WCIRB: By Insurers, For Insurers

.gif)

The Workers’ Compensation Insurance Ratings Bureau (WCIRB) is one of the most influential organizations guiding the decisions of legislators, regulators, and other stakeholders in California workers’ comp.

But there’s one enormous problem: the WCIRB represents the insurers.

WCIRB data are routinely cited to inform conclusions and make recommendations that affect the entire workers’ comp system. Policies justified by WCIRB data impact injured workers, providers, and employers. However, the WCIRB openly acknowledges that its data are unverified and self-reported by its insurer members.

From its leadership to its membership to the disclosures in its reports, the WCIRB couldn’t wave its red flags any harder. Far from conducting dispassionate research for the benefit of all stakeholders, the WCIRB simply reports whatever data insurers are willing to share with policymakers.

WCIRB Leadership

The WCIRB is perhaps best characterized by Workers’ Comp Executive, which consistently describes the WCIRB as:

“...supported exclusively by insurance carriers in whose interests it operates.”

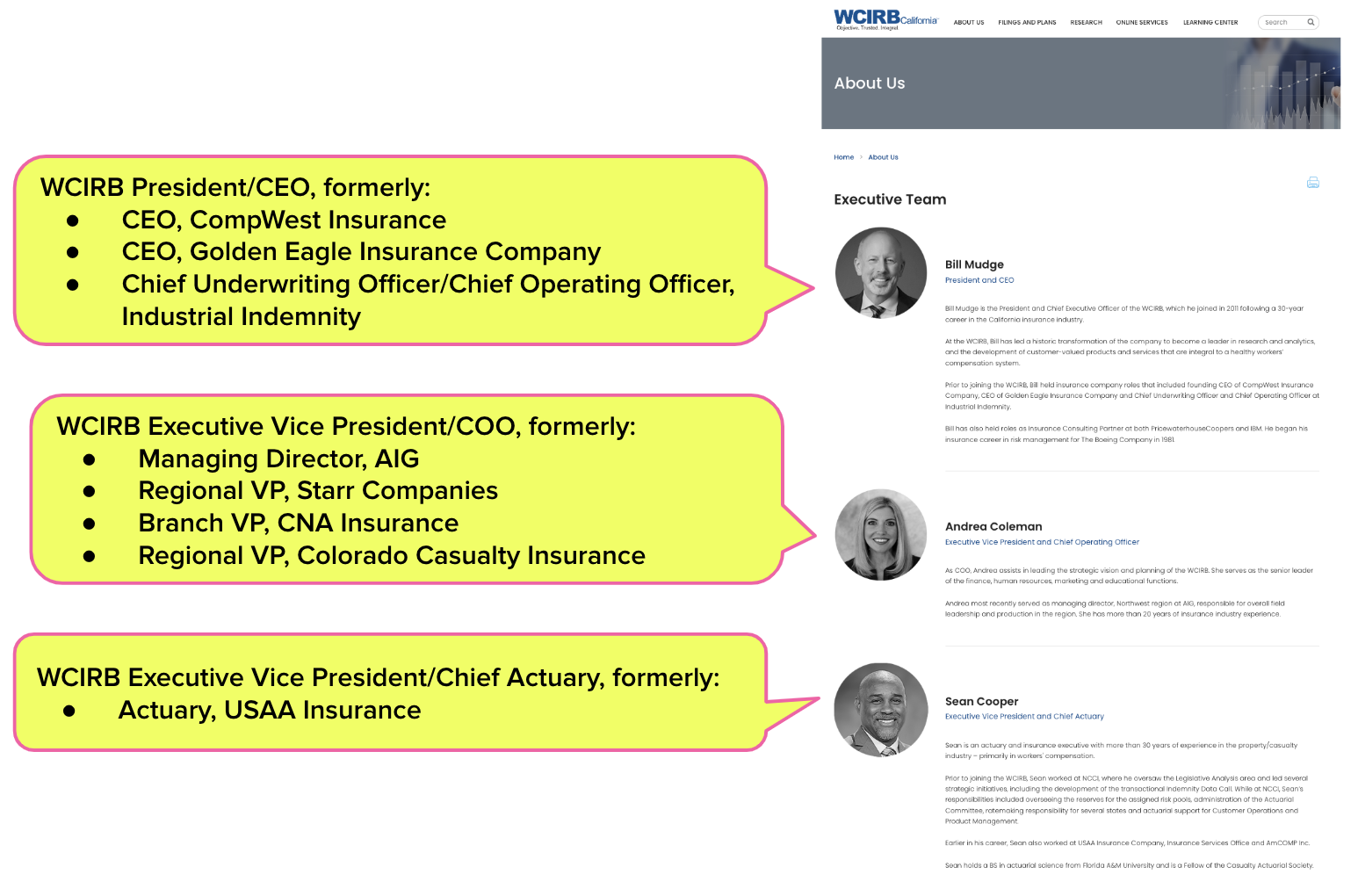

A look at the WCIRB Executive Team offers the first clues as to the organization’s interests. According to the WCIRB’s Executive Team page and its members’ LinkedIn pages, three out of the five members are former insurance executives (the other two handle legal and customer service).

Bill Mudge, the WCIRB’s current President and CEO, previously led CompWest Insurance and Golden Eagle Insurance before joining the WCIRB.

Is it possible that former insurance executives can face the challenges of workers’ comp objectively and lead with as much interest in the outcomes for injured workers, providers, and employers as they do for insurance companies? Sure. But what does the makeup of this Executive Team suggest about the WCIRB’s priorities?

No former medical providers or medical provider organization members, no one from labor, and no one representing self-insured employers wield power at the executive level of the WCIRB.

WCIRB Temporary Committees

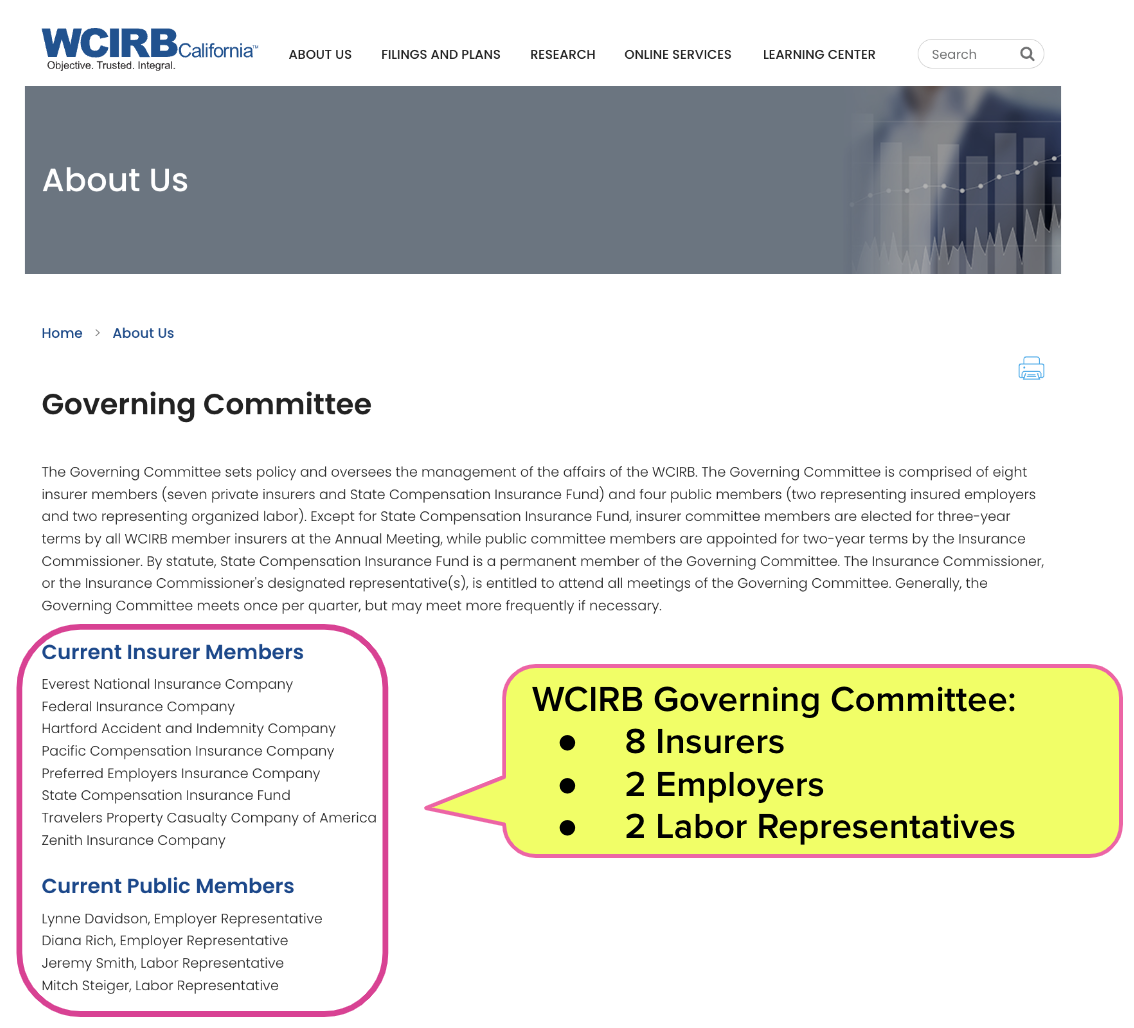

The WCIRB's member list is no longer accessible from the organization’s public website. However, the website still lists the members of its current Governing Committee, which comprises representatives of:

- Eight insurers

- Two employers (Tito’s Tacos and Foundation Building Materials)

- Two labor organizations

- Zero healthcare provider groups

The eight insurers are elected by “all WCIRB member insurers,” while the labor and employer representatives are appointed by the “Insurance Commissioner” for two-year terms.

We cannot say how much substantive input comes from those temporarily appointed to the WCIRB Governing Committee. However, we know precisely how much input the WCIRB gets from the providers who fulfill the mission of workers' comp by rendering treatment to injured workers: none whatsoever.

Disclosures: WCIRB “Can Make No Warranty”

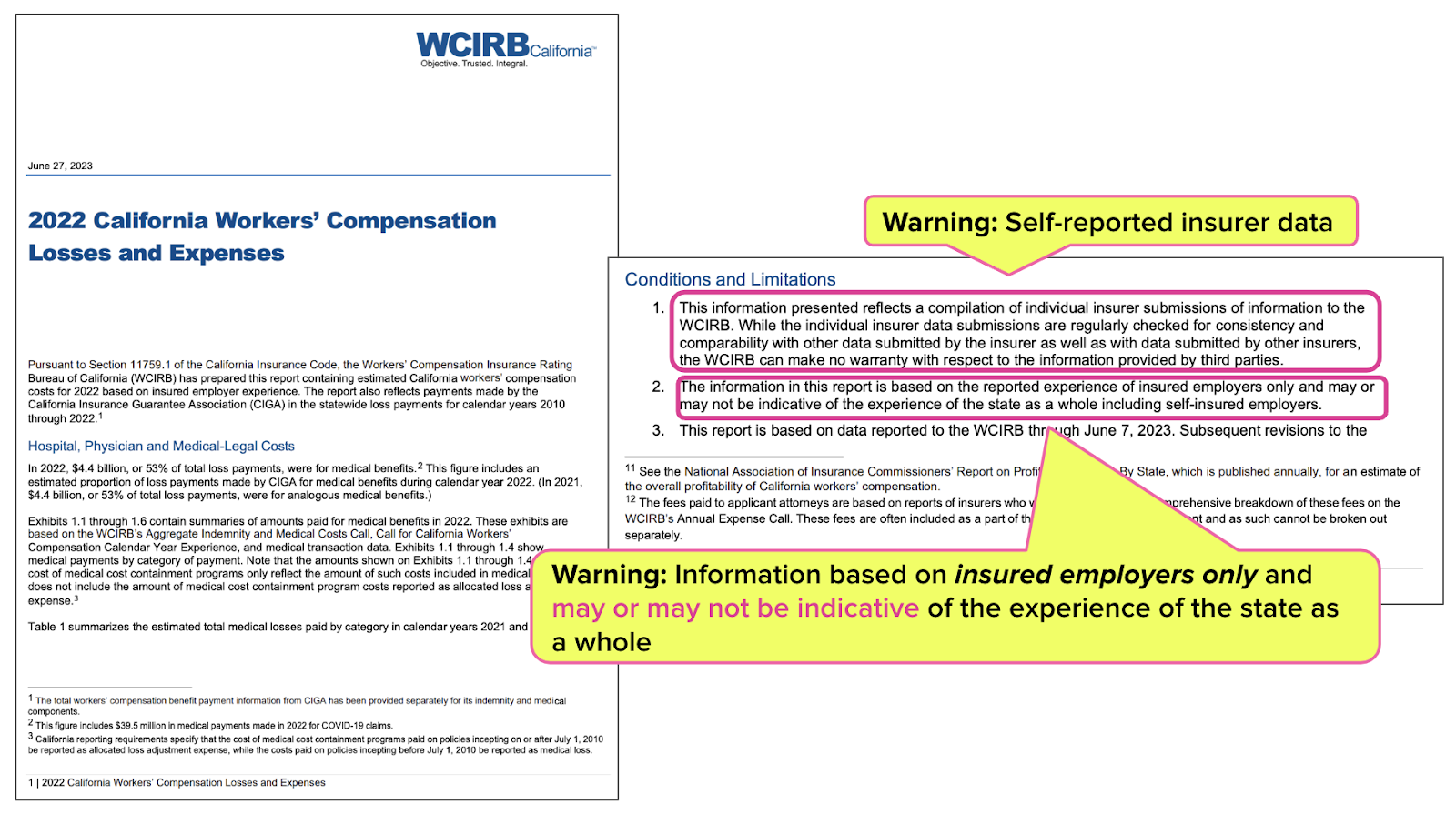

Almost invariably, WCIRB-published materials and reports include three disclosures (emphases ours):

-

The data are self-reported by insurers: WCIRB reports note that “This information presented reflects a compilation of individual insurer submissions of information to the WCIRB,”

-

The data are unverified: “...the WCIRB can make no warranty with respect to the information provided by third parties [i.e., self-reporting insurers],”

- The data have questionable applicability: WCIRB reports note that “...the information in this report is based on the reported experience of insured employers only and may or may not be indicative of the experience of the state as a whole including self-insured employers.”

In other words, the WCIRB feels compelled to state the obvious: WCIRB data are solely from insurers, haven’t been checked out, and have limited value in providing an accurate picture of the statewide workers’ comp system.

Below are two examples of these disclosures. The first is from the WCIRB’s 2022 California Workers’ Compensation Losses and Expenses report.

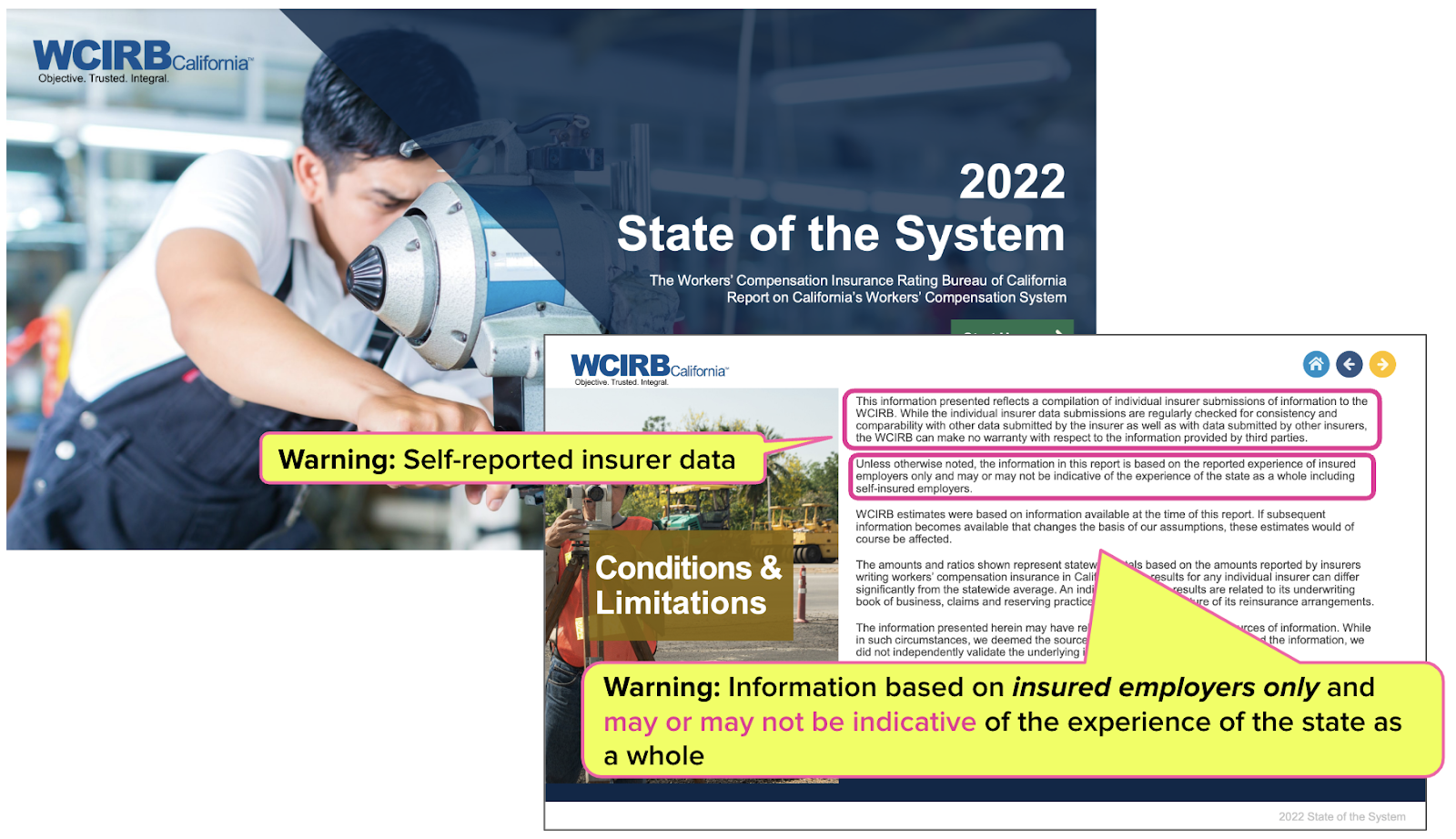

Next, the WCIRB’s 2022 State of the System report.

The reports above and several other WCIRB sources are cited in the Commission on Health and Safety and Workers’ Compensation (CHSWC) draft 2023 Annual Report, a guiding document for state workers’ comp policymakers.

“Supported exclusively by insurance carriers in whose interests it operates.”

In 2022, the WCIRB’s California Workers’ Compensation Aggregate Medical Payment Trends made waves by decrying a sharp increase in medical costs. As we pointed out then, the WCIRB was sure to note that its data were “not verified” — a more direct way of stating that the WCIRB “can make no warranty” regarding the data’s accuracy.

If the WCIRB “can make no warranty concerning” the data in its reports, California legislators and regulators should seek more complete, objective, and useful data to diagnose and address the challenges of its ailing workers’ comp system.

Each time a state authority parrots WCIRB insurance “data,” it should be accompanied by a footnote (and alarm bells) reminding all concerned that the WCIRB is “...supported exclusively by insurance carriers in whose interests it operates.”

daisyBill makes treating injured workers easier, faster, and less costly. Request a free demonstration below.

REQUEST DEMO

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.png)

Has daisyBill, or any other organization reached out to WCIRB to offer input for the medical providers? If so, what was their response?