Alert: Sedgwick's Phantom Payment Reductions

Recently, Sedgwick Claims Management Services reduced a daisyBill doctor’s payments to 25% below the amount allowed by the California Physician Fee Schedule. To justify the reductions, Sedgwick cited nothing more than an “Other Adjustment” — which is exactly as meaningless as it sounds.

Here’s the bad news: Despite states like California having perfectly sound fee schedules, Preferred Provider Organizations (PPOs) and other discount networks have made a mess of real-world workers’ comp reimbursement rates.

This payment chaos allows claims administrators to take reductions without even bothering to substantiate them, forcing providers to submit appeals begging for accurate compensation.

With little regulatory enforcement to protect providers, some claims administrators falsely reduce reimbursement with impunity. Appealing these false reimbursement discounts is yet another administrative expense for practices — and claims administrators know that the harder they make it for providers to collect payment, the less likely it is that claims administrators have to pay providers’ bills (correctly).

Here’s the good news: providers can challenge improper payment discounts successfully (as this doctor did) with minimal expenditure of time and effort.

Sedgwick Takes 25% Cut, No PPO Listed

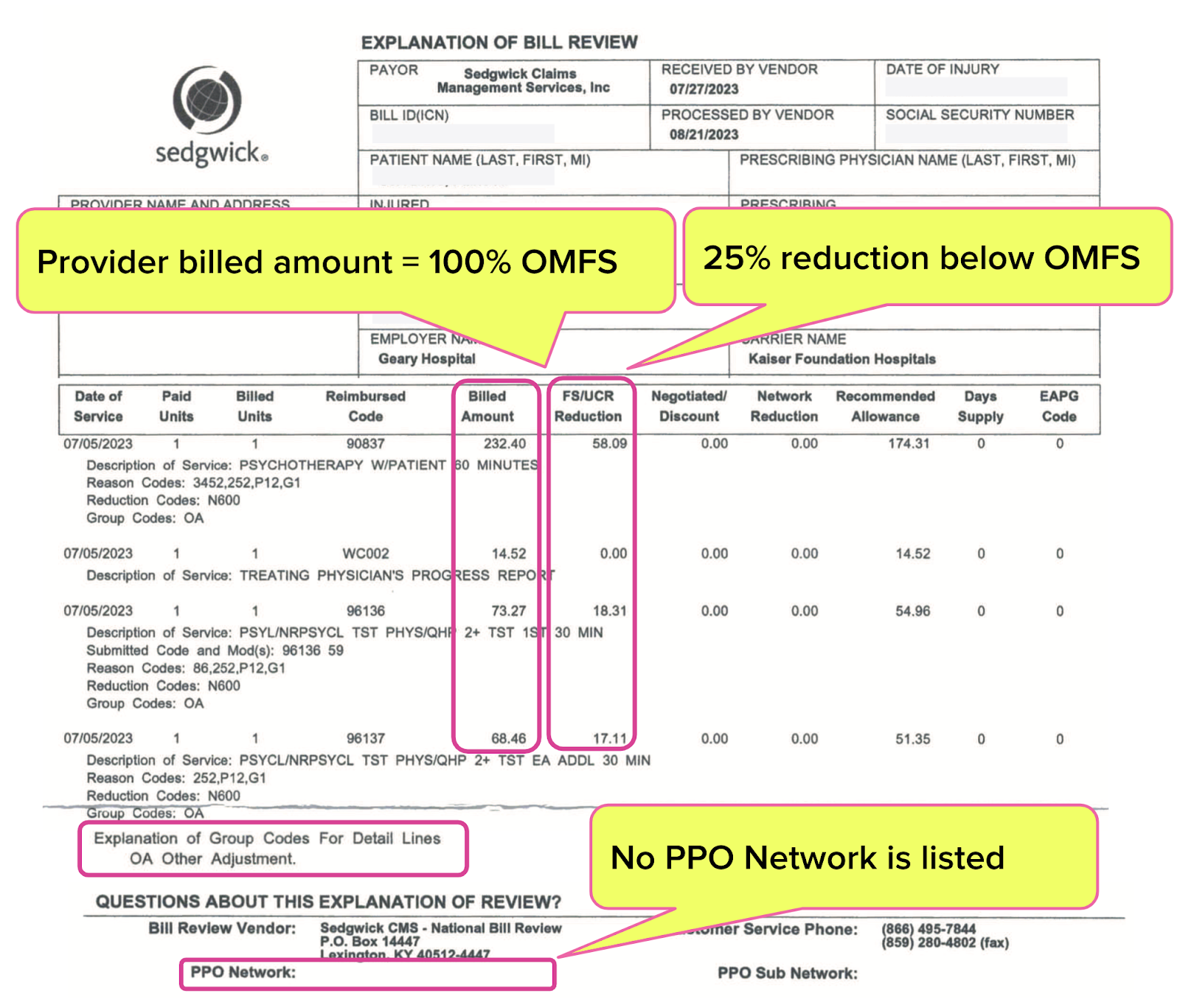

The Explanation of Review (EOR) below is a case study of how easy it can be to short doctors who treat injured workers.

The doctor sent Sedgwick a bill listing the Official Medical Fee Schedule (OMFS) rates for the authorized services rendered. Yet Sedgwick reduced the provider’s bill by 25% and paid the provider only 75% of the rates allowed by the OMFS.

What was the justification Sedgwick provided for this reduction? According to the EOR, listed under “FS/UCR” (Fee Schedule/Usual & Customary Rates), Sedgwick made an “OA Other Adjustment.”

Because why not, right?

The EOR Sedgwick sent did not list a PPO Network.

Because, why be bothered?

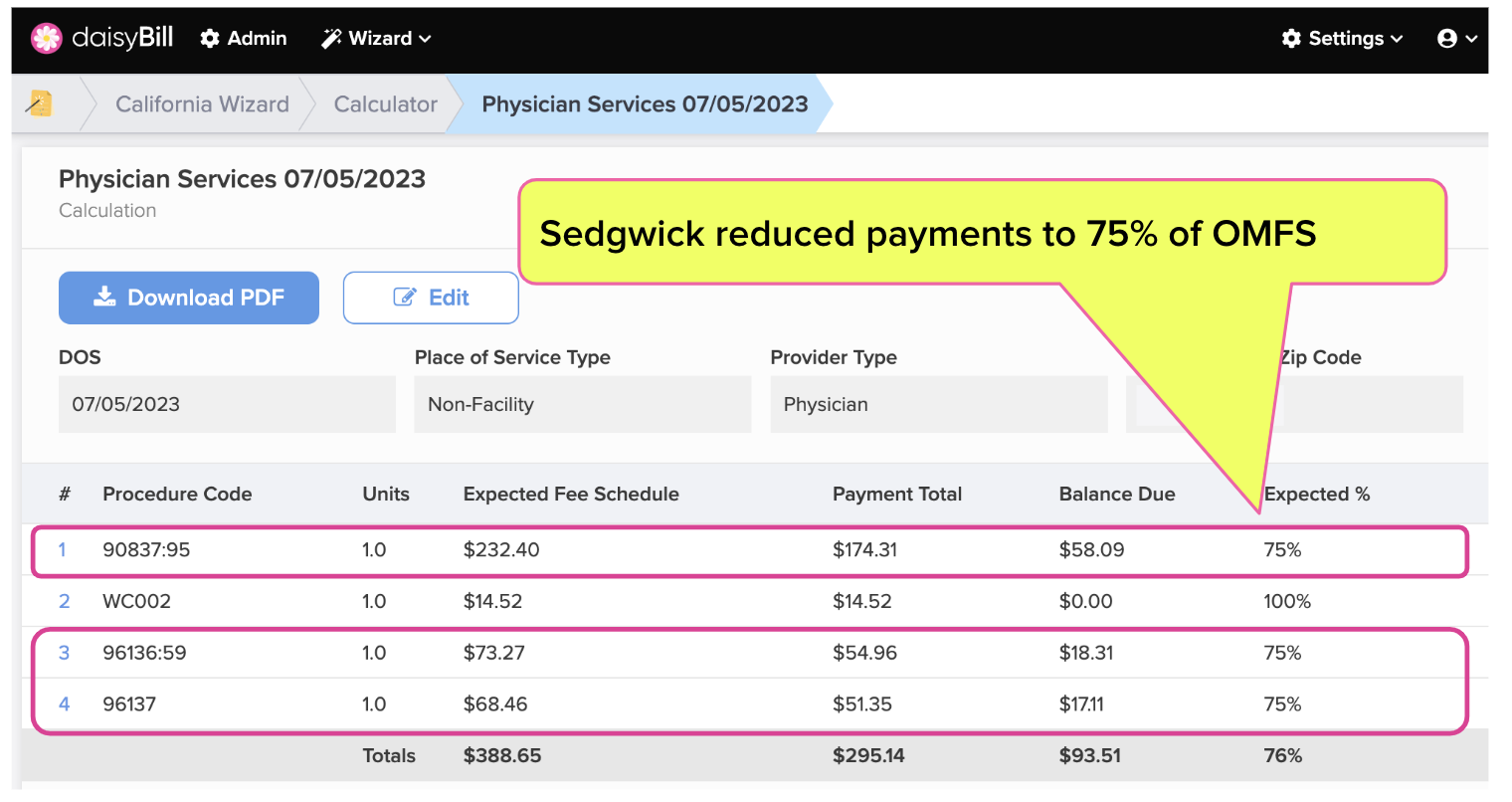

As daisyBill’s Fee Schedule Calculator shows, these unattributed discounts reduced the affected payments to 25% below the fee schedule (for whatever reason, Sedgwick didn’t apply the mysterious “Other Adjustment” to the doctor’s required PR2 progress report).

The Solution: Second Bill Review

daisyBill clients have collected over $130 million of additional revenue by submitting Second Review appeals to dispute incorrect payments like this Sedgwick example.

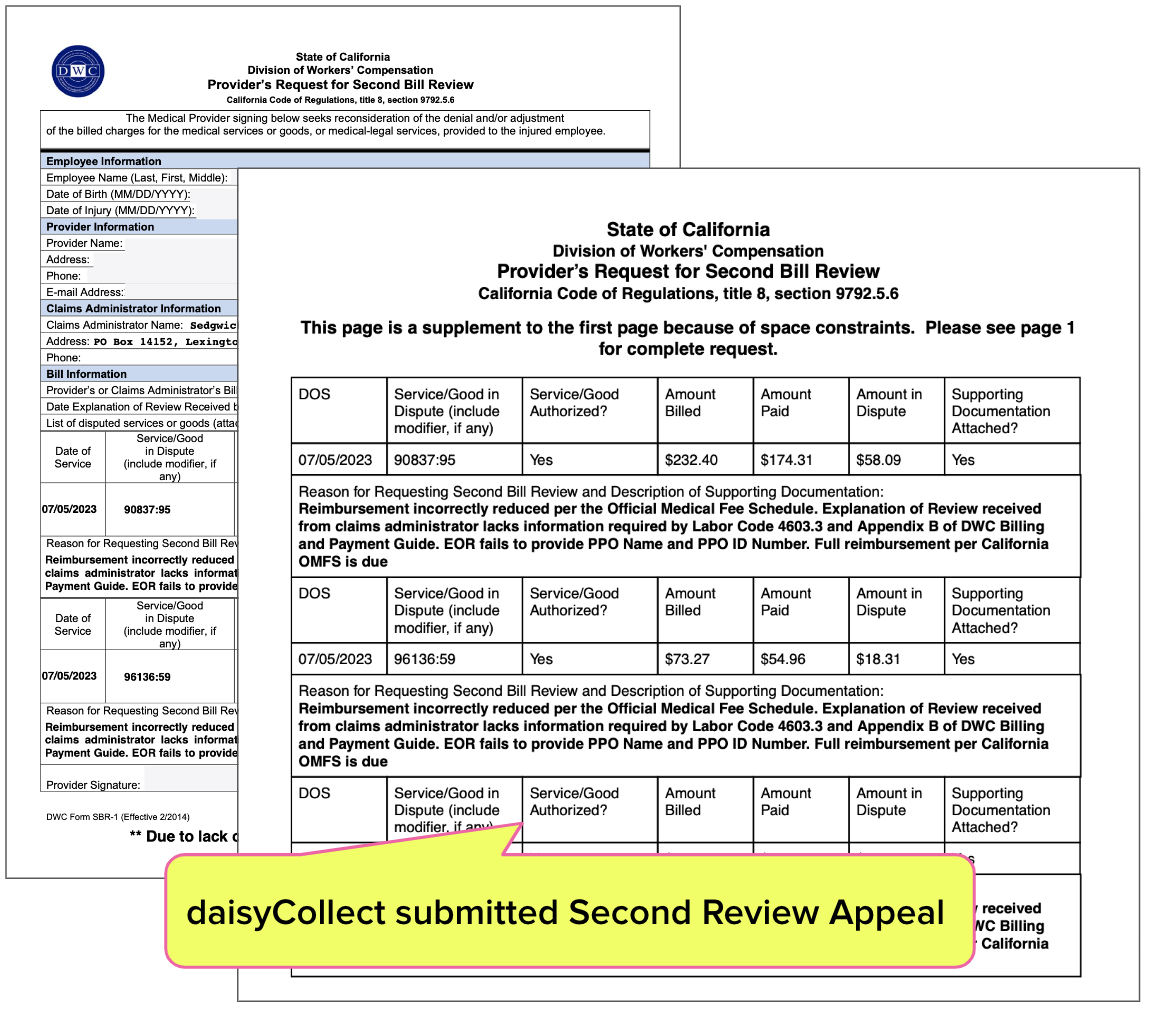

In this case, daisyCollect electronically submitted the Second Review appeal below on the doctor’s behalf (non-daisyCollect providers can also submit these appeals in seconds).

The appeal cites both:

- California Labor Code Section 4603.3, which requires Sedgwick to disclose the basis for any adjustment and

- The Division of Workers’ Compensation (DWC)’s Billing and Payment Guide which requires Sedgwick to identify any PPO or Medical Provider Network (MPN) on which a discount is based.

Since Sedgwick’s EOR and its “Other Adjustment” fail to satisfy either of those requirements, the reduction is invalid.

Success: Sedgwick Pays Physician

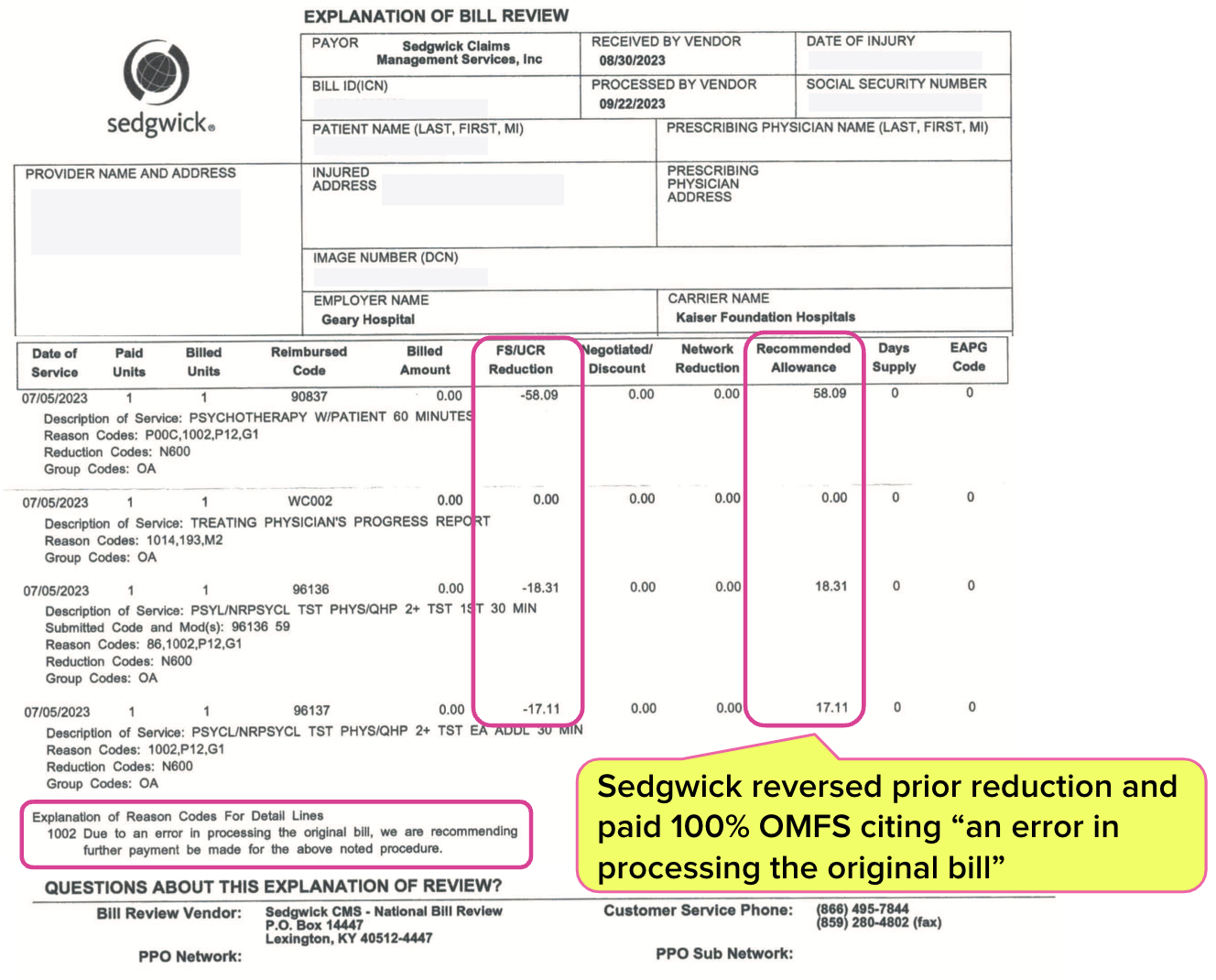

After receiving the Second Review appeal, Sedgwick reimbursed the doctor at 100% OMFS.

Whether erroneously, incompetently, or for some other reason, the hard reality of treating injured workers is that claims administrators will foist inappropriate reductions on your practice. Sadly, there is no real functional regulatory protection to address this plague.

The final EOR (below) explained:

“Due to an error in processing the original bill, we are recommending further payment be made for the above noted procedure.”

With little to no protection from the DWC, providers must inspect every single EOR received from claims administrators; there’s simply NO incentive for claims administrators to keep their reductions above board.

Protect your practice. Make sure you’re being reimbursed appropriately, and take action if not. It’s the only way to ensure that treating injured workers is financially sustainable in the long term.

Know instantly when to appeal, and do so in less than a minute with daisyBill. Request a free demonstration below.

REQUEST DEMO

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

Any wonder so few doctors are willing to treat work comp patients? Between absurd and unconscionable reductions in fees, MPN madness, delays in care that ensure conditions become chronic, and the dearth of specialists willing to see injured workers, and with the concomitant delays in obtaining such care for the few who will see them, our patients and the whole system are at serious risk of total collapse. Thank you daisyBill for continuing to shine a light on the issues and consequences. Aside from those of us who have to look our patients in the eye and explain why reasonable care has again been denied and they will now have to live with higher disability for the rest of their lives because the system doesn't care, what ever happened to "fixed and assured benefits."

I often ask senior claims examiners if they would report a work injury. Not one ever has. I certainly would not. Time to acknowledge the system is broken and needs to be fixed! Wayne Whalen DC