Data: Workers' Comp Fastest Payers 2024

No provider who treats injured workers should wait months for payment. And yet, payment delays plague the system—except where efficiency and technological competence reign.

The numbers don’t lie. daisyData reveals that in 2024 claims administrators paid our provider clients’ 3 million workers’ comp bills in an astonishing 9.4 working days on average. That’s not luck—that is the power of e-billing.

The secret sauce of this staggering speed is that daisyBill submitted 91% of all bills electronically as e-bills. This is possible due to our proprietary direct electronic connections with all the workers’ comp clearinghouses (and the Department of Labor and CorVel, which do not use a clearinghouse).

Below, we unveil the Top 20 Fastest-Paying Claims Administrators of 2024 (aka payers, which includes insurers, Third-Party Administrators (TPAs), and self-insured employers).

Stay tuned; we will also expose the payers who were the slowest to reimburse providers in 2024

The Champions: 2024 Top 20 Fastest-Paying Claims Admins

The table below reflects the claims administrators (excluding network payers) who processed at least 1,000 medical treatment bills in 2024.

The gold medal goes to Gallagher Bassett Services, Inc. This TPA delivered payment in an average of 5.4 days, which is even more impressive considering that it is the second-largest claims administrator in our system by bill volume, processing almost 178,000 bills in 2024.

Two claims administrators tied for silver: Midwestern Insurance Alliance and Hanover Insurance Company. Both had an average payment time of 5.7 days.

All payers listed below deserve congratulations for making it easier for providers to treat injured workers in 2024. On average, every claims administrator in the table below paid our providers in under a week, clearly showing how administratively and financially sustainable treating injured workers can be for providers.

Claims Administrator |

Type |

Bill Delivery |

Average Days to Payment |

2024 Bill Count |

Gallagher Bassett Services Inc. |

Third-Party Administrator |

e-Bill |

5.4 |

177,981 |

Midwestern Insurance Alliance |

Insurance Company |

e-Bill |

5.7 |

1,297 |

Hanover Insurance Company |

Insurance Company |

e-Bill |

5.7 |

4,098 |

JT2 Integrated Resources |

Third-Party Administrator |

e-Bill |

6.2 |

1,799 |

Employers Compensation Insurance Company |

Insurance Company |

e-Bill |

6.2 |

24,192 |

Sentry Insurance |

Insurance Company |

e-Bill |

6.4 |

21,221 |

Salus |

Third-Party Administrator |

e-Bill |

6.5 |

3,386 |

Self-Insured Schools of California (CA) |

Joint Power Authority |

e-Bill |

6.6 |

6,568 |

Beta Healthcare Group Risk Management Authority |

Joint Power Authority |

e-Bill |

6.6 |

6,277 |

Adminsure, Inc. |

Third-Party Administrator |

e-Bill |

6.6 |

21,848 |

National Liability and Fire Insurance Company |

Insurance Company |

e-Bill |

6.6 |

1,587 |

The Walt Disney Company |

Self-Insured Employer |

e-Bill |

6.7 |

1,934 |

Farmers Insurance |

Insurance Company |

e-Bill |

6.8 |

11,118 |

Schools Insurance Authority (CA) |

Joint Power Authority |

e-Bill |

6.8 |

1,665 |

Omaha National Group |

Insurance Company |

e-Bill |

6.8 |

8,325 |

City of Los Angeles (CA) |

Self-Insured Employer |

e-Bill |

6.8 |

10,535 |

Markel First Comp Insurance |

Insurance Company |

e-Bill |

6.9 |

3,895 |

Travelers |

Insurance Company |

e-Bill |

6.9 |

82,939 |

County of Santa Clara (CA) |

Self-Insured Employer |

e-Bill |

6.9 |

5,457 |

National Casualty Company |

Insurance Company |

e-Bill |

6.9 |

2,457 |

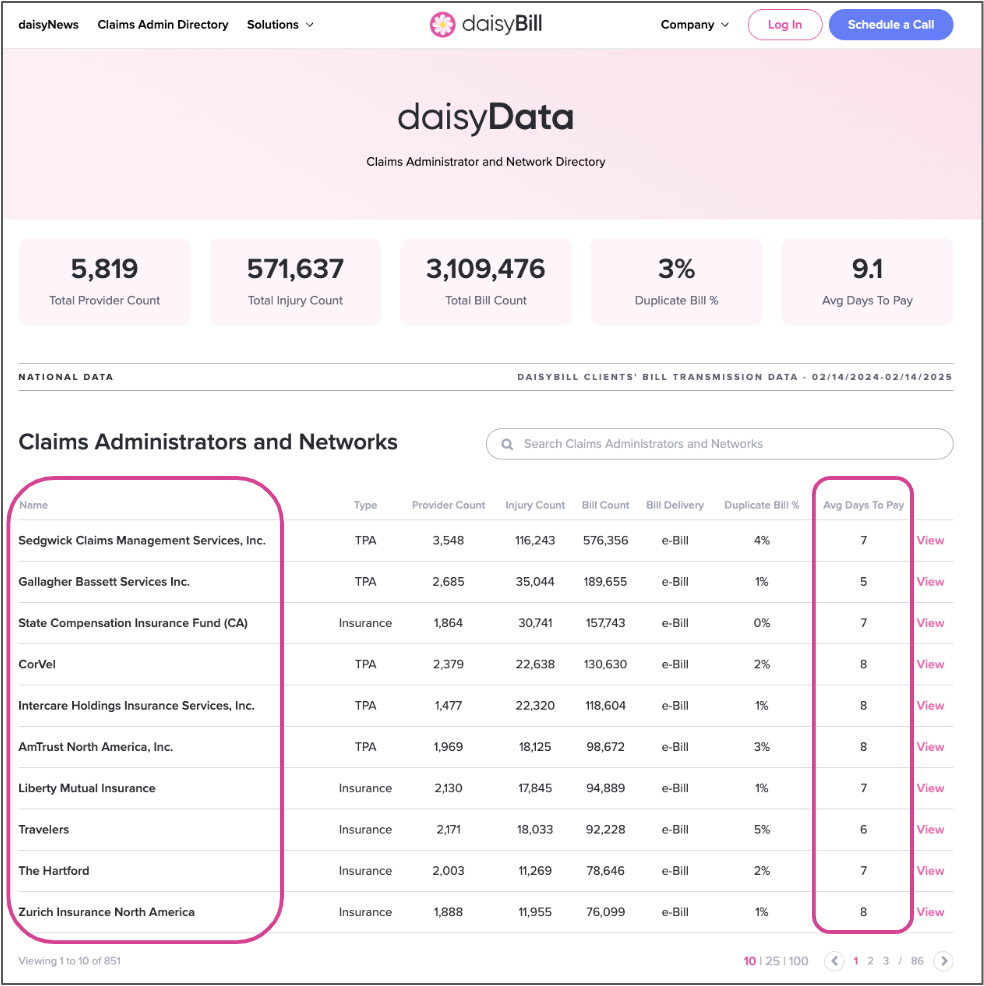

Claims Administrator and Network Directory

On our Claims Administrator and Network Directory, daisyBill tracks and reports payment speeds and compliance data for all the claims administrators in our system on a rolling 365-day timeframe.

Check the Directory for vital information, including compliance rates, contact information, web portals, and vendor details. This resource is free for any provider who wishes to use it—client or not.

daisyData proves that the billing and payment friction that historically characterizes workers’ compensation can and should be eliminated.

When payers prioritize efficiency, providers are empowered to accept more injured workers, ensuring better access to care. But let’s be clear—this only works when payers step up. The companies above have set the gold standard.

As for those dragging their feet? We’ll be naming names soon. Stay tuned.

We make treating injured workers easier, faster, and less costly. Book a brief chat with our experts to learn how.

SCHEDULE A CALL

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.gif)