Mob Rule: SCIF/Anthem Hold Patient(s) Hostage

On paper, Medical Provider Networks (MPNs) are a simple workers’ comp quality/cost-control measure. Employers designate an MPN, and injured workers choose from among the MPN providers for treatment. But in practice, unscrupulous actors use MPNs as a cudgel to intimidate providers into accepting reduced reimbursements.

Case in point: California’s State Compensation Insurance Fund (SCIF) removed a provider from the SCIF MPN. Subsequently, SCIF transferred care of the patient in question elsewhere, leaving both provider and patient distraught.

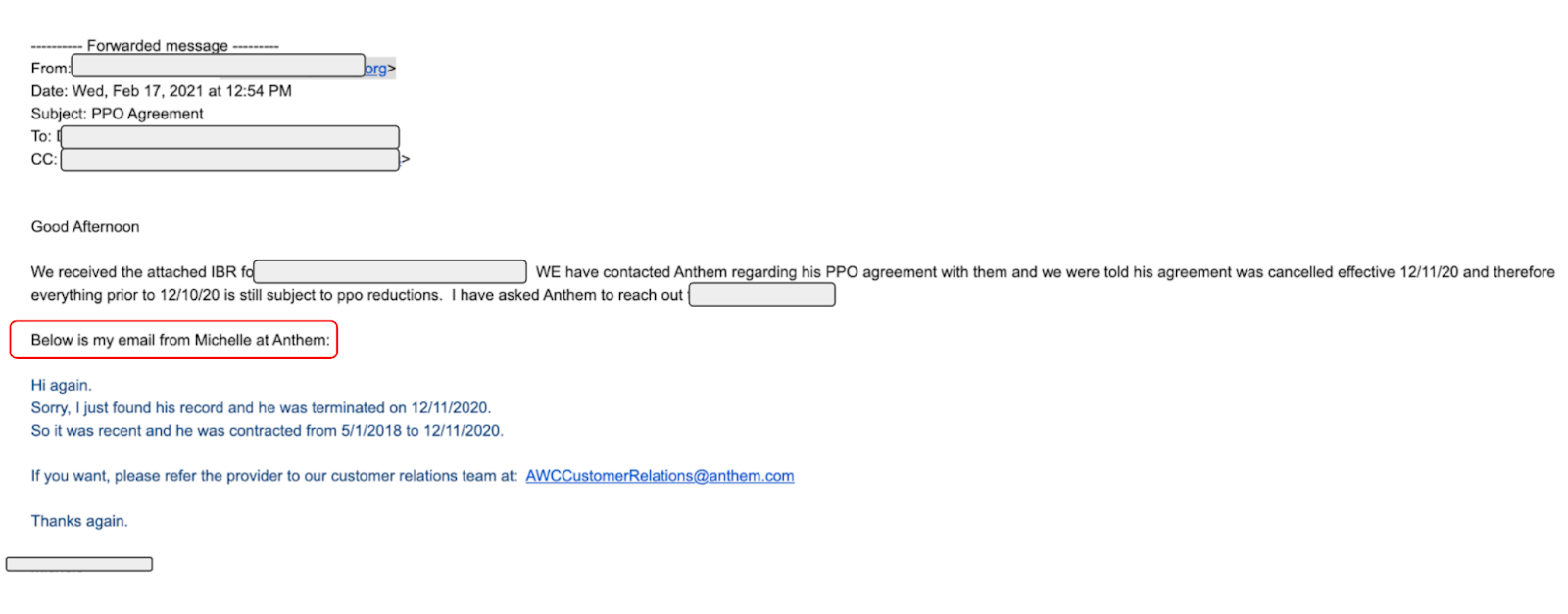

“Surprisingly” enough, SCIF removed the provider from the SCIF MPN only after the provider refused to accept non-MPN network reductions imposed by Anthem.

There was no apparent reason to disrupt this patient’s care. Clearly the well-being of the patient is not the first priority. Instead, reducing the provider’s reimbursements to below Official Medical Fee Schedule (OMFS) rates appears to be the driving force.

In a move reminiscent of classic mob tales, Anthem first booted the provider from their list of preferred Blue Cross of California providers, then offered the provider one way back into the Anthem “family:” by accepting reduced reimbursements from any bill review and payer that use the Anthem discount (SCIF, for example).

Provider Demands Compliance, Anthem Retaliates

The provider submitted a Second Review appeal to dispute the Anthem-referenced reimbursement reduction, which SCIF used to lower the provider’s reimbursements to 95% of the OMFS.

Specifically, the provider questioned whether the SCIF/Anthem discount complied with Labor Code Section 4609. As the appeal stated:

Per LAB 4609 § (c)(2), [PROVIDER] has the right to request that State Compensation Insurance Fund (CA) demonstrate its entitlement to pay [PROVIDER] a reduced contracted rate. Once requested, the claims administrator must make this demonstration within 30 business days of receipt of the request. This letter serves as such a request.

As directed by LAB 4609 §§ (c)(2) and (b)(2), State Compensation Insurance Fund (CA) shall be deemed to have demonstrated its entitlement to pay a reduced contracted rate by:

Identifying a written agreement between [PROVIDER] and State Compensation Insurance Fund (CA) that entitles State Compensation Insurance Fund (CA) to pay a reduced contracted rate and by either:

1. Describing the specific practices that the employer, [EMPLOYER], utilizes “to actively encourage employees” to seek medical care from [PROVIDER] (Note that LAB 4609 § (b)(2) explicitly states that “Internet Web site addresses alone shall not be deemed to satisfy [these] requirements…”); or

2. Identifying in that written agreement the mandated disclosure that State Compensation Insurance Fund (CA) is permitted to pay the Provider a reduced contracted rate without actively encouraging the employees of [EMPLOYER] to use [PROVIDER] when obtaining medical care.

The provider questioned the legitimacy of SCIF taking 5% of the provider’s revenue in exchange for nothing. Anthem responded to this questioning by removing the provider from its list, without even informing the provider. In fact, the provider found out from a different claims administrator!

SCIF Offers No Explanation. Anthem Offers A New Contract

Recently SCIF transferred care of the injured worker to another provider. SCIF offered no explanation to either the provider or the patient, who was treated by the provider since August 2020. Having seen almost 500 SCIF patients since 2016, this provider never received a single complaint from SCIF regarding the quality of care.

Understandably, the provider is horrified. The injured worker is in tears (a questionable back-to-work strategy if ever we saw one).

Evidently, there is nothing wrong with the provider, other than their demand for reimbursement equal to 100% of the OMFS. On April 14, 2021, Anthem sent the provider a new contract, offering reinstatement to the Anthem list of preferred Blue Cross of California providers — if the provider agreed to accept reimbursement at 95% of OMFS rates.

A Widespread Threat to Practice Revenue

If the provider accepts Anthem’s offer, the Anthem reduction would not only apply to SCIF-covered workers. As with Prime Health Service’s model, the Anthem reduction will be transferred to an ever-growing list of Bill Review services and payers. Anthem’s “offer” is a Trojan horse, one that has a significant impact on overall long-term revenue for the practice.

When the provider belonged to the Anthem MPN “family,” the payers listed below reduced every reimbursement sent to the provider. These entities simply slapped “Anthem” on the explanation of review (EOR), and paid the provider 95% of the OMFS.

To return to Anthem means the provider must again succumb to revenue shakedowns by these payers:

Payers Reducing Provider's Reimbursement With Anthem Contract |

Acclamation Insurance Management Services |

American Claims Management, Inc |

AmTrust North America |

Athens Administrators |

Berkshire Hathaway Homestate Companies |

California Insurance Guarantee Association |

CompWest Insurance Company |

Contra Costa County Risk Management (CA) |

Contra Costa County Schools Insurance Group (CA) |

Employers Compensation Insurance Company |

Great American Insurance Company |

Guard Insurance Group |

Hanover Insurance Company |

Helmsman Management Services |

Insurance Company of the West |

Keenan & Associates |

Liberty Mutual Insurance |

Markel First Comp Insurance |

Midwest Insurance |

Municipal Pooling Authority (CA) |

Pacific Gas & Electric |

Sedgwick Claims Management Services |

State Compensation Insurance Fund (CA) |

Sutter Health |

Tristar Risk Management |

Throughout California, claims administrators and bill reviews are using MPNs to strong-arm providers out of the reimbursements established by the OMFS. Unfortunately, these MPNs wield the power to force providers out of the system when they refuse to capitulate.

We can’t predict the fate of Assembly Bill 1465, which would defang MPNs by establishing an alternative statewide network from which workers can seek care. But whatever the outcome, we would be overjoyed to see the MPN cudgel taken from the hands of organizations like SCIF and Anthem.

Make workers’ comp billing (much) easier. DaisyBill software produces clean, compliant bills for faster, more accurate payment. Contact us to learn how.

LET’S CHAT

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

.png)