactly surprise daisyBill; in years past, daisyBill has submitted formal Audit Complaints to the California Division of Workers’ Compensation for tens of thousands of violations by both of these insurers.

Unfortunately, California rarely imposes consequences for non-compliant carriers. The TX DWC, however, pledges to “focus oversight efforts on insurance carriers found to be poor performers in PBO.”

Moreover, Texas Administrative Code §180.26(e) directs the TX DWC to consider PBO ratings when deciding how severely to sanction a carrier found to engage in regulatory violations. Sanctions can include fines, suspensions, and more.

Texas providers take note. If an insurance carrier is found to be underperforming in its legal obligations to providers and injured workers, it may be a bright red flag regarding your practice’s ability to get paid quickly and correctly for treating those carriers’ covered workers.

Yes, you CAN submit workers’ comp bills and documents electronically in Texas (and get paid faster). Click below to learn more.

LEARN MORE

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.gif)

^^Touché.

I find it interesting that two of the four companies that are rated "poor" are owned by the same parent company. Berkshire Hathaway and Redwood Fire and Casualty are sister companies.