Gallagher Bassett Bounces Foster Farms Check

You read that headline right.

Doctors may need to pin a notice on the wall next to the cash register, as a warning that Gallagher Bassett, a third-party claims administrator (TPA), sends rubber checks when reimbursing for the treatment of injured workers.

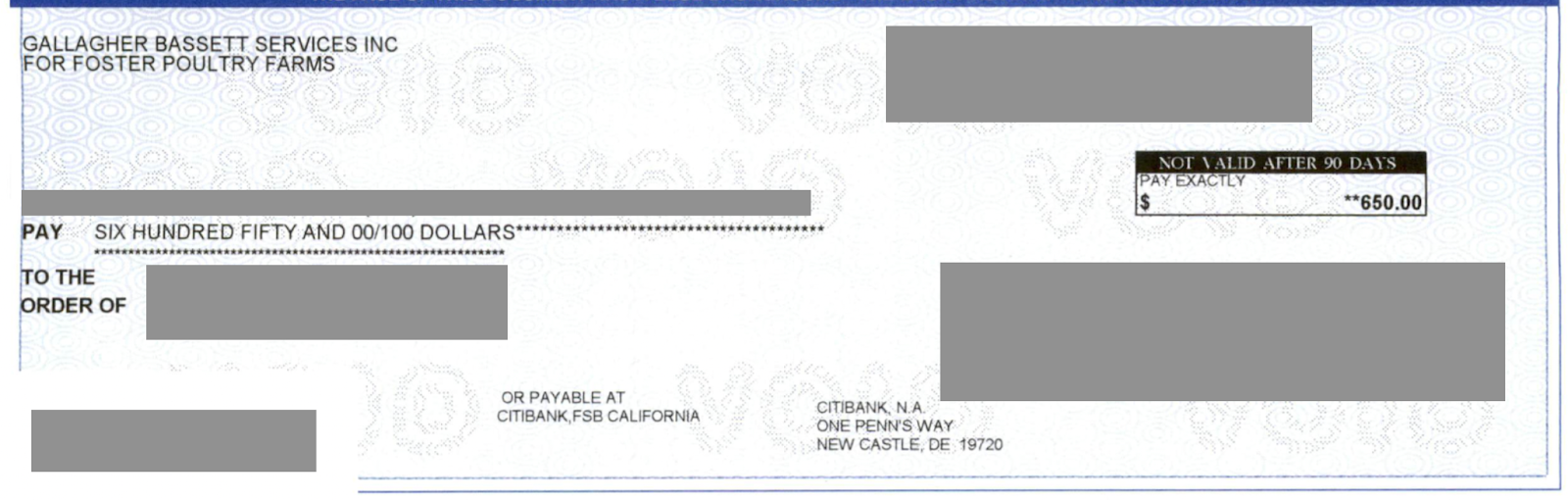

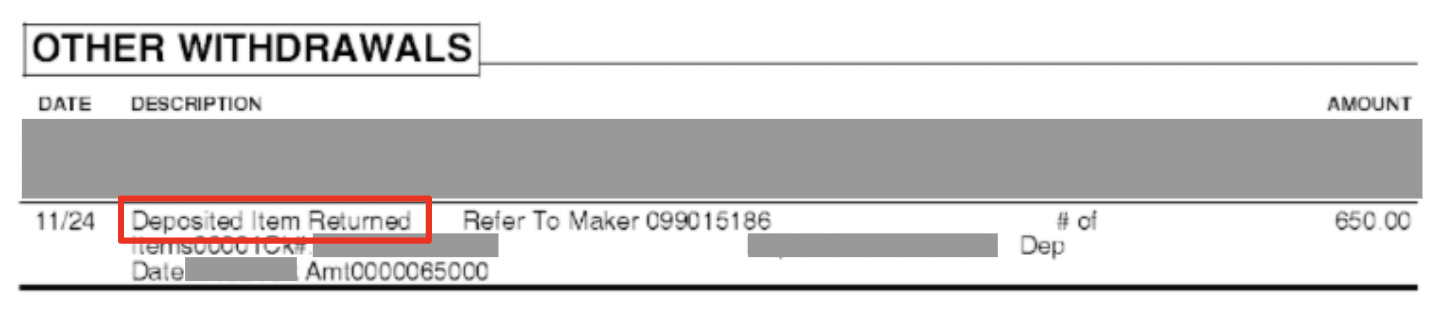

Gallagher Bassett remitted a check for $650 to a daisyCollect provider client, which promptly bounced. As if it wasn’t hard enough to obtain proper reimbursement for workers’ comp services in California, we now have to contend with the actual possibility that a claims administrator’s checks might not clear.

We can’t make this stuff up.

Gallagher Bassett & Foster Farms Cluck On

The hits keep coming from Foster Farms. In March 2021, the self-insured employer designated Gallagher Bassett as their claims administrator. As a reminder, Gallagher Bassett promptly lost track of all Foster Farms claims.

After a month of pecking — during which no one could access Foster Farms employee claims, providers could not submit bills, and no reimbursements were issued — Gallagher Bassett finally got its digital chicken sh*t together and resumed processing bills.

So it was with a heavy sigh-and-eye-roll combination that we first heard the news from one of our Medical-Legal physician clients: a check from Gallagher Bassett for a Foster Farms employee failed to clear.

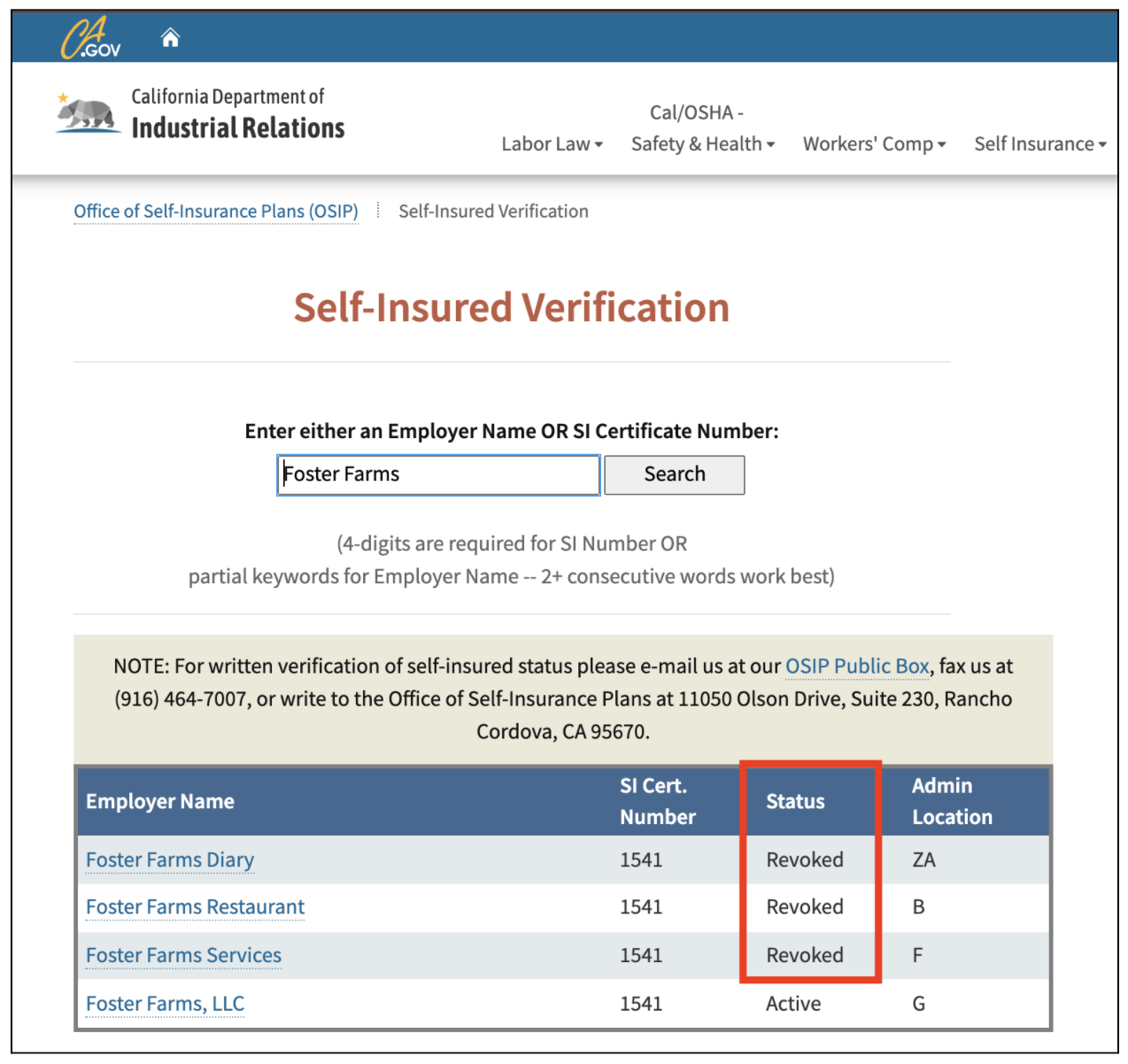

Given the strict rules and requirements governing the right of an employer to self-insure, one wonders what California’s Office of Self Insurance Plans (OSIP) would make of the hash Foster Farms has made of claims administration under Gallagher Bassett.

Particularly concerning is that the OSIP Self-Insured Verification website lists Foster Farms Self-Insured Verification status as revoked no less than three times.

Gallagher Bassett Refuses To Provide Reason

DaisyCollect contacted Gallagher Bassett to ascertain if there was any conceivable reason for bouncing the check. (The provider is not listed as suspended by the DWC, per Labor Code §139.21(a)).

Rather than providing a reason for the bounced check, Gallagher Bassett explained that the only way to obtain a reason was to mail written correspondence to Gallagher Bassett’s PO Box.

In a second attempt to determine a reason for the bounced check, daisyCollect contacted Gallagher Bassett again with additional questions. The second Gallagher Bassett representative could offer no reason, and directed us to contact Jopari, Gallagher Bassett’s clearinghouse vendor.

This kind of failure to reimburse is exactly the kind of hassle that should make providers think twice about treating Foster Farms injured employees. Even if you receive a payment from this TPA, don’t count your chickens until the check actually clears.

Make workers’ comp a better investment. From fee schedule calculators to billing software to complete managed billing, DaisyBill has your back. Contact us to learn more.

LET’S CHAT!

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.