Data: Fastest and Slowest Payers 2023

If you treat injured workers, there’s no need to wait weeks or months while snail-mailed bills clog up your practice’s Accounts Receivable.

Overall, 2023 data shows that daisyBill providers’ workers’ comp bills receive payment in less than nine working days on average. We are able to achieve such fast payment because our software sends over 92% of providers' bills electronically; the remaining bills are either faxed or emailed, with only 0.5% of bills mailed.

But of course, some payers (also known as claims administrators) pay more quickly than others.

Below, we reveal the ten insurers and Third-Party Administrators (TPAs) that delivered the most lighting-fast reimbursements in 2023 — and the ten that took their sweet old time.

Kudos! 2023 Top 10 Fastest-Paying Claims Admins

The tables below reflect claims administrators to which daisyBill providers sent at least 1,000 bills in 2023.

First place among our speediest payers is Pacific Compensation Insurance Company. On average, this fleet-footed insurer paid daisyBill providers in five business days. No one, with the possible exceptions of Amazon Prime and your nearest pizza joint, delivers the goods more quickly.

That said, even the slowest of the fastest payers remitted reimbursement in just over six working days on average.

These are laudable metrics. Every claims administrator in the table below deserves praise for making it easier for practices to treat injured workers by ensuring swift reimbursement.

Claims Admin |

Average Days to Payment |

Bill Count |

Pacific Compensation Insurance Company |

5 |

12,038 |

Sentry Insurance |

5.1 |

15,469 |

Employers Compensation Insurance Company |

5.5 |

14,268 |

Farmers Insurance |

5.7 |

8,736 |

Adminsure, Inc. |

5.9 |

17,852 |

Alaska National Insurance |

6.1 |

7,415 |

Gallagher Bassett Services Inc. |

6.1 |

128,209 |

Omaha National Group |

6.1 |

4,417 |

Liberty Mutual Insurance |

6.1 |

65,656 |

CompWest Insurance Company |

6.1 |

11,946 |

What’s the Holdup? 2023 Slowest-Paying Claims Admins

The bad news: the ten claims administrators below were the slowest to reimburse daisyBill providers in 2023.

The not-as-bad news: all but two of the ten slowest still managed to remit payment within one month, on average.

The slowest horse in this race was New York State Insurance Fund (NYSIF). Providers who billed NYSIF waited an unacceptable 65 working days on average for payment.

Affirmative, a TPA whose positive-sounding name belies its lethargic performance, was also over the two-month mark at 61.5 days — leaving us to wonder if it’s time to replace the decaf in Affirmative’s break room with something a little stronger.

The fastest of the 10 slowest was Packard Claims Administration, which managed to reimburse in 17.1 working days on average.

Claims Admin |

Average Days to Payment |

Bill Count |

Packard Claims Administration |

17.1 |

1,049 |

United Heartland |

17.5 |

1,891 |

Tristar Risk Management |

18.7 |

10,565 |

Pacific Claims Management |

19 |

3,571 |

Creative Risk Solutions |

22.3 |

1,080 |

County of San Bernardino (CA) |

25.2 |

1,526 |

Marriott Claims Service Corp |

26.5 |

2,463 |

Cottingham & Butler Claims Services, Inc. |

29.8 |

4,438 |

Affirmative |

61.5 |

4,297 |

New York State Insurance Fund |

65 |

1,386 |

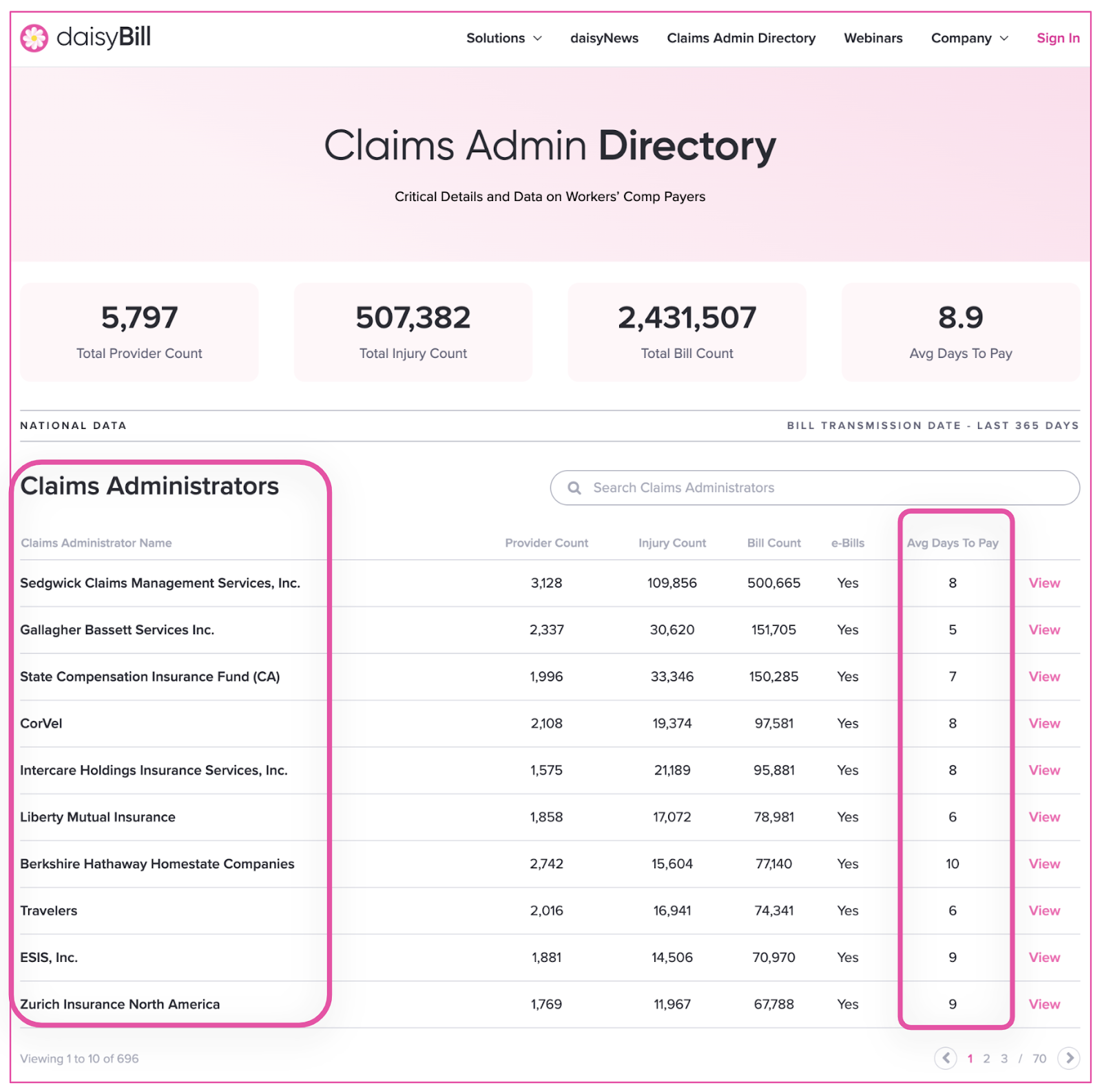

On our Claims Administrator Directory, daisyBill tracks and reports payment speeds and other metrics for all claims administrators in our system, on a rolling 365-day timeframe. Be sure to check the Directory for vital information including compliance rates, contact numbers and website, and vendor details.

These statistics are proof that workers’ comp e-billing can work smoothly when technology simplifies, streamlines, and speeds up billing and payment.

We make treating injured workers easier, faster, and less costly. Request a free demonstration below.

REQUEST DEMO

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.