Payor Rankings: Our Biggest Work Comp Payors

Our mission is simple: to take the hassle out of California workers’ comp. We want providers to treat injured workers with full confidence in their ability to obtain proper reimbursement, quickly and easily.

Holding the payors accountable is a vital part of that effort. Electronic billing makes the provider's’ end of the equation easier and faster. Likewise, e-billing allows payors to pay more quickly and easily. Among the biggest insurers— those who pay the lion’s share of our providers’ bills — we find some exemplary timeliness. We also find some that owe our providers a better effort.

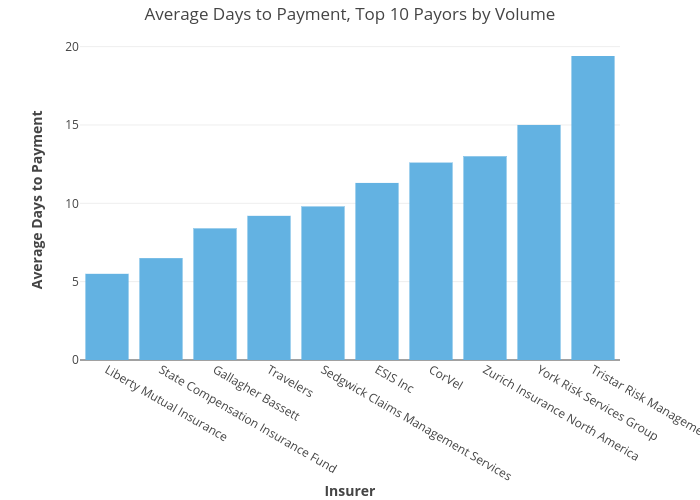

Absent a separate reimbursement contract, all payors (insurance companies, self-insured employers, and third-party claims administrators) have 15 working days to pay electronic bills, according to California Labor Code § 4603.4. Sadly, providers are essentially responsible for enforcing this rule, which results in inconsistent compliance by payors.

To shed light on payor behavior, we created our Insights Tool and its Average Days to Payment tracker. This tool compiles data for physician, medical-legal, interpreter, copy services, and pharmacy bills. For all these services, we track Original Bills, Second Review, and Independent Bill Review (IBR). We also rank insurers by the sheer volume of bills they process, tracking their respective percentages of the total number of bills submitted.

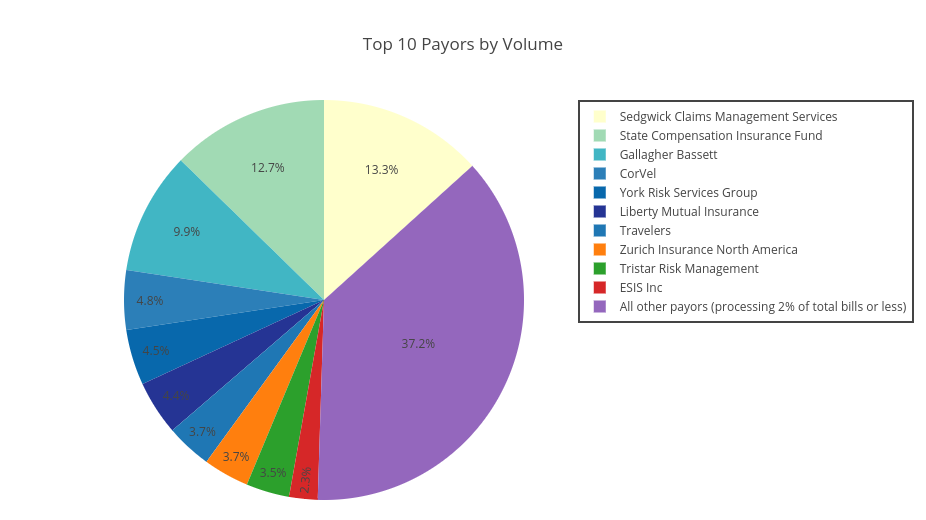

The Top 10 Insurers by Volume

Our biggest insurers — behemoths like Sedgwick, SCIF, Gallagher Bassett, and Liberty Mutual — processed almost 63% of original medical bills providers submitted between July 1, 2016, and June 30, 2017.

Over 37% of all claims were handled by the top 3: Sedgwick, SCIF, and Gallagher Bassett, in that order. All three maintained respectable average days to payment, remitting what they owed in under 10 days (though just under, in Sedgwick’s case). The rest of the top 10 ranged from lightning quick to inexcusably slow.

The Best of the Biggest Payors

The fastest payor was Liberty Mutual, our sixth largest insurer by volume and no stranger to the top of our speed rankings. With an average of 5.5 days to payment, Liberty Mutual showed just how fast electronic payment can be, even for a huge company processing massive numbers of claims. Liberty Mutual consistently pays on time, with an average of 9 days to spare before the legally mandated deadline — a feat that’s surely appreciated by our providers!

Just a day slower was our runner up, the California State Compensation Insurance Fund (SCIF), the second largest insurer by volume. Considering the fact that SCIF processed more than double the number of total bills processed by Liberty Mutual, SCIF’s average of 6.5 days to payment is nothing at which to sneeze.

The bronze medal goes to Gallagher Bassett, with an average of 8.4 days to payment, again impressive given the volume of bills the insurer processed. Our third largest by volume, Gallagher Bassett handled nearly 10% of all bills submitted. Not bad, Gallagher Bassett.

The Slowest of the Biggest Payors

On the other end of the spectrum, third-party administrator (TPA) Tristar Risk Management earned the unfortunate distinction of being the only insurer in our 10 largest to exceed the 15-day standard. With an average days to payment of 19.4, Tristar kept providers waiting over four days longer than California law considers reasonable, and nearly two weeks longer than Liberty Mutual does.

Barely maintaining an acceptable average was York Risk Services Group, another TPA, paying within an average of 15 days. York kept itself on the right side of the compliance divide by a matter of hours. Acceptable, but surely a performance that leaves room for improvement.

We strongly encourage any providers who are not timely paid to demand the appropriate penalties and interest fees if applicable, and submit audit complaints* if necessary.

E-billing serves one purpose: to make the workers’ comp billing and payment process smoother, easier, and faster. We applaud those payors that do their part to help realize this goal. With the cooperation of all parties involved, technology can make the complicated landscape of work comp billing and payment navigable for everyone.

*NOTE: The Audit Complaint form was updated in 2019. Access the updated form here: https://www.dir.ca.gov/dwc/Auditref.pdf

Need e-billing? We’ve got e-billing. California workers’ comp billing and payment is complicated enough. Save time, decrease administrative costs, and get your office paid quickly and correctly. Schedule a free demonstration of daisyBill for your office today.

REQUEST DEMO

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.gif)