Audit Complaint: PacificComp Fails to Process e-Bills

In California workers’ comp, a provider’s failure to adhere to the billing regulations allows the payer to refuse payment for treatment of the injured worker. But all too often, these same payers see zero consequences for failing to properly accept and process providers’ bills in accordance with California laws and regulations.

Case in point: insurer Pacific Compensation Insurance Company (PacificComp).

For California workers’ comp payers, accepting electronic bills is not optional. Yet often, there are no consequences imposed on payers that flaunt workers’ compensation laws, regulations, and rules.

Below we demonstrate the apparent disregard exhibited by PacificComp in failing to ensure that it properly processed hundreds of e-bills submitted by California providers.

A Simple Requirement: CA Payers Must Accept e-Bills

California Labor Code Section 4603.4 mandates that all payers must accept compliant electronic bills for workers’ comp services. Inherent in that requirement is payers’ responsibility to take the steps necessary to fulfill the state-mandated technical requirements of receiving and processing providers’ e-bills.

To manage the regulatory details of accepting e-bills, most claims administrators turn to clearinghouse vendors. These vendors implement the necessary technology and know-how to accept e-bills from providers, provide the mandated receipts, pass the e-bills to the claims administrator, and ultimately facilitate the return of a compliant electronic Explanation of Review (EOR) to the provider.

Even though most claims administrators rely on clearinghouses, it is the claims administrator’s sole responsibility to ensure compliance — a fact of which PacificComp apparently needs reminding.

Non-Compliant e-Bill Rejections

In July, daisyBill noticed that PacificComp incorrectly rejected over 100 e-bills submitted by daisyBill providers. First, daisyBill contacted PacificComp, which verified that the claim information the provider reported in the e-bills was correct.

Next, daisyBill contacted PacificComp’s clearinghouse vendor, WCEDI, to determine the reason the vendor was incorrectly rejecting the bills.

WCEDI acknowledged that it was indeed incorrectly rejecting PacificComp e-bills. However, WCEDI reported that PacificComp was to blame for the rejections. According to WCEDI, “The bills failed because we [WCEDI] didn't have the claim data in our system from the payer [PacificComp] yet.”

Regardless of which entity is technically at fault (PacificComp or WCEDI), PacificComp is legally responsible for processing these e-bills. The question is: Will PacificComp be held responsible for failing to comply with California laws?

No Consequences, No Compliance

Remember, in California, if a provider files an appeal a single day late, the claims administrator can refuse to pay. Yet while payers can penalize providers for mistakes, California does not consistently penalize payers for their errors.

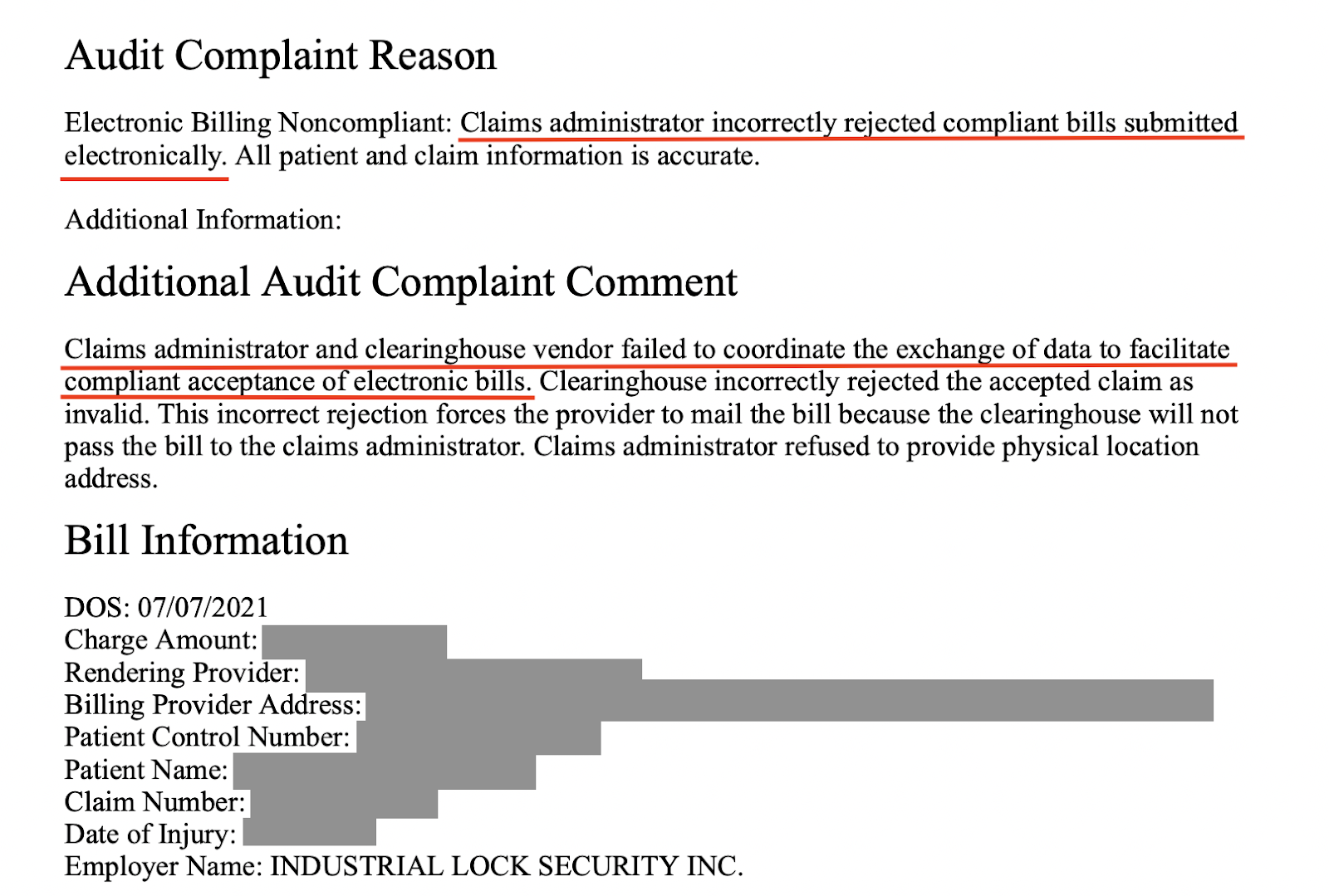

For our part, daisyBill filed an Audit Complaint against PacificComp, displayed in part below:

If a provider failed to properly or timely submit hundreds of e-bills, the consequence would be an automatic loss of revenue. Yet when the payer fails to follow California laws, regulations, and rules, the provider must take it upon themselves to file appeals and/or complaints — with no guarantee of any consequences for the payer.

Since we filed the Audit Complaint, PacificComp resolved the issues preventing e-bill processing. However, in the interest of fairness and accountability, we are calling for the imposition of equivalent penalties against claims administrators that fail to comply with state regulations.

Without enforcement, there are no rules.

Get paid in full and on time. With quick & easy tools for authorization, billing, and appeals, daisyBill helps protect your practice’s revenue. Reach out to learn more.

CONTACT dAISYBILL

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.