Provider Alert: Sedgwick Can't Pay Bed Bath & Beyond Bills

FYI, providers: if your practice treats injured employees of the newly bankrupt Bed Bath & Beyond, you may have trouble getting paid.

A daisyCollect provider recently billed Sedgwick Claims Management Services, Inc. for the treatment of a Bed Bath & Beyond worker (Sedgwick is the Third-Party Administrator (TPA) for this claim). When payment never came, daisyBill investigated; Sedgwick informed daisyBill that Bed Bath & Beyond’s recent bankruptcy stopped the flow of funds to Sedgwick for provider payment.

Further details are below. But the bottom line is that regardless of which entity should reimburse providers for treating Bed Bath & Beyond employees, no entity — employer, insurer, or TPA — has so far claimed that responsibility.

As is often the case in California workers’ comp, the provider is left holding the proverbial bag. Providers, note that this problem may affect doctors throughout the United States, as Bed Bath & Beyond is a national company.

Sedgwick: No Reimbursement for Bed Bath & Beyond Treatment

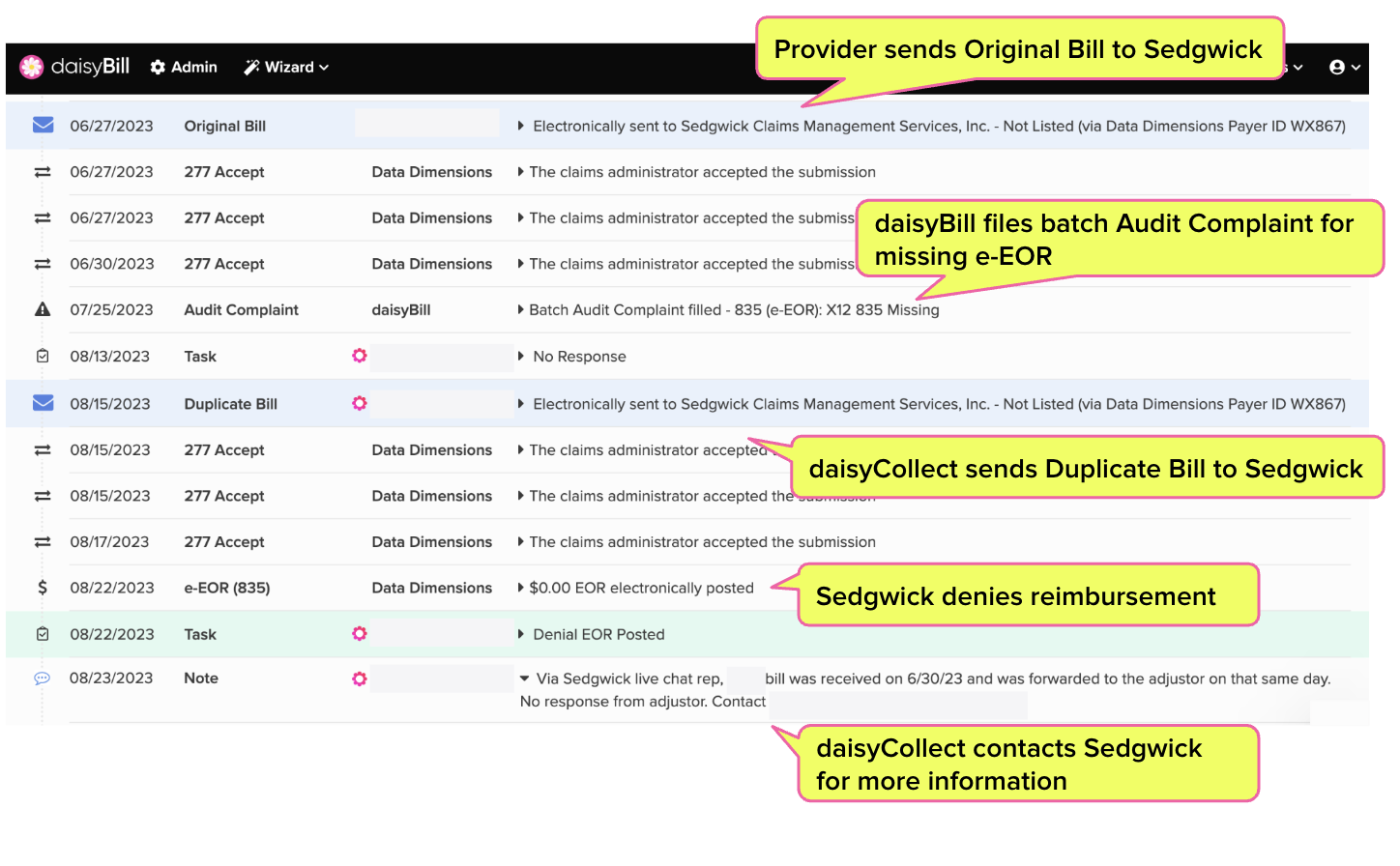

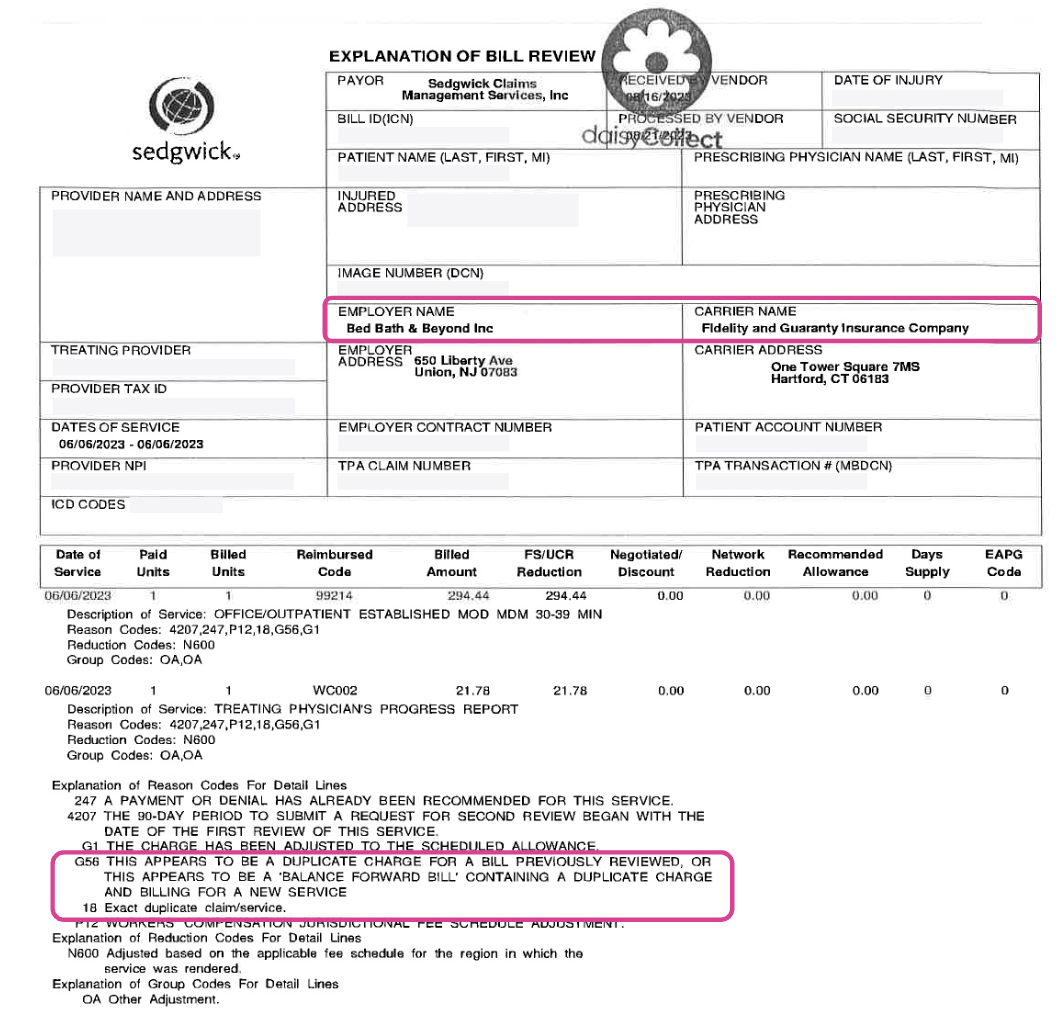

As a Bill History screenshot and Explanation of Review (EOR) show below, the provider billed Sedgwick electronically, and the e-bill was received and accepted by Sedgwick’s clearinghouse. However, the 15-day mandatory deadline for payment of e-bills came and went with no reply from Sedgwick.

daisyCollect ultimately resubmitted the e-bill, and included the e-bill in a batch of formal Audit Complaints to the Division of Workers’ Compensation (DWC) reporting Sedgwick’s failure to respond.

Sedgwick — being Sedgwick — denied payment because the e-bill was a duplicate (which it was, but only because Sedgwick failed to respond to the first e-bill). Next, daisyCollect contacted Sedgwick to ascertain the problem.

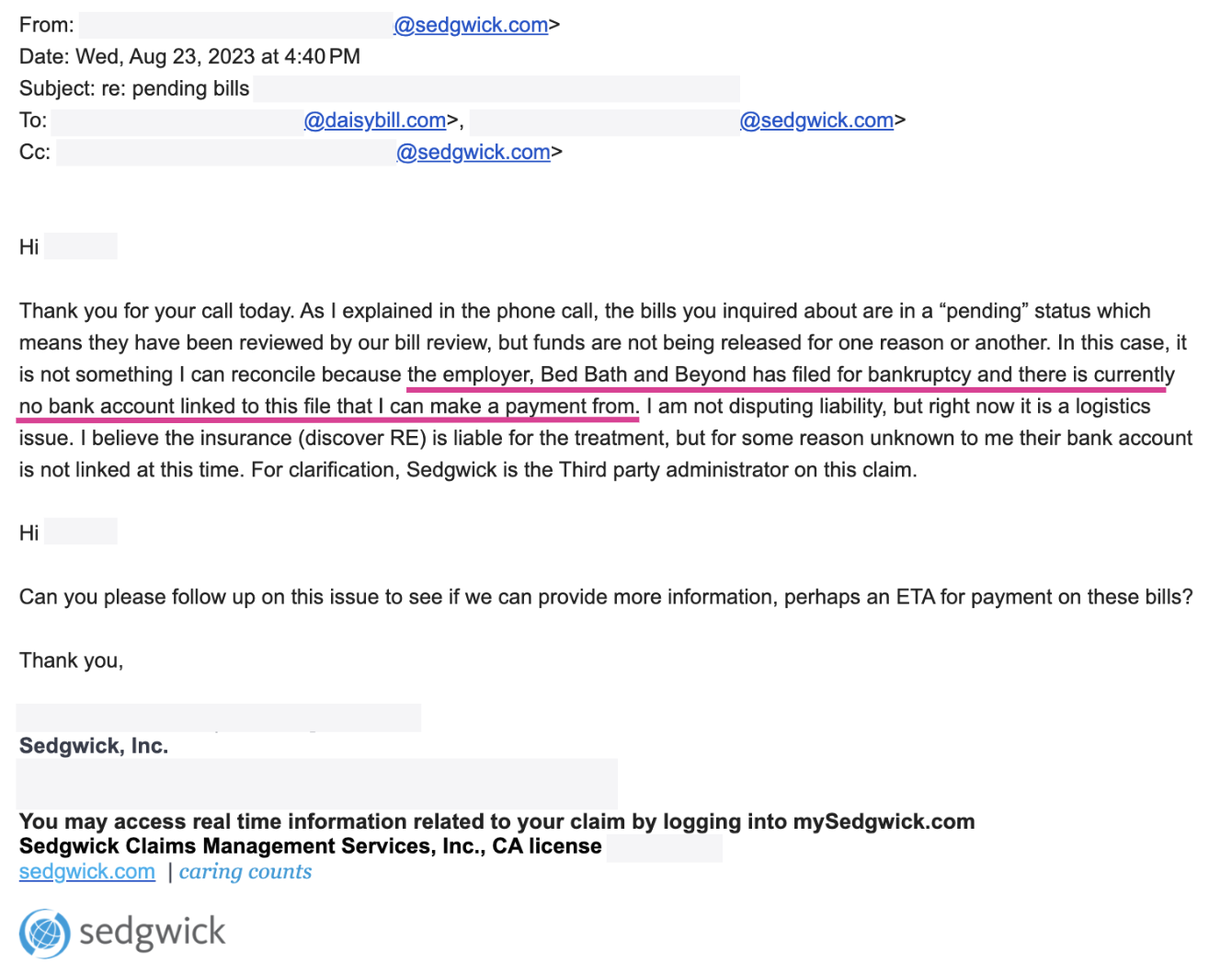

Following a phone conversation, a Sedgwick representative sent daisyCollect an email explaining that Sedgwick could not pay the bill because the employer filed for bankruptcy, claiming:

“Bed Bath and Beyond has filed for bankruptcy and there is currently no bank account linked to this file that I can make a payment from. I am not disputing liability, but right now it is a logistics issue.”

This Sedgwick email brings us to the age-old question: Whenever a dispute, complication, or “logistics issue” arises in workers’ compensation, why is the provider consistently deprived by default?

Regardless of which exact entity owes this provider payment (plus penalties and interest), neither Sedgwick nor the insurer are offering to pay for treatment rendered to an injured worker.

Let the experts handle your workers’ comp billing. daisyCollect professionals use advanced software (and years of experience) to protect your practice. Learn more and request a demo below:

LEARN MORE

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.

I would lien it, add P&I and it and get the employers law firm involved. If they can pay their higher ups, they can pay my lien. Period.

Isn't this why claims administrators have to post bonds for self-insured accounts?