Payers Deny 48% of CA Physician's Bills

Attention California providers: it is extremely difficult to obtain reimbursement when you treat or provide services to an injured worker, because the Division of Workers’ Compensation (DWC) has promulgated payment regulations that effectively incentivize claims administrators to deny the payment you are owed.

Medical-Legal evaluators are no exception. In the case study below, we share how claims administrators collectively denied payment for 48% of Medical-Legal bills submitted by a single physician evaluator for a single month.

For 21 evaluations the physician performed in August 2024, claims administrators baselessly denied payment for ten clean, compliant, accurate bills. The stated reasons for the denials are demonstrably invalid.

Based on entirely spurious reasons, payers refused to pay $19,120.07 owed to this physician.

DWC regulations make it easy for payers to game the California workers’ comp payment system by denying bills for any reason, valid or not. The regulations dictate that providers automatically forfeit the reimbursement owed if they fail to timely and compliantly appeal improper denials—while claims administrators suffer no repercussions for those faulty denials.

Therefore, it makes financial sense for payers to reflexively deny bills and then wait to see if you fail to appeal in a timely manner.

This evaluator’s struggle demonstrates just how insidious payment denial abuse has become in California. Rather than continue to sacrifice expensive administrative efforts to engage in a lopsided payment battle in which the DWC does nothing to discourage the abuse, providers are (understandably) abandoning workers’ comp.

The Bad News: 10 Med-Legal Bills Improperly Denied

Each of the ten Medical-Legal bills below was denied for a reason that is objectively untrue.

Nine of the bills were denied for insufficient documentation. Yet all nine had every bit of documentation required—in fact, they had the exact same types of documentation as the eleven paid bills the evaluator submitted in the same month, including:

- The Medical-Legal evaluation report

- The attorney letters requesting the Medical-Legal evaluation

- The medical record page count attestation

One bill was denied on the grounds that the claim is “non-compensable.” As we continue to remind readers, Medical-Legal services are not subject to “compensability”; they are requested by the parties to the dispute.

Claims Administrator - Denied ML Bills |

Bill Date of Service |

MLFS Billing Code(s) |

Supporting Documents Page Count |

MLFS Amount Owed |

Payment Amount |

Payment Denial Reason |

Gallagher Bassett Services Inc. |

08/08/2024 |

ML203-94 |

8 |

$877.50 |

$0.00 |

Claim non-compensable |

Acclamation Insurance Management Services |

08/15/2024 |

ML203-94 |

9 |

$877.50 |

$0.00 |

Documentation insufficient |

JT2 Integrated Resources |

08/16/2024 |

ML203-94 |

8 |

$877.50 |

$0.00 |

Documentation insufficient |

Intercare Holdings Insurance Services, Inc. |

08/08/2024 |

ML203-94, ML205 |

9 |

$1,771.25 |

$0.00 |

Documentation insufficient |

ESIS, Inc. |

08/05/2024 |

ML202-94 |

22 |

$1,776.94 |

$0.00 |

Documentation insufficient |

County of Santa Clara (CA) |

08/19/2024 |

ML202-94, MLPRR |

25 |

$1,821.94 |

$0.00 |

Documentation insufficient |

Sedgwick Claims Management Services, Inc. |

08/05/2024 |

ML201-93-95 |

21 |

$2,216.50 |

$0.00 |

Documentation insufficient |

CNA Insurance |

08/19/2024 |

ML201-94 |

23 |

$2,720.25 |

$0.00 |

Documentation insufficient |

Gallagher Bassett Services Inc. |

08/05/2024 |

ML202-94, MLPRR |

33 |

$3,012.94 |

$0.00 |

Documentation insufficient |

Sedgwick Claims Management Services, Inc. |

08/05/2024 |

ML201-93-94, MLPRR |

34 |

$3,167.75 |

$0.00 |

Documentation insufficient |

Totals |

192 |

$19,120.07 |

$0.00 |

The Critical Importance of Second Review Appeals

The DWC has implemented payment regulations that effectively incentivize payers to improperly deny payment to providers, including Medical-Legal evaluators.

Even for plainly invalid payment denials like the ones above, the claims administrators win by default if the provider doesn’t take action.

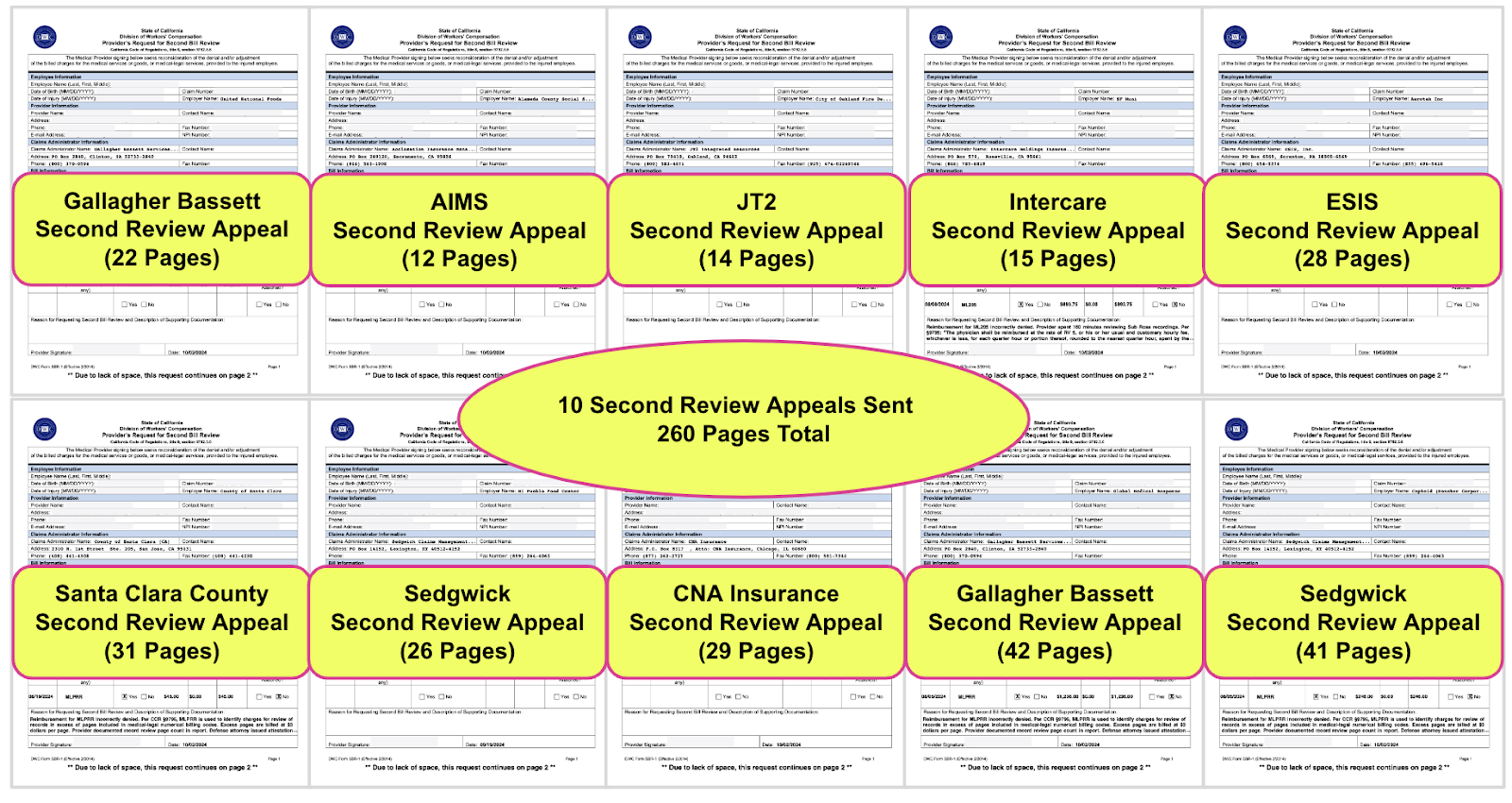

To dispute the denials above, this physician evaluator submitted ten Second Review appeals with required documentation totalling 260 pages (that’s in addition to the documentation submitted with the original bills).

If this provider failed to submit these ten compliant Second Review appeals within 90 days, California law dictates that the provider forfeits the entire reimbursement owed.

Since the DWC takes little action against claims administrators who improperly deny payment, the eight claims administrators above can simply deny payment for these bills, then wait to see if the provider submits the required appeal on time.

Worse, as shown in previous disputes, even when a payment denial is verifiably invalid, the DWC will rule a provider’s Second Review ineligible if the provider makes a single error, like failing to include a signature on the appeal form.

In other words, the DWC allows claims administrators to deny reimbursement improperly, but if the provider fails to properly submit an appeal, the default outcome is that the claims administrator keeps every cent.

CA Providers Tortured by Misaligned Payment Incentives

As explained above, the DWC has structured the workers’ comp payment system in a way that effectively encourages denials of valid bills, even on indisputably erroneous grounds. Even worse, the DWC invalidates providers’ appeals based on regulatory technicalities.

It’s easy enough to deny payment for any reason, then sit back and see if the provider navigates the gauntlet (or wait for the DWC to rule against providers who manage to submit the required appeals). With little enforcement effort from the DWC and penalties and interest on unpaid bills “self-executing,” what incentive exists to put much effort into adjudicating bills correctly?

This is of equal concern to Medical-Legal evaluators and providers furnishing medical treatment, the latter of whom are subject to the same torture to obtain often much lower reimbursement amounts.

We can’t know whether bogus denials are a purposeful strategy of any claims administrator, or simply a convenient and profitable kind of incompetence. What we know is that this physician had to manage Second Review appeals for 48% of the evaluations provided in a single month.

daisyBill technology made this Herculean administrative effort, including compliance with nonsensical DWC payment regulations, more manageable. However, as this story demonstrates, the DWC has mismanaged workers' compensation to the point that it is unsustainable for many California providers.

Med-Legal billing takes specialized expertise. daisyCollect agents use our advanced software (and years of experience) to get your practice paid. Learn more below:

LEARN MORE

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.