CA: Alert - IBR Filing Fee to Increase in 2025

Pursuing correct payment for treating injured workers is about to get even more expensive for California providers.

When a claims administrator incorrectly denies or reduces payment and refuses to pay correctly in response to the provider’s Second Review appeal, the provider’s next step is to request Independent Bill Review (IBR) from Maximus.

Maximus is a private entity to which the California Division of Workers’ Compensation (CA DWC) outsources IBR decisions. To submit the IBR request, the provider must pay Maximus a (currently) $180 filing fee.

However, according to an email from Maximus to daisyBill, the IBR filing fee will increase to $195, effective January 1, 2025.

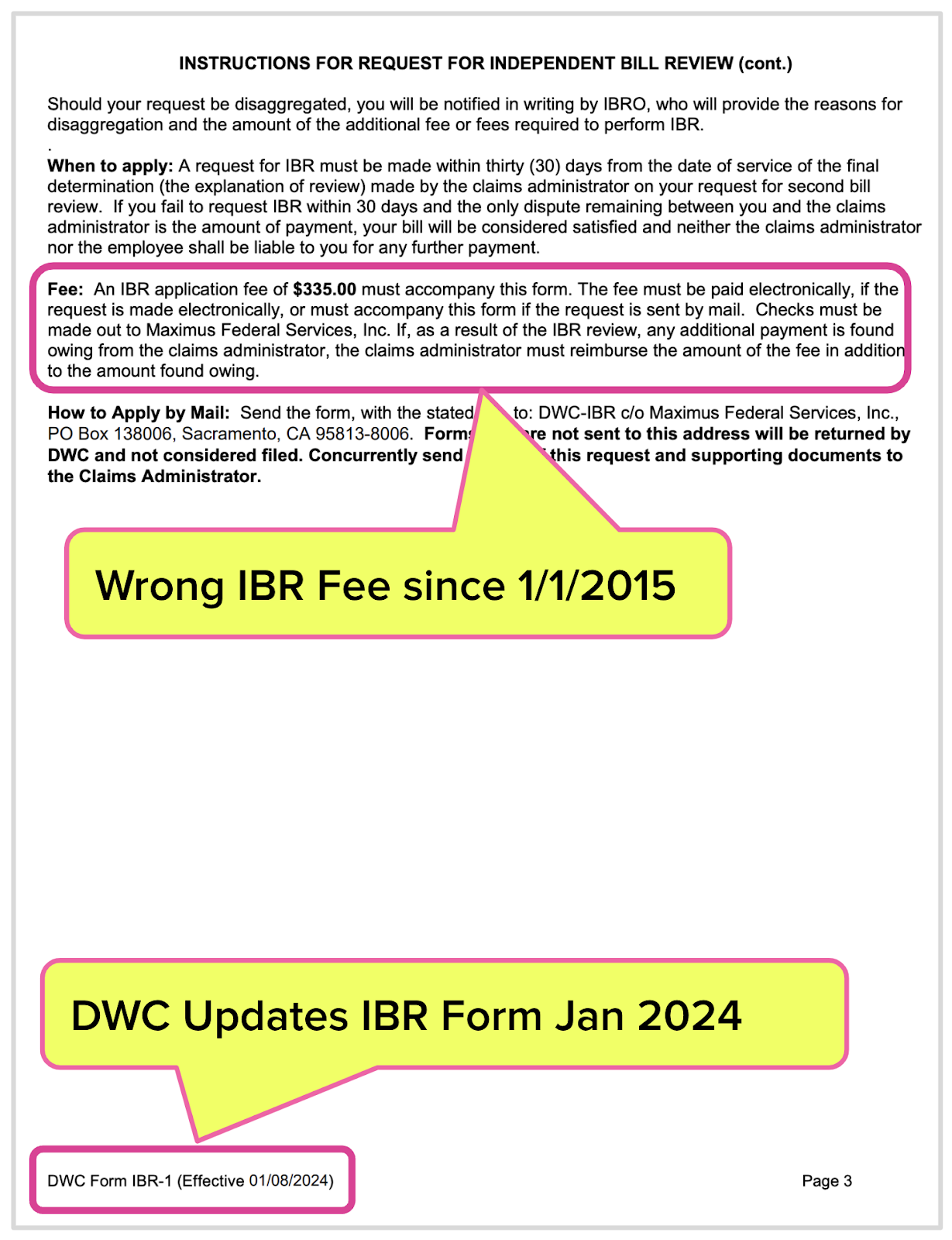

As daisyNews has periodically pointed out since 2015, the form that the CA DWC mandates providers use to request IBR, Form IBR-1, lists an incorrect filing fee of $335—an ever-present sign of the CA DWC’s blatant disregard for providers who treat California’s injured workers.

New IBR Filing Fee Effective January 2025

In October, daisyBill received a message from Maximus, stating (emphasis ours)

“Please be advised the IBR filing fee will increase to $195.00 effective 1/1/2025. IBR cases received on or after 1/1/2025 require a $195.00 application fee.”

To our knowledge, the CA DWC has yet to inform providers of the impending increase, evidently leaving that responsibility to Maximus (and daisyNews). However, assuming the CA DWC knows about the increase, refraining from alerting providers is perfectly on-brand for the inept agency.

CA DWC - ‘D’ Is for Dreadful

This is the third time the IBR filing fee has changed. In 2015, the CA DWC reduced it from $335 to $195, and further reduced it to the current rate of $180 in 2020.

However, DWC Form IBR-1, which the CA DWC publishes, still lists the original fee of $335. daisyNews has published five articles alerting and reminding providers of the correct fee amount.

In August 2023, daisyBill clients alerted us that their IBR requests were not being delivered when submitted through the mail. Upon investigation, we discovered that the address listed on the IBR-1 was no longer correct.

In January 2024, the DWC published a new IBR form correcting only the address listed but not correcting the filing fee amount.

Arguably, this erroneously inflated $335 filing fee can dissuade doctors from pursuing the appeals process—an effective win for claims administrators and their private equity owners. Once again, the CA DWC acts as the wingman for these entities.

Below are previous daisyNews articles warning providers about the incorrect filing fee amount listed on the IBR-1 form. (Yes, our article about the well-run and hyper-informative Texas DWC was an attempt to shame the CA DWC into something resembling competence):

- DWC's Updated IBR Form - F Is for Fail - July 2024

- FYI: Inaccurate DWC IBR Form May Cost Your Practice - September 2023

- Shout Out: Texas DWC - July 2023

- How It Works: Independent Bill Review (IBR) - October 2017

- More on Reduced Filing Fees for Workers' Comp IBR and IMR - July 2015

We’ve come to expect very little (read: nothing) from the CA DWC in terms of provider support, protection, or guidance. The agency’s overt neglect of any obligation to keep providers informed is unsurprising.

The CA DWC’s consistently shoddy work, exemplified by the IBR-1, is just another example (among many) demonstrating how the agency’s failures discourage California providers from treating injured workers.

This IBR-1 error further cements the well-founded suspicion that the CA DWC will never prioritize providers’ rights over the interests of payers and private equity.

With tools for quicker, easier appeals, daisyBill helps your practice demand full reimbursement — with just a few clicks. Learn more or request a demo below:

LEARN MORE

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

![Texas: How to Register to Treat Injured Workers [2024 Checklist]](https://kb.daisybill.com/rails/active_storage/blobs/proxy/eyJfcmFpbHMiOnsibWVzc2FnZSI6IkJBaHBBenNGTXc9PSIsImV4cCI6bnVsbCwicHVyIjoiYmxvYl9pZCJ9fQ==--313c5188f4d896eac60be4a26eaf4b4f7ae1bf88/TX-doc-symbols.gif)