Marriott (Finally) Sending e-EORs

.gif)

Fans of workers’ comp billing and payment compliance, rejoice!

After literally years of hounding from daisyBill, self-insured employer Marriott is finally adhering to California law and regulations by responding to electronic bills with electronic Explanations of Review (e-EORs).

As providers know, e-EORs are critical to revenue management. e-EORs automatically post payment information to the practice’s e-billing system, saving inestimable time and effort. For that reason, California requires (not requests) that all claims administrators send e-EORs in response to e-bills.

Marriott was slow to come around — but a win is a win, no matter how long it takes.

A History of Non-Compliance

daisyNews has been publicly shaming Marriott since 2022, when we first noticed Marriott’s consistent failure to remit e-EORs.

Marriott’s failures violated Section 7.1 of the DWC Medical Billing and Payment Guide, which requires the claims administrator to send an e-EOR within 15 working days of receipt of an e-bill. Following multiple attempts to reach Marriott representatives to discuss the issue with no reply, we submitted formal Audit Complaints to the Division of Workers’ Compensation (DWC) reporting thousands of violations.

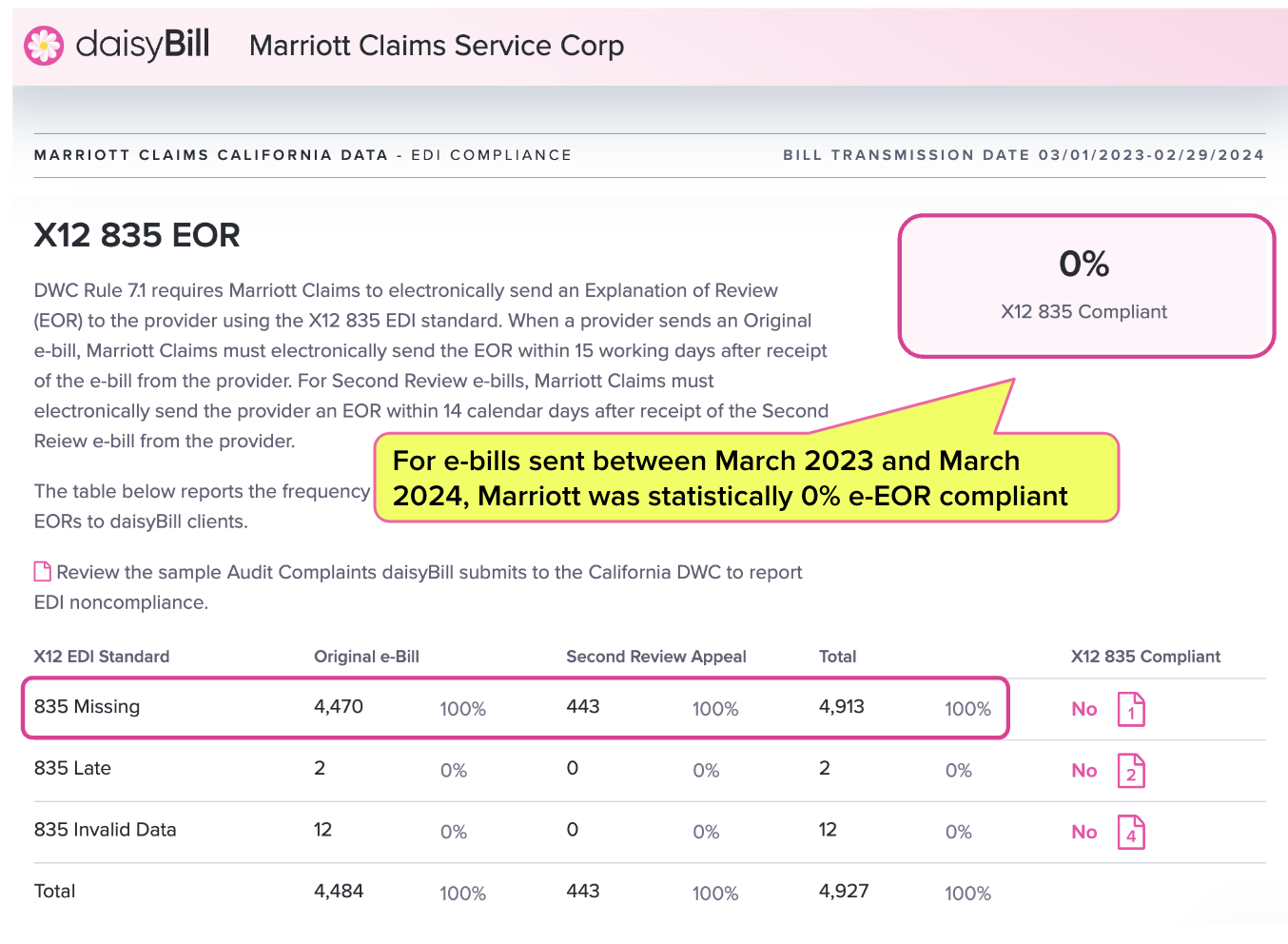

The non-compliance continued throughout 2022, 2023, and 2024. At one point, Marriott had a statistical e-EOR compliance rate of 0% (as shown on Marriott’s Claims Administrator Directory Page below).

Data Dimensions Breaks Through

With nothing but crickets coming from Marriott, daisyBill took the matter to Marriott’s clearinghouse, Data Dimensions.

As the entity hired by Marriott to accept e-bills and return e-EORs on Marriott’s behalf, Data Dimensions worked with its client to identify and resolve whatever was preventing e-EORs from reaching providers.

Note that while Data Dimensions sends the e-EORs, claims administrators are 100% legally responsible for compliance, regardless of any vendors involved. As the DWC Electronic Medical Billing and Payment Companion Guide states (emphasis ours):

“Billing agents, electronic billing agents, third party administrators, bill review companies, software vendors, data collection agents, and clearinghouses are examples of companies that may have a role in electronic billing. Entities or persons using agents are responsible for the acts or omissions of those agents executed in the performance of services for the entity or person.”

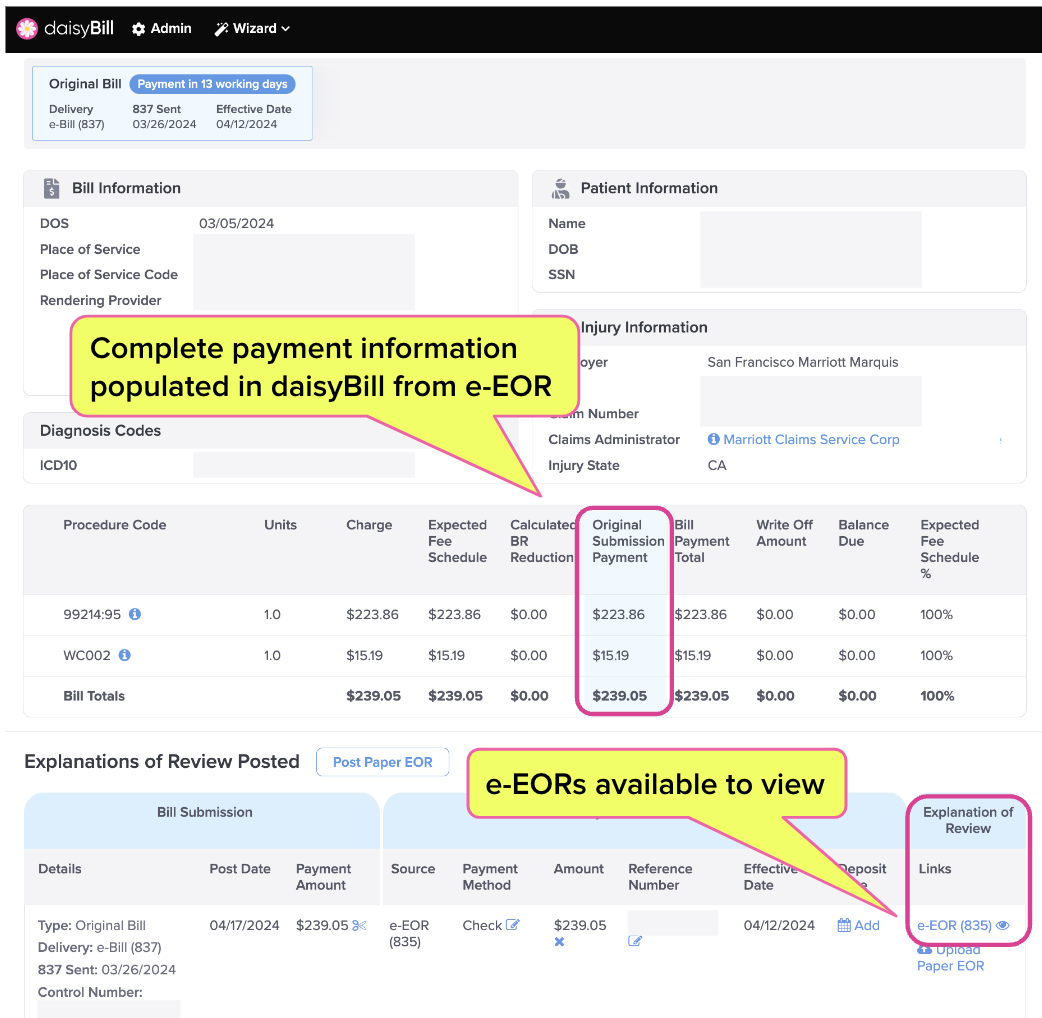

According to Data Dimensions, the underlying problem was fixed on April 10, 2024, and Marriott will now consistently remit e-EORs. So far, this has proven true; the daisyBill screenshot below shows that e-EORs are now populating payment information for our providers’ bills.

While nothing can excuse the years of non-compliance that preceded it, we’re happy that Marriott, with help from its clearinghouse, has finally started meeting its legal obligations.

Perhaps our persistence made an impact, and there’s hope for even the most recalcitrant offenders in workers’ comp — looking at you, Sedgwick.

daisyBill makes treating injured workers easier, faster, and less costly. Request a free demonstration below.

REQUEST DEMO

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.gif)