New! Networks Listed in Workers' Comp Directory

Since 2022, daisyBill has offered free public access to our Claims Administrator Directory, where providers and administrative staff can find critical information on insurers, self-insured employers, and Third-Party Administrators (TPAs).

You can now find details on another entity type in the Directory: Networks.

While networks (or “Network Payers,” as we sometimes refer to them) are not claims administrators, providers submit hundreds of thousands of bills directly to these middle-person entities annually. The network then sends providers’ bills to the claims administrator and pays the provider a portion (often significantly reduced) of the reimbursement owed.

Networks are not subject to equivalent state payment regulations as claims administrators, such as timely payment or compliance with electronic billing rules. Instead, providers enter into contractual agreements with networks, often sacrificing regulatory payment protections.

The network data now available in the Directory demonstrates that workers’ comp providers fare much worse when dealing with network payers.

Networks: Slower Payment

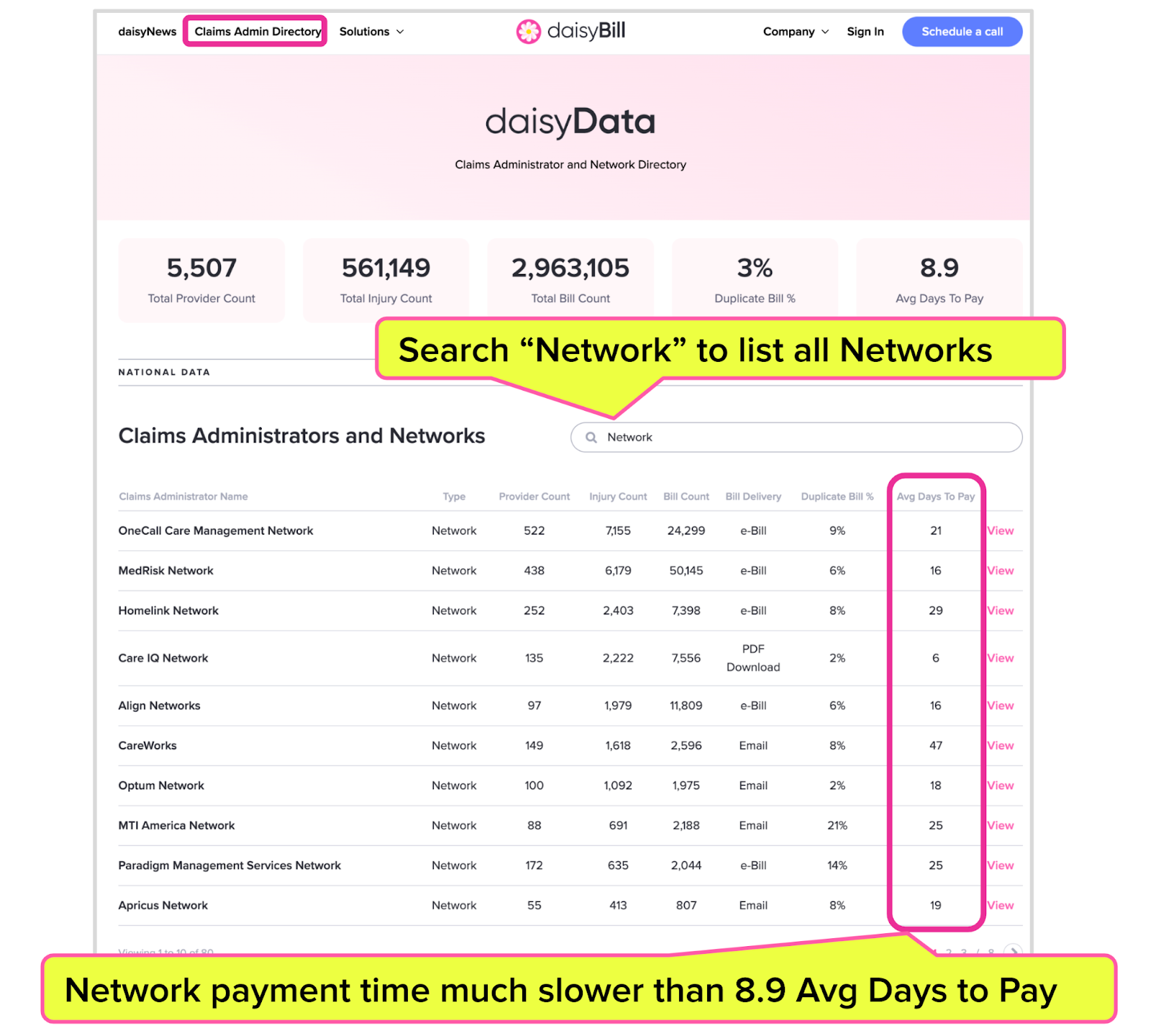

Below is a screenshot from the updated Claims Administrator and Network Directory demonstrating how entering “Network” in the search bar will provide a list of all the networks in our system. The first page of results displays the top ten networks as measured by the count of bills sent by daisyBill providers.

Note the “Avg Days to Pay” for each of these networks. Networks often pay providers much more slowly than claims administrators.

All ten networks below, except Care IQ Networks, take much longer to reimburse providers than the 8.9-day average days to pay across all claims administrators and networks in our system. CareWorks, on average, takes an abysmal 47 days to reimburse its network providers—over five times as long as the overall 8.9-day average.

Networks Make Workers’ Comp More Difficult for Providers

Unfortunately, some networks perform dismally in their efforts (or lack thereof) to pay providers without unnecessary administrative hassle.

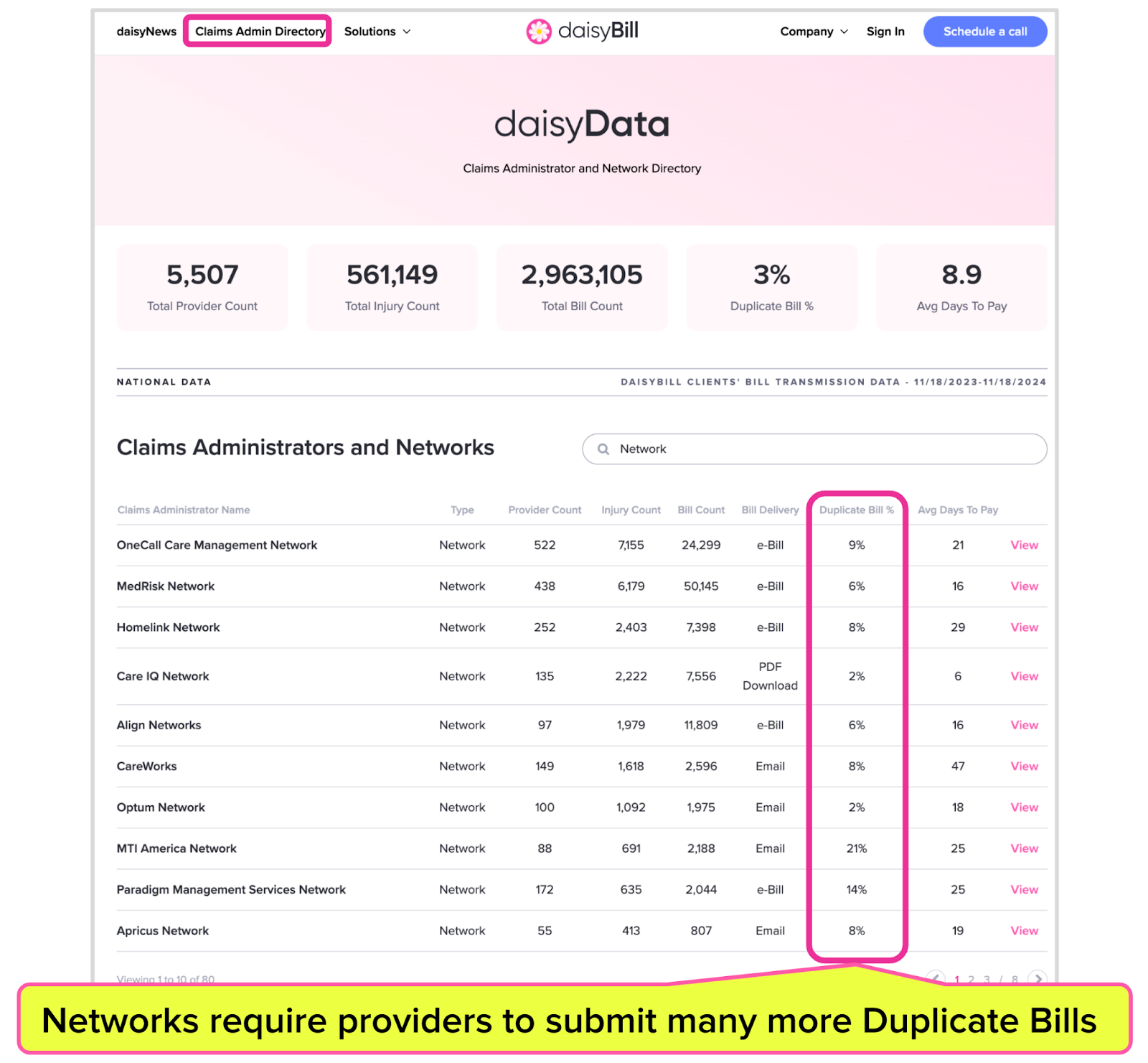

For example, bills submitted to networks rather than claims administrators are more likely to need resubmission as duplicate bills for the provider receive payment.

On average, providers must resubmit 3% of bills submitted to our system's claims administrators and networks. Below, the “Duplicate Bill %” is circled for each of the top ten networks; for all of these networks except Care IQ Networks and Optum Networks, providers were forced to resubmit a higher-than-average percentage of duplicate bills.

For MTI America, providers had to resubmit a disgraceful 21% of bills (and daisyData shows it takes MTI America an average of 25 days to reimburse providers).

Because networks are not claims administrators, and pay providers according to contractual network agreements rather than state laws and regulations, they have no legal obligation to make billing and payment easy for providers—which may explain the ugly payment data.

All providers, daisyBill clients or not, are welcome to use the Claims Administrator and Network Directory. By sharing this network information and data, we aim to help providers and empower them to demand better.

“Average Days to Pay based on bills submitted through daisyBill-verified submission routes, from the previous 365 days of available data and excluding liened claims and other statistical outliers.

Protect your practice. Harness the power of daisyBill software, data, and expertise for faster, better workers’ comp billing. Reach out to learn how we can help.

CONTACT US

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

![Texas: How to Register to Treat Injured Workers [2024 Checklist]](https://kb.daisybill.com/rails/active_storage/blobs/proxy/eyJfcmFpbHMiOnsibWVzc2FnZSI6IkJBaHBBenNGTXc9PSIsImV4cCI6bnVsbCwicHVyIjoiYmxvYl9pZCJ9fQ==--313c5188f4d896eac60be4a26eaf4b4f7ae1bf88/TX-doc-symbols.gif)

This is a very awesome resource to have, especially with the introduction of these pesky networks, particulary Apricus, they just hord payments for ever