Tristar Gives DWC Inane Defense of Non-Compliance

Tristar Risk Management violates clear California e-billing regulations, making it more costly and difficult for providers to treat injured workers.

The Third-Party Administrator (TPA) consistently fails to compliantly respond to electronic bills with electronic Explanations of Review (e-EORs). This non-compliance burdens practices with the administrative task of posting payment details manually.

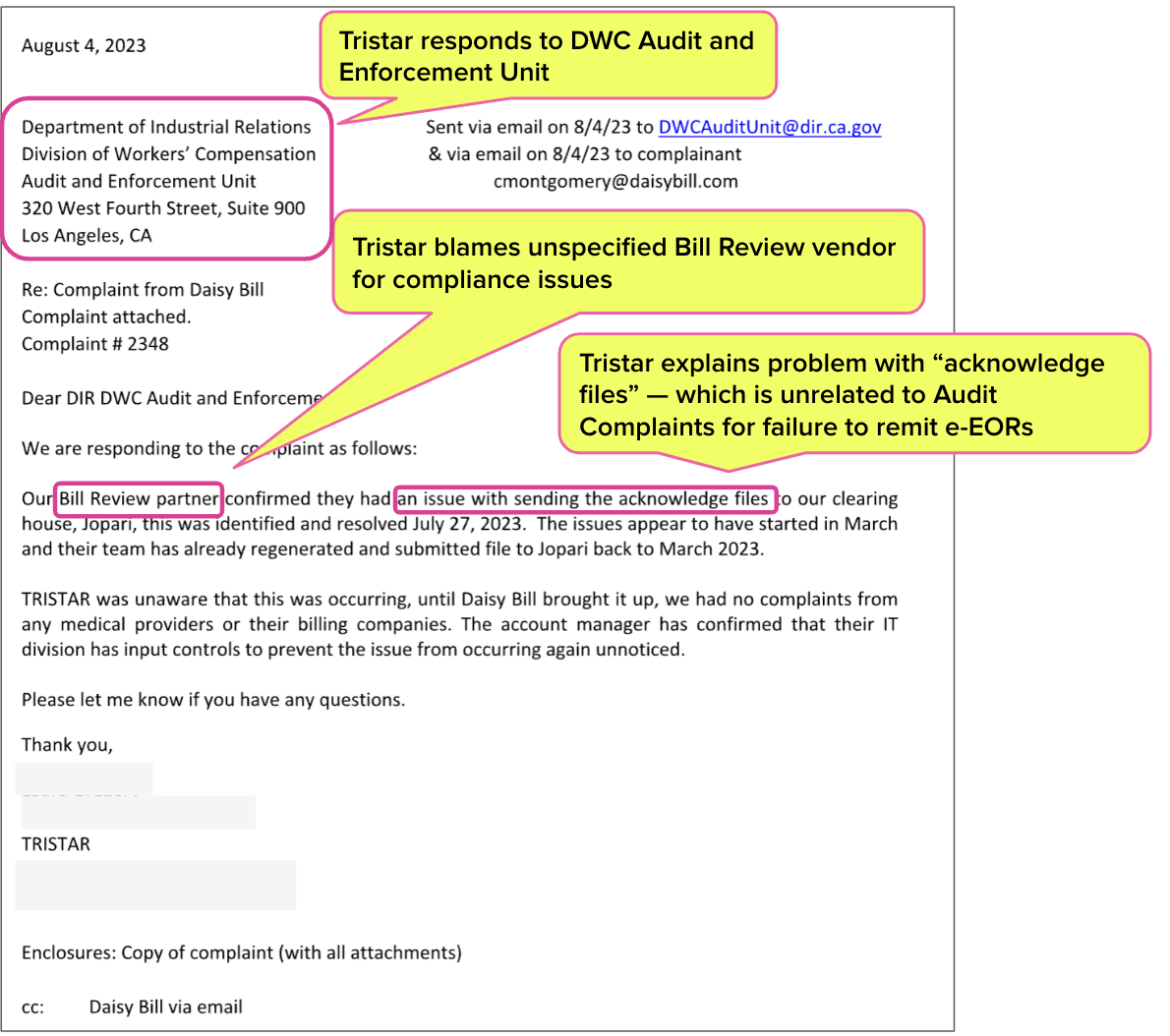

Worse, in response to over 3,600 formal Audit Complaints submitted by daisyBill to report the non-compliance, Tristar offered the Division of Workers’ Compensation (DWC) a generally irrelevant, wholly inadequate defense. In the letter Tristar sent to the DWC (shown below), Tristar addressed a technical error unrelated to the e-EOR Audit Complaints daisyBill filed.

Not only did Tristar fail to address the non-compliance reported by daisyBill; the non-compliance continues, and providers continue to sacrifice administrative resources due to the TPA’s failure.

Tristar Fails to Send e-EORs

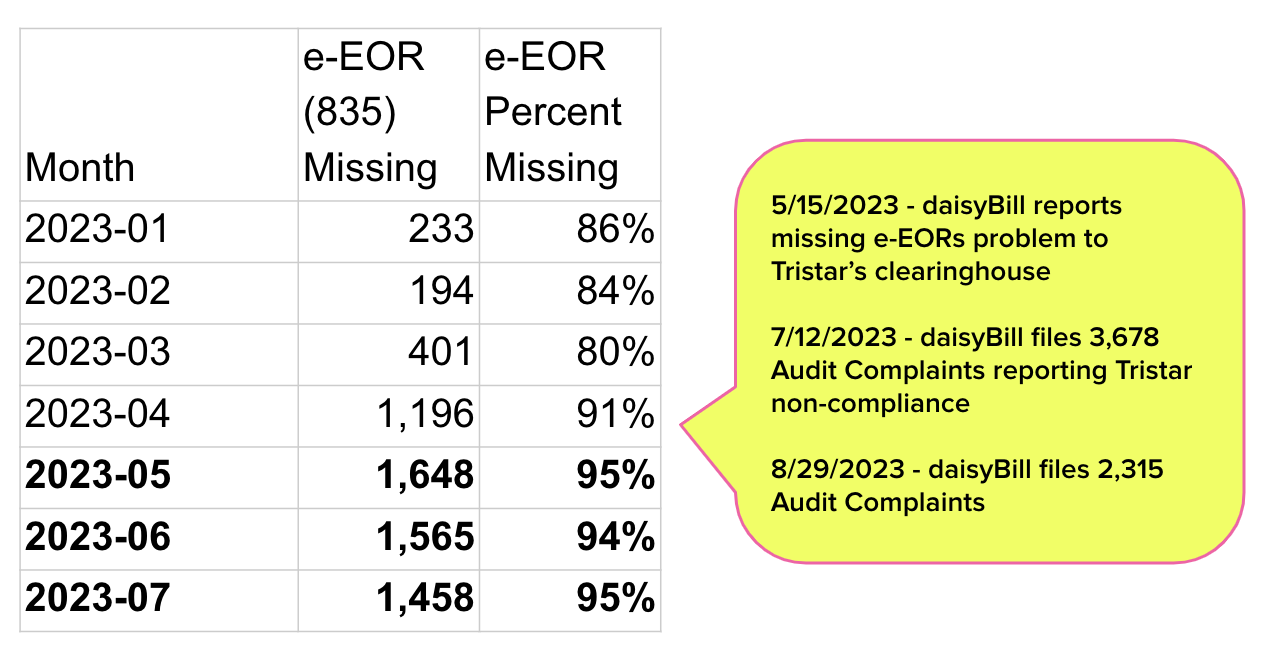

In July, daisyBill submitted Audit Complaints to the DWC for 3,678 e-bills for which Tristar failed to remit e-EORs.

The DWC Medical Billing and Payment Guide requires claims administrators to respond to e-bills with an e-EOR and payment within 15 working days — and bills for which the claims administrator fails to meet this requirement are subject to audit penalties per California Code of Regulations Section 10111.2.

Because e-EORs automatically post bill payment details to the practice’s e-billing system, failure to remit e-EORs creates significant, unnecessary administrative work for providers, whose staff must manually post the information.

In a letter to the DWC, Tristar attempted to explain its non-compliance by claiming that its bill review vendor “had an issue with sending the acknowledge files,” an apparent reference to 277 Acknowledgements (277 ACKs).

277 ACKs serve only to inform the provider whether the e-bill was accepted for processing or not. While the 277 ACK establishes the date the e-EOR and payment are due, this is otherwise a separate issue — and no excuse for failure to remit e-EORs.

Moreover, even if Tristar’s non-compliance resulted from failures by its bill review or any other vendor, claims administrators are 100% responsible for e-billing compliance. As the DWC Electronic Companion GuideGuide states:

Billing agents, electronic billing agents, third party administrators, bill review companies, software vendors, data collection agents, and clearinghouses are examples of companies that may have a role in electronic billing. Entities or persons using agents are responsible for the acts or omissions of those agents executed in the performance of services for the entity or person.

Even though the DWC forwarded daisyBill’s Audit Complaints to Tristar, Tristar’s non-compliance has only continued, necessitating an additional 2,315 Audit Complaints.

As the table below shows, Tristar’s failure to remit e-EORs has increased steadily throughout 2023, and shows no signs of abating.

Nothing in Tristar’s message to the DWC excuses or even remotely defends its failure to follow an essential, foundational, important e-billing mandate. We urge the DWC Audit and Enforcement Unit to act accordingly and impose appropriate consequences on Tristar and any claims administrator who ignores its mandates.

Consistent enforcement is critical to the treatment of injured workers in California. As explained in a recent Risk & Insurance article penned by daisyBill, the lopsided approach to enforcement in which only providers are consistently punished for billing non-compliance — while the DWC allows claims administrators to opt out of following the rules at will — isn’t just wrong; it’s unsustainable.

Make workers’ comp easy. Harness the power of daisyBill software, data, and expertise for faster, better workers’ comp billing. Request a demo below.

REQUEST DEMO

DaisyBill provides content as an insightful service to its readers and clients. It does not offer legal advice and cannot guarantee the accuracy or suitability of its content for a particular purpose.