SB 537 Reveals Murky World of Discount Contracts

In 2019, California passed Senate Bill 537. Among the changes to take effect on July 1st is a disclosure mandate requiring discount contracting entities to disclose to the claims administrator if contracted providers are reimbursed less than 80% of Official Medical Fee Schedule (OMFS) rates.

The law does not require disclosure of discounts less than 20% of OMFS rates.

Even more disturbingly, network discount contracting entities can require the claims administrator to sign a non-disclosure agreement, keeping the discount rates hidden.

This law exposes just how secretive the world of discount contracts really is, and the state’s tacit endorsement of keeping employers and insurers in the dark as to the amount paid to providers for treating injured workers.

Apparently, secrecy and opacity will continue to rule the day in California workers’ comp.

A New Labor Code

SB 537 adds a new Section to California’s Labor Code, §5307.12, effective July 1, 2021. It begins:

(a) If a health care provider or health facility, licensed pursuant to Section 1250 of the Health and Safety Code, and an entity that provides physician network services, as defined in subdivision (b) of Section 4616.5, or an entity that provides ancillary network services, as defined in subdivision (c) of Section 4616.5, contract for a reimbursement rate that is more than 20 percent below the official medical fee schedule, excluding goods and pharmaceuticals, the entity that provides physician or ancillary network services shall provide the payor with a written disclosure, on a form promulgated by the administrative director, of the reimbursement amount paid to the provider. [emphasis added]

Labor Code Section 4616.5 defines these network entities as:

- A medical network licensed by the Department of Insurance or Department of Managed Health Care, or

- A third-party claims adjusting organization licensed by the Department of Insurance or certified by the Office of Self-Insurance Plans, or

- A legal entity that offers medical management or physician network services within California.

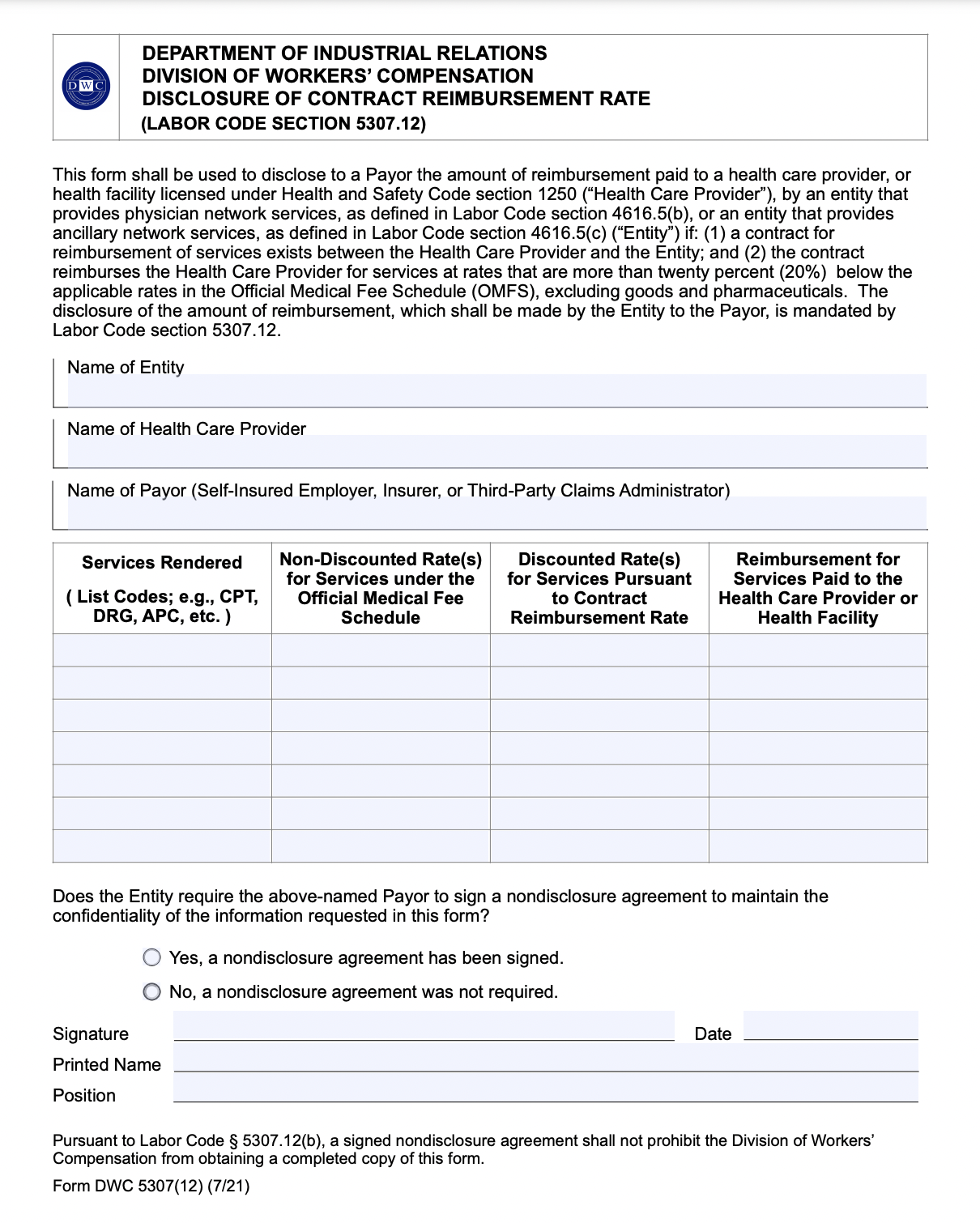

In plain English: Starting Thursday, network discount contracting entities must formally inform the employer or insurer if contracted providers are reimbursed less than 80% of Official Medical Fee Schedule (OMFS) rates, using the form pictured below.

And it gets far, far weirder.

In such cases — when the network must inform the claims administrator of exactly how much reimbursement the provider loses — the network can require the the claims administrator to keep the reimbursement rates a secret.

§5307.12 continues:

(b) Before providing the disclosure required pursuant to subdivision (a), the entity that provides physician or ancillary network services may require the payor to sign a nondisclosure agreement with the entity that provides physician or ancillary network services agreeing to maintain the confidentiality of the disclosed information. [emphasis added]

What’s Going On Here?

This legislation raises some very important questions:

-

Why the secrecy?

The new disclosure mandate implies that prior to July 1, 2021, employers and insurers were unaware of the amount of money paid for injured workers’ treatment. As of Thursday, discounts less than 20% of the OMFS will remain under wraps.

-

From whom does the discount contracting entity want to hide the true reimbursement rates?

Before providing the required DWC discount disclosure form, the discount contracting entity can require the claims administrator to sign an NDA. Who, then, would the claims administrator be unable to disclose the discount rates to? Other discount contracting entities? Other employers or insurers? Providers?

-

Why does the state empower discount contracting entities to decide when and how to apply the law?

Hypothetically, what if an employer or insurer refuses to sign the NDA presented by the discount contracting entity? Does that make the discount contracting entity exempt from the disclosure requirement?

Since when does a government make its own requirements subject to the requirements of the entity the government is regulating? Or is the government, in this case, simply forcing employers and insurers to keep discount rates secret on the contracting entity’s behalf?

-

Why would California require the disclosure of drastic reimbursement reductions to the claims administrator alone?

Aside from the provision discussed below, this rule does nothing to ensure that providers understand how much revenue they’re losing. It only widens the keyhole through which employers and insurers can peer into the shady realm of discount contracts.

- The most important question we’ve raised repeatedly: what happens to the percentage of OMFS reimbursements the provider doesn’t receive under these discount contracts? How are the spoils of these “discount” agreements divided?

SB 537 doesn’t offer many answers. Instead, this law strongly implies something we’ve long suspected: Network discount contracting entities want to hide the truth about payment arrangements. Now we know that these entities are hiding the truth from employers and insurers, as well as providers.

That should be cause for concern.

DaisyBill makes authorization, payment, and appeals faster, easier, better. Contact us to learn how DaisyBill can save your practice thousands in revenue for workers’ comp services.

LEARN MORE

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.