Data: Workers' Comp Slowest Payers 2024

Workers’ compensation should be about healing and recovery.

Yet, administrative friction can shift the focus from treating injured workers to navigating the quagmire of delayed payments. For medical providers, this friction isn’t just an inconvenience—it’s a decisive factor in their decision not to treat injured workers.

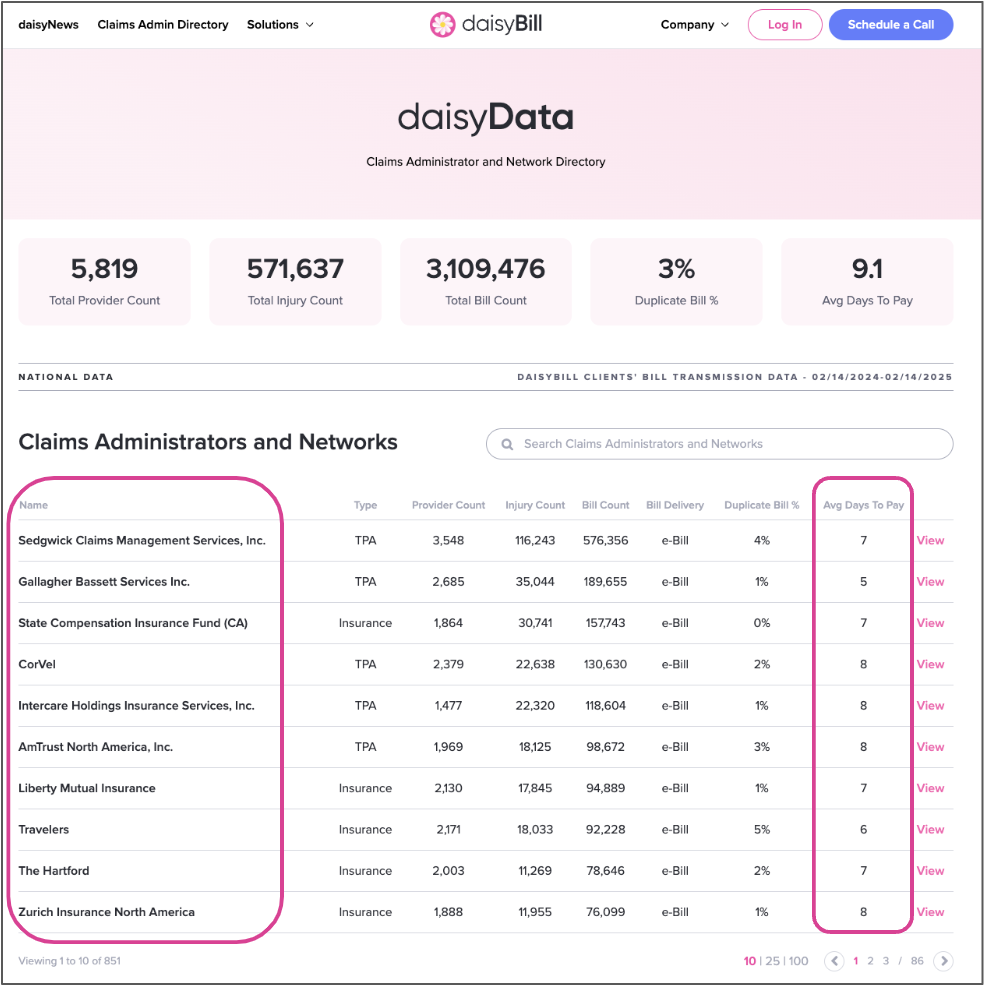

daisyData show that in 2024, the average bill payment time for our clients was 9.4 working days across all claims administrators. Of over 3 million bills daisyBill clients sent, our software submitted 91% electronically, leveraging our direct clearinghouse and claims administrator connections to accelerate payment times.

Gallagher Bassett led the pack in payment speed, paying in just 5.4 days on average. This rapid payment is excellent news for providers. However, the 9.4-day average is dragged down by repeat offenders who habitually delay payment to providers who treat injured workers.

Below, we reveal the 20 Slowest-Paying Claims Administrators of 2024 (aka payers, which includes insurers, Third-Party Administrators (TPAs), and self-insured employers).

The Drags on Workers’ Comp: 2024 Slowest-Paying Claims Admins

The 20 Slowest-Paying Claims Administrators of 2024 share a grim pattern: these insurers, TPAs, and self-insured employers consistently fail to meet the standards of an electronically integrated world.

At the very bottom? The New York City Law Department took an abysmal 37.2 days on average to pay providers. In an era of instantaneous digital transactions, such delays aren't just outdated. They’re inexcusable.

Of the slowest payers, a staggering 50% refuse to accept e-bills despite several states’ laws mandating electronic billing. For example, Affirmative (also known as Prime Administrators) took second place on the wall of shame, averaging 30.4 days to pay—a direct consequence of the TPA’s e-billing non-compliance.

On a brighter note, even among the slowest payers, the vast majority reimbursed providers in less than 30 working days. However, compared with their faster counterparts, these claims administrators lag behind the drastically improved standards that e-billing enables.

Claims Administrator |

Type |

Bill Delivery |

Average Days to Payment |

2024 Bill Count |

New York City Law Department |

Self-Insured Employer |

e-Bill |

37.2 |

1,788 |

Affirmative |

Third-Party Administrator |

30.4 |

19,359 |

|

Subsequent Injuries Benefits Trust Fund (CA) |

Insurance Company |

29.8 |

1,565 |

|

Anne Arundel County Risk Management (MD) |

Self-Insured Employer |

Fax |

29.1 |

1,237 |

County of San Bernardino (CA)* |

Self-Insured Employer |

Fax |

28.9 |

3,408 |

Cottingham & Butler Claims Services, Inc. |

Third-Party Administrator |

e-Bill |

26.2 |

8,398 |

State of Florida Division of Risk Management |

Self-Insured Employer |

24.6 |

1,201 |

|

ClaimQuest, Inc. |

Third-Party Administrator |

20.8 |

1,748 |

|

New York State Insurance Fund |

Insurance Company |

e-Bill |

19.2 |

4,434 |

Marriott Claims Service Corp |

Self-Insured Employer |

e-Bill |

19.1 |

7,158 |

Chesapeake Employers Insurance (Maryland) |

Insurance Company |

e-Bill |

18.7 |

2,713 |

California Insurance Guarantee Association |

Insurance Company |

e-Bill |

18.2 |

5,085 |

Brentwood Services Administrators, Inc. |

Third-Party Administrator |

e-Bill |

17.9 |

2,346 |

Risico Claims Management, Inc. |

Third-Party Administrator |

Fax |

17.8 |

3,164 |

Finish Line Self Insurance Group, Inc |

Self Insurance Group |

Fax |

17.7 |

1,001 |

Texas Mutual Insurance |

Insurance Company |

e-Bill |

17.6 |

2,695 |

WCF Insurance |

Insurance Company |

e-Bill |

17.3 |

3,873 |

City of Los Angeles Department of Water and Power (CA) |

Self-Insured Employer |

e-Bill |

16.7 |

2,455 |

biBERK* |

Insurance Company |

Fax |

16.7 |

2,418 |

Tribal First |

Third-Party Administrator |

16.3 |

2,252 |

*County of San Bernardino (CA) and biBERK now accept e-bills; for most of 2024, daisyBill delivered County of San Bernardino (CA) and biBERK bills via fax.

The good news is that the slow payment statistics in this article do not reflect the system overall. Claims administrators who pay our providers in more than 9 or 10 days on average are outliers.

daisyBill Keeps Score: Claims Administrator & Network Directory

As we remind readers, our Claims Administrator and Network Directory publicly tracks payment speeds and compliance data for all the claims administrators in our system.

These data are free, publicly available, and verifiable for any interested party. In an industry in which payer-derived data dominate analyses, we provide our daisyData as a counterpoint to the narratives that distract from the problem of slow payment and ineptitude among claims administrators.

All providers or third-party billers are welcome to access the Directory for vital information, including compliance rates, contact information, web portals, and vendor details.

For practices using reliable, workers' comp-specific e-billing technology, the administrative pain of workers’ comp is essentially negligible. The days of having to choose between treating injured workers and maintaining a financially stable practice are, for the most part, over.

We will continue to gather and publish daisyData to reward compliant, forward-thinking claims administrators—and hold those who bottleneck the system accountable.

We make treating injured workers easier, faster, and less costly. Book a brief chat with our experts to learn how.

SCHEDULE A CALL

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.gif)