99¢ Stores: Athens Halts Processing Bills

In April of this year, 99 Cents Only Stores LLC declared bankruptcy, leaving the self-insured employer with no way to pay its Third-Party Administrator (TPA), Athens Administrators, for handling its injured employees’ claims.

As a result, Athens has ceased processing providers’ bills for treating 99 Cents Store workers.

California’s Department of Industrial Relations (DIR) has assigned 99 Cents Store claims to the Self-Insurers’ Security Fund (SISF). Per California Labor Code, the DIR may declare the SISF responsible for meeting 99 Cents Store’s obligations to its injured workers and any providers who have treated them.

While the funds to meet 99 Cent Store’s workers’ comp obligations may ultimately come from SISF, TPA Tristar will take over claims administration and bill processing effective July 1, 2024.

Providers, of course, are expected to accept any resulting delays in payment without complaint.

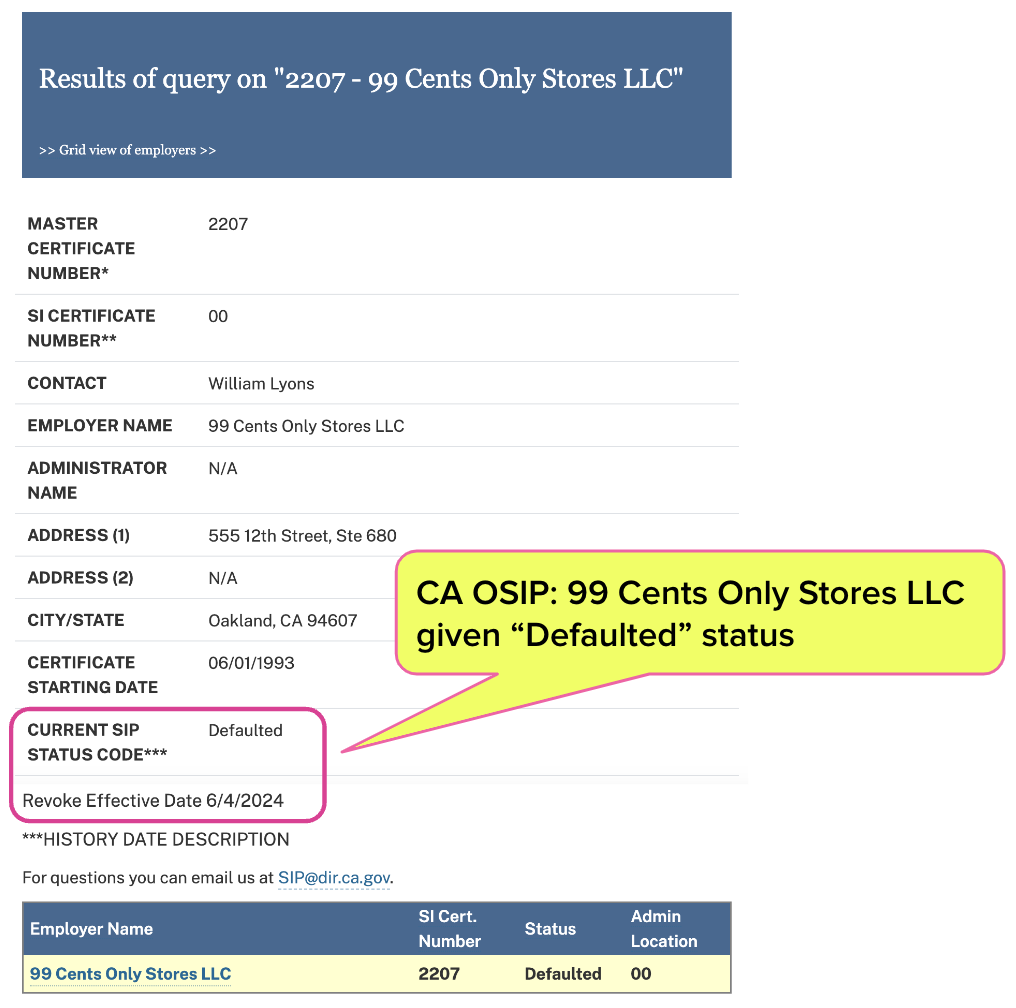

OSIP Lists 99 Cents Store “Defaulted”

California’s Office of Self-Insurance Plans (OSIP) governs self-insured employers, which provide their own workers’ comp coverage rather than relying on an insurer.

Employers are subject to strict financial requirements to maintain self-insured status. These requirements ensure they can meet their obligations to pay for any necessary workers’ compensation medical treatment, benefits, and claims administration.

As of June 4, 2024, OSIP revoked 99 Cents Store’s self-insured status following the employer’s declaration of bankruptcy. 99 Cents Store’s listing on the OSIP website as “Defaulted” is shown below:

Athens Left Holding the Bag

While employers like 99 Cents Store may self-insure, most do not choose to self-administer their workers’ comp claims, instead relying on TPAs like Athens to handle claims and process providers’ bills.

An Athens representative alerted daisyBill to the news, declaring that “We were caught off guard just like the providers and injured workers. I actually saw the news on Instagram before we got official word.” The representative confirmed that:

- 99 Cent Stores defaulted on its workers’ comp claims

- Athens halted all bill processing for 99 Cents Stores

- The Director of the DIR has assigned 99 Cents Stores claims to the SISF

- Tristar will take over claims administration for 99 Cents Stores as of July 1, 2024

- Athens will hold any bills received before July 1 for forwarding to Tristar

As the Athens representative stated:

“The employer, 99 Cent Only Stores, has defaulted on their workers’ compensation claims and they have been assigned by the Director of the Department of Industrial Relations to the Self-Insurers’ Security Fund for future handling. The notification of default was issued on June 5, 2024.

As a result of the default, there are currently no funds to make any payments. Pursuant to California Code, Labor Code - LAB § 3701.5 (c) If the director determines the payment of benefits and claims administration shall be made through the Self-Insurers’ Security Fund, the fund shall commence payment of the private self-insured employer’s obligations for which it is liable under Section 3743.

Tristar will be taking over on 7/1. All bills received by Athens will be held and routed to Tristar.”

Providers should keep track of all bills submitted to Athens for 99 Cents Store employees to ensure they are ultimately processed by Tristar. daisyBill will keep the workers’ comp community apprised of any further relevant details as July 1st approaches.

daisyBill tracks responses to your bills, appeals, and RFAs — so your practice knows when payers break the rules. Click below to learn more, or request a demonstration.

LEARN MORE

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

I know insurance is designed to be opaque, but I'm not sure I understand how bankruptcy of these large retailers would affect funds that are presumably coming from an insurance carrier--unless the retailer also defaulted on the insurance policy itself? Given that dates of injury on medical bills occurred, presumably, in the past, why isn't the insurance carrier liable for those claims regardless of the retailer's current liquidity? I mean, I guess they are and TriStar will administer those bills eventually, but it just seems odd that all payments can cease suddenly, or maybe I'm completely misunderstanding insurance, which is also possible.