AmTrust MPN Magic Denies Payment

Welcome to California workers’ comp, where claims administrators can use even the most demonstrably, objectively, provably untrue assertions to deny payment to a provider—with no threat of regulatory consequences.

One of the easiest ways for claims administrators to improperly deny reimbursement is to cite a Medical Provider Network (MPN), which we argue serves no function other than to offer flimsy pretexts for refusing to pay providers.

As an example, Third-Party Administrator (TPA) AmTrust North America recently denied a bill by citing MPN non-membership despite the following facts:

- The provider is a member of the applicable MPN

- AmTrust authorized the treatment

- AmTrust designated the provider as the Primary Treating Physician (PTP)

- AmTrust paid this provider’s previous bills for treatment of the same injury

daisyCollect submitted a timely Second Review appeal to dispute the flagrantly invalid payment denial on the provider's behalf. Even given a second chance to get it right, AmTrust stuck by its absurd claims and denied the Second Review appeal.

To receive payment for a state-mandated progress visit, as an MPN provider who AmTrust approved as the designated PTP, this provider must pay $180 to request an Independent Bill Review (IBR).

Despite being plainly wrong, AmTrust apparently just clicked “deny” (without consequences), forcing a California provider to endure an expensive, time-consuming administrative nightmare simply to receive payment for treating an injured worker.

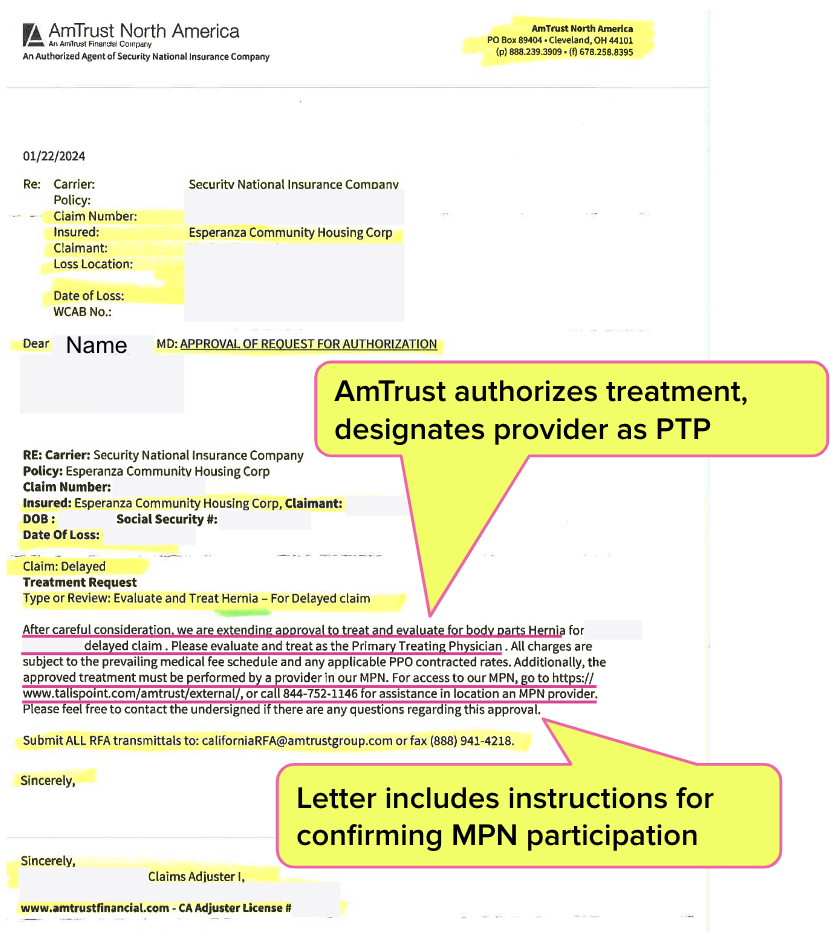

AmTrust Authorizes Care, Designates PTP

In the January 2024 letter below, AmTrust formally, “after careful consideration,” authorized the provider to “treat and evaluate” the injury “as the Primary Treating Physician.”

The letter notes explicitly that treatment must be within AmTrust’s MPN and includes the website URL where the provider can confirm their MPN participation.

As required by California Code of Regulations Section 9785(f)(8), this PTP evaluated the worker’s progress at least once every 45 days. Per the AmTrust approval letter, the provider evaluated the worker in February 2024, and AmTrust paid the bill without objection. AmTrust paid again when the same provider’s Physician Assistant treated the worker.

But when this PTP evaluated the worker for a third time, AmTrust had a realization that was as sudden as it was untrue: the provider was not an MPN member.

AmTrust Lists Provider in MPN, Denies Payment on MPN Grounds

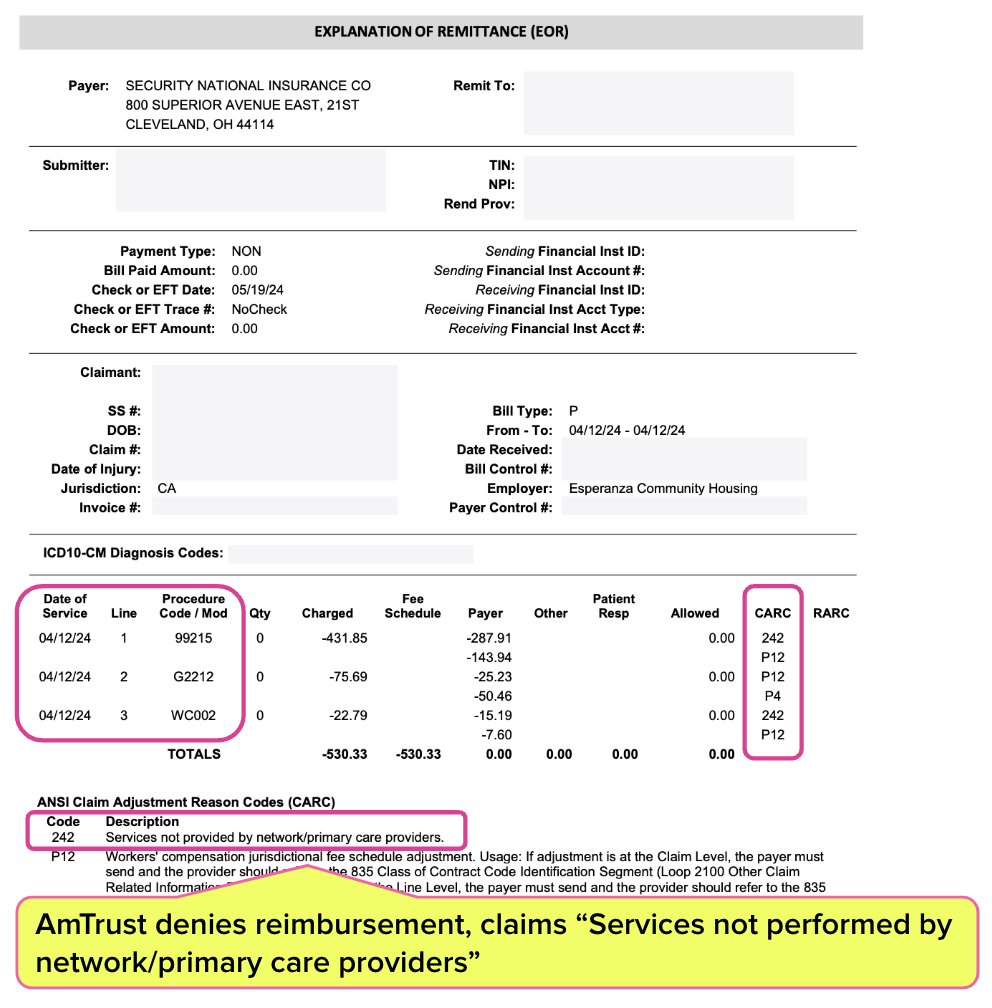

As the Explanation of Review (EOR) below shows, in April 2024, AmTrust denied payment for mandatory progress evaluation, citing “Services not performed by network/primary care providers.”

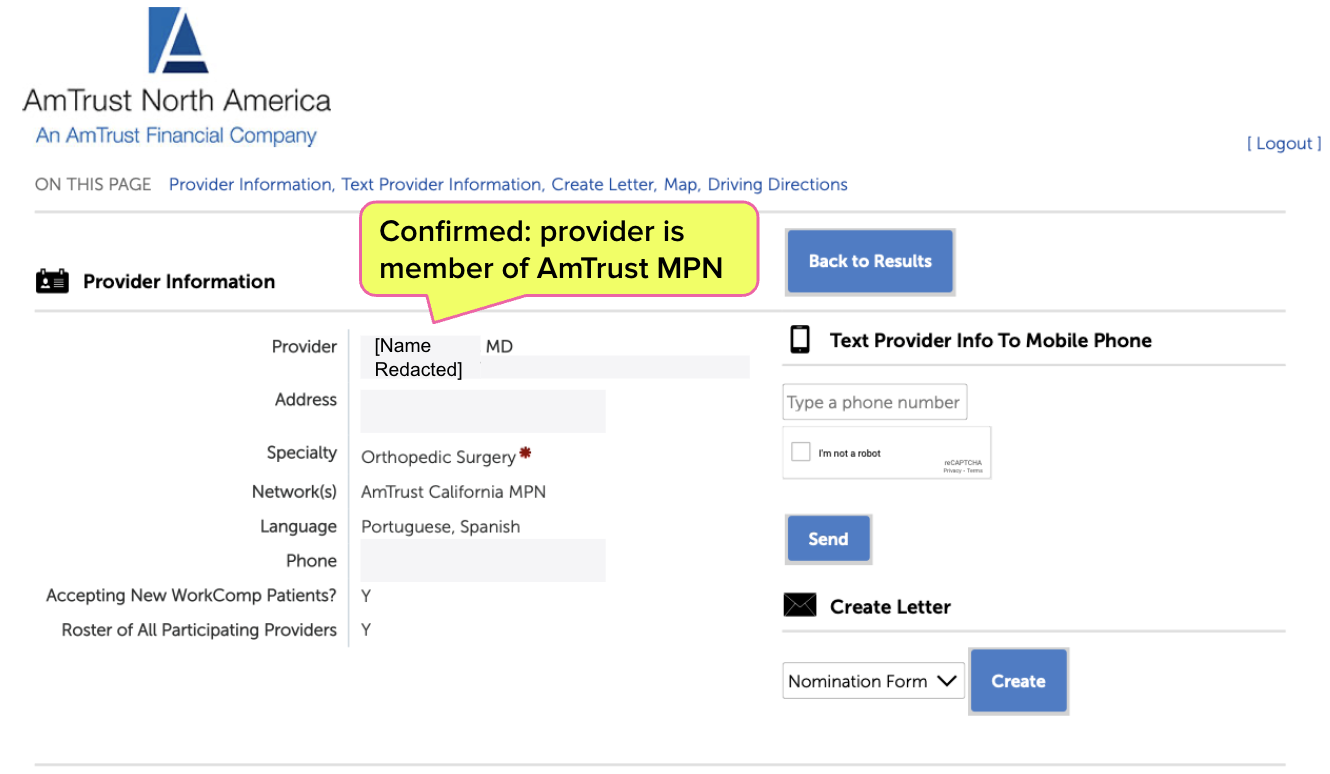

As it turns out, this bogus claim was easy to debunk. AmTrust was courteous enough to include a URL for its MPN provider roster in the authorization letter (...y’know, the one in which AmTrust designated the provider as the PTP and gave the green light for treatment).

A simple search of the provider’s name on the AmTrust MPN website reveals that the provider is listed in AmTrust’s MPN.

On behalf of the provider, daisyCollect submitted a timely, compliant, signed Second Review appeal to dispute the clearly, unquestionably inappropriate MPN-based denial. AmTrust denied payment again, falsely claiming again that the provider was not in the MPN.

With no other option, daisyCollect requested IBR from the state at an up-front cost of $180 (which AmTrust must supposedly replenish if/when IBR overturns this denial).

With the IBR application, daisyCollect included the AmTrust letter above, which establishes the provider’s status as the PTP and the treatment as authorized. This documentation should preclude the DWC from ruling the IBR is ineligible due to a “threshold loophole.”

Of course, we have little doubt that more time and resources will be required to chase after AmTrust—even after an IBR ‘Overturn’ decision—to collect the additional payment and the $180 IBR filing fee.

Unfortunately, AmTrust’s non-compliant payment denial is par for the course. We can only infer that claims administrators’ profits soar when they erect pointless roadblocks to reimbursement. If a provider makes the slightest error in attempting to navigate these roadblocks, there’s a good chance the DWC will intervene and ensure the claims administrator keeps the balance owed.

Are we still wondering why it’s more and more difficult to find providers willing to treat injured workers?

Workers’ comp billing takes specialized expertise. daisyCollect agents use advanced software (and unmatched experience) to protect your practice. Request a demo below:

REQUEST DEMO

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.png)

One of many boilerplate denials. Eeny meeny miny moe, ah, MPN; Let's toss it....

Thank you for the report. As you know, the majority of our client-partners are in our HCO program, and nearly all our filed MPNs are “deemed entities”….the same exclusive provider network as our HCO. I cannot recall an instance of a network provider being unpaid due to a claim they are not in the network. However, I’m an expert witness regarding HCOs and MPNs and have testified before 23 Boards. Listening to other cases before the judges, it amazes me how many MPN network/non-network issues I hear. I cannot understand how this occurs, possibly other than pure negligence, lack of attention to detail, or something intentional. We are working through stakeholder meetings with DWC, and hopefully some kind of remedy to this situation might be found.