Santa Monica & Lien on Me Improperly Reimburse MDs

In California workers’ comp, claims administrators often suffer from a troubling payment syndrome we call “Fee Schedule Lag.”

The symptoms of Fee Schedule Lag are easily recognizable. Following an update to the Official Medical Fee Schedule (OMFS) that raises reimbursement rates for providers, the claims administrator inexplicably continues to pay providers the previous, lower rates.

Recently, the City of Santa Monica, a self-insured and self-administered claims administrator, exhibited all the classic symptoms of Fee Schedule Lag, failing to pay providers the increased Physician Fee Schedule effective for dates of service on or after April 1, 2024.

As discussed an absurd number of times in this space, there are no regulatory consequences when a claims administrator ignores California fee schedules—creating the perfect conditions for Fee Schedule Lag to spread unabated.

Santa Monica / Lien on Me Ignore Fee Increase

The California Division of Workers’ Compensation (DWC) increased reimbursements for physician services for dates of service on or after April 1, 2024. Yet despite the increase, Lien on Me, the bill review vendor used by the City of Santa Monica, continued to reimburse providers at the prior fee schedule rates.

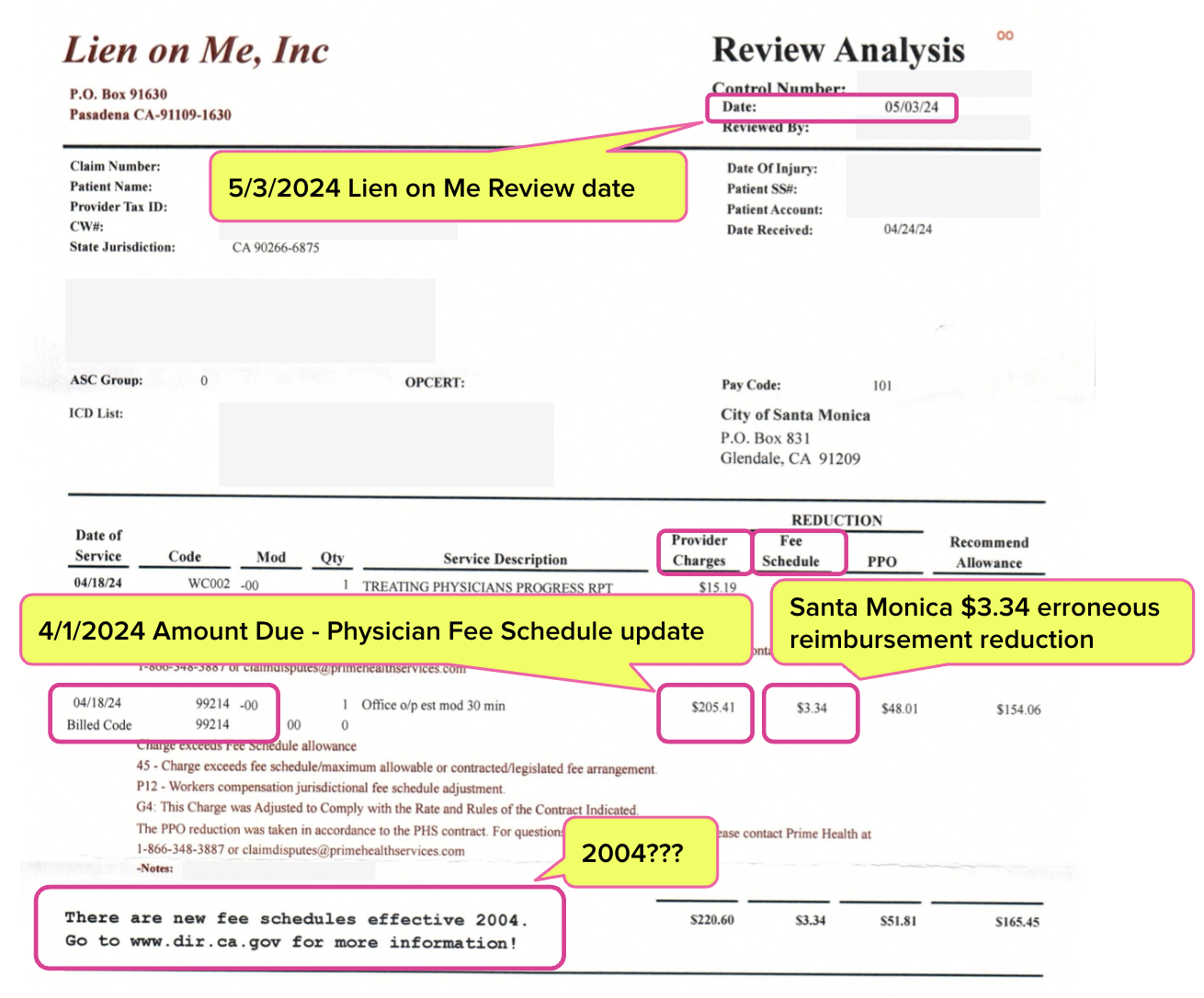

Below is an Explanation of Review (EOR) dated 5/3/2024 (over a month after rates increased) that Lien on Me sent to a provider on behalf of Santa Monica. The EOR reflects the lower pre-April-1 reimbursement rate for the common Evaluation and Management billing code 99214—despite the date of service being April 18, 2024.

The timeline of this particular flare-up of Fee Schedule Lag is as follows:

- 4/1/2024 - Physician Fee Schedule Increase becomes effective

- 4/18/2024 - Date of Service for the EOR below

- 5/3/2024 - Lien on Me Reviews bill on behalf of the City of Santa Monica

- 5/7/2024 - Santa Monica improperly reimburses the provider

As of 5/14/2024, daisyData from our providers shows that Santa Monica continues to pay incorrect amounts.

Lien on Me also displayed a less common symptom of Fee Schedule Update Lag: complete loss of any sense of irony. Despite the outdated reimbursement rates, the EOR helpfully reminds providers that “There are new fee schedules effective 2004.”

CA Incentivizes Underpayment

In effect, California law incentivizes fee schedule mistakes, and promotes the spread of Fee Schedule Lag through regulatory inaction.

If the provider fails to submit a timely Second Review appeal, the City of Santa Monica keeps the balance owed. And while the $3.34 balance owed in this case isn’t much, profits from consistent failure to pay updated rates across thousands of bills can add up to significant amounts.

It does not require any sort of vast conspiracy, or even a concentrated effort by claims administrators, to increase profits non-compliantly. All it takes is a state regulatory system that signals that abusing providers will not result in repercussions. What follows is inevitable.

Submit Second Review appeals in seconds with daisyBill. Request a free demonstration below.

REQUEST DEMO

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.