CHSWC Reports Use Questionable WCIRB Data

Employers are entitled to know precisely how their workers’ comp dollars are spent — which requires reliable, verifiable data.

Traditionally, California stakeholders have relied on the Commission on Health and Safety and Workers’ Compensation (CHSWC) annual reports for this essential workers' comp data.

However, CHSWC reports are highly suspect, because their conclusions are often based on data from the Workers’ Compensation Insurance Ratings Bureau (WCIRB), which openly acknowledges that its data are unverified and derived solely from information self-reported by the WCIRB’s insurer members.

Rather than using quality, verified, independent data to reach conclusions about how California employers’ workers’ comp dollars are spent, CHSWC uses this suspect WCIRB insurer data to furnish a picture of state-wide expenditures for all employers, even those that are self-insured — essentially making broad inferences based on narrow, questionable data.

Below, we explain why California employers and legislators cannot rely on CHSWC reports’ conclusions about workers’ comp costs.

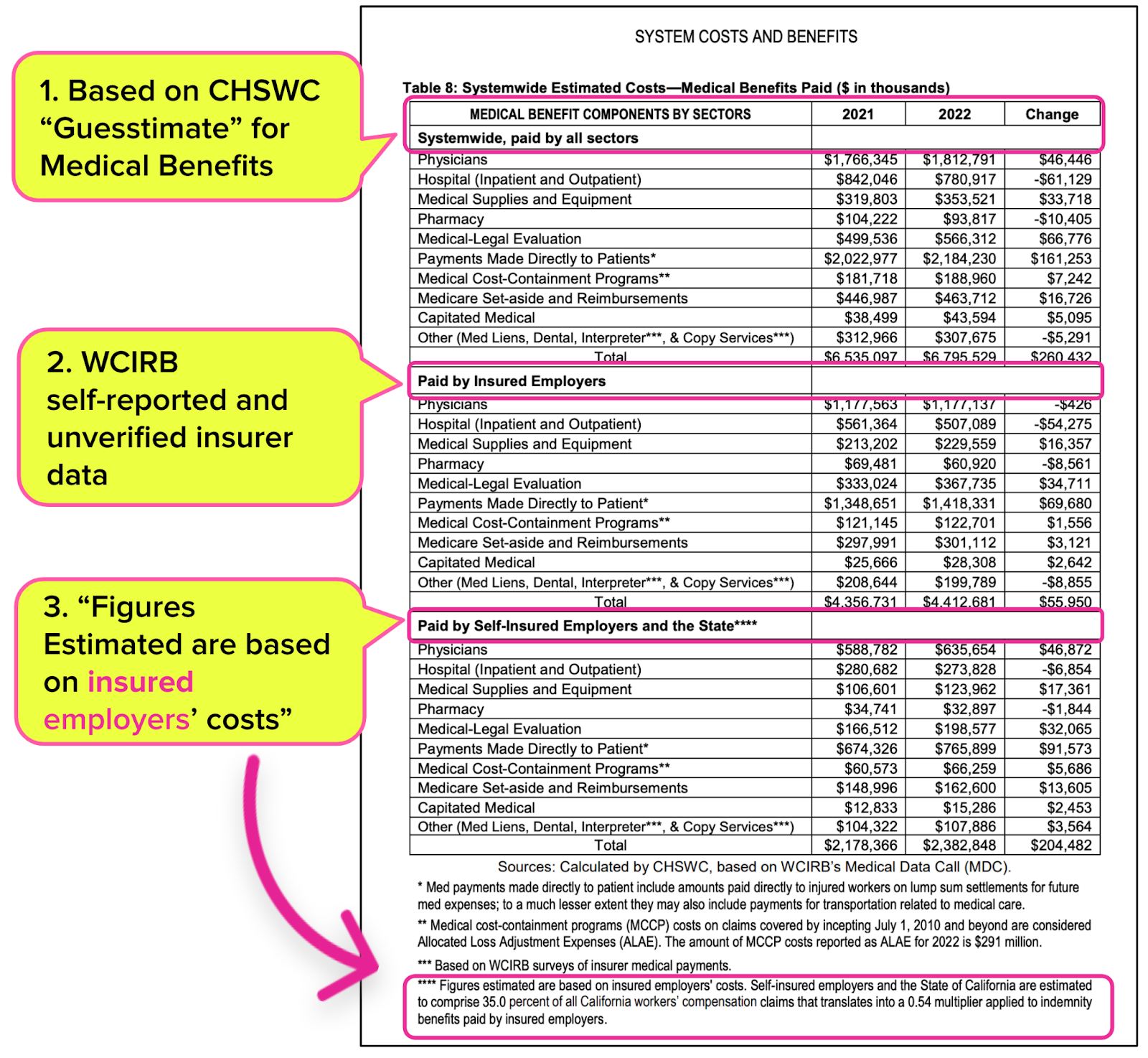

CHSWC Medical Costs: Guesstimates Extrapolated From WCIRB Data

CHSWC’s draft 2023 Annual Report heavily relies on WCIRB data to analyze workers’ comp medical costs and benefits paid in the entire state. For example, Table 8 of the CHSWC report (below) lists the 2021 and 2022 system costs and benefits in the following three categories:

- “Systemwide, paid by all sectors”

- “Paid by Insured Employers”

- “Paid by Self-Insured Employers and the State”

The problem is that the costs reported in Table 8 are based entirely on the (self-reported and unverified) insurer data from WCIRB members. The CHSWC report acknowledges using these WCIRB data as a basis for extrapolating medical costs and benefits paid “Systemwide” in “all sectors” and by “Self-Insured Employers and the State.”

Using WCIRB “data,” CHSWC calculates costs based on assumptions and educated guesswork. Table 8 footnotes outline CHSWC's formula to determine its best guesstimate of self-insured, state, and system-wide costs.

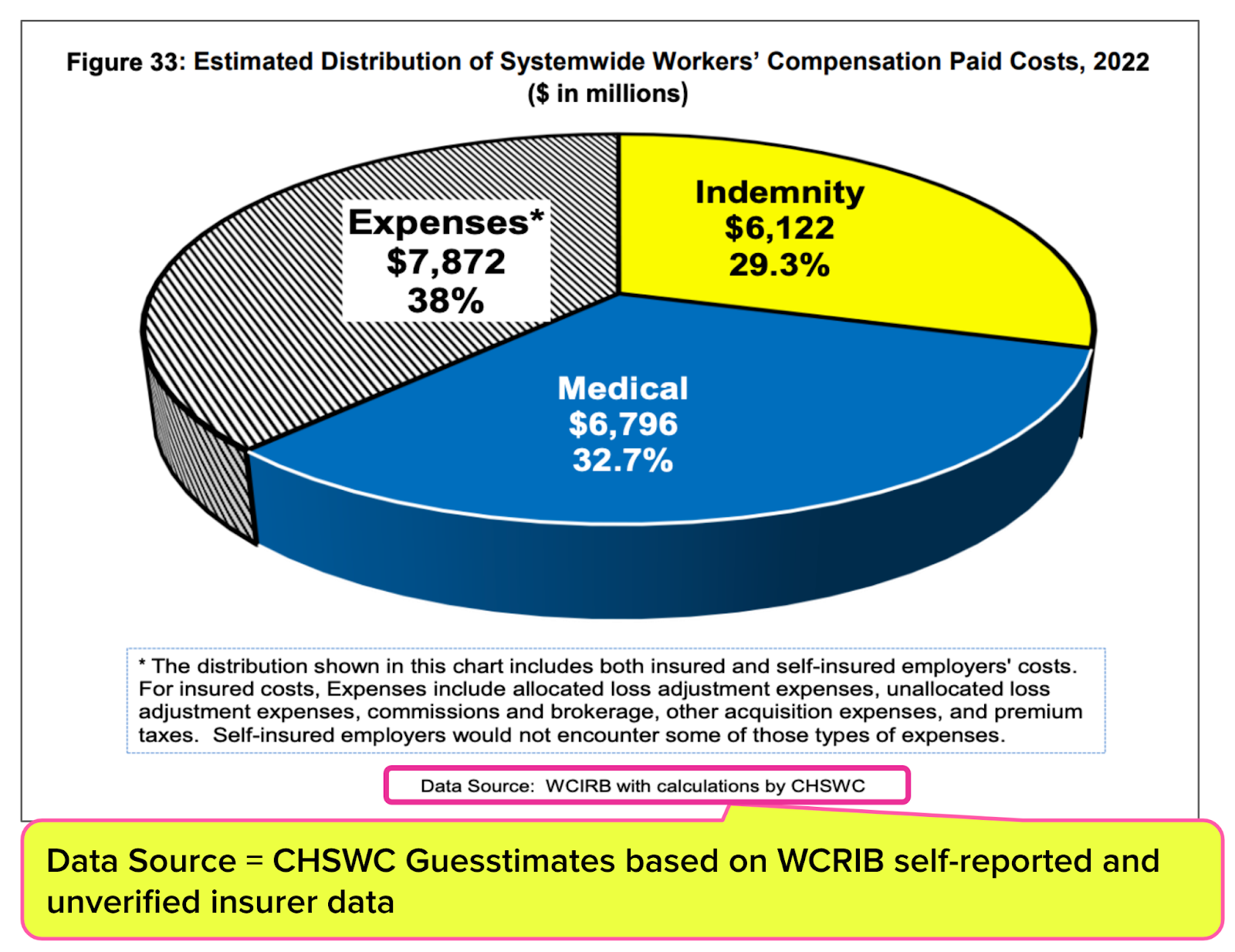

Estimated Distribution of Systemwide Work Comp Paid Costs

The CHSWC report also explores legal and administrative expenses as a percentage of workers’ comp costs. However, CHSWC again draws from (self-reported and unverified) WCIRB data pulled only from its insurer members.

CHSWC then — again — extrapolates the WCIRB numbers to furnish a portrait of the workers’ comp system as a whole, including self-insured employers (who cover 1 in 8 California employees) and state employees.

CHSWC acknowledges that its conclusions about the statewide system are limited to what CHSWC can deduce from WCIRB data, which WCIRB reports consistently disclose are:

- Exclusively from self-reporting WCIRB insurer members

- Unverified by the WCIRB or any independent party

The WCIRB is an insurer advocacy group with a significant stake in CHSWC recommendations. It is cause for concern that CHSWC simply parrots this organization’s figures and bases wide-ranging report conclusions on this data.

California employers deserve better than reports filled with guesswork based on inherently non-objective, questionable, limited data. To solve problems, California must diagnose those problems based on facts — not extrapolations, speculations, and incomplete analyses.

daisyBill makes treating injured workers easier, faster, and less costly. Request a free demonstration below.

REQUEST DEMO

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.gif)